August 2024

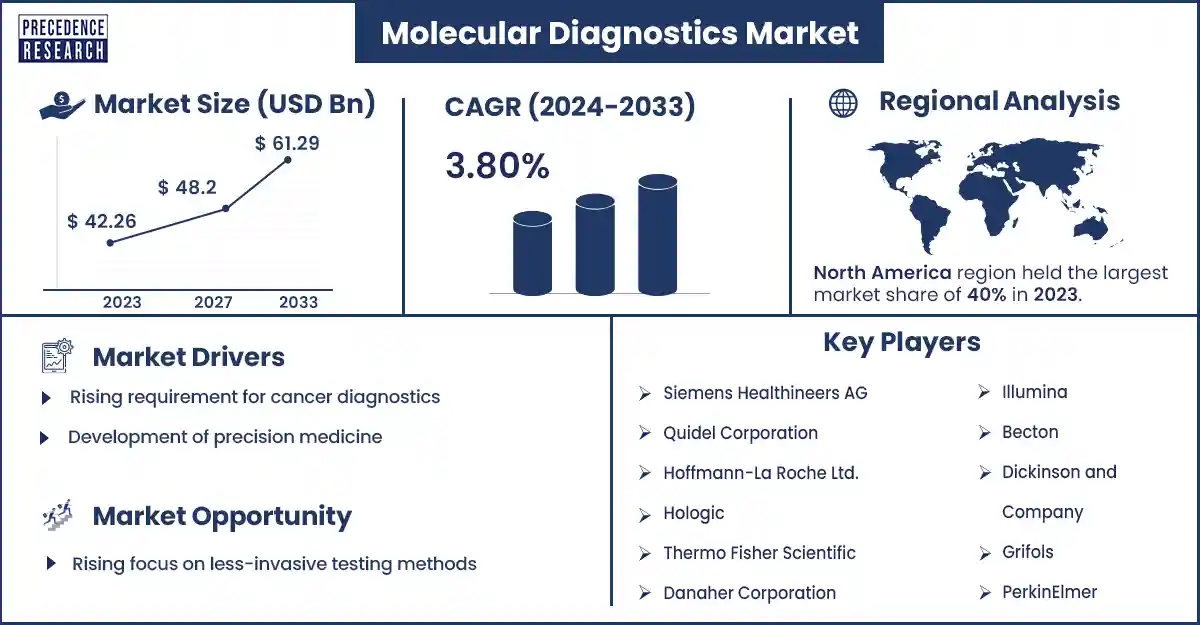

The global molecular diagnostics market size surpassed USD 42.26 billion in 2023 and is expected to rise around USD 61.29 billion by 2033, expanding at a CAGR of 3.8% during the forecast period from 2024 to 2033. The incidence of cancer and infectious diseases globally is anticipated to drive the growth of the molecular diagnostics market.

The molecular diagnostics market can detect diseases, including cardiovascular diseases, neurological diseases, infectious diseases, hereditary diseases, and other diseases, by examining molecules such as protein, RNA, and DNA in a fluid or a tissue. Various methods, including molecular imaging, in situ hybridization, next-generation sequencing, PCR, spectrometry, and others, are used to diagnose various diseases.

Molecular diagnostics uses advanced technologies, including biomarker identification, gene expression profiling, and DNA sequence analysis, to identify disorders accurately. The increasing geriatric population, rising incidence of sexually transmitted diseases, including HPV and HIV, and growing initiatives of market players to develop access to cost-effective resources are expected to enhance the market growth.

In addition, the increasing investments in research and development in molecular diagnostics and increasing demand for point-of-care testing are further expected to drive the growth of the molecular diagnostics market.

Increasing better management of chronic diseases fuels market growth

Faster diagnosis is crucial for infectious disease treatment, but it is also essential for the effective management of chronic disorders and conditions like cancer, nervous system diseases, strokes, cardiac diseases, chronic obstructive pulmonary disease, and monitoring of Parkinson’s disease. The application of molecular diagnostics to testing has permitted a shift from proactive testing to reactive testing and personalized treatment for an increasing number of genetic disorders.

