September 2024

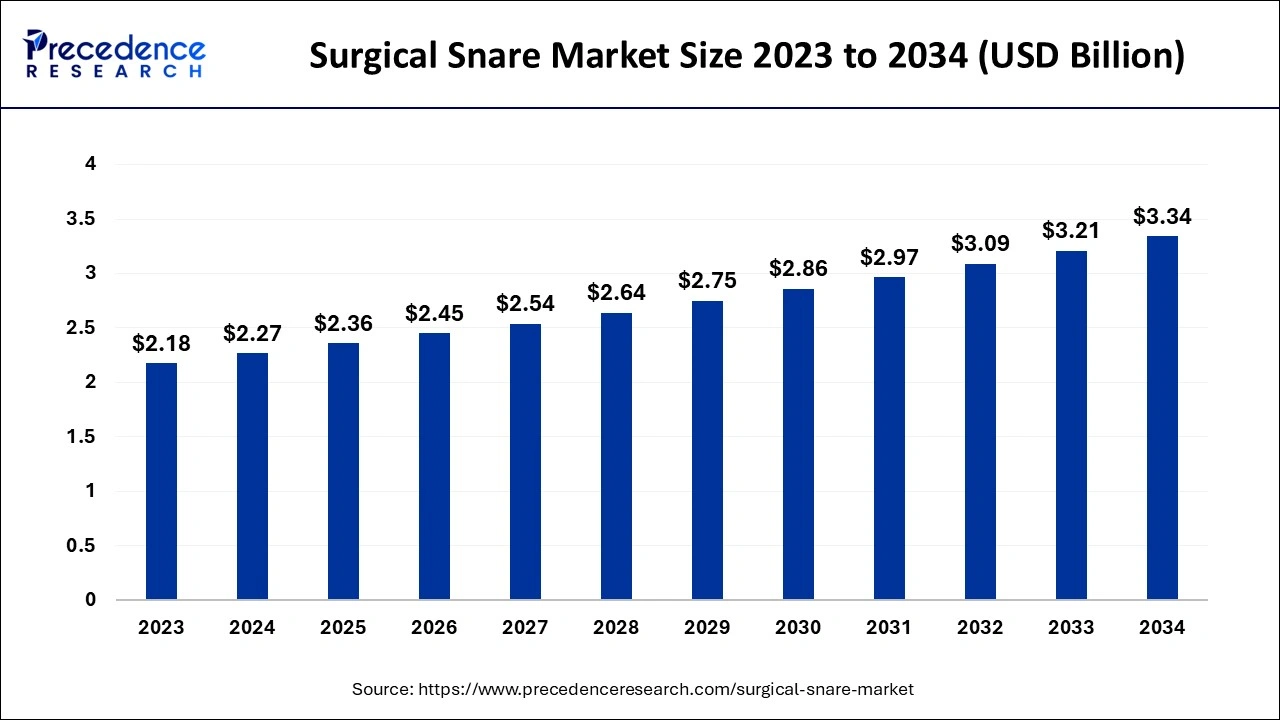

The global surgical snare market size accounted for USD 2.27 billion in 2024, grew to USD 2.36 billion in 2025 and is projected to surpass around USD 3.34 billion by 2034, representing a CAGR of 3.96% between 2024 and 2034. The North America surgical snare market size is calculated at USD 1.02 billion in 2024 and is expected to grow at a CAGR of 4.07% during the forecast year.

The global surgical snare market size accounted for USD 2.27 billion in 2024 and is expected to exceed around USD 3.34 billion by 2034, growing at a CAGR of 3.96% from 2024 to 2034. The surgical snare market is driven by the increasing incidence of gastrointestinal (GI) conditions that necessitate minimally invasive operations like polypectomy and tumor removal, such as colorectal cancer and polyps.

More accurate snaring of polyps or lesions is made possible by AI-integrated endoscopic equipment that can differentiate bad tissue from healthy tissue in real time. Adaptive surgical snare market designs can improve procedural success rates by addressing differences in tissue density or architecture. By guaranteeing that the surgery is performed precisely, AI analytics prevent issues, including bleeding, perforation, and partial tissue removal. After the procedure, artificial intelligence also verifies that the snared tissue was accurately and fully removed by evaluating biopsy or follow-up imaging data.

