What is the Torque Vectoring Market Size?

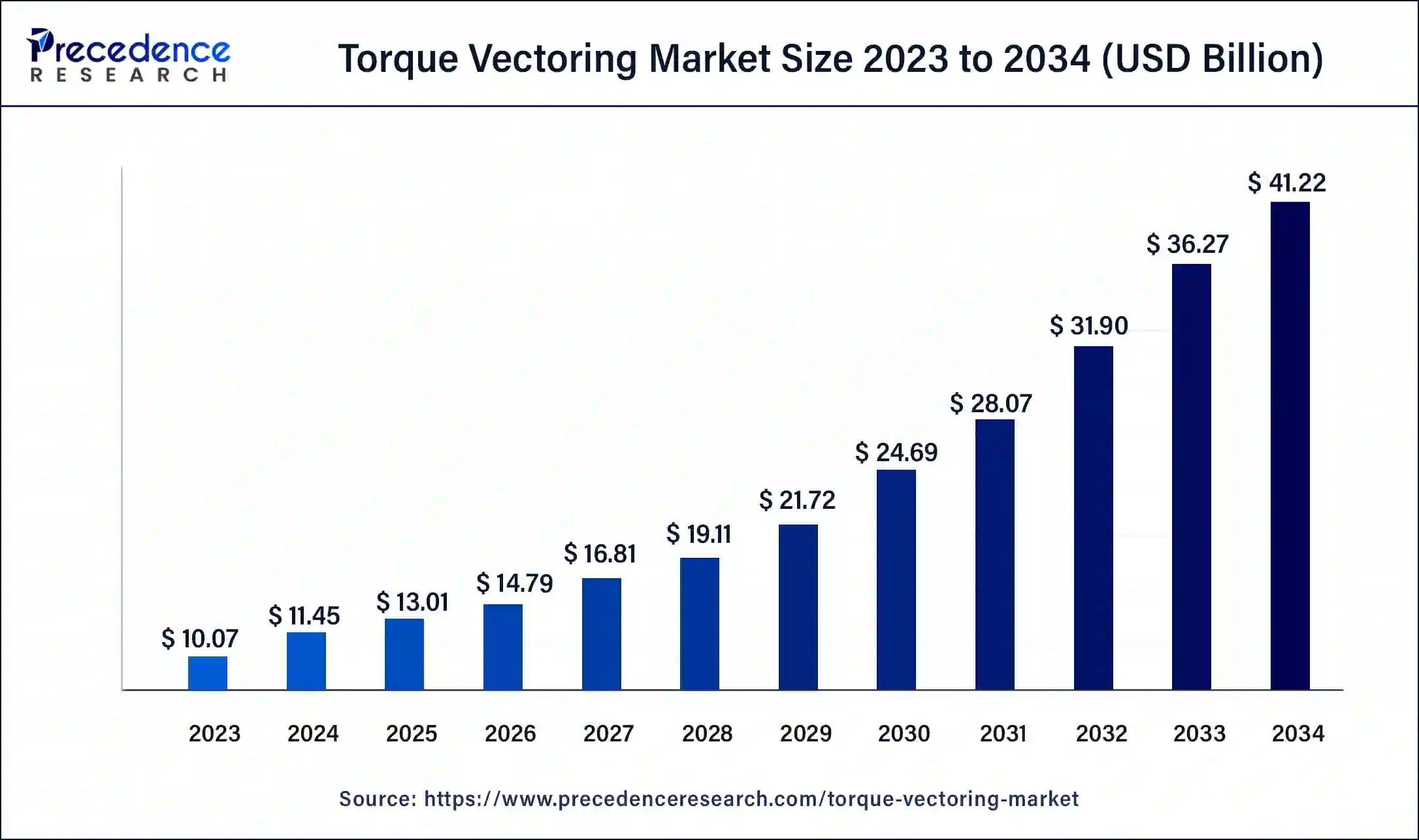

The global torque vectoring market size is calculated at USD 13.01 billion in 2025 and is predicted to increase from USD 14.79 billion in 2026 to approximately USD 41.22 billion by 2034, at a CAGR of 13.67% from 2025 to 2034. The growing sales of electric vehicles around the world has driven the growth of torque vectoring market.