Recognizing extra biomarkers can significantly improve the timing and accuracy of diagnosis and also help forecast a patient’s response to molecular diagnostics treatment. For instance, FISH tests are regularly used to discover chromosomal changes in cells to identify and classify the type of cancer and identify which drugs are most effective in molecular diagnostics treatment. These are the major factors expected to drive the growth of the molecular diagnostics market.

However, laboratory space requirements, personnel requirements, and the cost of molecular diagnosis may restrain the market's growth. The molecular amplification process requires enough space that may not be available in some clinical laboratories for molecular diagnosis.

In addition, depending on laboratory testing methodologies and accreditation requirements, they may not be skilled enough to perform molecular diagnosis completely. Moreover, molecular diagnosis is generally more costly than standard traditional diagnosis. Reagent and equipment costs could be banned in some molecular laboratories. These are the major factors expected to restrain the growth of the molecular diagnosis market.

| Report Coverage | Details |

| Market Revenue in 2023 | USD 42.26 Billion |

| Projected Forecast Revenue by 2033 | USD 61.29 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 3.80% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Development by Roche RHHBY

Recent Development by Thermo Fisher

Asia Pacific is expected to grow fastest during the forecast period. The increasing over-aged population, increasing diseases like obesity, diabetes, neurological diseases, cardiovascular diseases, and cancer in this region, and increasing infectious diseases like HIV and HPV are anticipated to drive the growth of the molecular diagnostics market in the Asia Pacific. India, China, Japan, and South Korea are the leading countries in the Asia-Pacific region.

In China, molecular diagnostics is changing the face of laboratory medicine and clinical laboratories. Noninvasive Prenatal Testing and Next-generation Sequencing have become popularly feasible in China. Life Medical and Illumina are the preferences of foreign equipment manufacturers in China.

China’s molecular diagnostics industry is growing and emerging very rapidly, without being affected by its small size. China’s molecular diagnostics initially emerged. Several technologies, including restriction fragment length, Southern blotting, dot blotting, and radionuclide labeling, were developed in China. China’s molecular diagnostics industry shows better capacity for industrialization. Many companies provide molecular diagnostics testing services, instruments, and kits, according to chain analysis of the molecular diagnostics industry.

In India, molecular diagnostics is becoming increasingly important and boosting the molecular diagnostics market due to various factors such as the need for personalized medicine, urbanization, population growth, and the prevalence of infectious diseases. India faces a high concern for infectious diseases, including hepatitis, HIV, and tuberculosis. Molecular diagnostics can offer sensitive, accurate, and rapid detection of these diseases and allow effective and timely treatment. India's rapid urbanization and growing population contribute to the increasing emergence of new pathogens and the risk of disease transmission.

India’s distinct population creates innovative genetic variations that can affect the efficacy of drugs and treatments. In India, molecular diagnostics have improved the management and detection of infectious diseases. These are the major factors in India that are anticipated to drive the growth of the market in the Asia Pacific region.

North America dominated the molecular diagnostics market in 2023. The increasing prevalence of chronic diseases, rising research and technological innovation in molecular diagnostics, and adoption of advanced diagnostics technology are expected to drive the growth of the market in North America. The U.S. and Canada are the major countries in North America. The U.S. has the largest market in molecular diagnostics.

Increasing demand for molecular diagnostics in Point-of-Care

In recent times, molecular diagnostics have been increasingly used in Point-of-Care settings. Various companies are making near-patients or assays for PoC testing and molecular designing platforms. Moreover, the growing advancements of new assays offer quick Point-of-Care results. Innovations in molecular diagnostics, especially in the POCT, have spread from clinical microbiology laboratories to molecular diagnostics laboratories and now even into exam rooms and clinics. These are the major opportunities expected to boost the growth of the market in the coming future.

Molecular Diagnostics Market News

Market Segmentation

By Product

By Test Location

By Technology

By Application

By End User

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2257

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

August 2024

January 2025

January 2025

January 2025