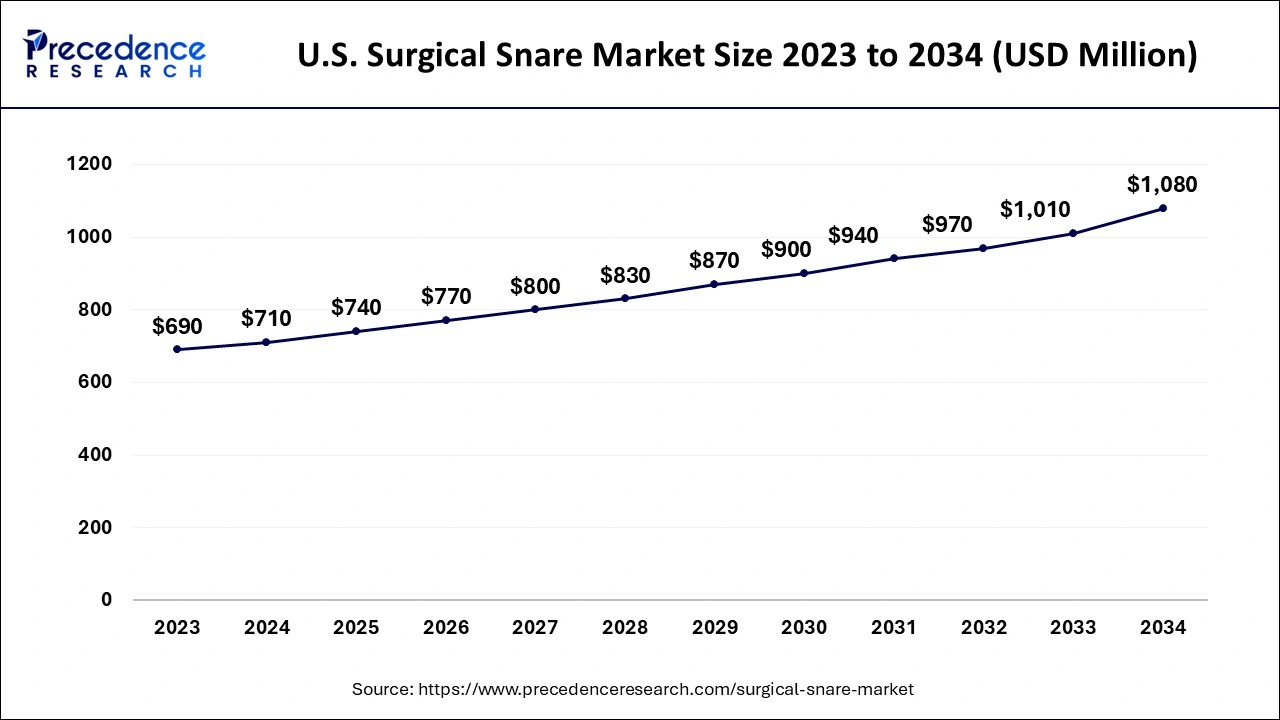

The U.S. surgical snare market size is exhibited at USD 710 million in 2024 and is projected to be worth around USD 1,080 million by 2034, growing at a CAGR of 4.16% from 2024 to 2034.

