July 2024

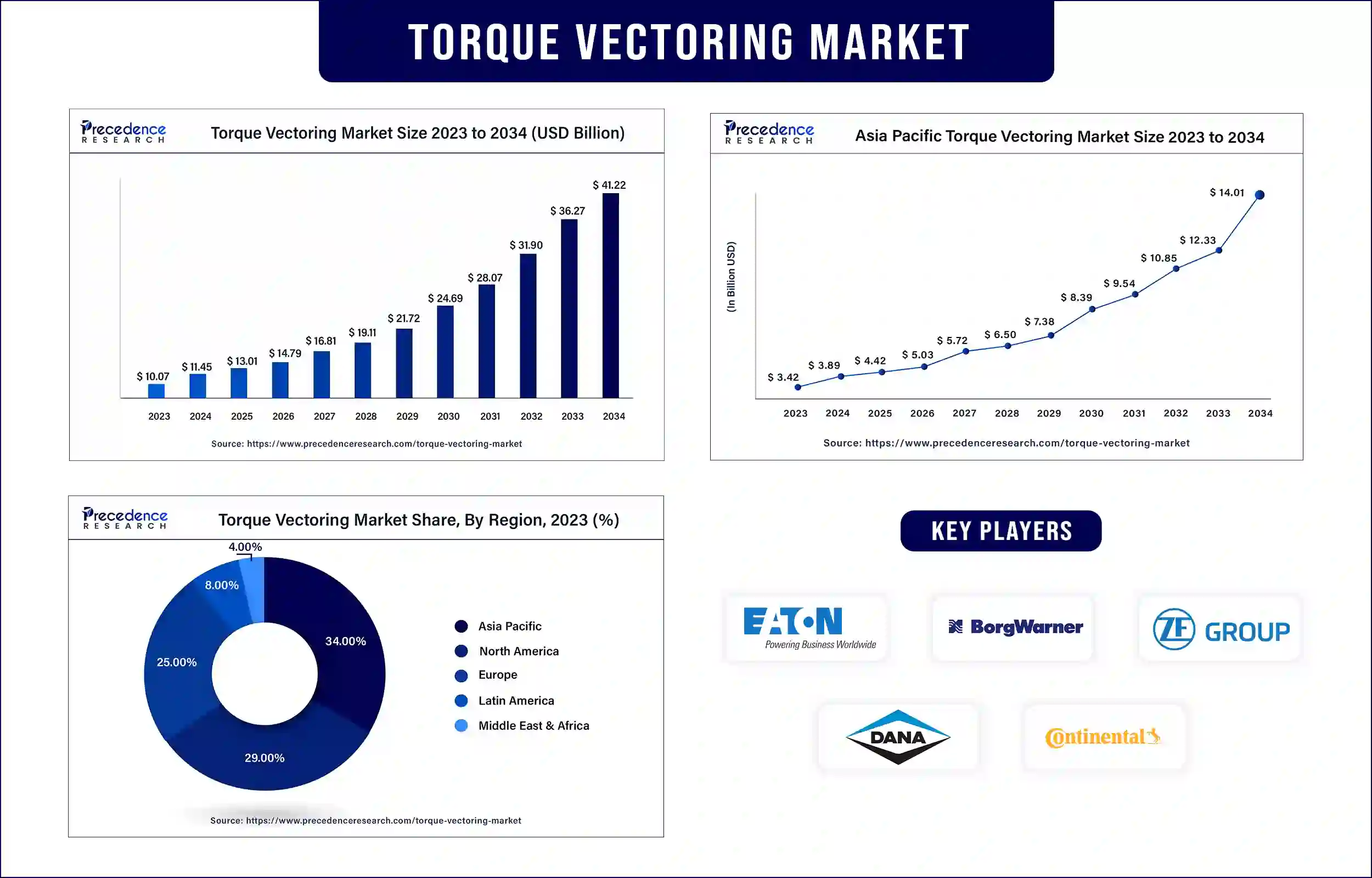

The global torque vectoring market surpassed USD 10.07 billion in 2023 and is predicted to attain around USD 26.27 billion by 2033, growing at a CAGR of 13.67% during the forecast period.Due to the rising concern about safety, handling, and performance, the torque vectoring market is observed to be growing significantly.