Torque Vectoring Market Key Takeaways

- The global torque vectoring market was valued at USD 11.45 billion in 2024.

- It is projected to reach USD 41.22 billion by 2034.

- The torque vectoring market is expected to grow at a CAGR of 13.67% from 2025 to 2034.

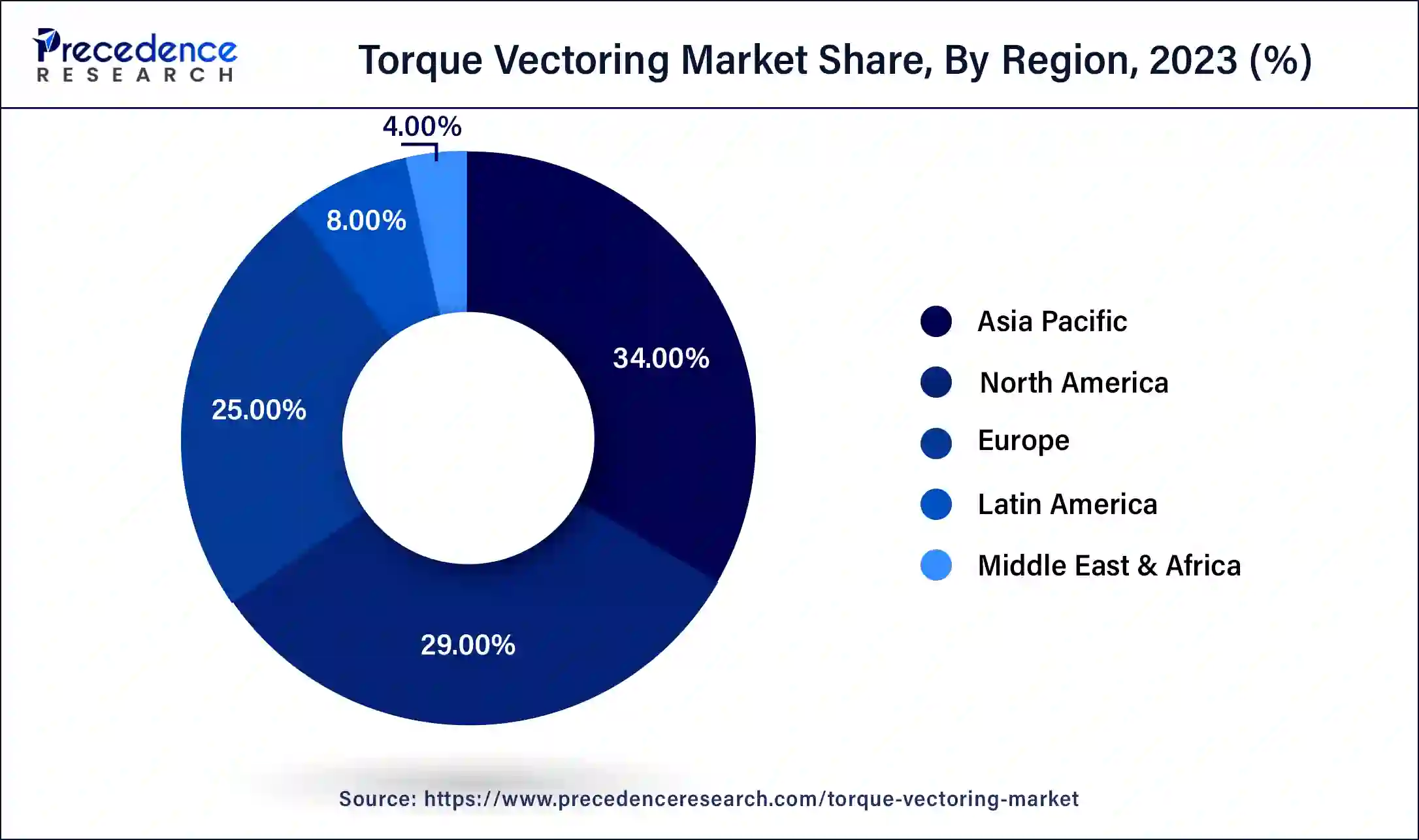

- Asia Pacific led the torque vectoring market with the highest market share of 34% in 2024.

- By region, North America is expected to grow with the highest CAGR during the forecast period.

- By clutch actuation type, the hydraulic clutch segment dominated the market in 2024.

- By clutch actuation type, the electronic clutch segment is anticipated to grow at a significant growth rate during the forecast period.

- By technology, the passive torque vectoring segment held a dominant share of the market in 2024.

- By technology, the active torque vectoring segment is likely to grow with the highest CAGR during the forecast period.

- By propulsion, the all-wheel drive/four-wheel drive (AWD/4WD) segment dominated the market in 2024.

- By propulsion, the rear wheel drive (RWD) segment is expected to grow with the highest CAGR during the forecast period.

- By vehicle type, the passenger car segment dominated the torque vectoring market in 2024.

- By vehicle type, the light commercial vehicles segment is expected to grow with the highest CAGR during the forecast period.

How is AI helping the Torque Vectoring Industry?

The automotive industry has developed significantly due to the advancements in modern technologies. The advancements in AI technologies have a major impact on shaping the landscape of the automotive industry. Nowadays, torque vectoring companies are using AI in their systems to improve the driving experience of vehicles. The application of AI in torque vectoring helps to manage torque output for enhanced handling and smooth acceleration during the cornering of vehicles. Thus, advancements in artificial intelligence technology are expected to help the torque vectoring market positively.

