January 2025

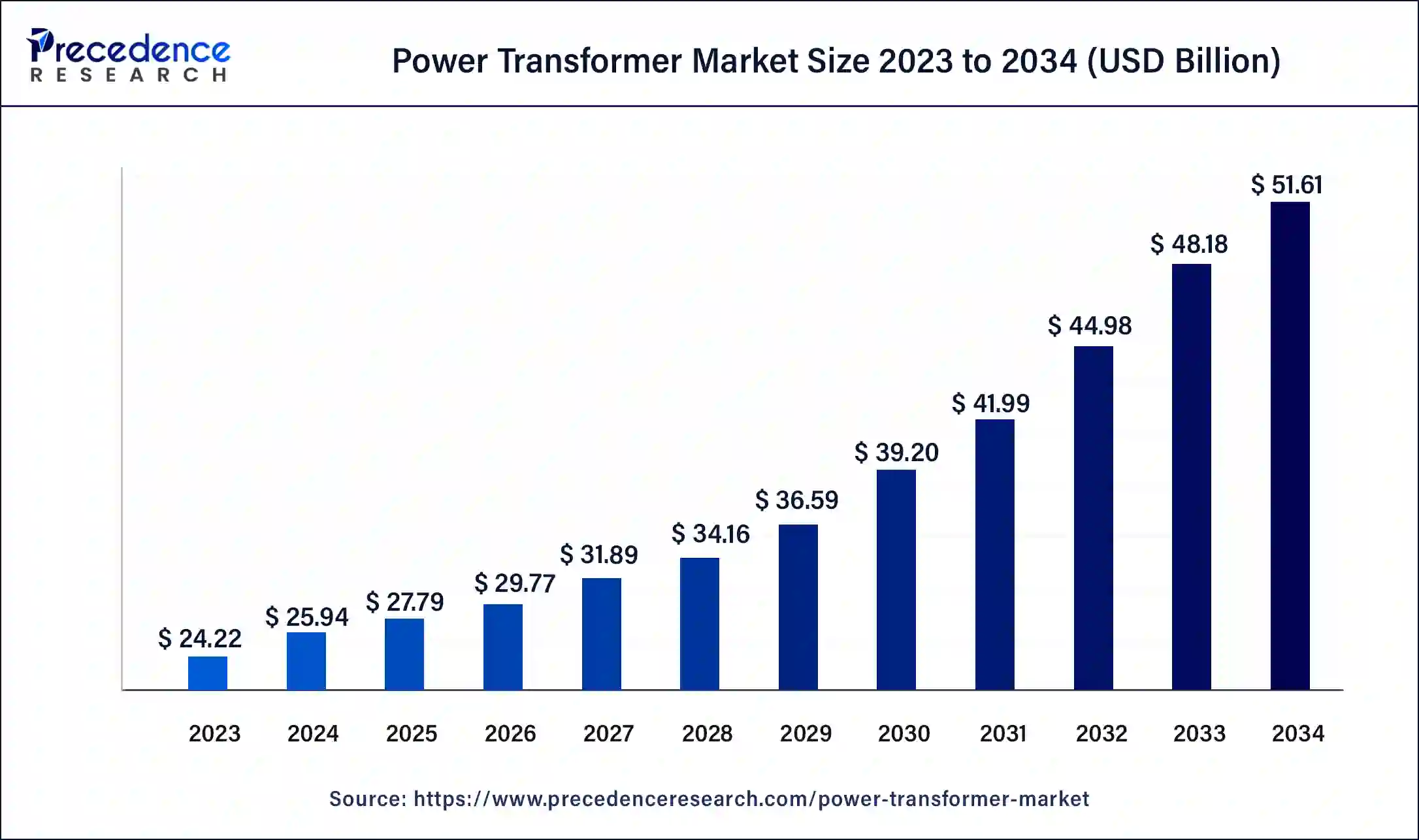

The global power transformer market size was USD 24.22 billion in 2023, calculated at USD 25.94 billion in 2024 and is expected to be worth around USD 51.61 billion by 2034. The market is projected to grow at a solid CAGR of 7.12% from 2024 to 2034.

