December 2024

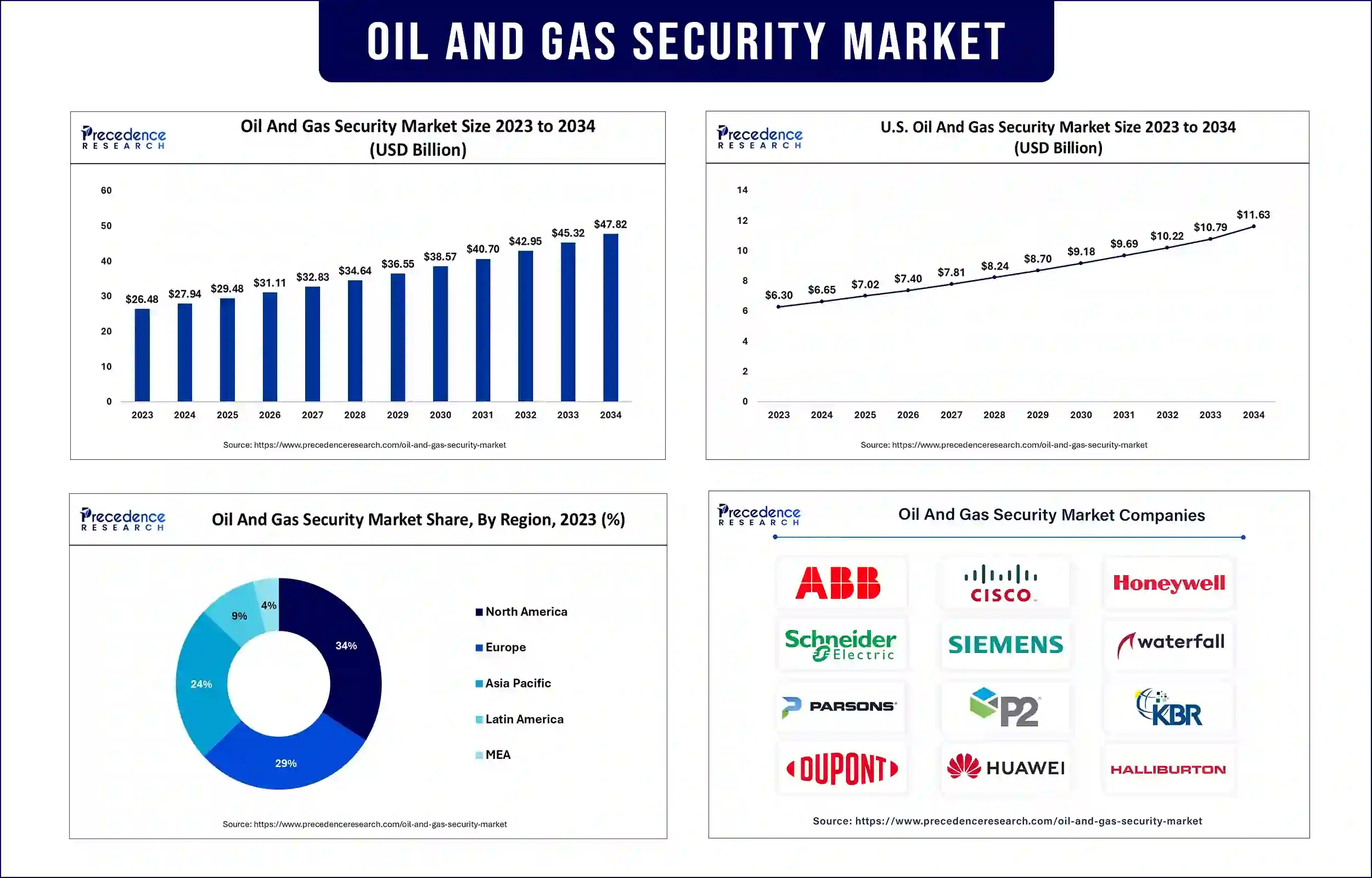

The global oil and gas security market revenue surpassed USD 27.94 billion in 2024 and is predicted to attain around USD 45.32 billion by 2033, growing at a CAGR of 5.52%. The demand for the oil and gas security market is rising due to the increasing threat of terrorism and cyber-attacks.

The oil and gas security market are the protection of industrial operational technology and infrastructure from potential cyber-attacks and data theft. This also involves protection systems such as data acquisition (SCADA) and supervisory control along with distributed control systems. The surge in cyber-attacks on the OT of oil & gas market players increases the demand for high-tech security in the market. However, the constant demand for security upgrades and heavy capital costs are the main drawbacks of the system.

The expanding threat landscape in the industry is constantly fuelling the demand for the oil and gas security market. As geopolitical tensions, cyber threats, and terrorist activities continue to create risks to the industry infrastructure, businesses are searching for more innovative security solutions. In addition, companies are also adopting new measures to safeguard critical assets and ensure the overall safety of personnel. This increase in security measures is a consequence of the evolving nature of threats.

Recent technological developments are leading to the oil and gas security market growth. Advancements like artificial intelligence (AI), Internet of Things (IoT), and machine learning (ML) provide new opportunities for improving security measures. Moreover, the integration of these technologies allows for predictive analytics, real-time monitoring, and automation of security measures, enabling more efficient security operations.

Oil and gas facilities are targeted for vandalism, theft, and terrorism, so physical security remains a main priority. In the oil and gas security market, physical security measures include perimeter security, access control systems, security guards, and asset tracking systems. Furthermore, companies are heavily investing in cybersecurity measures such as intrusion detection systems (IDS), firewalls, and data encryption to save themselves against cyberattacks.

North America dominated the oil and gas security market in 2023. The dominance of the region can be attributed to the recent technological advancements in data analytics and the Internet of Things (IoT) which are transforming the market. Companies are utilizing technologies like predictive analytics and real-time monitoring for smooth operations. Furthermore, the geopolitical influence of the U.S. plays an important part in its dominance in the region.

Asia Pacific is expected to witness the fastest growth in the oil and gas security market during the studied period. The growth of the region can be credited to the rise in cyber threats along with the increasing incidence of targeting major infrastructure, which has become a substantial concern for the industry. Moreover, countries like Japan have applied stringent regulations and technological measures to identify threats in the systems of their oil and gas facilities.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 27.94 Billion |

| Market Revenue by 2033 | USD 45.32 Billion |

| CAGR | 5.52% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Component

By End user

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/5220

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

December 2024

January 2025

April 2025

January 2025