April 2025

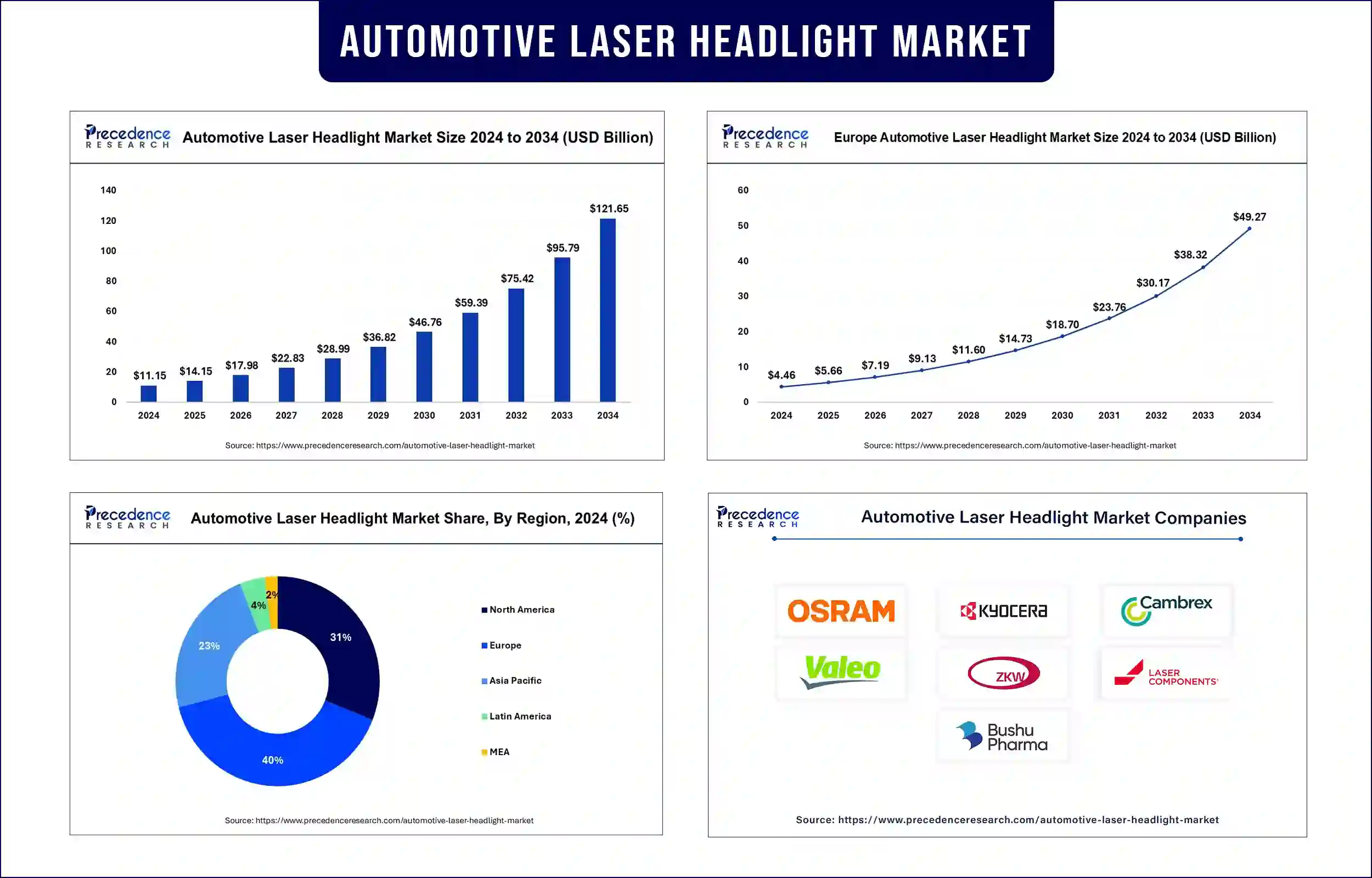

The global automotive laser headlight market revenue reached USD 14.15 billion in 2025 and is predicted to attain around USD 95.79 billion by 2033 with a CAGR of 27%. The global market is driven by increasing demand for advanced lighting technologies, growing focus on road safety, and rising adoption of high-performance vehicles.

The automotive laser headlight market encompasses advanced lighting solutions that use laser diodes to generate high-intensity beams, providing extended illumination range and superior brightness compared to conventional LED and halogen systems. The combination of performance improvements with safer nighttime vision enhancement and energy savings benefits also presents an attractive appearance for contemporary vehicles. Furthermore, the new regulatory standards and the continuous developments in technology.