- In May 2023, Faraday Future launched AI-powered “6x4 ai Hyper Technology 2.0 Architecture”. This architecture includes several technologies, including the “Magic All-” “Hyper Multi-Vectoring,” In-One, “driving,” and the “3rd airspace”.

What is Torque Vectoring?

The torque vectoring market is a developing industry in the automotive sector. This industry deals in the development and distribution of torque vectoring systems around the world. The torque vectoring industry manufactures various clutch actuation systems, including hydraulic clutch and electronic clutch. This market is generally driven by the rising trend of luxurious cars along with technological advancements in the automotive industries.

This industry uses different types of technology, including Active Torque Vectoring System (ATVS) and Passive Torque Vectoring System (PTVS). This industry designs torque vectoring systems for several types of vehicles: light commercial vehicles, heavy commercial vehicles, and passenger cars. This market is anticipated to grow significantly with the developments in the automotive industry.

- According to the Center for Strategic and International Studies, autonomous vehicles manufacturers invested above US$16 billion for developing AV technologies and this industry is expected to reach US$1 trillion in 2030 and US$3 trillion by 2040.

What are the Growth Factors of the Torque Vectoring Market?

- The rising demand for passenger cars around the world.

- Growing developments in the automotive industry.

- There is an increasing emphasis on increasing fuel efficiency in vehicles.

- Ongoing trend of 4*4 SUVs for off-roading purposes.

- Proliferation of hypercars in developed nations.

- Developments in sensor technology associated with torque vectoring.

- There is a rise in the number of cars with traction control capabilities.

- There is growing awareness regarding steering response and vehicle handling abilities.

- There is an increasing demand for trucks and crossovers among the people.

- Rising application of torque vectoring system in EVs.

