April 2025

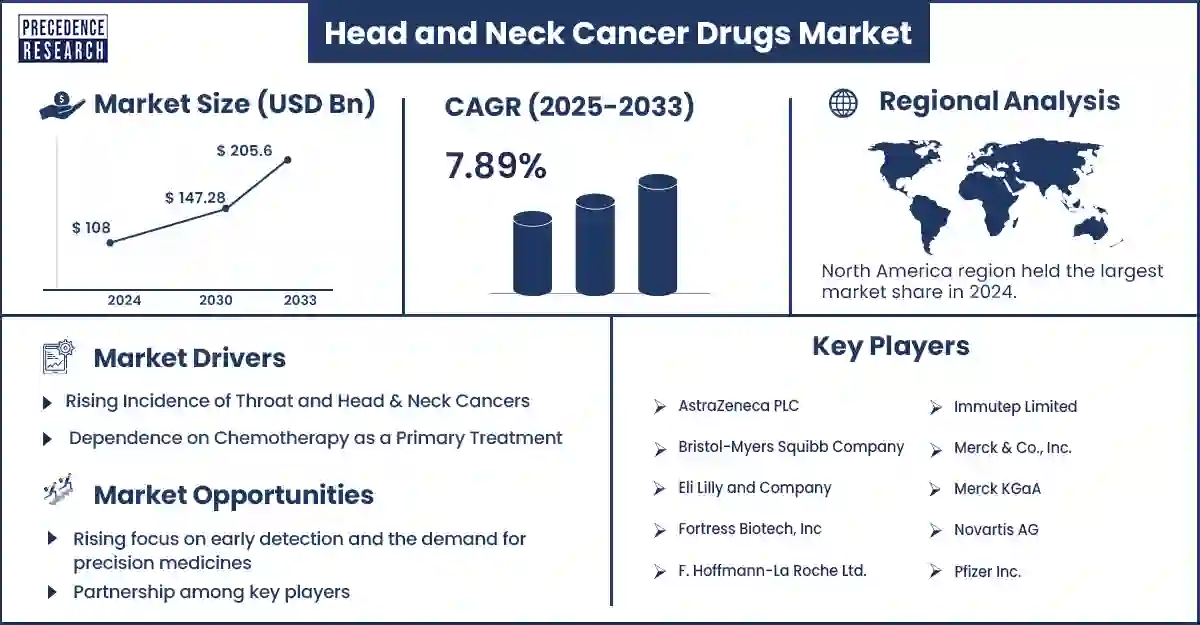

The global head and neck cancer drugs market revenue was valued at USD 18.78 billion in 2025 and is expected to attain around USD 32.65 billion by 2033, growing at a CAGR of 7.89% during forecast period. Increasing cases of head and neck cancer, largely attributed to tobacco and alcohol consumption, human papillomavirus (HPV) infections, and environmental pollutants, are driving market demand.

The head and neck cancer drugs market focuses on pharmaceutical treatments designed to combat malignancies affecting the oral cavity, pharynx, larynx, and other related regions. WHO reported in 2024 that global cases of head and neck cancer were increasing, which demonstrated a rising medical caseload. The observed increase in head and neck cancer cases results from the combined influence of tobacco use, alcohol drinking, human papillomavirus (HPV) infections, and environmental pollution.

The U.S. Food and Drug Administration (FDA) approved pembrolizumab as the initial therapy for head and neck squamous cell carcinoma in 2023, which became a groundbreaking development in treatment options. Medical research devoted to developing cancer vaccines and gene therapies continues to discover alternative treatment approaches. Global healthcare institutions work together to advance care standards for patients who experience head and neck cancers.

Treatment Type Insights

Sales Channel Insights

Rising Adoption of Immunotherapy

Immunotherapy, particularly PD-1 and PD-L1 inhibitors, is gaining widespread acceptance in the treatment of head and neck cancer. The success of nivolumab and pembrolizumab drugs in improving overall survival rates achieved multiple approvals that created their integration into standard treatment protocols. The advancements of immunotherapy prove essential for improving treatment results in cases of head and neck cancer.