The global power transformer market size is expected to be valued at USD 25.94 billion in 2024 and is anticipated to reach around USD 51.61 billion by 2034, growing at a CAGR of 7.12 % over the forecast period 2024 to 2034. Rising levels of industrialization and urbanization in emerging nations are driving up energy consumption, which calls for the development of power infrastructure and raises the need for the power transformer market.

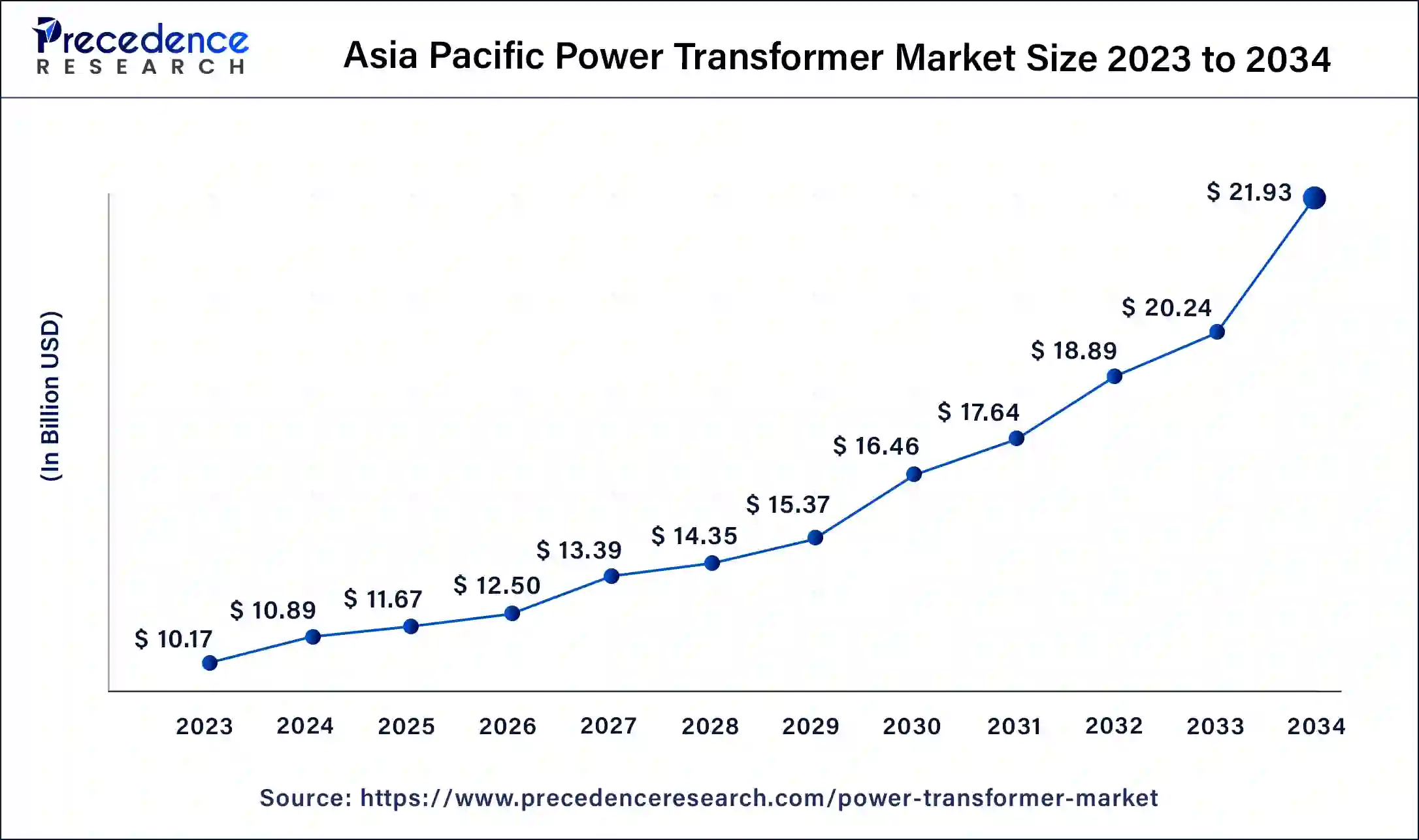

The Asia Pacific power transformer market size was exhibited at USD 10.17 billion in 2023 and is projected to be worth around USD 21.93 billion by 2034, poised to grow at a CAGR of 7.23% from 2024 to 2034.

