April 2025

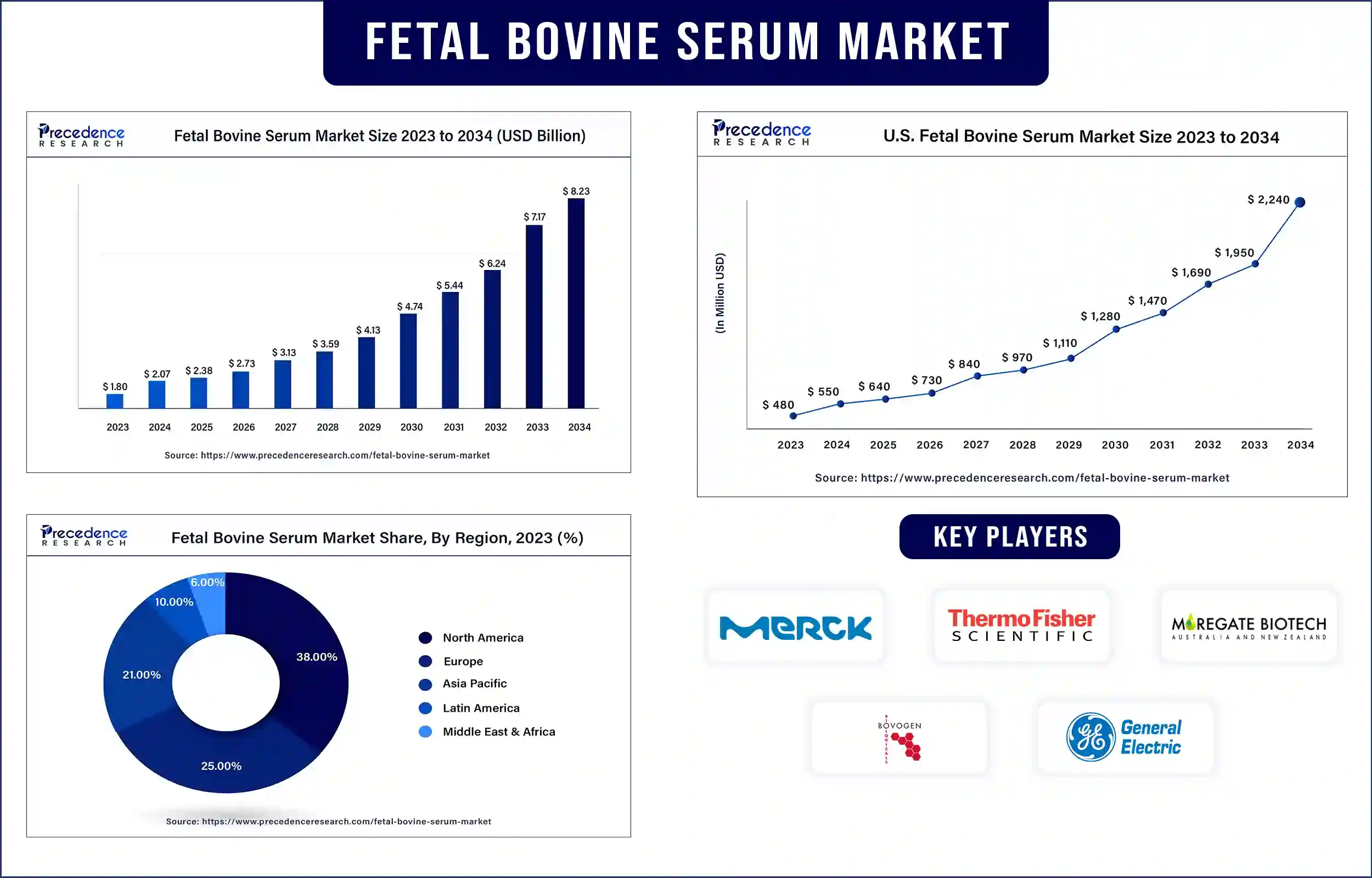

The global fetal bovine serum market revenue was valued at USD 1.80 billion in 2023 and is poised to grow from USD 2.07 billion in 2024 to USD 8.23 billion by 2034, at a CAGR of 14.8% during the forecast period 2024 – 2034. The increasing application in cell culture is expected to drive the growth of the fetal bovine serum market.

