May 2025

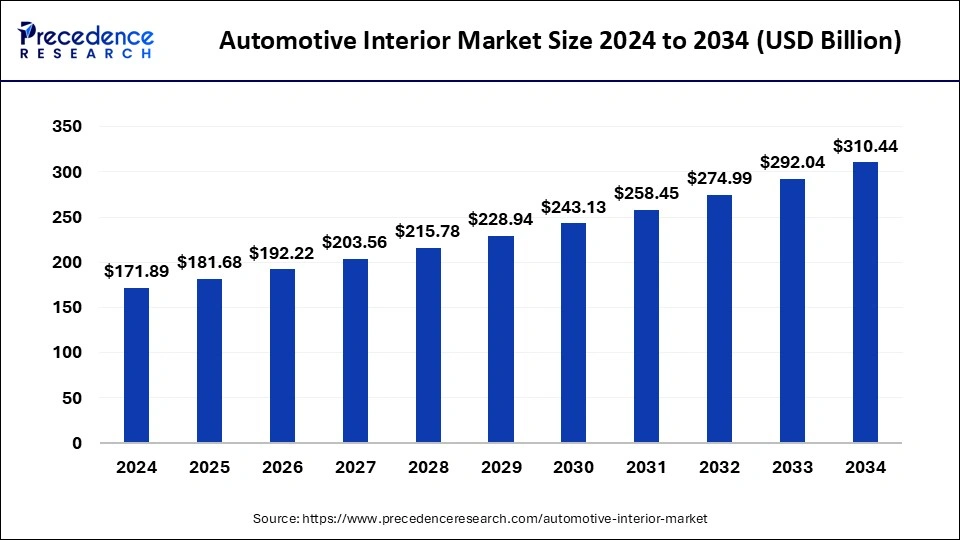

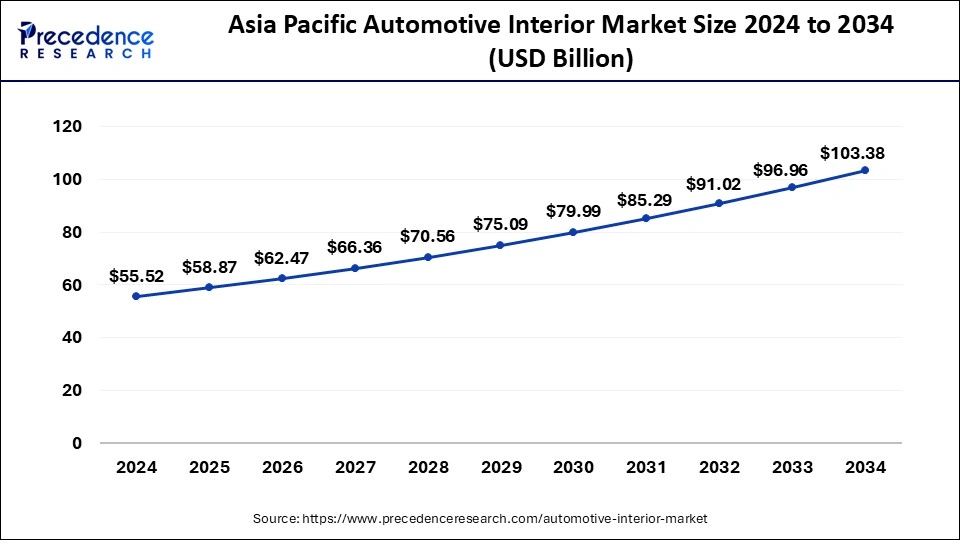

The global automotive interior market size accounted for USD 181.68 billion in 2025 and is forecasted to hit around USD 310.44 billion by 2034, representing a CAGR of 6.13% from 2025 to 2034. The Asia Pacific market size was estimated at USD 55.52 billion in 2024 and is expanding at a CAGR of 6.46% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive interior market size was calculated at USD 171.89 billion in 2024 and is predicted to increase from USD 181.68 billion in 2025 to approximately USD 310.44 billion by 2034, expanding at a CAGR of 6.13% from 2025 to 2034.

The Asia Pacific automotive interior market was exhibited at USD 55.52 billion in 2024 and is projected to be worth around USD 103.88 billion by 2034, growing at a CAGR of 6.46% from 2025 to 2034.

Asia Pacific dominated the global automotive interior market in 2024. It is also estimated to be the fastest-growing market during the forecast period. This is attributed to the growing demand for the comfort and luxury in the vehicles along with the rising production of automotive vehicles in the region. The availability of cheap factors of production and the favorable government policies have attracted the investments in the Asia Pacific region that made it the largest producer of the automotive vehicles. This increased the consumption of the automotive interiors in the Asia Pacific region. The popular automotive manufacturers like Toyota, Honda, Maruti, and Hyundai are contributing to the growth of the global automotive interior market.

