December 2024

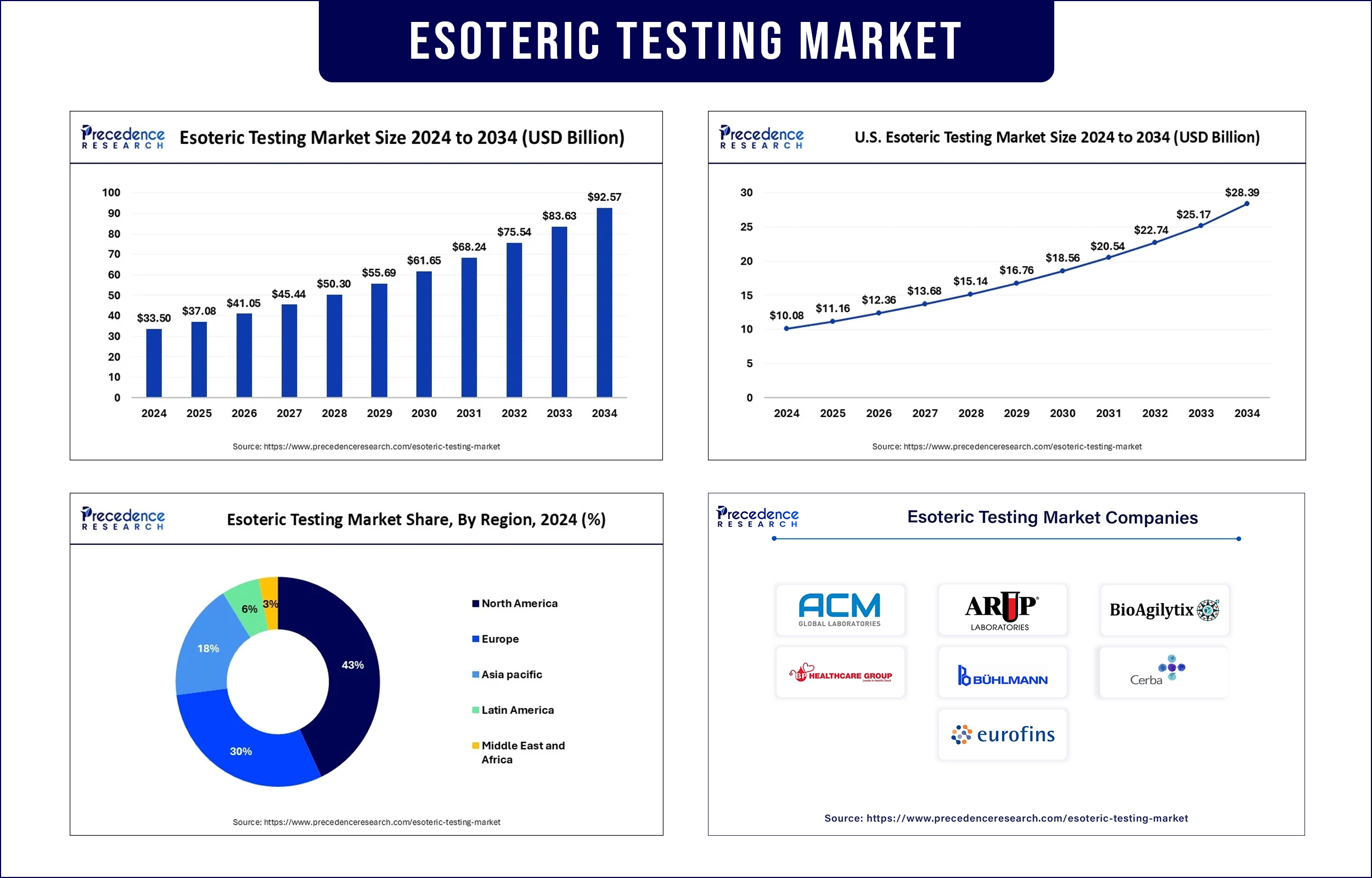

The global esoteric testing market revenue was valued at USD 37.08 billion in 2025 and is expected to attain around USD 83.63 billion by 2033, growing at a CAGR of 10.70% during forecast period. The esoteric testing market is propelled by advanced medical diagnostic tools that focus on discovering rare, complex medical problems that drive precision medical practices and early disease diagnostics.

