December 2024

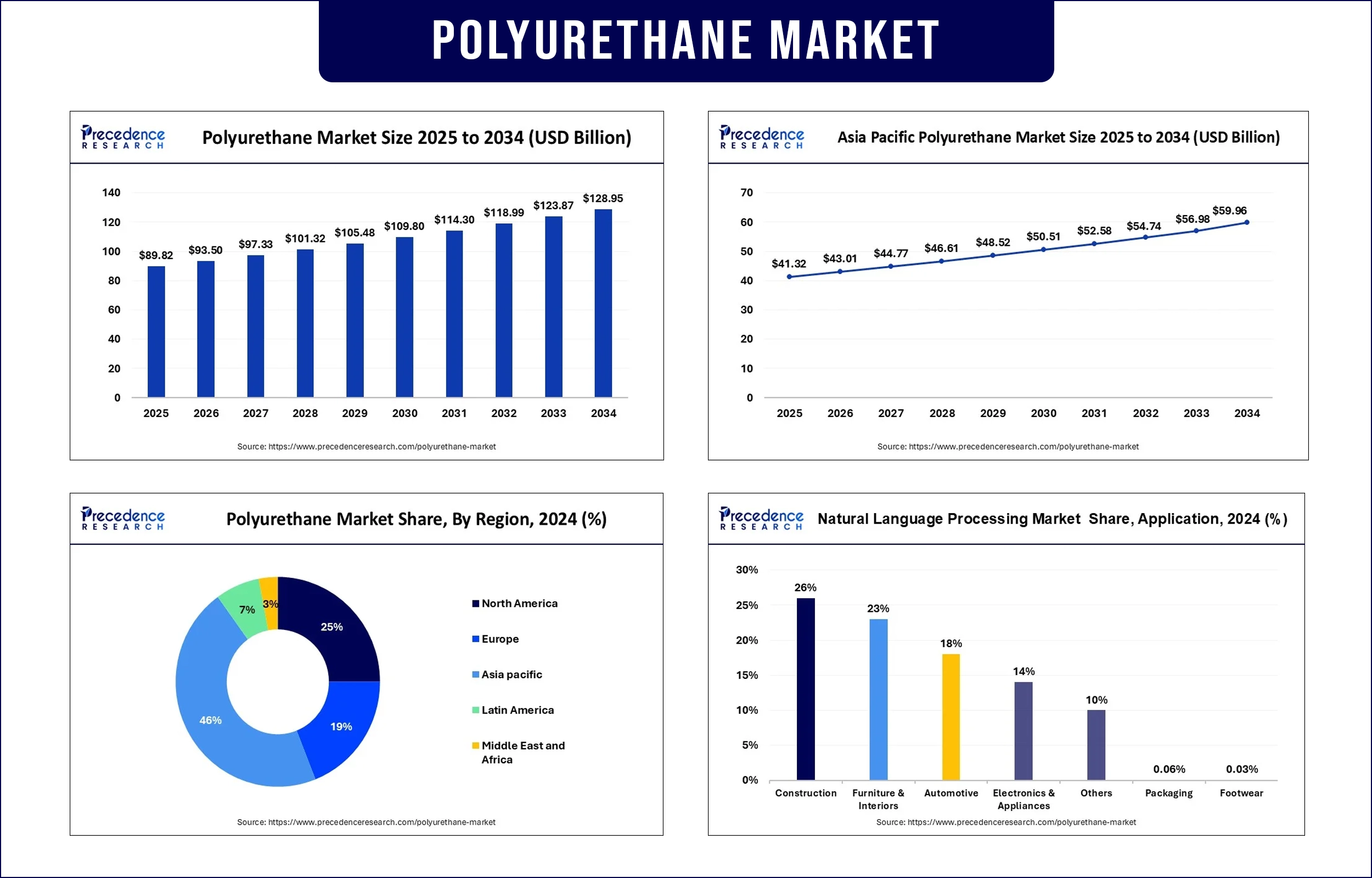

The global polyurethane market revenue was valued at USD 89.82 billion in 2025 and is expected to attain around USD 123.87 billion by 2033, growing at a CAGR of 46% during forecast period. The global market is experiencing steady growth, driven by increasing demand across the automotive, construction, electronics, and furniture industries.