The market growth is highly depended on the success of ongoing trials. Close evaluation of the CheckMate-141 trial demonstrated nivolumab extended survival beyond one year for 36% of patients against standard therapy, which achieved 16.6% survival. The 2024 study documented how pembrolizumab-treated patients lived for 15.8 months with sequential chemotherapy.

Growing Focus on Biomarker-Based Therapies

Advancements in precision medicine are fueling the demand for biomarker-driven treatments. Drug development has become more successful and specific to individual patients through genetic mutation detection with molecular marker analysis. Under the AHEAD program of the National Institute of Dental and Craniofacial Research (NIDCR), scientists work to find distinct molecular markers that enable clinicians to distinguish malignant from benign tissue damage. Cancer treatment advances steadily through both collective and individual research efforts, which demonstrate why disease management needs personalized genetic approaches.

Increasing Research on Combination Therapies

Head and neck cancer specialists at pharmaceutical institutions now focus their research on combining these three cancer treatment approaches for better results. The U.S. Food and Drug Administration (FDA) gave approval to toripalimab-tpzi (Loqtorzi) with gemcitabine and cisplatin for initial treatment of metastatic or recurrent nasopharyngeal carcinoma in October 2023.

The evaluation of combination therapies continues to take place as researchers aim to improve treatment effectiveness and clinical results for head and neck cancer patients. Nasopharyngeal carcinoma belongs to head and neck cancers. PDS Biotech started VERSATILE-003 Phase 3 clinical trials in March 2025 to test Versamune HPV alongside pembrolizumab for recurrent/metastatic HPV16-positive head and neck squamous cell carcinoma.

Government and Non-Profit Initiatives for Cancer Awareness

Global health organizations and governments are implementing awareness programs to promote early detection and preventive measures. Funding for clinical trials and cancer research is also expanding, further supporting drug development. Non-profit institutions, along with public organizations, work simultaneously to boost cancer-related awareness programs and scientific research initiatives that focus on early disease diagnosis and treatment effectiveness.

Breast Cancer Awareness Month received attention from the WHO in October 2024 as the organization highlighted the significance of detecting early warning symptoms to boost survival statistics. The National Cancer Institute (NCI) dedicated USD 6.8 billion from its FY2022 budget as an expansion of 5.7% compared to the previous year, to support cancer research and clinical trials.

North America dominated the head and neck cancer drugs market in 2024, driven by high cancer prevalence, strong healthcare infrastructure, and increasing FDA approvals of novel oncology drugs. The Food and Drug Administration granted nivolumab and hyaluronidase-nvhy to use as intravenous treatment for squamous cell carcinoma of the head and neck area and multiple other cancer types during the month of December 2024. According to the American Association for Cancer Research, an estimated 71,100 new cases of head and neck cancer (including the oral cavity, pharynx, and larynx) are expected in the United States in 2024. Approximately 16,110 of these cases are projected to result in death, which accounts for about 4% of all cancers and 2% of all cancer-related deaths.

The head and neck cancer drugs market in Asia Pacific is anticipated to expand rapidly in the near future, fueled by rising tobacco consumption, growing awareness regarding early cancer detection, and increasing investments in healthcare infrastructure. Countries such as China and India are focusing on expanding access to oncology treatments and clinical trials. Early- and validation-phase oncology clinical trials now find China to be their principal investigative location, thus showing profound global research progress. Improved healthcare infrastructure backed by new oncology treatment access and clinical trial expansion will shape the medical sectors of China and India in the coming years.

According to the NIH 2023 report, head and neck cancers in India constitute a considerable component of cancers that affect the population because the age-standardized incidence rate reaches 25.9 per 100,000 males and 8.0 per 100,000 females. In response to the market potential, key players are engaging in lucrative business ventures. In 2025, AstraZeneca has committed USD 2.5 billion to increase Beijing-based research and manufacturing operations throughout the upcoming five years to advance early-stage research and clinical development. Additionally, BioNTech's acquisition of Chinese cancer drugmaker Biotheus in 2025 for nearly USD 1 billion underscores the region's growing prominence in oncology drug development.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 18.78 Billion |

| Market Revenue by 2033 | USD 32.65 Billion |

| CAGR | 7.89% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Treatment Type

By Sales Channel

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/1474

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com| +1 804 441 9344

April 2025

January 2025

April 2025

January 2025