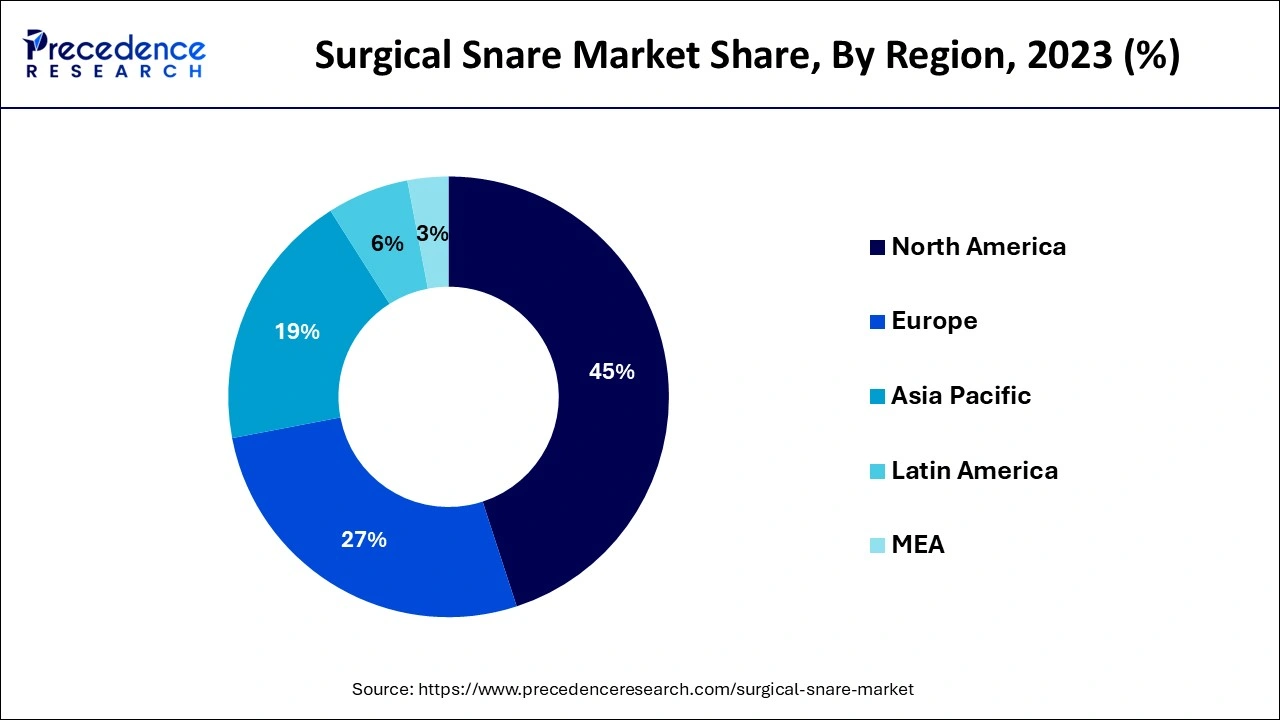

North America dominated the surgical snare market in 2023. Due to its sophisticated healthcare system, North America has substantial purchasing power. The high expenses of healthcare guarantee that clinics and hospitals can purchase the latest equipment, such as surgical snares, which are essential for carrying out various medical procedures. High accessibility to these medical gadgets results from government spending on healthcare, especially in the United States. The supremacy of the surgical snare market in North America is mostly due to the presence of major medical device manufacturers like Boston Scientific and Medtronic. Due to their extensive local production and distribution networks, these reputable businesses can satisfy the rising demand for surgical snares.

Asia Pacific is observed to host the fastest-growing surgical snare market during the forecast period. Oncology and endoscopic operations are receiving more attention because of the rising incidence of cancer, particularly in nations like China. In endoscopy, surgical snares are widely used to remove tumors, polyps, and other aberrant growths. The market for surgical snares expands in tandem with the growing need for cancer treatment and diagnostic operations. The use of minimally invasive surgical procedures has significantly increased in the area. For accuracy and effectiveness, these procedures, which usually entail fewer incisions and quicker recovery periods, frequently call for instruments such as surgical snares. The need for surgical snares in the area increases as these operations become more widespread.

