December 2024

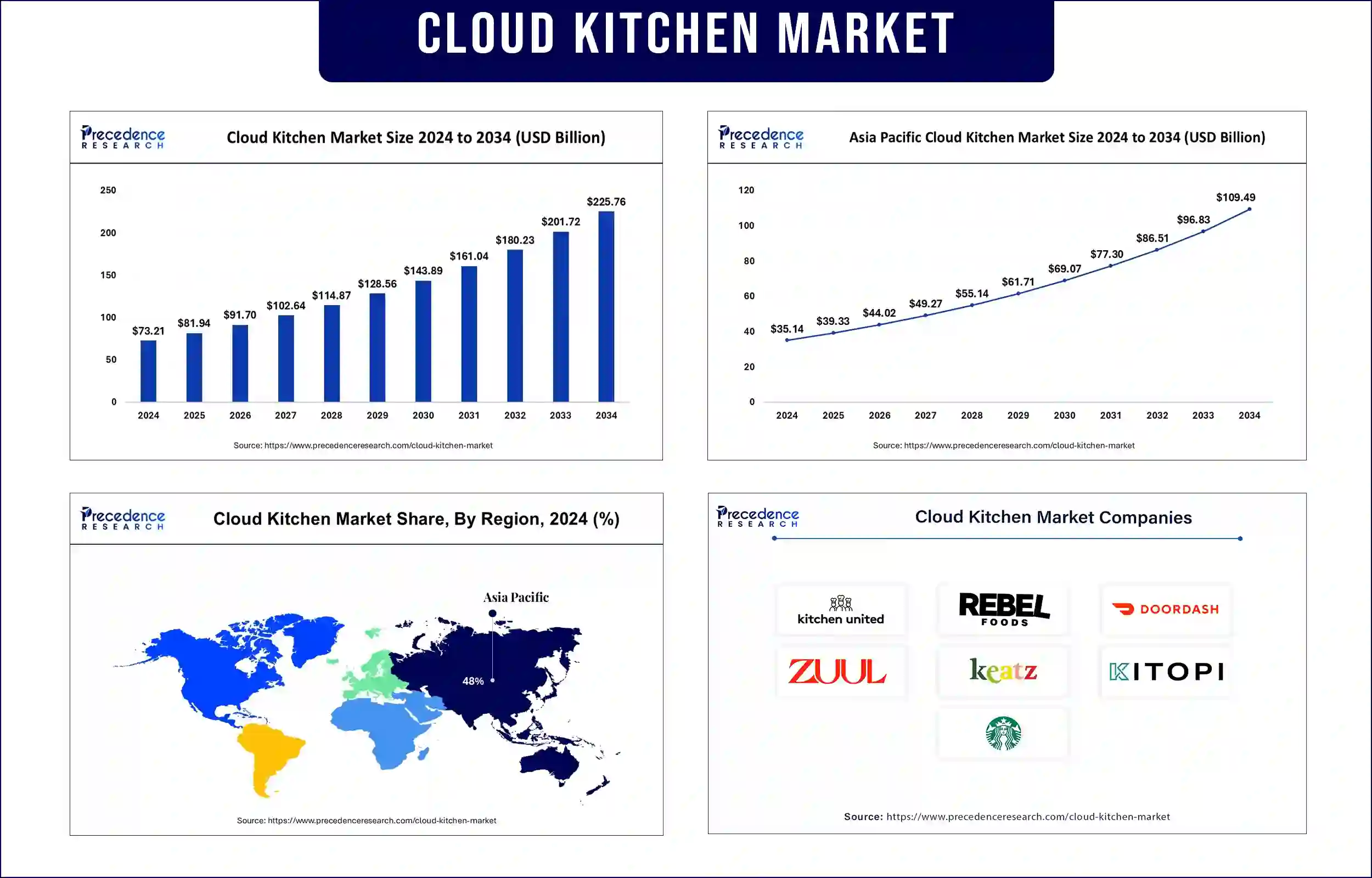

The global cloud kitchen market revenue reached USD 81.94 billion in 2025 and is predicted to attain around USD 201.72 billion by 2033 with a CAGR of 11.92%. The cloud kitchens market is experiencing growth because of factors including urbanization, changing lifestyles, technological advancements, and an expanding food delivery network.

The food service industry is experiencing a revolutionary change through cloud kitchens. The kitchen facilities can serve one brand or provide their services to multiple virtual restaurant brands through third-party management. The kitchen facilities run exclusively for delivery service and specialize in delivering premium quality food content to customers through digital platforms. The business model is designed to empower flexibility by letting food enterprises concentrate on their food operations while delivery logistics and other operational elements are managed by external sources.

Cloud kitchens offer an economical and convenient solution when food delivery demand continues to increase across the market. The fast and convenient meals are popular since urban residents maintain active lifestyles. The growth of disposable income in emerging economies enables those people to order food regularly, further promoting the cloud kitchen market. Users of smartphones and digital access make orders through platforms, which include Zomato and Uber Eats.

Growing Convenience Demand

The increasing speed in modern lifestyles creates a growing need for easy food alternatives. Cloud kitchens exist to serve the customer's need for fast and simple food choices. The development of food distribution services enables homebound customers to access different restaurants' menus without leaving their residences.

Extending Food Delivery Services

Cloud kitchens manage to succeed by avoiding the high operating expenses linked to conventional dining establishments because more consumers choose online food purchasing. Focusing on delivering high-quality food and rapid service allows cloud kitchens to provide several meal options to customers regardless of traditional restaurant limitations, thus promoting industry development.

Diversification of Menu

The cloud kitchens develop new menu choices, which include vegan, international, and gluten-free items, to expand their customer base. The increased menu variety enables brand expansion through market segmentation and better responses to consumers seeking personalized dining choices among different population groups.

Asia Pacific's cloud kitchen market accounted for the largest revenue share in 2024. Chinese and Indian markets experience growing food delivery service demand because of their expanding urban populations and the busy living of their residents. The growth of mobile App technology and food delivery services improves cloud kitchen operations, thus encouraging entrepreneurs to establish their businesses.

The Chinese cloud kitchen market is showing rapid expansion because consumers mainly receive food deliveries through online channels. Cloud kitchens continue to increase in major metropolitan areas of Beijing and Shanghai through their local dining options and international food services. The consumer demand for convenience and variety continues to grow, thus promoting the regional food industry trend.

North America is anticipated to host the fastest-growing cloud kitchen market due to rising population numbers and improved lifestyle trends. The rising consumer spending capacity in the region has accelerated cloud kitchens. Food consumers strongly favor both quick service and diverse eating choices, which drives up meal delivery service popularity. Cloud kitchens benefit from the rising demand for fast food choices; therefore, they can effectively satisfy consumer expectations.

The U.S. cloud kitchen market continues to grow rapidly throughout major metropolitan areas, including New York and Los Angeles, because these cities have high requirements for quick food delivery. The strategic partnerships between cloud kitchens and food delivery platforms expanded their customer base through improved market presence.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 81.94 Billion |

| Market Revenue by 2033 | USD 201.72 Billion |

| CAGR | 11.92% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Product

By Deployment Types

By Solutions

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @ https://www.precedenceresearch.com/sample/1595

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

December 2024

January 2025

April 2025

January 2025