The polyurethane market extends to multiple sustainable product types, such as rigid and flexible foams with elastomers, coatings, and adhesive and sealant solutions. Polyurethanes serve as fundamental ingredients that make insulation possible for footwear, refrigeration sectors, and electronics operations. The need for both lightweight, energy-efficient materials drives the adoption of polyurethane solutions. Furthermore, the rising scale of energy-efficient building applications signals rising polyurethane utilization rates.

Product Insights

Application Insights

Shift Toward Bio-Based Polyurethanes

The growing pursuit of green manufacturing practices prompts polyurethane producers to create these chemicals from sustainable materials. This involves plant-derived soybean oil alongside castor oil, together with additional plant-based constituents. The bio-based materials function to minimize both air and fuel-based pollution. Researchers in 2024 achieved a completely sustainable polyurethane coating when they combined castor oil with ethyl ester L-lysine triisocyanate as their primary materials. Furthermore, the environmentally friendly alternatives are taking a prominent role in polyurethane manufacturing, thus further boosting the market.

Increasing Use in Energy-Efficient Construction

Building managers widely select rigid polyurethane foam for its superior thermal resistance capabilities. The worldwide implementation of energy-saving guidelines for construction has generated rising market demand for polyurethane insulation materials. In 2023, the U.S. Environmental Protection Agency (EPA) enacted regulations requirements for reduction of high global warming potential (GWP) hydrofluorocarbons (HFCs) that appear in foam products starting from January 1, 2025. Rigid polyurethane foam provides essential support for enabling modern construction methods for energy-efficient which further fuels the market in the coming years.

Innovation in Automotive Lightweighting

The material plays an essential role in helping decrease motor vehicle weights in modern engineering. Polyurethane shows exceptional capability to reduce vibrations. It serves dual functions as a performance enhancer and a crucial element in lowering vehicle emissions and fuel consumption. The U.S. Environmental Protection Agency (EPA) found industrial manufacturing responsible for 30% of total U.S. greenhouse gas emissions in 2022. Thus, demonstrating that adopting polyurethane in automotive manufacturing yields environmental advantages, which further fuels the demand for polyurethane solutions. These advancements demonstrate that polyurethane conservation plays a crucial part in better fuel efficiency.

Enhanced Durability in Electronics and Consumer Goods

The electronic sector demonstrates a growing preference for polyurethane as a protective surface layer material for electronic applications. The material possesses both flexibility and moisture resistance qualities, which enable its usage in demanding conditions. Polyurethane serves as the outer insulation shell for cardiac pacing leads in current clinical research. New research conducted in 2024 showed polyurethane-insulated implantable cardioverter-defibrillator (ICD) leads held their mechanical structure for extensive periods. Furthermore, the research demonstrates how polyurethane serves to enhance the reliability with durability of both electronic and medical products.

Asia Pacific dominated the polyurethane market in 2024. Expanding urbanization, infrastructure development, and growing end-use industries are factors driving the market. China, India, and South Korea increase their spending on sustainable construction, which fuels polyurethane consumption rates. Polyurethane production and consumption reach their peak in China because the country operates multiple manufacturing facilities and implements green building technology across the nation. Furthermore, the automotive sector relies heavily on flexible polyurethane foam to make car seats and headrests alongside foam-interior components, thus fuelling the market in the coming years.

North America is expected to grow at a significant pace in the polyurethane market in the coming years, due to its high utility in protective coatings and its ability to make sealants and insulate materials. The material maintains flexibility while resisting moisture, thus allowing its use in demanding settings. The U.S. Environmental Protection Agency (EPA) finished updating regulations about persistent bioaccumulative and toxic (PBT) chemicals in 2023, including those from flame retardants found in polyurethane products, to reduce health effects from electronic waste.

The recent market trends demonstrate how essential it is to improve durability and safety standards in polyurethane applications used in electronics and consumer goods. Energy efficiency regulations that promote building insulation, along with foam usage, receive additional support. Additionally, the implementation of regulatory regulations helps North America maintain its present market expansion along with polyurethane-related innovations.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 89.82 Billion |

| Market Revenue by 2033 | USD 123.87 Billion |

| CAGR | 46% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Product

By Raw Material

By Application

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @ https://www.precedenceresearch.com/sample/1845

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

December 2024

January 2025

April 2025

January 2025