February 2025

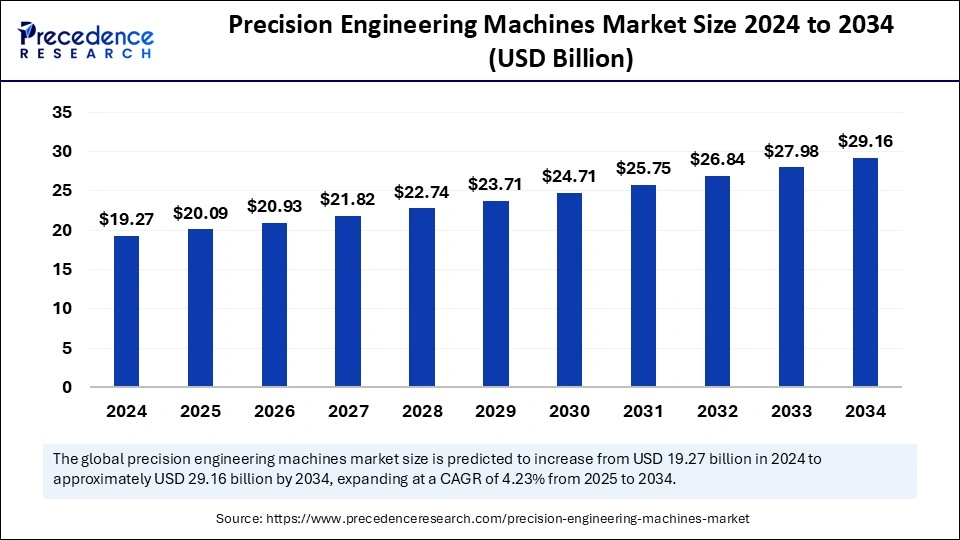

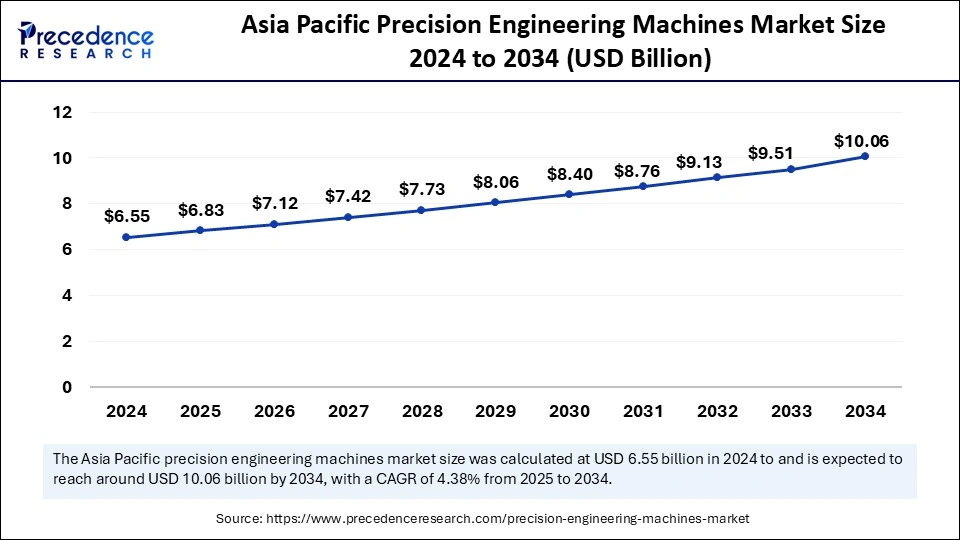

The global precision engineering machines market size is calculated at USD 20.09 billion in 2025 and is forecasted to reach around USD 29.16 billion by 2034, accelerating at a CAGR of 4.23% from 2025 to 2034. Asia Pacific market size surpassed USD 6.55 billion in 2024 and is expanding at a CAGR of 4.38% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global precision engineering machines market size accounted for USD 19.27 billion in 2024 and is predicted to increase from USD 20.09 billion in 2025 to approximately USD 29.16 billion by 2034, expanding at a CAGR of 4.23% from 2025 to 2034. The growth of the market is driven by the rise in demand for high-precise components in sectors like aerospace, electronics, and automotive.

