December 2024

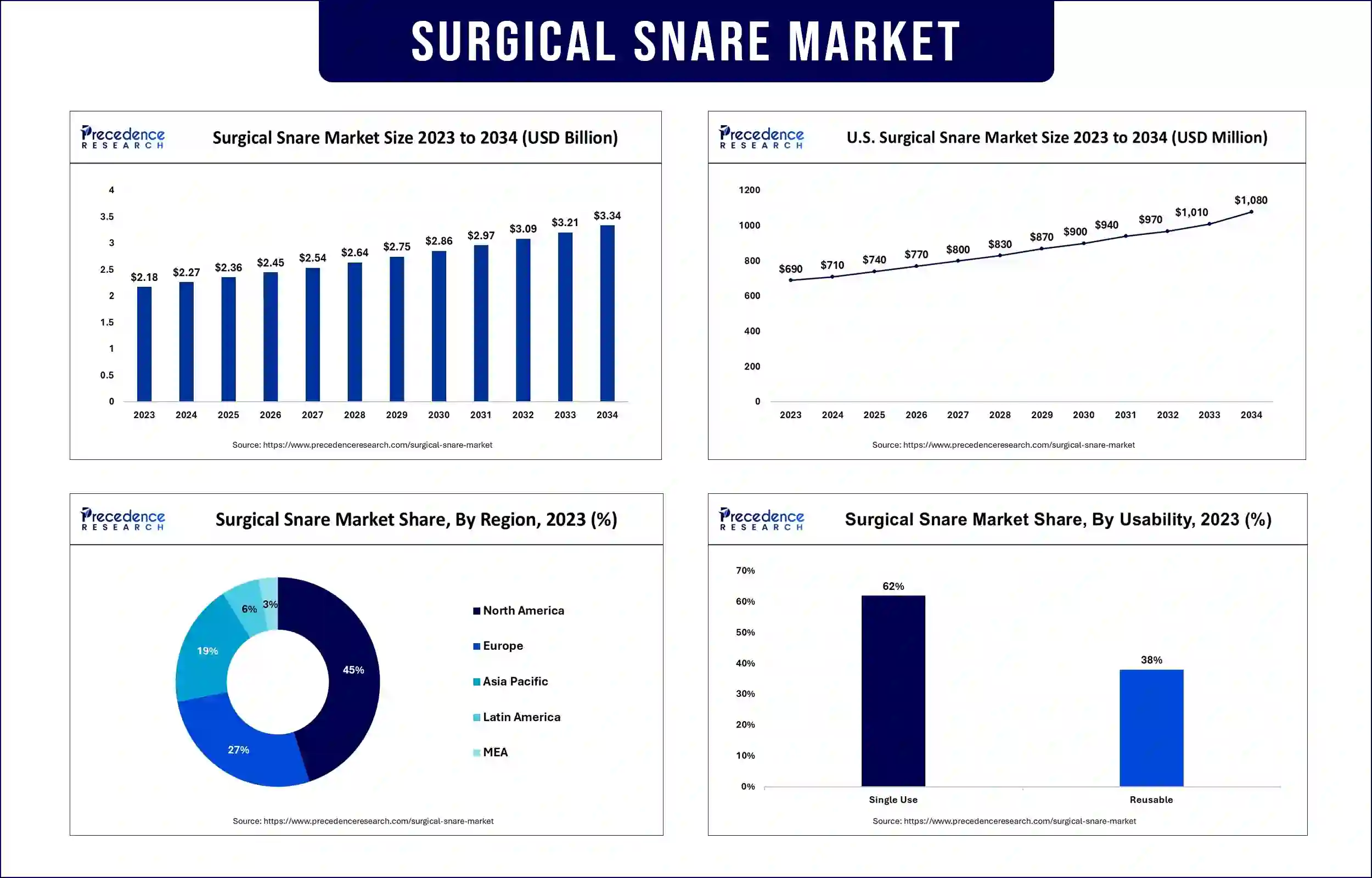

The global surgical snare market revenue was valued at USD 2.27 billion in 2024 and is expected to attain around USD 3.21 billion by 2033, growing at a CAGR of 3.96% during the forecast period. A significant element supporting the surgical snare market expansion is the growing emphasis on enhancing the state of healthcare facilities and infrastructure.

Medical devices called surgical snares are used to remove growths from tissue surfaces, mainly when inside bodily cavities. The surgical snare market products are commonly used to treat growths such as tumors, lymphoid tissue (tonsils), and polyps. The growing prevalence of illnesses like colorectal cancer, one of the main causes of cancer-related deaths worldwide, is propelling the market. To remove precancerous polyps and support early detection and prevention, surgical snares are essential.

Increasing healthcare expenditure

The increased financial commitment to healthcare creates an atmosphere where healthcare facilities are more likely to implement cutting-edge technologies in the surgical snare market. With their improved cutting mechanisms and technical improvements, surgical snares are seen as invaluable tools for medical providers looking to reduce patient stress and recovery times while providing the best possible treatment.

Advancements in snare design

Manufacturers in the surgical snare market are always developing new ways to enhance the functionality and appearance of single-use surgical snares. Recent developments include smoother sheath transitions for user convenience, better wire design for better tissue capture, and ergonomic grips for increased maneuverability. By increasing efficiency during treatments, these design enhancements provide doctors with more control and precision.

North America dominated the surgical snare market in 2023. Medical technological improvements, the rise in gastrointestinal and urological disorders, and the need for less invasive operations contribute to North America's remarkable growth. During interventional cardiology treatments, cardiologists typically use snares to seal defects and extract foreign bodies. During endoscopic treatments, gastroenterologists employ snares to clear polyps and other lesions. This use increases the need for specialized snares that provide safety and precision, which benefits from developments in endoscopic technologies.

Asia Pacific is observed to host the fastest-growing surgical snare market during the forecast period. The adoption of less invasive surgeries, the expansion of research, the growth of healthcare systems, and the growing populations of China and India are all to blame for this. The government authorities hope to provide access to high-quality surgical equipment for various treatments by broadening the scope of medical services. Significant expenditures are being made by several countries in the region to modernize and enlarge their healthcare systems. This means developing state-of-the-art medical facilities, applying technology to the medical industry, and improving access to medical treatment. As hospitals and surgical facilities become more advanced, there is an increasing demand for the newest surgical instruments, such as surgical snares.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 2.27 Billion |

| Market Revenue by 2033 | USD 3.21 Billion |

| CAGR | 3.96% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Usability

By Application

By End-use

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/5368

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

December 2024

January 2025

April 2025

January 2025