April 2025

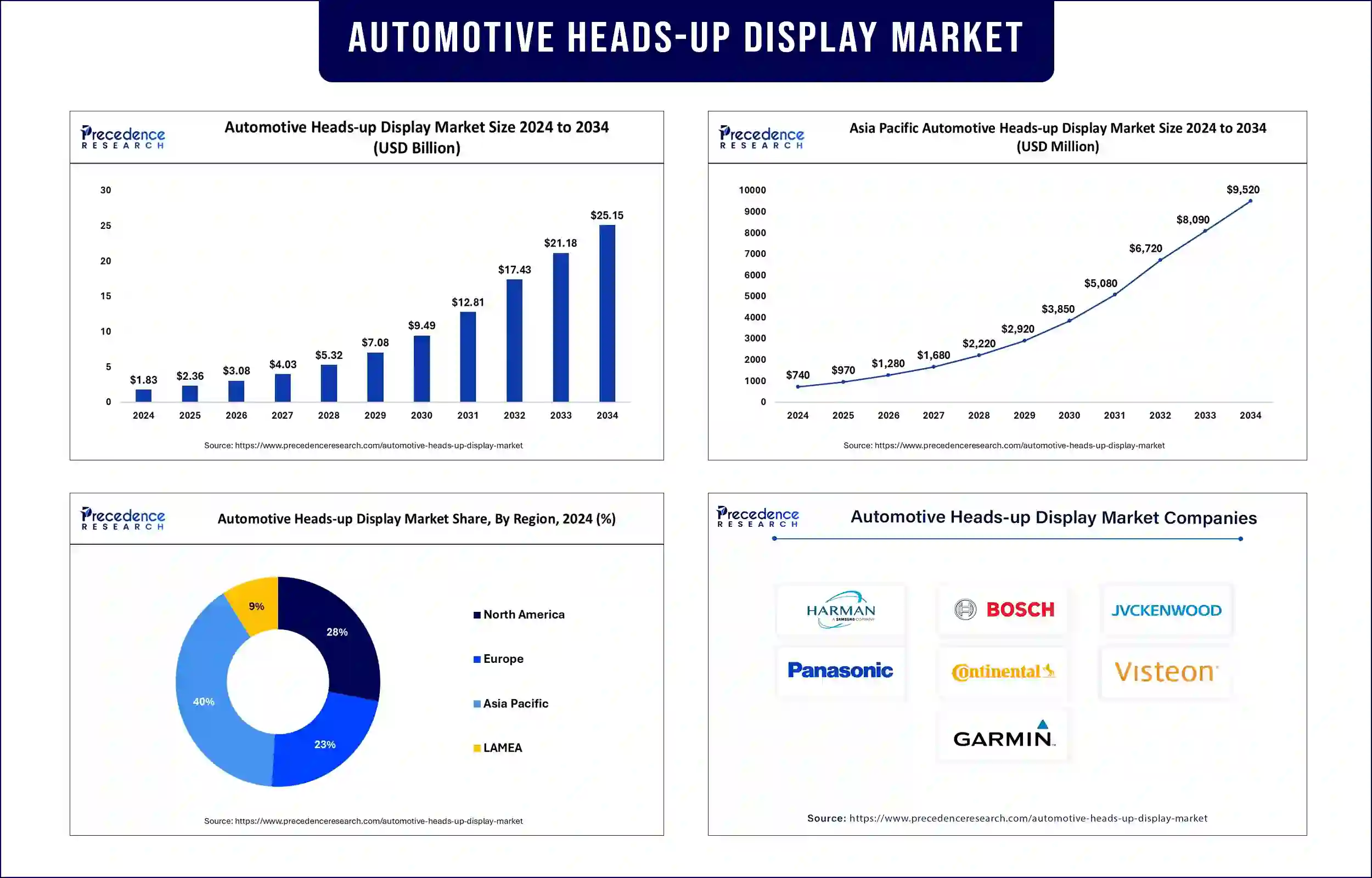

The global automotive heads-up display market revenue surpassed USD 2.36 billion in 2025 and is predicted to attain around USD 21.18 billion by 2033, growing at a CAGR of 29.95%. The increasing demand for connected vehicles, stringent safety regulations, and advancements in augmented reality (AR) and artificial intelligence (AI) are driving market expansion.