Surgical snares are crucial in minimally invasive procedures like gastrointestinal endoscopy, colonoscopy, and bronchoscopy, which are now the gold standard for identifying and treating diseases like colorectal cancer and gastrointestinal disorders. These procedures are recommended because of their decreased dangers, quicker recovery, and shorter hospital stays. Awareness efforts and government-led screening programs for the early diagnosis of malignancies and other gastrointestinal problems have strengthened the surgical snare market application in diagnostic and therapeutic operations.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.34 Billion |

| Market Size in 2024 | USD 2.27 Billion |

| Market Size in 2025 | USD 2.36 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.96% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Usability, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Significant increase in gastrointestinal procedures

The main purpose of surgical snares is to remove aberrant tissue from the GI system, such as polyps or tiny tumors, during endoscopic treatments. The need for these tools has grown as routine colonoscopies and upper gastrointestinal endoscopies have increased. Manufacturers in the surgical snare market are developing advanced surgical snares with increased safety, flexibility, and cutting precision. Bipolar and hybrid snares, for instance, are intended to lower the risk of bleeding during procedures, hence improving patient outcomes.

Increasing prevalence of chronic kidney diseases

Kidney biopsies are frequently used to diagnose chronic kidney disease, assess the degree of damage, and identify underlying causes, such as glomerulonephritis, diabetic nephropathy, or autoimmune disorders. Chronic kidney illnesses are now detected early because of awareness programs and improved diagnostic tools. Surgical snares are necessary for early intervention treatments like biopsies and stone removal.

Limited infrastructural facilities

Well-equipped hospitals and diagnostic facilities are scarce in many developing nations. Finding the facilities needed to carry out minimally invasive treatments, such as specialized operating rooms, cutting-edge imaging equipment, and trained staff, is frequently impossible. Compared to other pressing healthcare concerns, investing in such infrastructure may not be financially feasible for healthcare institutions in resource-constrained environments.

High cost of the product

For performance, flexibility, and longevity, surgical snares are constructed using cutting-edge materials and technologies, including coated loops, stainless steel, and tungsten wires. These elements raise the cost of production. Although disposable surgical snares improve safety and hygiene, they are costly and increase ongoing hospital expenses. Reusable snares are more expensive initially, but they must also be maintained and sterilized, which raises operating costs.

Rising incidence of cancer

Early-stage polyps are the precursor to many malignancies, including colorectal cancer. Surgical snares can safely and completely remove polyps during colonoscopies, greatly lowering the chance that they will progress to cancer. Minimally invasive procedures are becoming increasingly popular among patients and healthcare professionals due to their many advantages, such as quicker recovery periods, fewer complications, and cheaper costs. Surgical snares are increasingly used in oncology applications as essential tools for minimally invasive procedures.

Increasing awareness about the benefits of surgical snare

Patients now have easier access to medical information because of the growth of digital health platforms. Many people are taking the initiative to learn about their alternatives for treatment, including how surgical snares function in minimally invasive procedures. The need for less intrusive, outpatient-friendly procedures enables producers to reach a broader range of customers. Healthcare workers are becoming more aware of sophisticated surgical snare designs, such as those with ergonomic handles, improved flexibility, and electrosurgical compatibility. Since these advancements in the surgical snare market have become the go-to option for endoscopic procedures because they enhance procedural results.

