December 2024

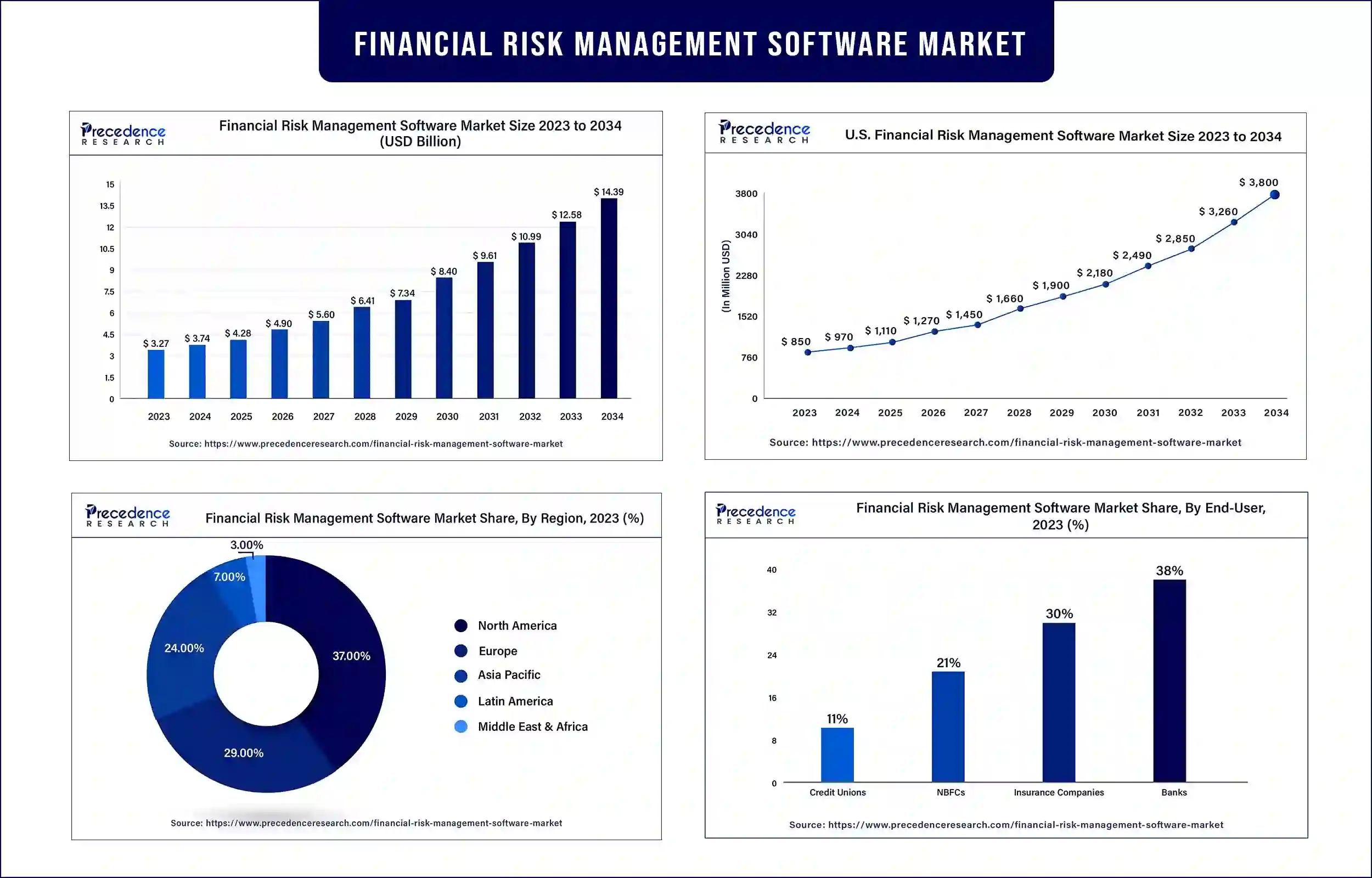

The global financial risk management software market revenue surpassed USD 3.27 billion by 2023 and predicted to be worth around USD 12.58 billion by 2033 with a CAGR of 14.42% during the forecast period. The increasing demand for the automation in the streamlining the risk management and predicts the forthcoming challenges in the finance industry is driving the growth of the market.

Financial risk management software is a technology that can analyze and identify the decision-making process for investment purposes. Financial risk management software is widely accepted by several financial institutes for risk mitigation and appropriate decision-making, including investment managers, insurance companies, and the baking sector. There are several types of financial risk management software used by the financial sectors, including treasury and payment management software, that help mitigate risks related to fraud and liquidity. Risk management for investment management software, credit risk management software, fraud detection software, and internal compliance software.

The increasing demand for real-time risk monitoring in the financial sector is driving the growth of the financial risk management software market

The increasing cases of real-time challenges in the financial sectors such as high volume and velocity of data, complexities of financial instruments, regularity compliances, market volatility, cybersecurity threats, and global and 24/7 operations cause the demand for financial risk management software for addressing the real-time risks associated with the finances that driving the growth market.

On the other hand, the increased costs associated with the installation and maintenance of financial risk management software and the unavailability of skilled professionals are hampering the growth of the market.

Recent Innovation by Oracle in the Financial Risk Management Software Market

| Company Name | Oracle |

| Headquarters | Austin, Texas, United States |

| Development | In September 2024, Oracle launched the Oracle Fusion Cloud Sustainability. It is an app that integrates data from Oracle Fusion Cloud SCM and Oracle Fusion Cloud ERP that offers reporting and analysis within Oracle Fusion Data Intelligence and Oracle Fusion Cloud Enterprise Performance Management (EPM). |

Recent Innovation by Riskconnect in the Financial Risk Management Software Market

| Company Name | Riskconnect |

| Headquarters | London, United Kingdom |

| Development | In April 2024, RiskConnect, a leading software solution provider, collaborated with the WTW to pilot an analytic delivery tool that connects exposure and claims data with the new WTW Risk IQ API. |

Asia Pacific is expected to grow at the fastest rate during the forecast period. The growth of the market is attributed to the rising population, and the increasing financial sector is driving the demand for the financial risk management software market. The rising adoption of the technologies in the industries and the financial sectors of the regional countries are adopting advanced risk analytics, which helps in getting core insights into the risk profiles.

North America dominated the financial risk management software market in 2023. The region is known as the early adopter of technologies such as artificial intelligence, machine learning, internet of Things, and others that are fueling the demand for financial risk management software. The rising cases of cyberattacks and data breaches in finance create the demand for flexible software to mitigate, which fuels the growth of the market across the region.

Technological integration in the financial sector

The continuous research and development activities in the technological evaluation in the industries and the financial sector as well. There is a rise in the integration of smart technologies such as artificial intelligence, machine learning, and IoT in financial risk management for faster, easier, and smarter operations. Furthermore, automation plays a significant role in financial risk management for operating complex tasks, including risk assessment, decision-making, and data analysis, which results in the improvement of overall accuracy and efficiency. Additionally, the rising intervention of the leading players in innovations and the launch of financial risk management software as per the requirements of the organizations are contributing to the growth of the financial risk management software market.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 3.74 Billion |

| Market Revenue by 2033 | USD 12.58 Billion |

| CAGR | 14.42% from 2023 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Deployment

By Enterprise Type

By End-user

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/5092

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

December 2024

January 2025

April 2025

March 2025