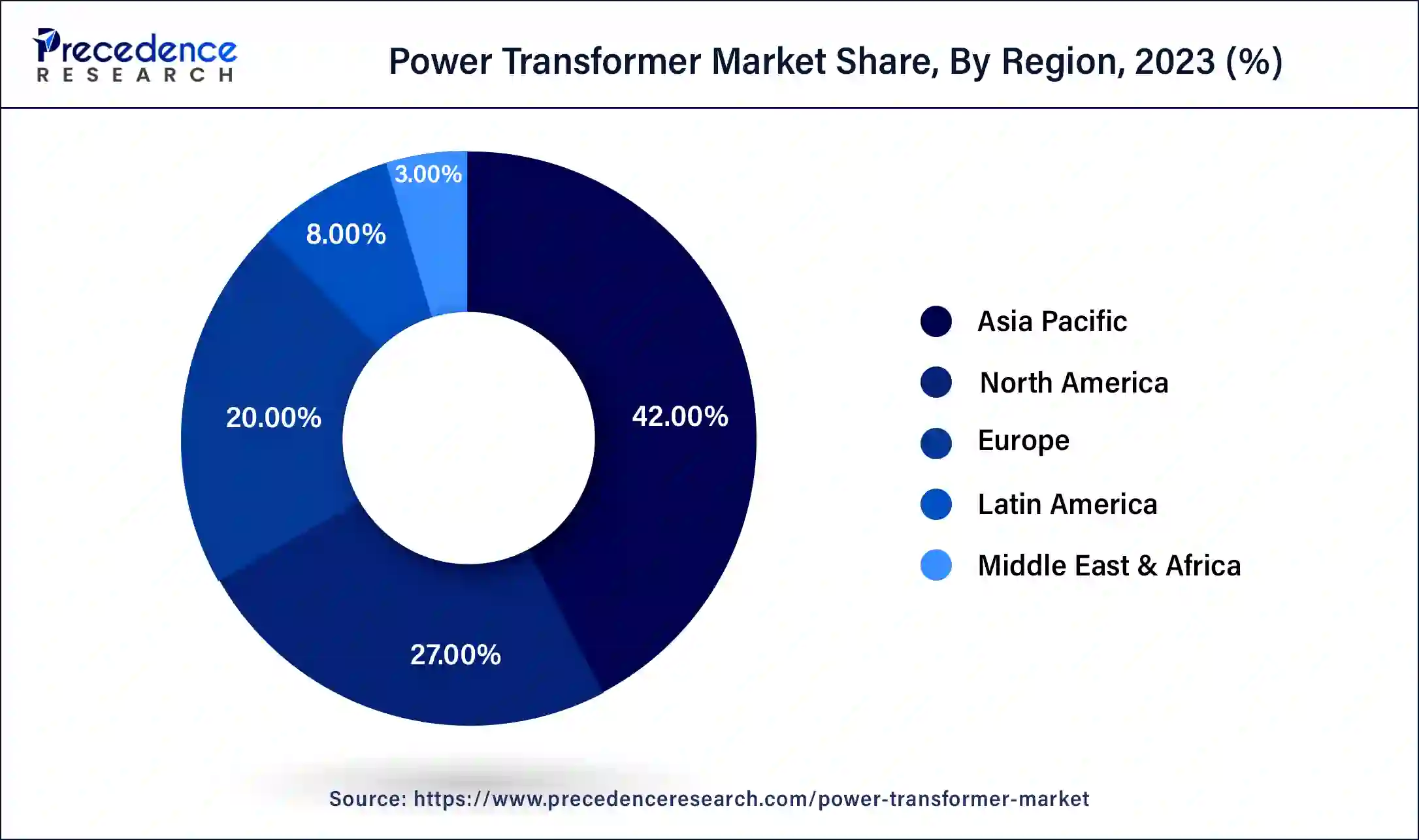

Asia Pacific held the largest share of the power transformer market in 2023. The Asia Pacific power transformer market is expanding significantly as a result of several factors, including industrialization, urbanization, and rising energy sector investments. The need for energy is rising due to rapid urbanization and industrial growth in nations like China, India, and Southeast Asia, which is also increasing the requirement for power transformers.

Power transformers that are efficient are necessary for grid integration in the growing number of renewable energy projects, especially those involving solar and wind energy. The market is growing as a result of government policies and initiatives targeted at modernizing and extending the current electricity infrastructure. Power transformer demand is rising in the region as a result of rural electrification efforts in developing nations.

North America is expected to host the fastest-growing power transformer market over the studied period. One main factor is the requirement to modernize and replace the deteriorating electrical infrastructure. In North America, a large number of power transformers are nearing the end of their useful lives and need to be replaced. Power transformer demand is increasing due to population increase and industrialization, which are driving up the demand for electricity. Other important issues are the growth of smart grids and urbanization.

Modern transformers that can manage fluctuating power loads and improve grid stability are necessary for the integration of renewable energy sources like solar and wind power into the grid. Market expansion is being propelled by advancements in transformer technology, including eco-friendly substitutes and digital transformers. These developments provide better monitoring and diagnostics, increase efficiency, and decrease losses.

Urbanization, industrialization, and the expansion of infrastructure have all contributed to the steady growth of the power transformer market globally. The development of renewable energy sources and the requirement to modernize old power infrastructure both have an impact on growth. A notable trend is the adoption of smart transformers, which provide improved communication, diagnostic, and monitoring features. Utilities benefit from these transformers by increasing dependability, efficiency, and the successful integration of renewable energy sources. Due to government incentives for infrastructural development, fast industrialization, and urbanization, Asia Pacific now leads the industry. Driven by attempts at grid modernization and integration of renewable energy, North America and Europe also make major contributions.