The automotive sector shows increasing market expansion for head-up displays since manufacturers incorporate innovative display systems to improve both driver safety features along with driving ease. The automotive heads-up display (HUD) projects necessary information about speed along with navigation and alerts directly onto a transparent viewing surface that sits on the windshield to prevent drivers from taking their eyes off the road. The Centers for Disease Control and Prevention (CDC) 2022 reports that distracted driving crashes result in nine daily U.S. fatalities based on their statistics.

The automotive heads-up display market expansion occurs as connected vehicles drive increased demand, alongside safety requirements and advancements in augmented reality and artificial intelligence. The Virtual and Augmented Reality Scientific Interest Group (VARIG) under the National Institutes of Health (NIH) works to investigate how mixed reality assists medical research and clinical practice but demonstrates the wider AR technology interest within the medical field. Modern automobiles use more HUDs with the rising demand for electric vehicles (EVs), coupled with autonomous driving development continues to drive their integration.

Rising Demand for Advanced Driver Assistance Systems

HUDs are becoming a critical component of ADAS, providing real-time alerts on lane departure, speed limits, and collision warnings, reducing driver distraction and enhancing road safety. The integration of HUDs with ADAS systems addresses critical safety problems, as they deliver crucial information to drivers within easy reach, thereby reducing their distraction.

ARDIG opened its doors as the Virtual and Augmented Reality Scientific Interest Group (VARIG) to investigate mixed reality applications within medical fields and clinical settings after receiving support from the NIH. The integration of HUD technology into ADAS systems through advancing automotive technologies establishes a primary position in road safety improvements while decreasing accident frequency.

Integration of Augmented Reality

The merging of augmented reality systems with heads-up displays offers drivers crucial windshield-based information through critical cues and notifications, which improves visibility and avoids driver diversions. Driving safety improves as AR-HUDs display critical information directly in front of drivers without diverting their attention from driving tasks. HUDs become safer with AR built-in, as they help prevent dangerous driving events that stem from driver distraction.

Increasing Electric and Autonomous Vehicle Adoption

The market is growing with rising electric and autonomous vehicle adoption to increase driver interactions and improve vehicle communication and safety functions. Real-time navigation and speed and hazard alerts presented in front-of-eye perspective reduce driver distraction. EV manufacturers, together with automakers, dedicate their finances to developing high-end AR-based HUDs for self-driving vehicles, which experts expect to deliver improved road conditions through enhanced situational awareness and accident prevention capabilities.

Advancements in Display Technology

New advancements in display technology transform automotive heads-up displays (HUDs) by improving both visibility and responsiveness and better engaging drivers on the road. The U.S. Department of Transportation (DOT) recognizes that OLED and micro-display projection-based modern HUDs deliver superior visibility under different lighting conditions with reduced glare.

Automobile producers combine augmented reality overlays with windshields to show 3D navigation and lane guidance and obstacle detection features, which enhance situational understanding during driving. These new technologies improve safety functions and create better comfort experiences while delivering enhanced user interactions, mostly within electric and autonomous vehicles.

Asia Pacific dominated the automotive heads-up display market in 2024, driven by increasing vehicle production in China, Japan, and South Korea, along with government initiatives promoting smart mobility and connected vehicle technologies. Vehicle production in Japan together with South Korea produced significant numbers which enhanced the growth of automotive industries within the region. The region demonstrates dedication to adopt technological progress as a means of enhancing safety performance and efficiency on roads.

North America is anticipated to grow at the fastest rate in the automotive heads-up display market during the forecast period, supported by stringent road safety regulations, high consumer demand for advanced vehicle technologies, and the strong presence of leading automakers investing in ADAS. ADAS integration for driver safety improvement receives strong support from the National Highway Traffic Safety Administration (NHTSA). The region is leading the world in HUD adoption, owing to its dedication to road safety through technological innovation and its plans to expand the implementation of these systems in more vehicle models.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 2.36 Billion |

| Market Revenue by 2033 | USD 21.18 Billion |

| CAGR | 29.95% |

| Quantitative Units |

Revenue in USD million/billion, Volume in units

|

| Largest Market |

North America

|

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Technology

By Heads-up Display Type

By Dimension

By Vehicle Class

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/1487

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

April 2025

January 2025

April 2025

January 2025