AI significantly impacts the precision engineering machines market. Integrating AI algorithms into precision engineering machines improves accuracy and efficiency. AI monitors machine performance in real-time and identifies anomalies, enabling proactive maintenance and lowering machine downtime. AI significantly increases production by analyzing vast amounts of data. AI interface also guides machine operators, making it easy to operate machines. By learning from past experiences, the accuracy and speed of precision engineering machines can be improved, making them adaptable to many end-use industries. AI also offers digital twins' integration, which helps simulate and test machine performance for manufacturers before deployment.

Asia Pacific precision engineering machines market size was exhibited at USD 6.55 billion in 2024 and is projected to be worth around USD 10.06 billion by 2034, growing at a CAGR of 4.38% from 2025 to 2034.

Asia Pacific Precision Engineering Machines Market

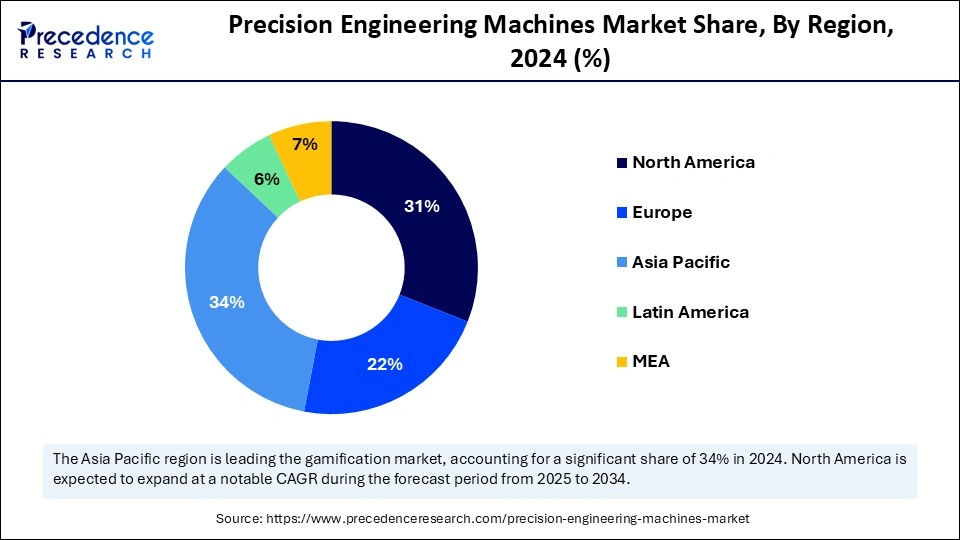

Asia Pacific dominated the market with the largest share in 2024. This is mainly due to the increased manufacturing operations, in which precision engineering machines play a crucial role. The rising investments in advancing industrial infrastructure and automation further bolstered the market in the region. Moreover, a strong focus on industrial automation, the evolution of Industry 4.0, and government initiatives to promote advanced manufacturing technologies positively influenced the market in the region.

China is a major contributor to the Asia Pacific precision engineering machines market due to its robust industrial base and increasing demand for high-precision products. China is known as the world’s largest manufacturing hub. With the rising manufacturing activities, there is a high demand for advanced solutions to boost production efficiency, unlocking avenues for precision engineering machines. Moreover, supportive government regulations to promote the use of precision engineering machines drive the market’s growth.

European Precision Engineering Machines Market

Europe is expected to witness the fastest growth in the coming years. The regional market growth can be attributed to the rising adoption of advanced technologies in manufacturing industries to boost the productivity and efficiency. The European Society for Precision Engineering and Nanotechnology (euspen) plays a crucial role in the market. euspen is an influential community that connects researchers, industrialists, respected authorities, and established and new players worldwide. It helps companies and research institutes to promote their latest technology and services and keep up to date with those in the field. Moreover, leading manufacturers and researchers are making efforts to build ultra-precise machines to support precision engineering.

North American Precision Engineering Machines Market

North America is expected to witness notable growth during the forecast period. The regional market growth is mainly attributed to the rising adoption of advanced technologies, such as robotics and automation solutions, in various industries. There is a high adoption of CNC machining. The rising focus on boosting the efficiency of manufacturing further contributes to market growth.