For electricity to be transmitted and distributed from power-producing plants to a variety of end customers, including the commercial, industrial, and residential sectors, power transformers are necessary. They are essential to the conversion of voltage, which guarantees the effective distribution of electricity. Difficulties include complicated integration of renewable energy into current systems, environmental concerns, and strict regulatory criteria. Geopolitical issues and changes in the economy can also have an effect on the power transformer market expansion. As more nations upgrade their electrical infrastructure to meet rising demand and incorporate more renewable energy sources, the market is predicted to continue expanding. Future developments will probably be fueled by innovations in digital technologies, design, and materials.

| Report Coverage | Details |

| Market Size by 2034 | USD 51.61 Billion |

| Market Size in 2023 | USD 24.22 Billion |

| Market Size in 2024 | USD 25.94 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.12% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Core, Insulations, Phase, Rating, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Modernization of aging infrastructure

The increasing demand for electricity due to growing urbanization and industrialization has made it necessary to modify the infrastructure of power transformers to accommodate the increased load. Modernizing the current grid infrastructure is necessary due to the transition towards renewable energy sources such as hydropower, solar power, and wind power. The variable inputs from various renewable sources require power transformers to be flexible.

In order to integrate cutting-edge technologies like artificial intelligence (AI) and the Internet of Things (IoT), modern transformers must be able to analyze data in real-time, monitor systems in real-time, and operate more efficiently. Globally, governments are enacting laws and policies aimed at encouraging energy conservation and mitigating carbon emissions. These laws frequently require that older transformers be swapped out for newer, more energy-efficient units.