Rising Demand for High-Performance and Luxury Vehicles

Premium car manufacturers are increasingly equipping their vehicles with laser headlights to enhance aesthetics, visibility, and energy efficiency. Brands, including BMW and Audi, have introduced laser headlights in select models, setting new standards for automotive lighting technology. Most premium vehicle manufacturers now equip their vehicles with laser headlights, as these features improve both visual performance and design appeal, and power efficiency. The automobile sector received a leap in lighting technology when BMW and Audi released laser headlights in their select lineup of vehicles.

Advancements in Laser Lighting Technology

Continuous innovation in laser diodes and phosphor materials is improving the efficiency, range, and adaptability of laser headlights. The recent developments in laser diode technology alongside phosphor materials have enabled adaptive intelligent lighting products to modify beam patterns for optimized illumination without glare effects for other drivers. Modern vehicle technology is accelerating the adoption of adaptive lighting systems built with laser technology due to new advancements and updated regulations.

Regulatory Push for Safer and Adaptive Lighting Systems

Government agencies worldwide, including the U.S. National Highway Traffic Safety Administration (NHTSA) and the European Commission, are encouraging the adoption of adaptive driving beam (ADB) technology to enhance night-time road safety and reduce accidents. ADB technology now receives U.S. regulatory approval in alignment with worldwide initiatives that include Europe and Japan due to its capability for bright illumination without producing glare for other road users. The European Commission backs advanced lighting system integration, especially ADB technology, within its extensive road safety program. A global commitment exists to combine advanced lighting technologies for better vehicle safety and night driving hazard reduction purposes through regulatory activities.

Integration of Laser Headlights in Electric Vehicles (EVs)

The growing EV market is driving the demand for energy-efficient lighting solutions. Electric vehicle manufacturers are creating increased demand for power-saving lighting solutions as electric vehicles are gaining market share. The energy-saving objectives of electric vehicle production benefit from laser headlights, which supply powerful illumination through reduced power requirements. New laser headlight models require approximately one-half of the power required by LED headlights, thus making them ideal lighting options for electric and hybrid vehicles. The lower power usage in laser headlights helps extend the driving range of EVs since fewer battery watts migrate to lighting systems. Laser headlights demonstrate superior energy efficiency along with superior visibility, as they are well-suited for electric vehicles with their dual performance and sustainability goals.

Europe dominated the global automotive laser headlight market, driven by strong regulatory frameworks supporting advanced lighting systems and increasing adoption of high-end vehicles equipped with laser headlights. Automotive safety requirements created by the EU stimulate headlight advancements that improve driving safety. The European Union established 2011 as the deadline for new cars and small delivery vans to install Daytime Running Lights (DRLs) to enhance vehicle visibility and decrease traffic accidents. The EU continues to embrace modern automotive lighting technologies because they further improve driving safety according to their regulatory framework.

According to the European Union's 2024 report, the new automotive safety regulations, referred to as the "General Safety Regulation," require that all new vehicles sold in the EU be equipped with various advanced driver assistance systems (ADAS). These systems include lane-keeping assist, automated emergency braking, intelligent speed assistance, driver drowsiness warnings, and reversing cameras. The aim of these regulations is to significantly enhance road safety and protect passengers.

The EU oversees complete instructions for installing and operating headlights as part of vehicle lighting systems to ensure road users remain visible and glare-free from other drivers. The combination of tough safety requirements has pushed car manufacturers to research and implement new lighting technologies, including laser headlights.

Asia Pacific is projected to experience the fastest growth in the automotive laser headlight market, supported by expanding automotive production, rising disposable incomes, and growing investments in luxury and electric vehicles. The Eastern nations of China, Japan, and South Korea dedicate funds to research and develop advanced lighting systems that advance vehicle engagement and security capabilities.

China maintains powerful manufacturing capabilities as its thriving automotive sector ramps up its efforts in implementing state-of-the-art technology and laser headlights to fulfill customer requirements for luxury vehicles. Japan, together with South Korea, represents a forefront innovative automotive company, dedicating generous funds to research and develop modern lighting systems through organizations including Toyota, Honda, Hyundai, and Kia.

The business sector continues to invest in automotive safety improvement initiatives which mirror worldwide developments toward advanced automobile technologies with higher performance. Advanced lighting technologies will drive substantial development in the automotive laser headlight market of Asia Pacific during the upcoming years due to its commitment to improving vehicle performance and safety.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 14.15 Billion |

| Market Revenue by 2033 | USD 95.79 Billion |

| CAGR | 27% from 2025 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Technology

By Vehicle Type

By Sales Channel

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/1049

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

April 2025

January 2025

April 2025

January 2025