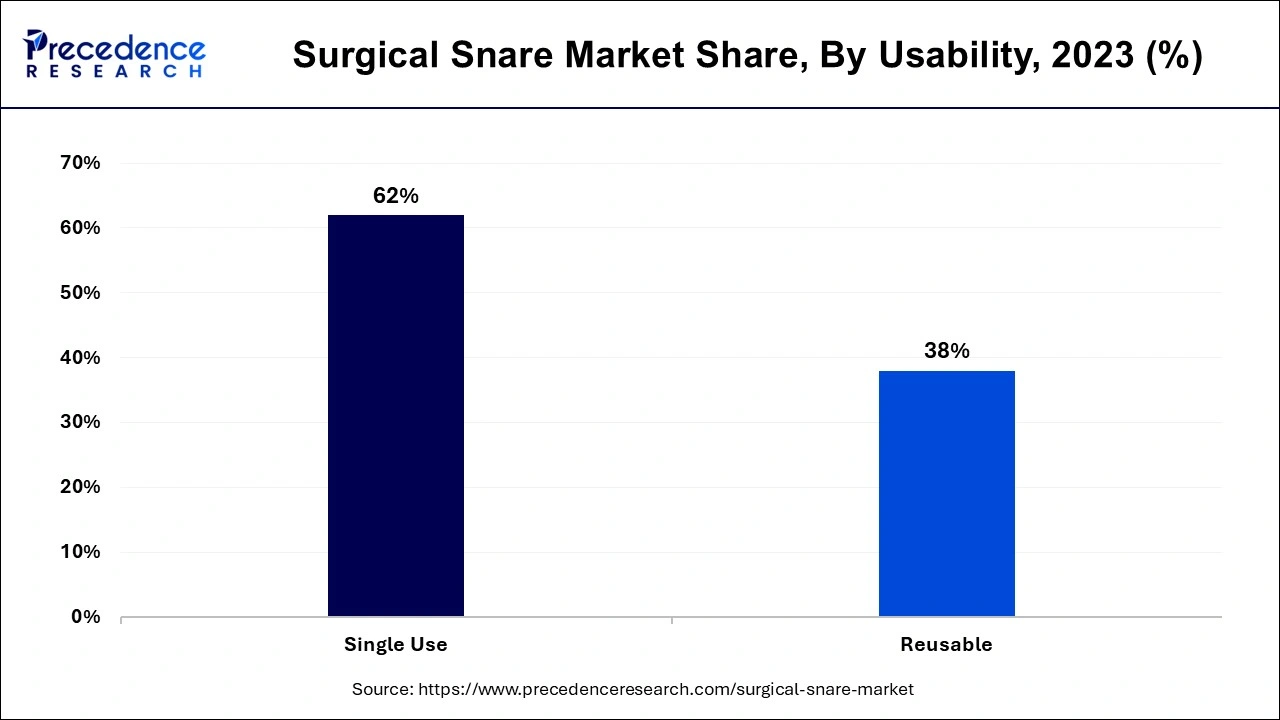

The single-use segment dominated the surgical snare market in 2023. By being pre-sterilized and disposed of after only one usage, single-use surgical snares reduce the possibility of infection transmission between patients. This is especially important in surgical and endoscopic treatments when sterilizing is crucial. Single-use devices remove the need for extra effort and resources for maintenance, in contrast to reusable snares that require labor-intensive cleaning, disinfection, and re-sterilization procedures.

The reusable segment is observed to grow at the fastest rate in the surgical snare market during the forecast period. Hospitals and surgical facilities can save money by using reusable surgical snares. Reusable snares can be used repeatedly after being properly sterilized, which lowers the total cost per treatment even though their initial cost may be more than that of disposable ones. Reusable snares are appealing because of their long-term cost-saving feature, particularly for healthcare practitioners with limited funding. Reusable solutions are now more effective thanks to ongoing advancements in surgical snare technology, with designs aimed at increasing patient outcomes, lowering the risk of complications, and improving simplicity of usage. Because of these improvements in functionality and design, more medical practitioners are choosing reusable snares over disposable ones.

The GI endoscope segment held the largest share of the surgical snare market in 2023. Using an endoscope, endoscopy is a minimally invasive treatment that enables doctors to inspect the GI system. With GI endoscopes, surgical snares are frequently used for tissue sampling, tumor excision, and polypectomy (removal of polyps). The need for surgical snares has increased dramatically due to the growth of endoscopic applications, such as in the diagnosis and treatment of different GI disorders. Endoscopic treatments have replaced traditional open operations as the least invasive way to do procedures like gastroscopies and colonoscopies.

The arthroscopy segment is observed to expand rapidly in the surgical snare market during the forecast period. Joint issues are becoming more common as the world's population ages, which increases the demand for arthroscopic operations. Arthritis, which frequently necessitates arthroscopic intervention, is more common in older people. A surgical snare is necessary to remove tissue or foreign objects from the joint area during arthroscopy. Advanced snares that provide greater accuracy, effectiveness, and safety have been developed due to the rise in arthroscopy procedures.

