February 2025

Power Amplifier Market (By Type: Audio Power Amplifier, Radiofrequency (RF) Power Amplifier, Linear Power Amplifier; By Material: Gallium Nitride (GaN), Gallium Arsenide (GaAs), Silicon Germanium (SiGe); By End user: Consumer Electronics, Healthcare, Aerospace and Defense, Telecommunication, Others (Automotive, Energy and Power, and Oil and Gas)) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

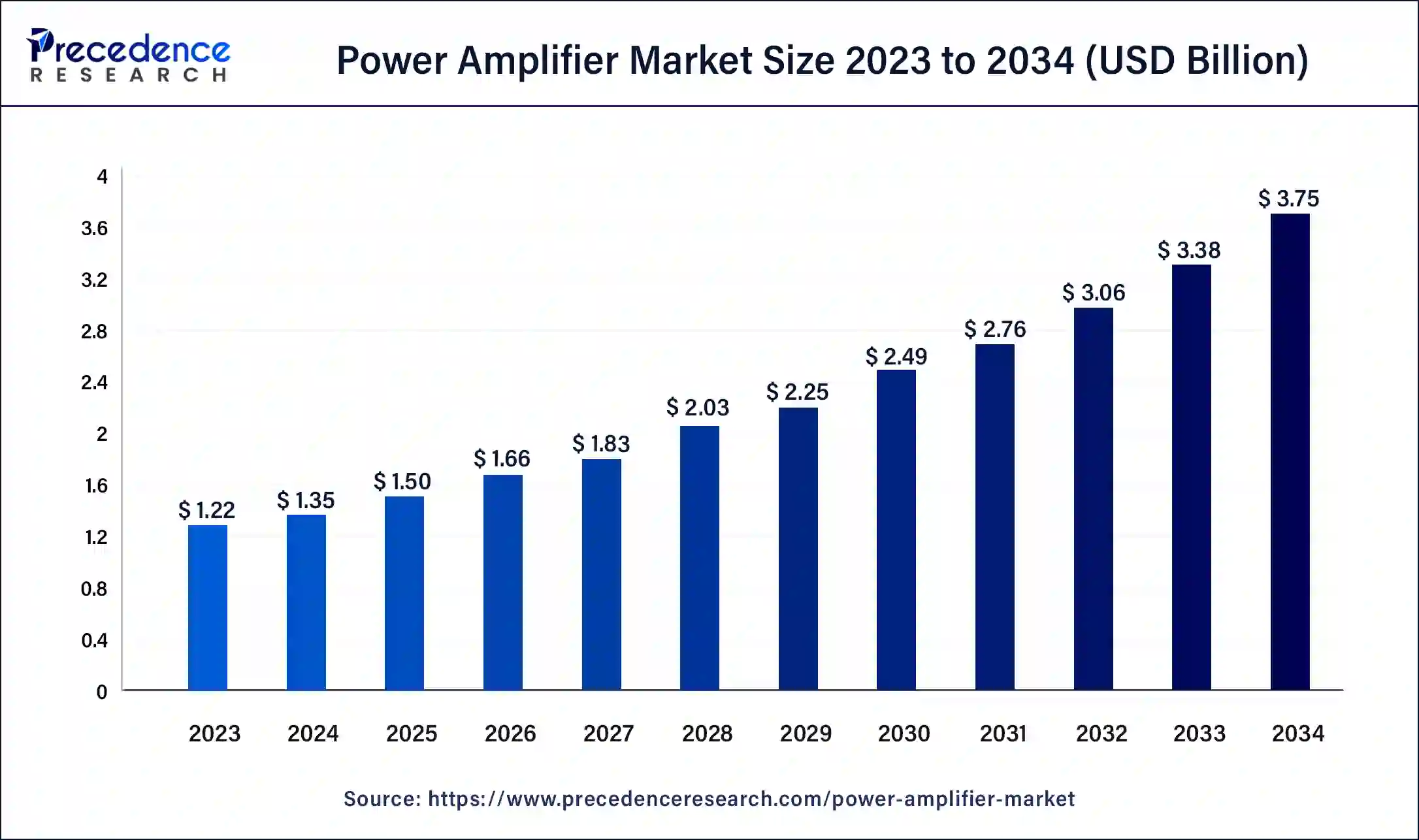

The global power amplifier market size was USD 1.22 billion in 2023, calculated at USD 1.35 billion in 2024 and is expected to reach around USD 3.75 billion by 2034. The market is expanding at a solid CAGR of 10.74% over the forecast period 2024 to 2034. Rising demand for radio frequency power amplifiers can boost the power amplifier market.