The fetal bovine serum is an important component in cell culture applications in several research disciplines. It is widely used in drug delivery, regenerative medicine, stem cell research, and other areas of life sciences research. Fetal bovine serum provides necessary hormones, growth factors, and essential nutrients for the proliferation and growth of cells in culture. The increasing significance of developing novel therapeutics and understanding mechanisms has led to a growth in demand for FBS in research settings.

It is expected to enhance the growth of the market. In addition, rising technological advancements in high-throughput screening techniques and cell-based assays, as well as growing investment in research and development within the life sciences sector, are further anticipated to enhance the growth of the fetal bovine serum market during the forecast period.

Growing market participants' investments in the life science industry to fuel the market growth.

The market for fetal bovine serum is being enhanced by a growth in research & development efforts in the life science platform. Regenerative medicine is an advanced area in the life science industry that deals with growing, repairing, and replacing damaged organs or tissues. In cell-based therapy and tissue engineering, two vital fields of regenerative medicine research, FBS is continuously employed.

The need for fetal bovine serum as an essential component of these therapies increases as market players invest more in clinical trials and regenerative medicine research. This enhances the market growth and increases venture country investment, government initiatives, the rapid expansion of the pharmaceutical industries, and a strong workforce. Thus, these major factors are expected to accelerate the growth of the fetal bovine serum market.

However, increasing prices of fetal bovine serum may restrain the market growth. It has been admitted that utilizing cattle to produce fetal bovine serum has surged the price of fetal bovine serum on the market. A growing number of calves are being killed for producing FBS, which is illegal, and the manufacturers face steep fines that have gone down their market output. The significant decline in production and spike in demand for FBS are the reasons for this cost increase. Thus, these factors are expected to restrain the growth of the fetal bovine serum market.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 2.07 Billion |

| Market Revenue by 2034 | USD 8.23 Billion |

| Market CAGR | 14.8% from 2024 to 2034 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Innovations in the Fetal Bovine Serum Market by Omeat

Recent Innovations in the Fetal Bovine Serum Market by IntegriCulture

North America dominated the fetal bovine serum market in 2023. The presence of a more significant number of private universities and research labs and a maximum number of leading vital players that conduct exclusive research and development activities need FBS as an important component in the region. The U.S. and Canada are the leading countries in North America. The U.S. has skilled laborers, well-developed instrumentations, and better funding facilities, which further help to drive the growth of the market. Thermo Fisher Scientific is the leading FBS manufacturing company in the U.S. and offers excellent value for specific assays, specialty research, and cell culture. U.S. fetal bovine serum companies earn the trust of researchers with award-winning support and consistent quality that helps consumers address their budget and needs requirements. These factors are anticipated to enhance the growth of the fetal bovine serum market in North America.

Asia Pacific is expected to undergrow maximum growth during the forecast period. The growing number of biopharmaceutical manufacturers in emerging countries and experiencing rapid growth by serving their regional and domestic markets are expected to drive the growth of the market in the region. China, Japan, India, and South Korea are the leading countries in the Asia Pacific region. In addition, rising consumer demand for improved medications and growing government assistance contributed to propelling market growth. Furthermore, the Indian market for fetal bovine serum is the fastest growing, and the Chinese market has the largest market share in the region.

Increasing demand for fetal bovine serum because of the shortage

The fetal bovine serum can be easily obtained from commercial vendors and is reasonably priced compared to other growth supplements. Prices may increase if there is an increasing demand for fetal bovine serum compared to the supply. FBS suppliers and manufacturers now have the chance to take advantage of the pricing difference and increase earnings and sales. Producers are also investing in increasing their production capacity to satisfy the rising benefit and demand from advantageous market conditions, which are estimated to offer growth opportunities. These factors are expected to enhance the growth of the fetal bovine serum market in the coming years.

Market Segmentation

By Application

By End-User

By Geography

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2509

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

April 2025

January 2025

February 2025

January 2025