The healthcare field needs to diagnosis specific rare medical situations that require specialized diagnostic testing known as esoteric examinations. Regular clinical laboratories do not conduct esoteric diagnostic procedures because they require specific equipment, special technologies, and expert personnel. The scientific development of diagnostic tools builds momentum to advance the creation of complex esoteric tests.

The number of medical conditions like cancer, diabetes, and heart disease influences an increasing demand for esoteric testing. Emerging market healthcare systems expand the esoteric testing market when they improve their infrastructure and allocate more funds to healthcare. Rising esoteric testing requirements due to the rising genetic disorder problems, rare medical diseases, and increasing infectious diseases.

Rising Incidence of Complex Diseases

Medical laboratories perform esoteric tests because advanced complex ailments like cancer, autoimmune diseases, and infectious conditions continue to increase. Esoteric testing in the field of cancer, such as next-generation sequencing alongside autoimmune disease antibody testing, provides essential diagnostic and prognostic information, which leads to individualized treatment designs and sets the groundwork for effective patient condition management.

Rising Demand for Personalized Medicine

The practice of using genetic profiles to customize patient treatment increases the market need for esoteric testing. These genetic tests help healthcare providers make better decisions about treatments and also predict how patients will respond to therapy while providing individualized care to match the rise of precision healthcare, which leads to improved results.

Increased Awareness and Patient Advocacy

Better patient and healthcare professional understanding of early diagnosis helps create demand for the esoteric testing market through accurate diagnosis initiatives. Patient awareness campaigns work to demonstrate specialized testing for rare diseases, which results in better healthcare access and improved patient results.

Genetic and Molecular Advances

Modern genetic and molecular diagnosis technologies help doctors better recognize rare diseases, which facilitates better treatment opportunities. A series of advances drives healthcare professionals to use specialized testing in laboratories because these techniques effectively detect hard-to-detect conditions to deliver targeted medical treatments.

North America dominated the esoteric testing market in 2024. The established healthcare facilities and substantial purchasing ability have generated substantial market development. The increased incidence of rare and persistent diseases, such as cancer, autoimmune diseases, and genetic conditions, has accelerated the requirement for complex diagnostic testing methods due to their specific testing needs. North American healthcare facilities support esoteric testing by government funding, which enables high-quality healthcare service access and reimbursement procedures that simplify advanced testing availability.

The U.S. will dominate with the largest market segment in North America as it operates advanced healthcare services across wide geographic areas and keeps its healthcare spending at high levels. The market drives forward because Laboratory Corporation of America Holdings ARUP Laboratories and Quest Diagnostics remain its dominant influencers.

Asia Pacific is anticipated to host the fastest-growing esoteric testing market. Advanced diagnostic solutions increase across countries such as China and India because these nations are rapidly advancing their healthcare infrastructure. Rising purchasing power and disposable income changes have enabled people from these countries to obtain high-tech esoteric testing services more easily. Current diagnostic transformations in the region become possible through the adoption of advanced technologies that include next-generation sequencing and enzyme-linked immunoassay.

Healthcare accessibility programs by the government, which provide funding for rare disease diagnostics, drive the growing demand for esoteric testing services. China experiences powerful diagnostic demand because the government increases support for health care while spending more money on medical services, and citizens become aware of early disease detection.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 37.08 Billion |

| Market Revenue by 2033 | USD 83.63 Billion |

| CAGR | 10.70% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Type

By Technology

By End User

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @https://www.precedenceresearch.com/sample/2019

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

December 2024

January 2025

April 2025

January 2025