January 2025

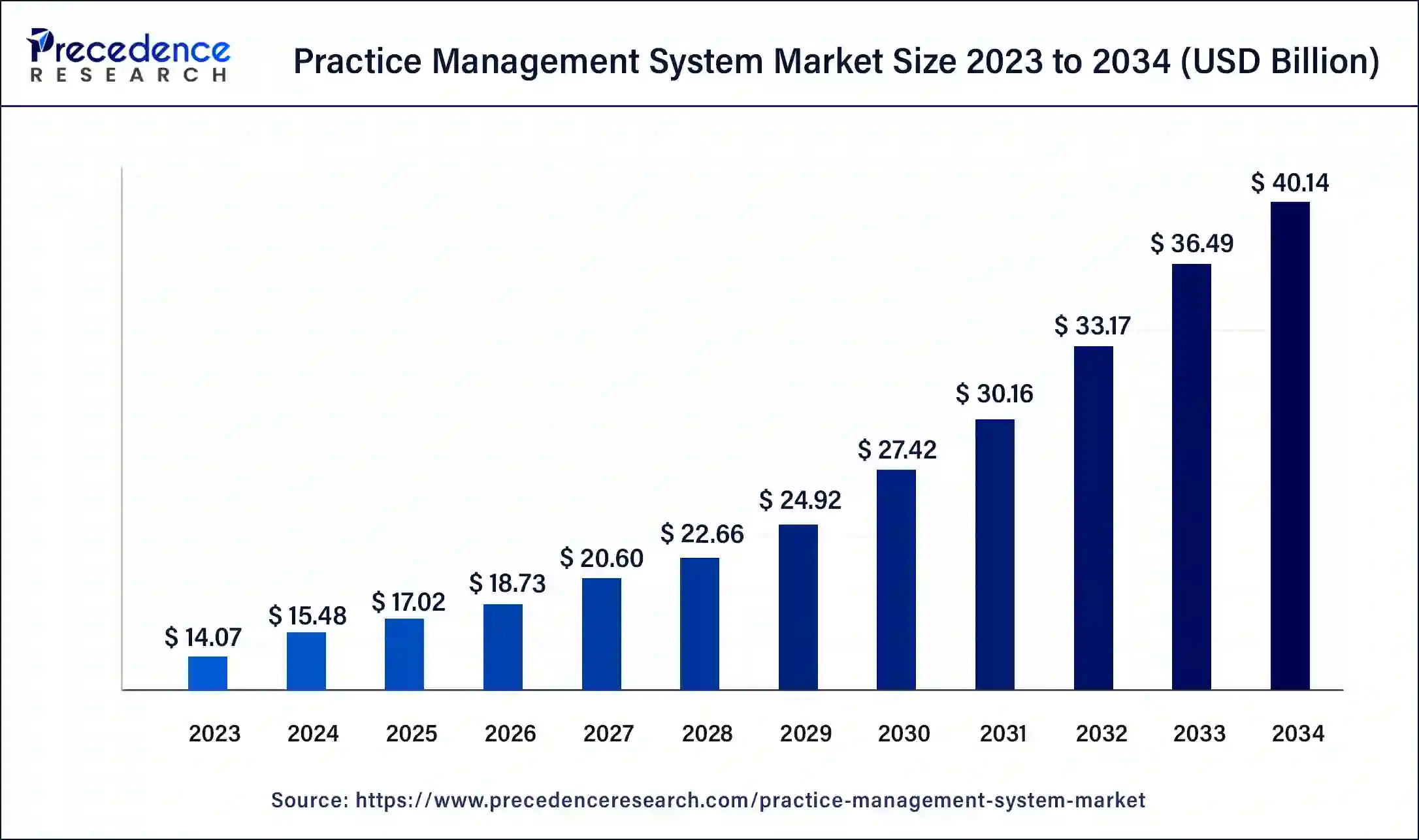

The global practice management system market size was USD 14.07 billion in 2023, calculated at USD 15.48 billion in 2024 and is projected to surpass around USD 40.14 billion by 2034, expanding at a CAGR of 10% from 2024 to 2034.