Complex installation processes

In the power transformer market, intricate installation procedures have a big impact on growth and market dynamics. These multi-stage procedures call for a high degree of skill and strict respect for safety precautions and regulatory standards. Power transformer costs might rise dramatically as a result of intricate installation procedures. The whole cost includes the cost of trained labor, specialized equipment, and logistics.

Labor markets may be strained by the need for highly qualified specialists to manage complicated installations. Technological advancements in installation, like modular transformers, can simplify and expedite procedures. The effectiveness of installations and operational dependability can be increased by implementing smart technology for remote monitoring and diagnostics.

Smart grid implementation

The power transformer market's use of smart grid technology is a major engine of innovation and expansion. Smart grids monitor, control, and optimize power distribution by using digital technologies to manage electricity more effectively. By minimizing blackouts and guaranteeing a steady supply of electricity, smart grids improve the effectiveness and dependability of electricity distribution.

Smart grid-enabled power transformers optimize load management and reduce energy loss by monitoring and reacting to data in real time. Renewable energy sources, like solar and wind power, can more easily be integrated into the electrical grid thanks to smart grids. Proactive maintenance is made possible by the continual monitoring and diagnostics that smart transformers can do, which helps to anticipate any faults.

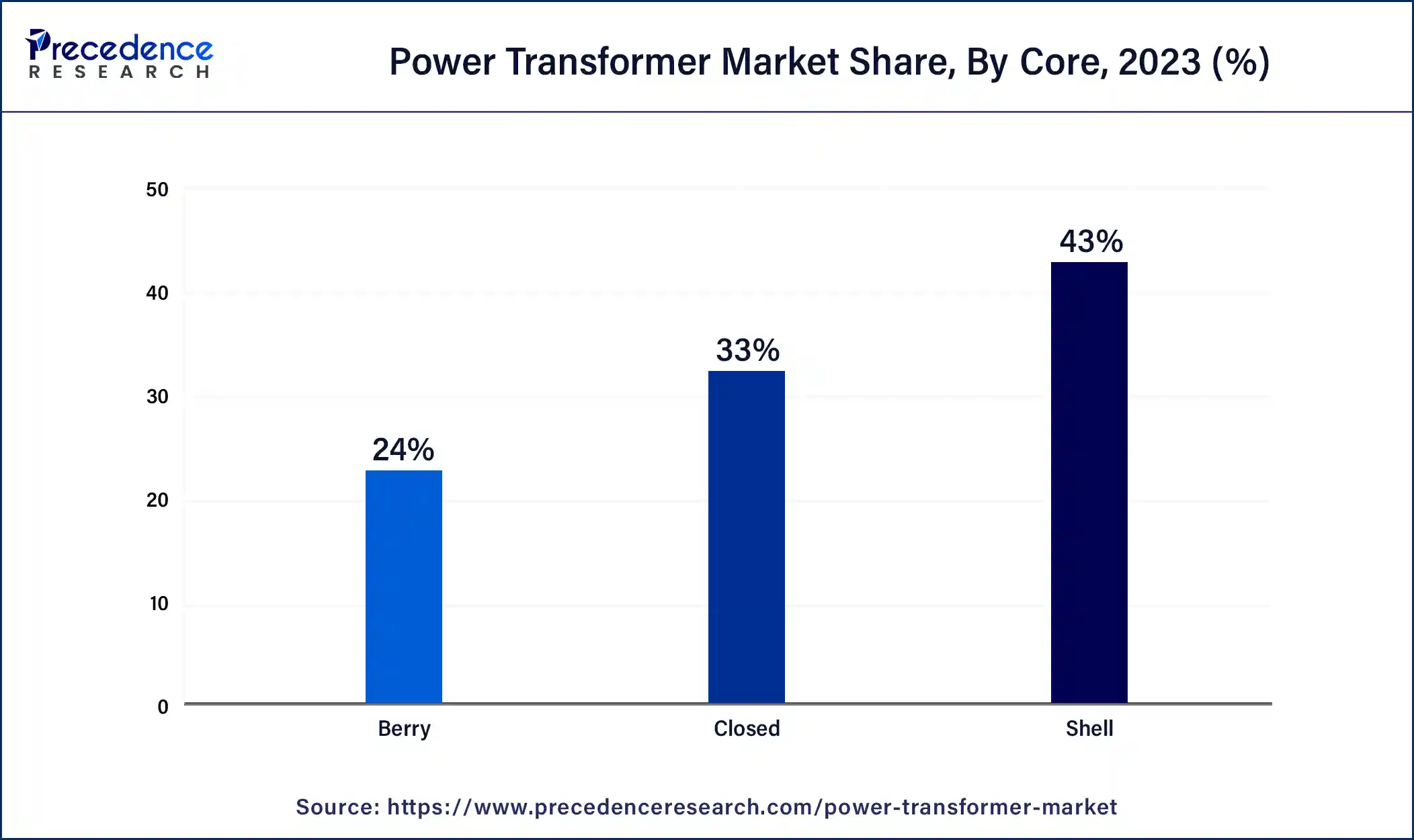

The shell segment accounted for the largest share of the market in 2023. In the market, a particular kind of transformer design is referred to as the shell section. The core of shell-type transformers encircles the windings. Better winding protection and a more compact design are made possible by this arrangement. By splitting the magnetic circuit, a channel for the magnetic flux contained within the core is created, minimizing leakage and increasing efficiency.

In order to accommodate variable power loads and improve grid stability, the growing emphasis on integrating renewable energy sources into the power grid may spur additional advancements in shell-type transformer designs. The power transformer market's shell category is expected to experience expansion because of its advantages in terms of efficiency, durability, and appropriateness for high-voltage applications.