The power amplifier market refers to the electrical devices used to boost an input signal's power level. Broadcasting, telecommunications, instrumentation, and audio systems are just a few of the many uses for them. The antenna, speaker, or other high-power device can be driven by a power amplifier, which boosts a low-power signal to a level sufficient to operate it.

The main purpose is to supply a sizable quantity of power to the load while maintaining the integrity of the original signal. Because they allow signals to be transmitted and amplified to specified power levels, power amplifiers are essential in many different disciplines. From efficient RF transmission to high-fidelity audio reproduction, their operation and design are customized to satisfy the unique needs of many applications.

The power amplifier market is fragmented with multiple small-scale and large-scale players, such as Texas Instruments Inc., Renesas Electronics Corporation., Qualcomm Incorporated., Skyworks Solutions, Inc., Infineon Technologies AG, STMicroelectronics N.V., Broadcom Inc., Toshiba Corporation, Analog Devices, Inc, NXP Semiconductors N.V.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.75 Billion |

| Market Size in 2023 | USD 1.22 Billion |

| Market Size in 2024 | USD 1.35 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 10.74% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Material, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for wireless communication

The rising demand for wireless communication can grow the power amplifier market. The proliferation of wireless communication networks, encompassing 4G, 5G, and forthcoming technologies, necessitates the comprehensive construction of infrastructure. Power amplifiers are essential parts of base stations, repeaters, and other network components to provide robust and dependable signal transmission over extended distances.

High production cost of power amplifiers

The high production cost of power amplifiers may slow down the power amplifier market. The power amplifiers' high manufacturing costs can have a domino effect on competitiveness, price, profitability, innovation, and market acceptance, which would eventually slow down the market's growth.

Rising adoption and production of electric vehicles

The rising adoption and production of electric vehicles can be the opportunity to boost the power amplifier market. The latest technologies play a major role in power management, battery charging, entertainment systems, and communication in electric cars. These high-frequency electronic systems depend heavily on power amplifiers, which raises the need for dependable and efficient amplifiers.

The audio power amplifier segment dominated the power amplifier market in 2023. The portable speakers, sound bars, headphones, and home theater systems are among the high-quality audio equipment that are in greater demand. There is a growing need for sophisticated audio power amplifiers as consumers want more immersive audio experiences and higher sound quality. Music, film, and gaming are all part of the entertainment business that is growing quickly.

In both consumer and professional contexts, such as recording studios, music halls, and theaters, this expansion is driving up demand for high-performance audio equipment. The accessibility and affordability of high-quality audio are increasing due to advancements in audio amplifier technology, such as Class D amplifiers, which provide great efficiency and compact size.

The radio frequency (RF) power amplifier segment is expected to grow at the highest CAGR in the power amplifier market during the forecast period. Radiofrequency (RF) power amplifiers are becoming increasingly necessary due to the growing need for wireless communication technologies like 5G, Wi-Fi, and the Internet of Things (IoT). For a variety of wireless devices and applications, these amplifiers are essential to provide powerful, dependable signals. In order to manage greater frequencies and faster data transmission rates, 5G network deployment and growth will require sophisticated RF power amplifiers.

Due to the significant infrastructure construction required for the 5G transition, radio frequency power amplifiers are becoming more and more in demand. The need for RF power amplifiers has been spurred by ongoing expenditures in base stations and cell towers, among other pieces of infrastructure used in telecommunications. The upkeep and improvement of network performance depend heavily on these amplifiers.

The silicon germanium (SiGe) segment dominated the power amplifier market in 2023. The SiGe power amplifiers function very well in terms of linearity, efficiency, and gain. Due to its advantages in high-frequency applications, SiGe is a popular material in a lot of contemporary wireless communication systems. SiGe technology offers performance and cost in a way that is fairly balanced.