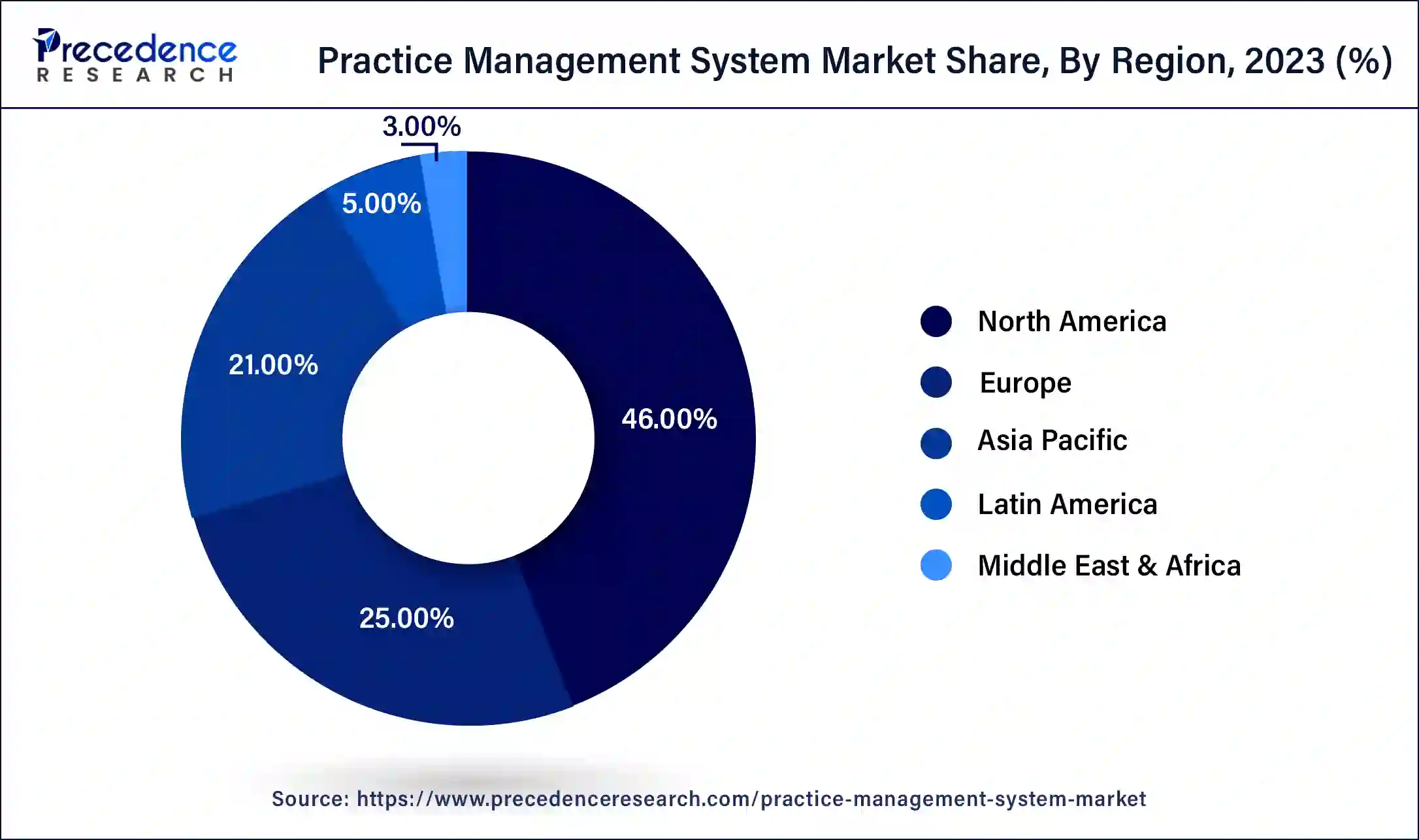

The global practice management system market size accounted for USD 15.48 billion in 2024 and is expected to be worth around USD 40.14 billion by 2034, at a CAGR of 10% from 2024 to 2034. The North America practice management system market size reached USD 6.47 billion in 2023.