Top 10 Sports Car Brand

- Ferrari

- Aston Martin

- BMW

- Porsche

- Lamborghini

- McLaren Automotive

- Mercedes

- Bugatti

- Alfa Romeo

- Audi

Torque Vectoring Market Outlook

- Industry Growth Overview: From 2025 to 2030, the torque vectoring sector is anticipated to experience significant growth, supported by the upswing in electric vehicle adoption, the increasing consumer requirement for improved vehicle stability, and the special focus of premium original equipment manufacturers on performance. Enhanced adoption of advanced drivetrains in the Asia-Pacific and North America regions is further strengthening torque vectoring markets in anticipation of EV adoption, with various automakers developing their future mobility systems with increased value and high-tech customization.

- Global Growth: Leading suppliers of torque vectoring technology are expanding across Southeast Asia, Eastern Europe, and Latin America to aim at fast-growing EV hubs and to gain regulatory and local supplier advantages. In addition, major drivetrain suppliers are launching new production lines in the Asia-Pacific regions to cater to high-value OEM contracts and to increase local content.

- Major Players: Private equity firms, along with OEM-supported funds, are getting involved in the torque vectoring space because of high technical barriers and future demand related to electric vehicles. Recent investments have increased portfolios related to electric drivetrains, high-performance axles, and software-powered torque control systems.

- Startup Ecosystem: New players are entering niches in artificial intelligence-powered control algorithms, e-axle systems that integrate compact designs as well as modular torque-vectoring units. New startups in the U.S, Europe, and India are receiving venture funding for their scalable, software-driven designs that aim to improve the efficiency and handling of electric vehicles.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 41.22 Billion |

| Market Size in 2025 | USD 13.01 Billion |

| Market Size in 2026 | USD 14.79 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.67% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Clutch Actuation Type, Vehicle Type, Propulsion, Technology, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

The rising trend of sports cars among people

The automotive industry is growing rapidly with the rising demand for sports cars around the world. The demand for sports car has increased due to several advantages such as eye-catching looks, advanced technology, enhanced driving performance, status and elegance and some others. These cars are becoming popular among enthusiast drivers due to fantastic driving experience along with arrangements of numerous racing events across the world.

Most sports cars use torque vectoring systems to improve drivability and enhance braking. Thus, with the growing trend of sports cars, the demand for torque vectoring systems has increased, which in turn drives the growth of the torque vectoring market during the forecast period.

- In June 2024, the government of Lancaster in England announced that it would host a car racing event in September. The participants of this event will be from various nations, including Japan, Australia, Germany, England, Canada, the U.S., and some others.

- In November 2023, Porsche launched new-gen Panamera in India. Panamera is a powerful sportscar that comes with 2.9-litre twin-turbo V6 engine and Porsche Torque Vectoring Plus.

Restraint

Expensive and limited usability

The torque vectoring industry experiences several problems in day-to-day operations. The prices of torque vectoring systems are very high, and the maintenance and service charges are also costly, which limits the use of these systems. Moreover, the application of a torque vectoring system is only required for off-roading and track-driving purposes. Thus, the high cost, along with limited applications of torque vectoring systems.

Opportunity

Advancements in autonomous vehicles

The torque vectoring market is experiencing significant growth due to numerous developments in the automotive landscape. Currently, autonomous vehicle manufacturers such as Tesla, Ford, General Motors, Toyota, and some others have started using torque vectoring systems in autonomous vehicles for several advantages. The use of torque vectoring systems in modern autonomous vehicles helps enhance stability, improve maneuverability and handling, improve steering response, and others. Thus, the rising advancements in autonomous vehicles are expected to create ample growth opportunities for the market players in the years to come.

- In April 2024, Geely launched “driverless drifting” technology. This technology helps in enhancing the drifting capabilities in driverless cars by using torque vectoring control.