It is appealing for a variety of applications as it is more affordable than some other cutting-edge materials like gallium arsenide (GaAs) and gallium nitride (GaN). SiGe enables the coexistence of digital and analog components on a single chip. This feature is useful for creating highly integrated circuits, which are valuable in the mobile and wireless communication sectors because they minimize the size, cost, and power consumption of devices.

The gallium arsenide (GaAs) segment is expected to grow at a significant CAGR in the power amplifier market during the forecast period. Gallium arsenide power amplifiers provide high electron mobility, high-frequency capabilities, and low noise levels, among other good performance qualities. Because of these characteristics, gallium arsenide is a great choice for high-performance applications like cutting-edge wireless communication systems.

The market for gallium arsenide is driven by the growth of high-frequency applications, such as radar systems, satellite communications, and 5G networks. The gallium arsenide is perfect for these applications as it excels at processing high-frequency impulses. The power amplifiers for 5G technology must have increased frequency and bandwidth capabilities. Due to their suitability for these needs, gallium arsenide power amplifiers are an essential part of the deployment and growth of 5G infrastructure.

The consumer electronics segment dominated the power amplifier market in 2023. The increasing use of tablets, smartphones, and other mobile devices is creating a large need for power amplifiers. For these devices to manage wireless communication and guarantee optimal performance, small and effective power amplifiers are needed. The use of wireless communication technologies like Wi-Fi, Bluetooth, and 4G/5G is becoming more and more common in consumer devices.

For these devices to continue transmitting signals that are dependable and robust, power amplifiers are a must. Smart TVs, music systems, and home theater systems are just a few of the home entertainment systems that are becoming more and more popular. For these systems to provide better connection and sound, high-quality power amplifiers are frequently needed.

The healthcare segment is expected to grow at a notable CAGR in the power amplifier market during the forecast period. An increasing number of advanced medical devices, including CT and MRI scanners, ultrasound machines, and patient monitoring systems, need effective power amplifiers. For precise signal processing and crisp images, these devices depend on high-performance amplifiers. Steady wireless communication technologies are required in light of the COVID-19 epidemic and the subsequent growth of telemedicine and remote patient monitoring. For these systems to provide strong and consistent communication between patients and healthcare professionals, power amplifiers are crucial.

The market for small and effective power amplifiers is being driven by the growing popularity of wearable health devices, such as medical-grade wearables, fitness trackers, and smartwatches with health-monitoring capabilities. Amplifiers are necessary for these devices to manage additional functions, such as wireless data transfer.

Asia Pacific dominated the global power amplifier market in 2023. The consumer electronics industry in Asia Pacific is enormous, especially in nations like China, Japan, South Korea, and India. In this area, there is a great need for power amplifier-using electronics such as audio systems, televisions, cellphones, and other gadgets. Asia Pacific is home to production sites for many international electronics firms because of the region's established supply chains, trained labor force, and cheaper labor prices.

The strong demand for the power amplifier market in a variety of electronic goods is driven by production concentration. Leading nations in technology innovation include South Korea and Japan, especially in the areas of electronics and telecommunications. This region is seeing substantial growth of improved power amplifiers for a variety of applications, such as 5G and IoT. With substantial production and sales volumes, the automobile sector in Asia Pacific is substantial. The need for power amplifiers is increased by the growing integration of sophisticated audio and communication systems in automobiles.

North America is expected to grow at the highest CAGR in the power amplifier market during the forecast period. The United States, in particular, has a strong technological foundation that facilitates the creation and uptake of cutting-edge technology in North America. This infrastructure makes innovation and the use of high-performance power amplifiers in a range of applications easier. The need for power amplifiers is being driven by North America's growing use of smart technologies and Internet of Things (IoT) devices. These gadgets need to be dependable and effective.

North America is home to a large number of top semiconductor and electronics firms, including those that specialize in power amplifiers. These businesses spearhead the creation, advancement, and marketing of cutting-edge power amplifier technology. The adoption of 5G technology is leading the way in North America, and high-frequency and high-speed wireless communication depends on sophisticated power amplifiers. The demand for the power amplifier market is rising significantly as a result of the quick uptake and spread of 5G networks.

Segment Covered in the Report

By Type

By Material

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024

August 2024

December 2024