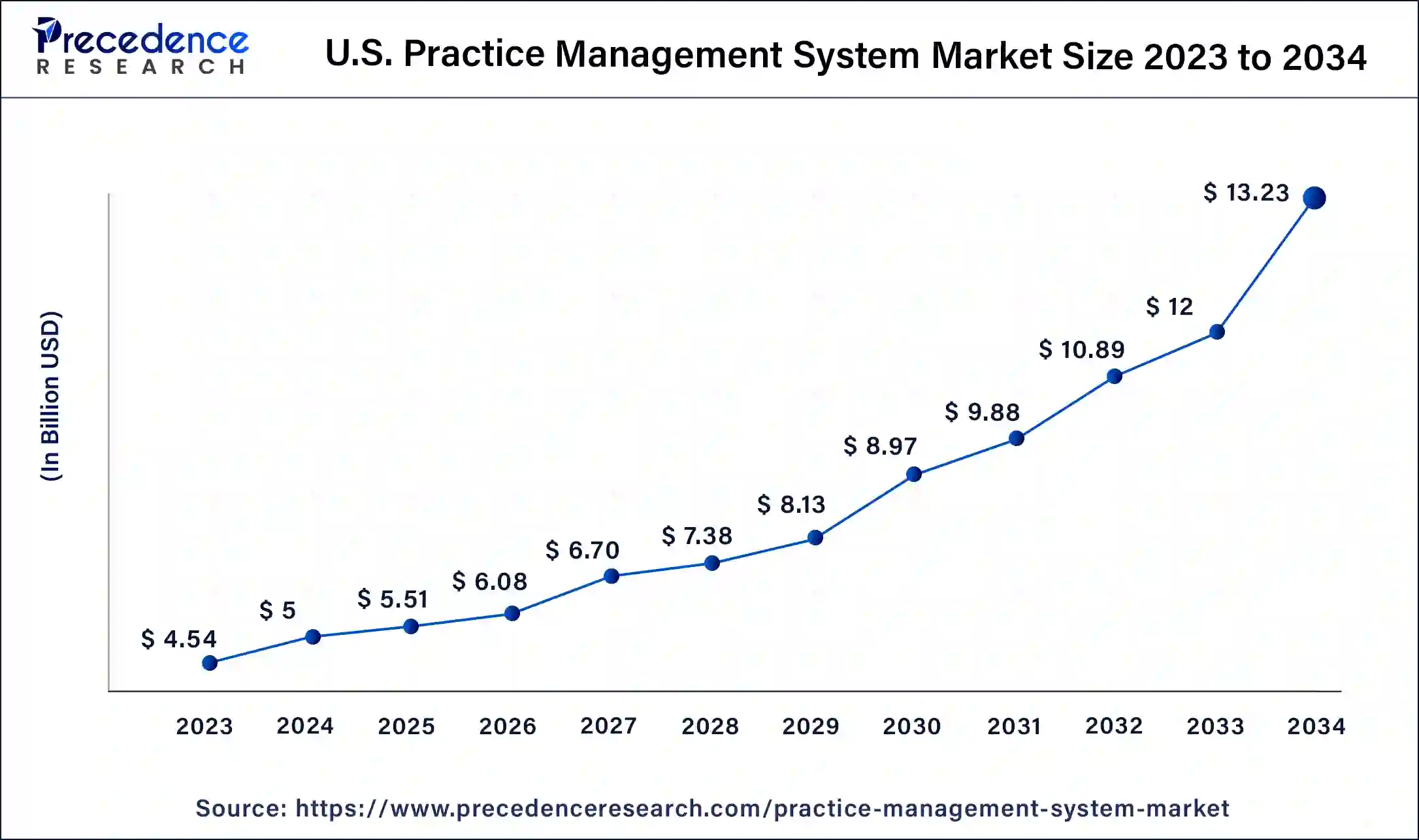

The U.S. practice management system market size was estimated at USD 4.54 billion in 2023 and is predicted to be worth around USD 13.23 billion by 2034, at a CAGR of 10.2% from 2024 to 2034.