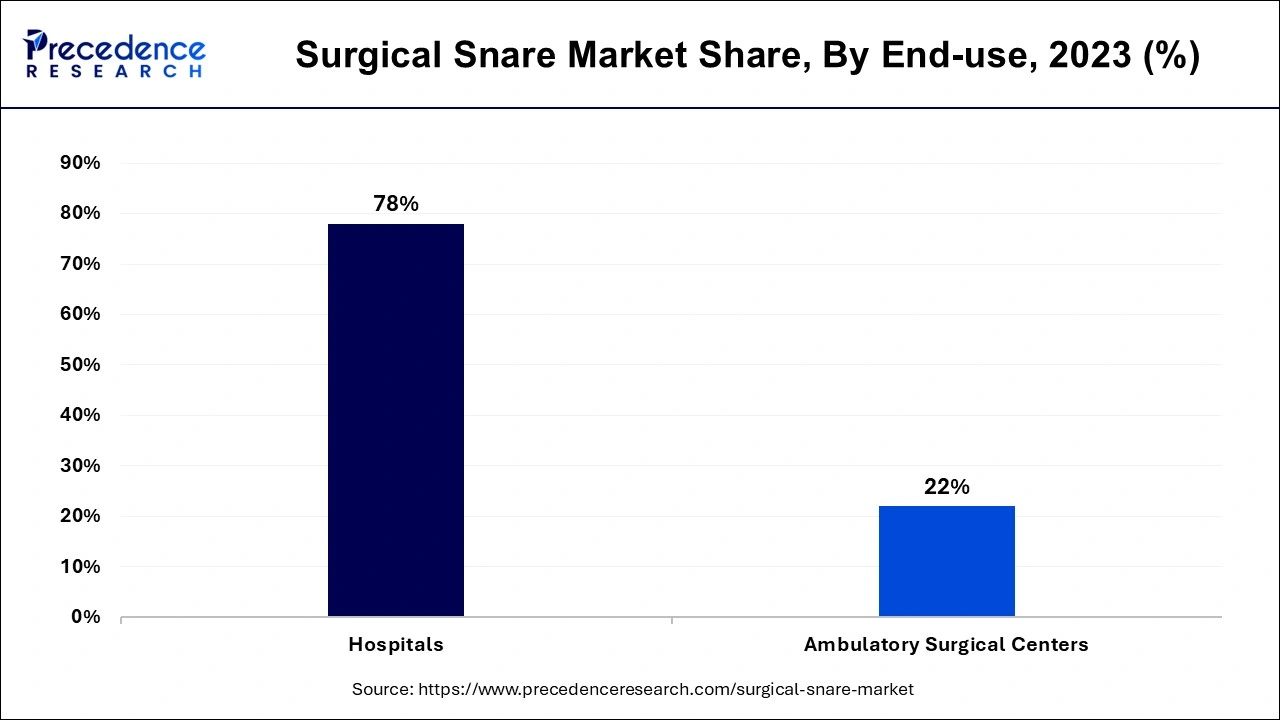

The hospitals segment accounted for the largest share of the surgical snare market in 2023. A considerable number of surgical procedures are performed in hospitals, particularly large medical institutes, every day. Specialized tools, including surgical snares, which are essential in many surgeries, are frequently needed for these procedures. Endoscopic procedures (such as those involving the gastrointestinal, pulmonary, or urinary systems), tumor excisions, biopsy collections, and polyp removals are the main applications for surgical snares. The need for surgical snares is fueled by the large volume of hospital surgeries, encompassing both simple and complicated operations.

The ambulatory surgical centers segment is observed to grow rapidly in the surgical snare market during the forecast period. More diagnostic and treatment operations are being carried out due to the growing prevalence of chronic illnesses such as colorectal cancer, gastrointestinal issues, and respiratory conditions. Surgical snares are frequently employed for polypectomy, tumor resection, and the excision of other malignant growths. The need for surgical snares in ambulatory surgical centers is anticipated to increase dramatically as these facilities offer specialist care in fields including cancer, pulmonology, and gastroenterology.

By Usability

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

January 2025