The torque vectoring market is evolving significantly due to the rapidly rising concern about the safety and performance of vehicles. The market is constantly working on torque vectoring development and distributing it across the world. The advanced automotive market and continuous demand for enhanced safety measures and vehicle performance are also driving the growth of the torque vectoring market. Torque vectoring stands for the capacity to spread torque to every wheel, enhancing stability, traction, and handling. This technology is incorporated in both electric and conventional vehicles due to the demand of people. This torque vectoring technology plays an important role in improving stability by spreading the torque on the entire vehicle from the wheels to the handle, which increases the safety of the driver and makes it the best choice for people. Major market players are concentrating highly on the development of the systems available in vehicles that accommodate both mainstream and luxury features.

Advancements in technology and rising demand for premium vehicles are driving the torque vectoring market

The automotive industry is constantly bringing advancement to the market with unique technologically advanced features. The demand for sports cars in the market, with various additions of luxury and looks, influences the torque vectoring market. The continuous advancement offered by market players brings new features in all the new models launched. With the introduction of various luxury vehicles to the various new model vehicles, this torque vectoring system is included as the demand for safety is rising among the public. Luxury includes the addition of digital screens, air curtains, voice assistance, and many others.

Recent Development by Koenigsegg

| Company Name | Koenigsegg |

| Headquarters | Ängelholm, Sweden |

| Development | In February 2022, Koenigsegg developed its in-house technology Terrier torque-vectoring EV-drive unit, David inverter, and Quark Raxial Flux motor. |

| Company Name | Aston Martin |

| Headquarters | Gaydon, United Kingdom |

| Development | In June 2023, Aston Martin prepared its set-up to develop electric components in collaboration with Lucid Group to work on their project of electric vehicles. It is all set to launch its first BEV in 2025. |

North America is expected to grow at the fastest rate during the forecast period. Playing the role of the leading producer, consumer, and exporter due to the advancements in the automotive industry and innovations is considered to be the driving factor of the torque vectoring market in this region. In addition, the government’s focus on awareness regarding safety in vehicles, light-projected vehicles, speed control, and various other advancements has expanded the market. The growing demand for electric vehicles, along with the advanced features, resulted in the development of the torque vectoring market. The major market players are working on providing balance to vehicles to avoid ongoing accidents.

Asia-Pacific dominated the torque vectoring market in 2023. With countries like China and India due to their expanding automotive industry and the demand for luxury features in every model. Moreover, the huge investments and funding by the government through respective regulatory bodies have also played a crucial role in expanding the market. Constant evolution in the automotive sector by several market players and their collaborations led to the growth of several markets that are involved in upgrades, and the major one among them is the torque vectoring market.

The launch of advanced technology in electric vehicles or electric supercars has enhanced the torque vectoring market in the countries. The continuous investment brings innovation to the market based on various requirements. Rising automotive companies such as Nissan, Toyota, Honda, Great Wall Motors, Geely, and many others are constantly working on bringing required changes.

The growing number of customers buying vehicles for off-road traveling purposes and also the advantages of torque vectoring features attract a high number of customers. With the rising demand for ADAS features, the leading market players are continuously focusing on providing updated models of several vehicles that have already been introduced to the market, which primarily enhance the market opportunities of the torque vectoring market.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 11.45 Billion |

| Market Revenue by 2033 | USD 36.27 Billion |

| CAGR | 13.67% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Clutch Actuation Type

By Vehicle Type

By Propulsion

By Technology

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/4875

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

July 2024

January 2024

April 2024

July 2024