The closed segment is expected to grow at the fastest rate in the market during the forecast period. Hermetically sealed or enclosed transformers are usually referred to as being in the ‘closed segment’ of the power transformer market. The interior components of these transformers are not intended to come into touch with the outside world. This closed design lowers maintenance needs, preserves insulation integrity, and shields the transformer from outside elements, including moisture, dust, and pollutants. For transformers used in challenging or outdoor settings where durability and dependability are crucial, this is an important factor to take into account.

The oil segment led the global market in 2023. The term ‘oil segment’ describes transformers that employ insulating oil, such as mineral oil, for cooling and insulation. Due to their efficiency in dispersing heat produced during operation, as well as their capacity to insulate and safeguard the transformer windings, these transformers are extensively utilized. Mineral oil is well-known for its strong dielectric strength and superior cooling capabilities, both of which are essential for transformer dependability.

When compared to dry-type transformers, oil-filled transformers are frequently more affordable, particularly for higher power ratings. To guarantee the best possible performance and long lifespan of oil-filled transformers, routine maintenance is required, including oil testing and treatment. The development of infrastructure, the integration of renewable energy sources, and the expansion of industry all have an impact on the need for power transformers, including oil-filled models.

The gas segment is expected to grow at the fastest rate in the market over the forecast period. Gas-insulated transformers (GITs) or transformers with gas monitoring systems are commonly referred to as part of the gas segment in the power transformer market. Sulfur hexafluoride (SF6) and other gases are used in these transformers for cooling and insulating. Because it provides benefits, including small size, improved safety, and effective performance in high-voltage applications, the gas section is essential. Because of regulations pertaining to greenhouse gas emissions and environmental concerns, monitoring systems for these gases are likewise becoming more and more important. This section contributes significantly to the modernization of electrical grids and guarantees dependable power distribution and transmission.