The surging demand for the private vehicles, rising standard of living of the consumers, rising disposable income, growing demand for luxurious vehicles, and growing popularity of the electric vehicles across the globe are some of the major factors that drives the growth of the global automotive interior market. The rising safety concerns coupled with the technological advancements is spurring the demand for the advanced automotive interiors. The growing demand for the light weigh commercial vehicles for the transportation of goods is fueling the market growth. The adoption of smart lighting systems, advanced seating systems, and rising investments in the development of comfortable and convenient interiors are significantly boosting the growth of the global automotive interior market. The adoption of the lightweight materials to offer innovative looks and finishing to the automotive interiors is a prominent driving factor. The government regulations pertaining to the carbon emissions, safety, and energy efficiency is resulting in the increased investments on the adoption of lightweight and innovative materials to reduce the weight of the vehicles that would increase energy efficiency is playing a crucial role in the market growth. Around 5% to 7% of the fuel can be saved by implementing a weight reduction of 10% of a vehicle. Moreover, the easy availability and suitability of plastics like polyvinyl chloride and acrylonitrile butadiene styrene is encouraging the OEMs to manufacture lightweight interior components for the various type of automotive vehicles. Moreover, the low costs and characteristicsof these plastics favors the adoption of the plastic materials in the manufacturing of interiors and offers cost-effectiveness to the OEMs. Thus, the adoption of lightweight materials is expected to drive the growth of the automotive interior market during the forecast period.

The autonomous and the semi-autonomous vehicles are gaining rapid traction in the market. The technological advancements in the automotive industry favored the adoption of digital technologies in the automotive interiors. The growing demand for the autonomous vehicles across the globe is expected to foster the growth of the global automotive interior market. The innovative designs and latest technologies in the autonomous vehicles boosting the growth of the cockpit electronic systems in the automotive vehicles. Therefore, the rising demand for the autonomous vehicles across the globe is fostering the growth of the automotive interior market.

| Report Highlights | Details |

| Market Size by 2034 | USD 310.44 Billion |

| Market Size in 2025 | USD 181.68 Billion |

| Growth Rate | CAGR of 6.13% from 2025 to 2034 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Vehicle, Material, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the component, the seat segment dominated the global automotive interior market in 2024. The growing vehicle production owing to a rise in the demand for the private and commercial vehicles coupled with the rising demand for the luxury, comfort, and convenience has exponentially driven the growth of this segment. Seat is an essential part of any vehicle and is the most important component with which the maximum comfort is associated with. Therefore, the primary focus of the manufacturers is to produce a comfortable seat. Therefore the development of adjustable seats, customizable comfort, and various other features has supplemented the growth of this segment in the forecast period.

On the other hand, rear seat entertainment is expected to be the most opportunistic segment during the forecast period. The increased demand for listening to online music while travelling is propelling the growth of this segment. The technological advancements and the entertainment in automotive vehicles have gained a rapid traction in the past few years and is expected to grow at a promising rate during the forecast period.