Clutch Actuation Type Insights

The hydraulic clutch segment held the dominant share of the market in 2024. The growing demand for lighter-weight materials in cars, along with the enhanced adaptability of hydraulic clutches, boosts the market growth. Also, the rising application of hydraulic clutches in modern vehicles, which allow for easier pedal press, is likely to proliferate market development. Moreover, the increasing use of hydraulic clutch in sports cars to allow the torque vectoring system to increase the speed of the wheels is expected to drive the growth of the torque vectoring market during the forecast period.

- In January 2022, Stromag launched the SHPU series of hydraulic power units. These power units can work properly with hydraulic clutches and brakes.

The electronic clutch segment is anticipated to grow with a significant CAGR during the forecast period. The rising trend of automatic vehicles among people increases the demand for electronic clutches. Also, the increasing application of electronic clutches in luxury cars to provide several advantages, such as precise control, quick response, smooth engagement, and others, has contributed significantly to market growth. Moreover, the development of electronic clutches that support torque vectoring to enhance maneuverability and vehicle handling boosts torque vectoring market growth.

- In March 2023, JJE launched DirectFlux mono-stable and bi-stable electromagnetic clutches. These clutches will be used in hybrid vehicles for providing faster driving, safer functionality and energy efficiency.

Technology Insights

The passive torque vectoring system (PTVS) segment dominated the market in 2024. The use of vehicle braking system for adjusting torque in every wheel during turning has increased the demand for passive torque vectoring. Also, the rising application of passive torque vectoring due to its higher potential to adjust acceleration levels has propelled the market growth. Moreover, the upsurge in demand for passive torque vectoring in EV industry to enhance vehicle performance and driving range has accelerated the market growth.

- In June 2023, Lucid announced a partnership with Aston Martin. This partnership is aimed at developing a twin motor for electric vehicles consisting of passive torque vectoring technology.

The active torque vectoring system (ATVS) segment is likely to grow with the highest CAGR during the forecast period. The rising demand for active torque vectoring technology to provide power to every wheel in a vehicle and improve handling and traction has driven market growth. Also, the growing application of ATV technology for distributing equal power to each wheel is likely to propel industrial growth. Moreover, the increasing use of active torque vectoring technology in SUVs to improve their performance and braking is expected to boost the market growth in a positive way.

- In February 2022, Honda launched the i-VTM All-Wheel Drive. This all-wheel-drive system is based on active torque vectoring technology that enhances the driving experience during off-roading and bad weather conditions.

Propulsion Insights

The all-wheel drive/four-wheel drive (AWD/4WD) segment held the dominant share of the market in 2024. The growing demand for SUVs among middle-aged people due to their off-roading capabilities has boosted the torque vectoring market growth. Also, the increasing demand for all-wheel drive/four-wheel drive (AWD/4WD) vehicles due to improved stability, better traction, and enhanced towing capacity is likely to propel the market growth. Moreover, there are numerous advantages of torque vectoring systems in AWD/4WD vehicles, such as superior handling, better acceleration, and increased fuel efficiency.

- In June 2024, Volkswagen launched Golf R. Golf R is an all-wheel drive performance car that delivers a power of 333PS and comes with R-Performance Torque Vectoring.

The rear wheel drive (RWD) segment is expected to grow with the highest CAGR during the forecast period. The rising demand for rear-wheel-drive cars for drifting capabilities has increased the demand for torque vectoring systems. Also, the growing application of torque vectoring systems in RWD vehicles to improve handling and stability has propelled market growth to some extent. Moreover, the increasing use of passive torque vectoring systems in RWD cars to maintain traction on slippery surfaces and bad weather conditions is beneficial.

- In July 2024, Porsche launched Macan Electric. Macan is rear-wheel drive electric car that comes with Porsche Torque Vectoring Plus (PTV Plus) to deliver a range of 398 miles on a single charge.