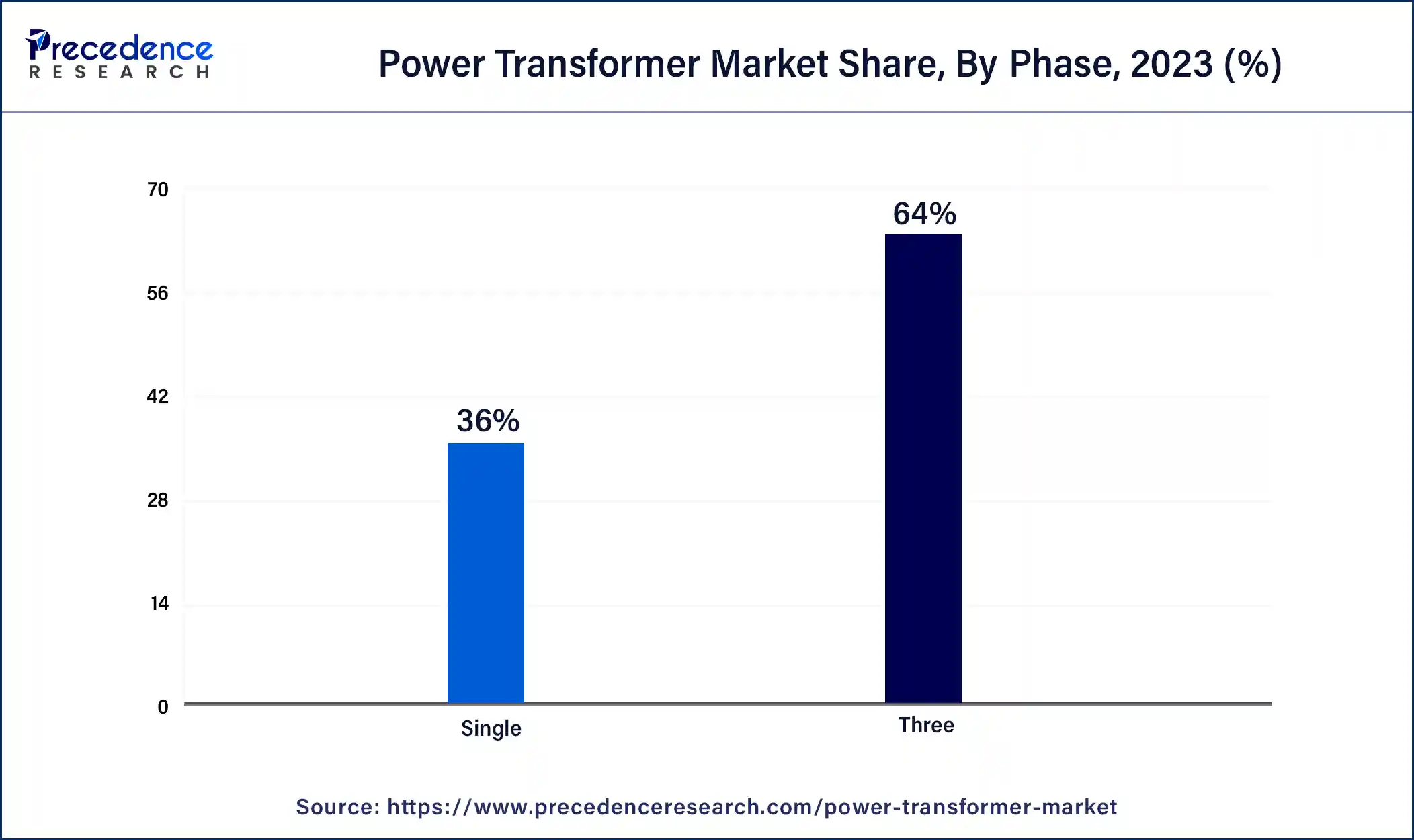

The three-phase segments held the largest share of the market in 2023. A substantial portion of the power transformer market, the three-phase segment primarily serves large-scale applications requiring the effective distribution or long-distance transmission of electrical power throughout commercial and industrial spaces. For sectors including industrial, utilities, and infrastructure development, stable voltage levels and effective power transmission are critical, and three-phase transformers play a key role in these areas.