Precision engineering machines include different range of equipment, systems, and tools utilizes in the fabrication and manufacturing process to achieve high accuracy and quality. The use of precision engineering machines offers consistency and reliability, which are essential factors for advanced manufacturing processes with minimal errors. Growing adoption of AI-based manufacturing solutions, automation, and computer numerical control machines are contributing to the market's expansion. Moreover, the increasing demand for compact yet highly efficient electronic components and the rising demand for sophisticated electronic components for electric vehicles (EVs) further boost the growth of the precision engineering machines market. The increasing focus on energy efficiency and sustainability is prompting industries to adopt sustainable machine processes. The increasing adoption of 3D printing technologies, automation solutions, and AI-powered tools further support market expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 29.16 Billion |

| Market Size in 2025 | USD 20.09 Billion |

| Market Size in 2024 | USD 19.27 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.23% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Product Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Demand for High-Precision Components

One of the major factors driving the growth of the precision engineering machines market is the increasing demand for highly accurate components in various end-use industries like aerospace, defense, medical devices, electronics, semiconductors, and automotive. These industries are increasingly seeking high-tolerance components as a smaller deviation can significantly change the overall performance of a system. Aircraft components such as gear parts for landing and turbine blades require highly accurate machining for safety purposes and seamless functioning. The increasing defense investments by many governments across the globe to ensure national-level safety further boosts the demand for precision engineering machines.

The rising demand for compact and high-performance electronic devices is another driver for the market. Systems like circuit board manufacturing, microelectromechanical systems, and wafer fabrication in the semiconductor industry require extreme precision, which can be achieved by precision engineering machines, making them an essential part of these ever-evolving industries.

Shortage of Skilled Workforce and High Investment

Substantial investments required to procure precision engineering machines hamper the growth of the market. Initial investment is relatively higher, which creates challenges for small and medium-sized businesses and new entrants in the market seeking low-budget solutions. These machines also require regular maintenance for their smooth operation and reduce the possibilities of downtime, adding to operational costs. Moreover, the shortage of skilled labor is another key factor that restrains the growth of the precision engineering machines market. These machines often require specialized knowledge about operating parameters, as even a small deviation can affect the overall output.

Growing Adoption of 3D Printing

The widespread acceptance of additive manufacturing or 3D printing in various industries creates immense opportunities in the precision engineering machines market. 3D printed parts often need post-processing or integration with other machinery to achieve the expected finishing of surfaces and accuracy along with desired mechanical properties. Additionally, the integration of AI and IoT with precision engineering machines creates lucrative opportunities for market expansion. Integrating AI and Inernet of Things into these machines improves the monitoring and predictive maintenance capabilities, significantly enhancing efficiency and productivity.

The automotive segment dominated the precision engineering market with the largest share in 2024. This is mainly due to the increased adoption of precision engineering machines in the automotive sector. These machines are used to design and manufacture intricate automotive components, such as engines, electrical systems, safety systems, and braking systems. Precision engineering is reliable for producing braking systems and stability control systems, as failure of these systems may increase the risks of accidents. Moreover, precision engineering is beneficial in selecting suitable materials for automotive parts.

The industrial machinery segment is expected to witness the fastest growth in the foreseeable period. The segment growth can be attributed to various factors such as enhanced performance, increased safety and reliability, and increased lifespan of the machines due to the incorporation of precision engineering in the industrial machinery. Machines can run smoothly by reducing friction due to precision engineering, increasing performance and lessening downtime. Machinery malfunction can be reduced and aids in meeting stringent safety standards to avoid accidents and failures, which is further beneficial for a longer lifespan and minimizes additional investment for machine maintenance.

The CNC machines segment held the largest share of the precision engineering machines market in 2024. This is mainly due to the rise in demand for various automotive parts with high precision. The increased production of automotive multimedia systems further bolstered the segment. Computer numerical control (CNC) machines are used to design high-precision automotive parts. Components like brake systems and engine components need to be accurately designed, boosting the demand for CNC machines.

The 3D printers segment is projected to grow at the fastest rate during the forecast period. The growth of the segment can be attributed to the growing demand for 3D printing or additive manufacturing in the automotive and aerospace sectors to produce small batches of complex automotive parts. 3D printers are helpful for rapid prototyping and tooling in the automotive industry, accelerating product development cycles.

By Application

By Product Type

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025

February 2025

September 2024