Vehicle Type Insights

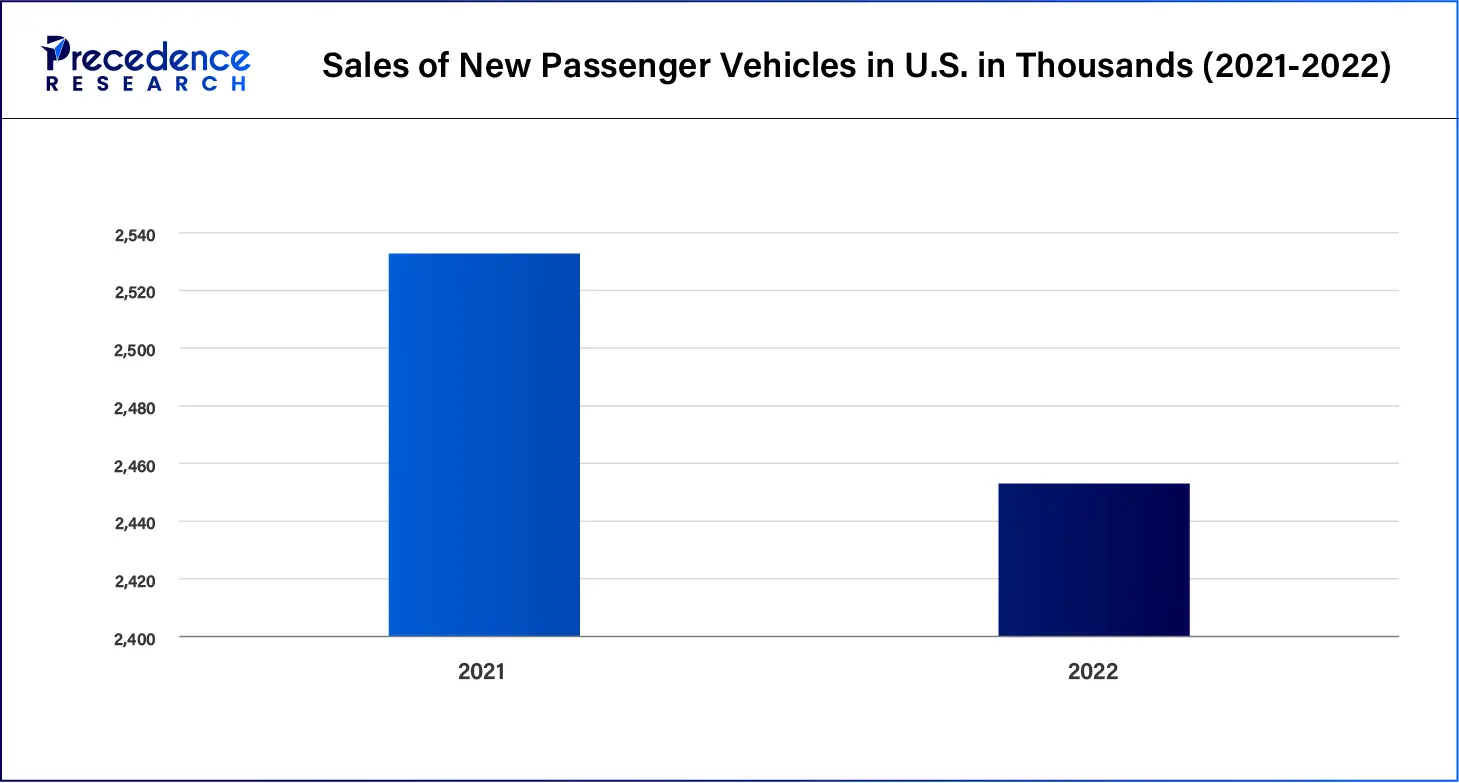

The passenger car segment dominated the torque vectoring market in 2024. The rising production and sales of passenger cars around the world has increased the demand for torque vectoring systems. Also, the increasing applications of active torque vectoring systems in small electric cars to improve the overall stability is likely to boost the market growth. Moreover, the growing use of torque vectoring systems in passenger cars to improve mileage has further benefited the market.