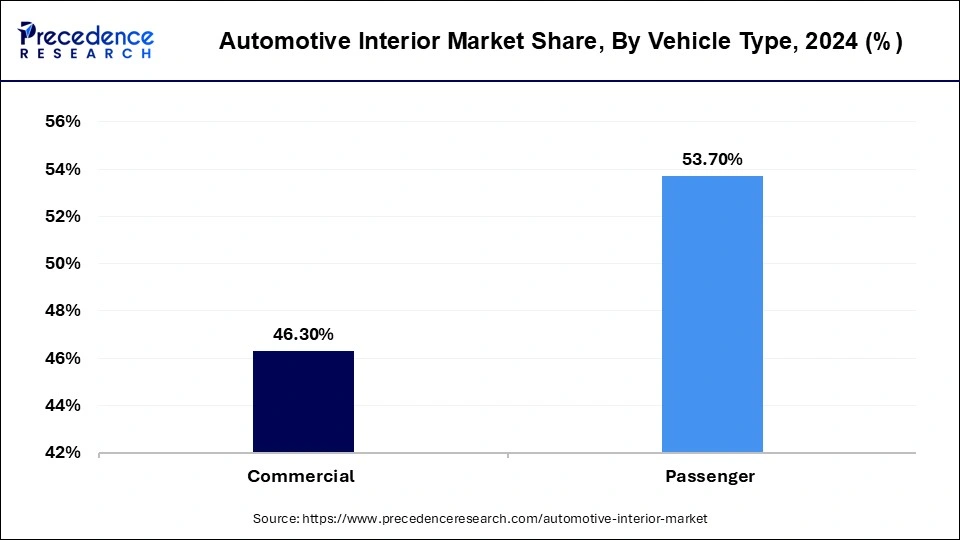

Based on the vehicle type, the passenger vehicles segment dominated the global automotive interior market in 2024. The increased number of passenger vehicles across the globe owing to the rise in disposable income, rising standards of living, and increased demand for the personal luxury vehicles across the globe has augmented the growth of the passenger vehicles segment. Moreover, the rising adoption of electric vehicles and autonomous vehicles is further expected to drive the growth of this segment in the forthcoming years.

The commercial vehicles segment is estimated to be the fastest-growing segment during the forecast period, owing to the rising economic activities across the globe. The growing investments for the industrial development has resulted in the rise in economic activities. The increased demand for the enhanced distribution systems, the demand for the lightweight commercial vehicles and heavy weight commercial vehicles is on the rise. Thus this segment is anticipated to witness a significant growth rate.

Automotive Interior Market Revenue, By Vehicle Type, 2022 to 2024 (USD Billion)

| By Vehicle Type | 2022 | 2023 | 2024 |

| Commercial | 71.13 | 75.20 | 79.58 |

| Passenger | 83.16 | 87.57 | 92.30 |

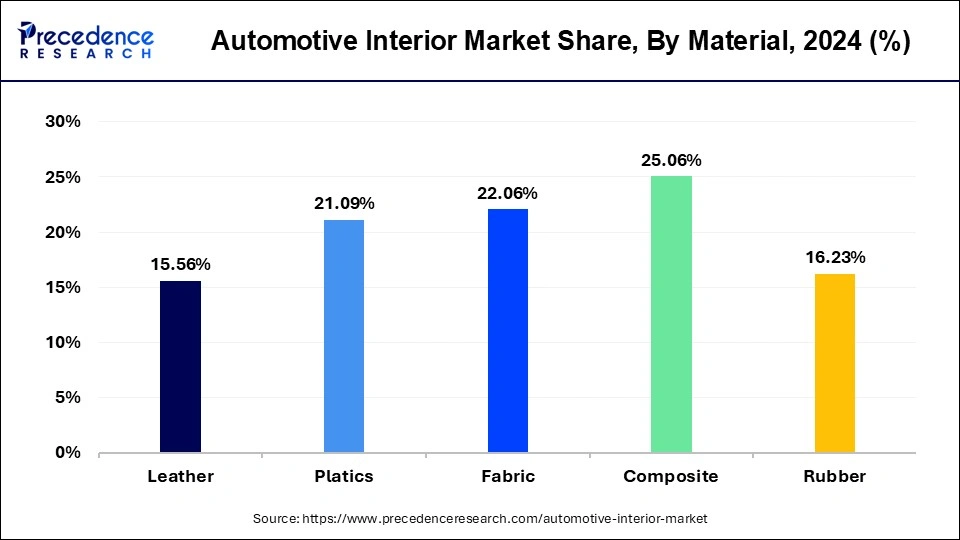

Based on the material, the glass fiber composite segment accounted for the largest share of the global automotive interior market in 2024. It is used in the production of wider variety of interior components in the automotive. Glass fiber composite is used for making components such as headliners, dashboards, insulation, and doors. The glass fiber composites offers several benefits like low cost, high impact resistance, and lightweight, which makes it an idle choice for making automotive interiors.

Fabric is estimated to be the most opportunistic segment. The fabric materials are attractive and comfortable. Fabrics are versatile and has durability which makes it a popular choice for the automotive interiors. For instance, the wool can be woven into any texture and it has increased applications in the seats that is expected to drive the growth of this segment during the forecast period.

Automotive Interior Market Revenue, By Material, 2022 to 2024 (USD Billion)

| By Material | 2022 | 2023 | 2024 |

| Leather | 23.94 | 25.29 | 26.75 |

| Plastics | 32.45 | 34.28 | 36.25 |

| Fabric | 33.97 | 35.87 | 37.92 |

| Composite | 38.60 | 40.76 | 43.07 |

| Rubber | 154.28 | 26.56 | 27.90 |

The various developmental strategies like collaborations, partnerships, mergers, and government policies fosters market growth and offers lucrative growth opportunities to the market players.

By Component

By Vehicle Type

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

April 2025

April 2025

January 2025