North America has dominated the market with the highest revenue share in 2023. Practice management systems are useful in the US for keeping track of patient records, billing, scheduling appointments, and insurance information, among other aspects of the healthcare industry. The majority of PMS systems are created in small- to medium-sized medical practices in the United States. Small and medium-sized practices typically use practice management software to handle routine tasks, such as accounting and administrative responsibilities. Some offices also utilize it to integrate with electronic medical records. A portion of the software was created specifically for or utilized by outside medical billing organizations. Hospital third-party medical billing companies employ some type of medical practice management software. Government funding will undoubtedly speed up healthcare providers' adoption of medical practice management and alter how players behave in general.

On the other hand, Asia-Pacific (APAC) is expected to grow at the highest CAGR, owing to supportive government reforms and organizations that support the development of patient engagement solutions, EHRs, and e-prescription platforms. Chronic disease prevalence is increasing, which aids market expansion in the Asia Pacific region. The World Health Organization estimates that chronic diseases are to blame for 71% of all fatalities in Asia. Aging populations, unhealthy lifestyles, and environmental factors are all contributing to an increase in the prevalence of chronic diseases. One of the most prevalent chronic diseases in Asia is chronic kidney disease (CKD), and there is wide regional variation in CKD prevalence (7.0%–34.3%). The number of patients who need continuing medical care as a result of these disorders expands, driving up the market for medical practice management software.

Many medical and healthcare practices use practice management software (PMS), a category of computer programs. The primary objective of this software is to help with administrative task organization, appointment scheduling effectiveness, invoice generation ease, and many other things.

A highly favorable environment is developing for the market for practice management systems due to rising investments in healthcare facility upgrades, particularly in developed countries, and the expansion of the healthcare IT sector in developing regions.

The existence of virtual or cloud-based service systems, which allow businesses far away to deliver services at affordable prices, is projected to lead to an expansion in the PMS industry.

The development of IT and the rise in the number of federal initiatives that support the consolidation of health records onto a single platform are driving the growth of the PMS sector. However, the high cost and length of time needed for integration, the scarcity of IT specialists for maintaining the PMS, and worries about data privacy and security restrain market expansion.

| Report Coverage | Details |

| Market Size in 2023 | USD 14.07 Billion |

| Market Size in 2024 | USD 15.48 Billion |

| Market Size by 2034 | USD 40.14 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type, By Component, By Mode of Delivery, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Improved patient care standard

A good system will enhance the overall efficiency and organization of your company, freeing up your staff to focus on the quality of patient care. An automated practice management system can take over a lot of the redundant and repetitive tasks that your employees must complete daily, freeing them up to interact with patients more effectively. Patient management software can increase efficiency because many patient care procedures take an unnecessarily long time. For instance, doctors and patients used to communicate mostly by phone calls and emails, but excessive no-shows, call drops, and schedule changes might result in unnecessarily long wait times and missed appointments.

However, by automating communication, a patient management system's patient portal can significantly raise patient satisfaction. Patients can arrange appointments online through patient portals, as well as change or cancel existing ones. With the help of a patient portal, several care processes, including the gathering of forms and surveys, patient reporting, appointment scheduling, and patient education, can be automated. As a result, time is saved, efficiency is raised, and patient care quality is improved.

Issues with privacy and data security

Data protection issues are becoming more difficult, despite the exciting transition from analog to digital medicine. If embraced by healthcare organizations, EMRs can offer numerous advantages to doctors, patients, and healthcare services. However, a few health institutions may implement EMRs at a relatively low rate due to worries about patient information security and privacy.

Many hospitals favor cloud-based MPMS over on-premises systems because of its accessibility and affordability. The use of cloud-based MPMS in medical practice is dangerous, though, as it might make patient data and insurance information public. The significant danger of information leakage makes data misuse or manipulation possible. Unauthorized insurance claims could raise legal and security challenges, as well as issues with regulatory and statutory compliance, auditing, and logging. Therefore, during the projected period, these factors can restrain market expansion for medical practice management software.

Popularity of e-prescriptions increases

An electronic prescription also referred to as an e-prescription or an e-RX, can be used to convert medical prescriptions into a digital form that can be stored in the MPMS systems. These electronic prescriptions can be created digitally, sent straight to the pharmacist, and stored as an electronic health record document on the patient's tablet, laptop, or mobile device. In comparison to paper prescriptions, e-RX is more practical.