- In May 2022, Land Rover launched Range Rover Sport. Range Rover Sport is a hybrid car that comes with torque vectoring system to enhance driving experience.

The light commercial vehicles segment is expected to grow with the highest CAGR during the forecast period. The growing demand for LCVs to transport goods in shorter distances has increased the demand for torque vectoring systems. Also, the rising application of torque vectoring system in LCVs to enhance driving experience during bad weather conditions drives the market growth. Moreover, the increasing use of torque vectoring systems in LCVs for several applications such as lane changing, stability and traction control is likely to contribute to the torque vectoring market growth.

- In August 2022, Ree Automotive launched P7-B. P7-B is an electric truck that comes with torque vectoring, AWD, adaptive regenerative breaking and some other features to enhance the performance of the vehicle.

Regional Insights

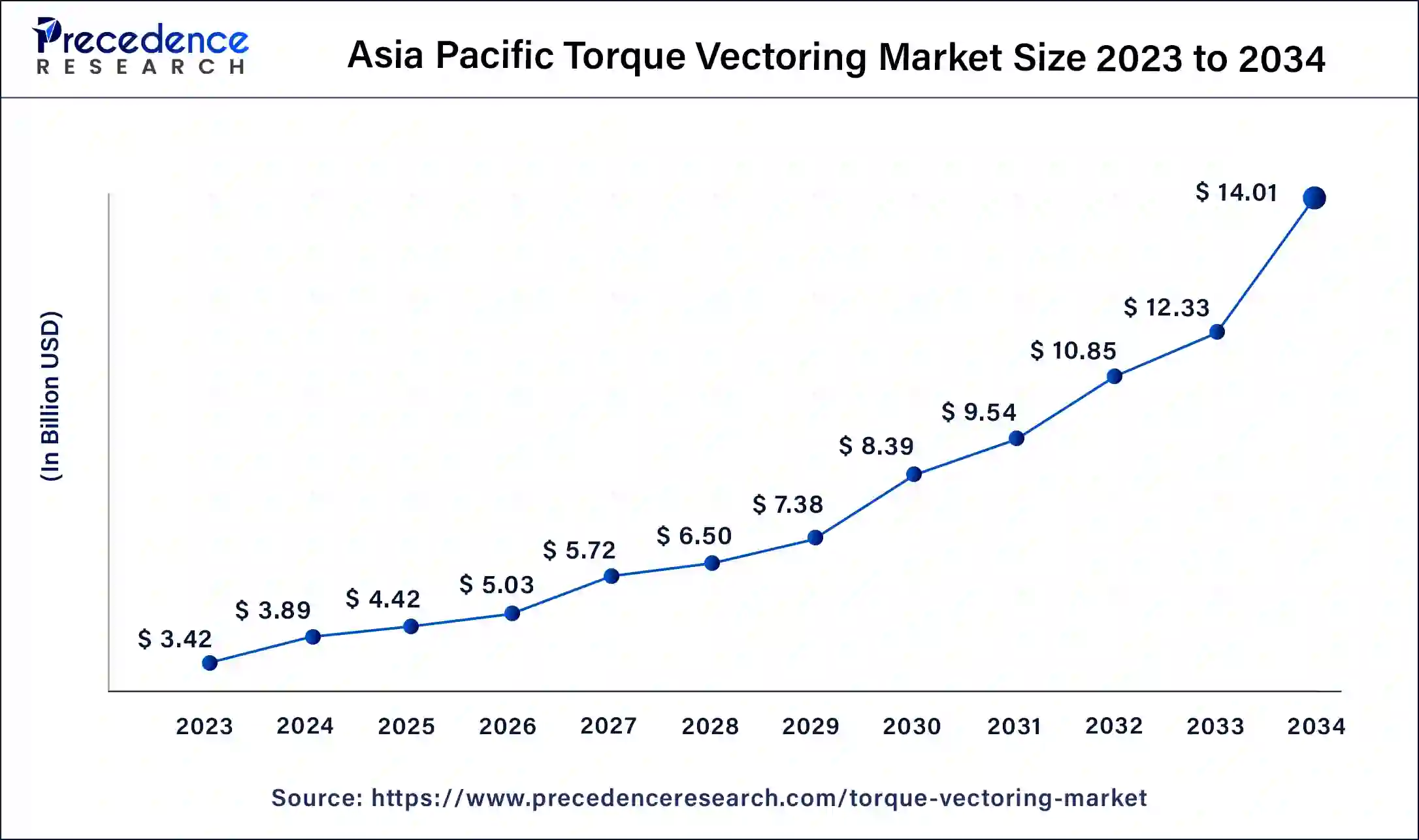

Asia Pacific Torque Vectoring Market Size and Growth 2025 to 2034

The Asia Pacific torque vectoring market size is exhibited at USD 4.42 billion in 2025 and is projected to be worth around USD 14.22 billion by 2034, poised to grow at a CAGR of 13.84% from 2025 to 2034.

Asia Pacific held the largest share of the torque vectoring market in 2024. This region consists of a highly developed automotive industry with numerous companies such as Toyota, Nissan, Hyundai, Mitsubishi, Mazda, Tata, Mahindra, Honda, Subaru, and some others that increase the demand for torque vectoring systems. The rising demand for sports cars in countries such as India, Japan, China, South Korea, Thailand, and some others has increased the applications of passive torque vectoring systems. Also, the growing trend of electric vehicles (EVs) to combat environmental problems and increasing fuel prices has boosted the torque vectoring market growth.

Asia Pacific consists of various market players in torque vectoring, such as Jtekt Corporation, Mitsubishi Motors Corporation, Aisin Seiki Co., and some others that are constantly engaged in developing high-quality torque vectoring systems for different vehicles. Also, these companies are adopting several strategies, such as partnerships, acquisitions, collaborations, launches, and business expansions.