They are essential in big power distribution networks and heavy industrial operations because they are made to withstand larger voltages and currents than single-phase transformers. These transformers are used in substations by utilities to efficiently distribute power over wide areas. When it comes to incorporating renewable energy sources like solar and wind power into the grid, three-phase transformers are essential.

The single-phase segment is expected to grow rapidly in the market during the projected period. Transformers intended to handle single-phase AC power are generally referred to as single-phase in the power transformer market. As these transformers demand less power than three-phase systems, they are frequently utilized in small-scale industrial, commercial, and residential applications.

They are essential in adjusting voltage levels to suit a range of uses, including smaller machines, appliances, and distribution networks. In order to effectively convert voltage levels while preserving electrical isolation and safety, these transformers are essential. Distribution networks frequently employ them to reduce high-voltage electricity to lower voltages appropriate for local consumption.

The 100 MVA to 500 MVA segment dominated the market in 2023. Transformers with a voltage between 100 and 500 MV are essential in the power transformer market, particularly for large-scale industrial applications and high-capacity power transmission projects. In order to provide a steady and dependable electrical supply throughout grids and industrial sites, these transformers are crucial for effectively stepping up or stepping down voltage levels. Their demand is frequently correlated with the growth of power transmission networks and infrastructural projects.

In order to ensure a steady supply of power and reduce transmission losses, they are generally utilized in applications that need higher voltage transmission or distribution. These transformers are essential parts of contemporary electrical networks, sustaining the world's expanding electricity consumption in a variety of industries.

The 501 MVA to 800 MVA segment will expand rapidly in the market in the upcoming years. Transformers with ratings ranging from 501 MVA to 800 MVA are commonly utilized in large-scale applications, including huge power plants, broad electrical distribution networks, and major industrial facilities, according to the power transformer market. These transformers play a critical role in the effective and low-loss transmission of high-voltage power over extended distances. They are crucial in making sure that there is a steady and dependable supply of electricity to suit the needs of the utility and industrial sectors.

They enable the effective and low-loss transmission of electricity across great distances, providing big cities, factories, and other high-demand sectors with a steady and dependable power supply. To maintain operational efficiency and reliability under varied load situations, modern insulating materials, cooling systems, and monitoring capabilities are incorporated into their design and construction.

The industrial segment accounted for the largest share of the market in 2023. Transformers intended to satisfy the unique power requirements of industrial facilities are often included in the industrial sub-segment of the power transformer market. These transformers are essential for maintaining dependable power management and distribution in industrial settings, which frequently have special power needs because of large-scale operations, manufacturing processes, and heavy machinery.

When compared to transformers used in residential or commercial applications, transformers in this subsegment frequently have larger capacities. Depending on the needs for industrial power, these transformers might be medium- or extra-high voltage. In industrial transformers, energy efficiency plays a major role in reducing power losses and operating expenses. This segment's transformers might use cutting-edge design elements and insulation materials to increase efficiency.

The residential & commercial segment is expected to show significant growth in the power transformer market during the projected years. Scaling down voltage levels from the transmission network to safe levels appropriate for domestic usage requires these transformers. Smart grid technologies, which depend on sophisticated transformers for effective energy distribution and management, are becoming more and more prevalent in residential areas.

Distribution transformers are necessary for commercial buildings to efficiently control voltage levels, much like in residential settings. To accommodate unique power demands, large commercial venues like malls, hotels, and office complexes frequently need specially designed transformers. Innovations in transformer technology, including as improvements in efficiency, dependability, and integration with smart grid systems, help both industries. This progression is meeting the increasing need for a reliable and effective power supply in both residential and commercial settings.

Segment Covered in the Report

By Core

By Insulations

By Phase

By Rating

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

August 2024

February 2025