E-prescribing systems are characterized by more concise drug descriptions, fewer patient visits, and the capacity to manage both regular prescriptions and those for banned medicines. Additionally, e-prescribing enhances patient security and reduces pharmaceutical mistakes. The benefits of e-prescribing for patient safety include a shorter travel time between the point of care and the point of service, fewer prescription errors, and higher standards of care. Market manufacturers also provide e-prescription functionality in MPMS solutions and mobile applications.

Based on products, the global market has been divided into integrated and standalone systems. The largest revenue share was accounted for integrated systems because of the associated benefits of their use. The standalone system sector is anticipated to grow at the fastest rate during the projected time frame. EHRs that are compatible with practice management software must be used with any other products that are sold separately. Whereas the administrative responsibilities and tasks associated with the provision of healthcare services are facilitated by a type of medical/healthcare software solution known as integrated practice management software (IPMS). Integrated solutions include patient involvement, billing systems, and electronic health records (EHR).

The healthcare sector is not complete without electronic health records. The digital revolution significantly aided the adoption of EHRs and their benefits by hospitals around the world. These solutions offer features like ePrescription, scheduling, appointment systems, and messaging and billing portals with built-in EHR capabilities.

The component segment features software and services from the top players. In 2022, the software segment's revenue share was the highest revenue holder. Software is simple to set up, operate, and retrieve data because of user-friendly interfaces and ongoing product updates. Providers, hospitals, and health systems employ them to improve patient satisfaction and care quality. Some value-based care compensation models, including the Inpatient Prospective Payment System (IPPS), take patient satisfaction into account.

According to the Agency for healthcare research and Quality (AHRQ), patient satisfaction is based on whether a patient's expectations for a medical contact were met. Small to medium-sized medical offices use software to streamline and automate procedures needed to manage the business. Regulatory bodies are concentrating on expanding the use of practice management software to enhance the delivery of healthcare services, particularly in industrialized countries.

However, Due to the rising need for cloud-based solutions, technical support, and data security, the services segment is predicted to expand at a faster CAGR than the software segment during the projected period. Various services, like consulting, training, integration, and outsourcing, are included in this market since they support the implementation, upkeep, and optimization of practice management software. The demand for consistent software upgrades, adherence to evolving regulations, and customization of solutions to meet the unique requirements of various end users are further factors driving the services sector.

The global market has been further segmented into on-premises and cloud-based, depending on the products. The software is installed and runs on the local servers or PCs of healthcare organizations in an on-premises practice management system. Security, accessibility, and ease of retrieval of patient data are all provided by on-premises practice management solutions. The ease of access to the information on-site is the main factor driving preference for on-premises solutions. High data security, customization, and system control are benefits of using an on-premise practice management system.

Cloud-based solutions facilitate access to easily accessible information, even from remote locations, and are anticipated to grow at the market's fastest CAGR due to their benefits, including improved reliability and quicker processing. Daily operations are increasingly being carried out using cloud-based solutions. The only thing you need is an internet connection to access the necessary data and apps with cloud-based solutions from anywhere in the world. This eliminates the need to be physically present when concluding most commercial deals and makes remote work and collaboration with distant resources relatively simple.

In 2023, the hospital industry contributed the largest market's total revenue share. Hospitals are one of the primary end users of practice management systems since they need to manage a lot of patient data, medical records, billing data, and administrative tasks. The rapid adoption of integrated solutions that incorporate practice management systems with electronic health records (EHRs), laboratory information systems (LIS), and radiology information systems (RIS) is expected to cause the hospital segment to expand quickly throughout the forecast period. While the diagnostic laboratories and pharmacy segments are expected to grow at a significant rate throughout the forecast period. Pharmacy services such as drug therapy management, e-prescribing, and specialty pharmacy services are becoming more and more necessary. In addition to managing their inventory and dispensing, pharmacies also handle their billing, claims, and customer support. Diagnostic laboratories can increase their productivity, accuracy, compliance, and profitability with the aid of practice management systems. They have a variety of responsibilities, including ordering tests, gathering samples, reporting results, billing, and quality control.

Segments Covered in the Report:

By Product Type

By Component

By Mode of Delivery

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

April 2025

September 2024