- In October 2022, JTEKT announced the launch of the ITCC (Intelligent Torque Controlled Coupling) system. This system will be used in a crossover SUV named "MAZDA CX-60" to increase fuel efficiency.

- In July 2023, Hyundai unveiled the 2024 i30 N-Line in South Korea. This car comes with 1.6-litre hybrid powertrain, torque vectoring technology and some others.

- In July 2024, Xiaomi unveiled the prototype of the SU7 ultra in China. SU7 Ultra is an all-electric sports car with torque vectoring and AWD capabilities.

Asia Pacific: China Torque Vectoring Market Trends

China's market is experiencing rapid growth, driven by increasing adoption of advanced vehicle stability technologies and the rising demand for electric vehicles (EVs). While traditional internal combustion engine vehicles still dominate, EVs, particularly electric all-wheel-drive systems, are the fastest-growing segment, pushing the need for precise torque distribution. Active torque vectoring systems are gaining preference over passive systems due to their superior performance and handling capabilities. Hardware components lead the market, supported by the expansion of sophisticated drivetrain architectures in modern vehicles.

North America is expected to grow with the highest CAGR during the forecast period. The developments in the EV industry due to increasing people's awareness along with government initiatives to adopt electric vehicles have increased the demand for torque vectoring systems. Also, the rising technological advancements in the automotive sector have propelled industrial growth. Also, the rising interest of people in long drives in hilly areas and terrains has increased the demand for AWD cars, which in turn increased the application of torque vectoring systems in this region.

Moreover, the presence of various automotive giants such as Ford, Tesla, Rivian, GM, and some others has increased the applications of torque vectoring systems. This region comprises several local torque vectoring companies, such as American Axle, BorgWarner, Timken, Dana, and others, that constantly manufacture torque vectoring systems for different vehicles in North America. This, in turn, is expected to propel the growth of the torque vectoring market.

- In January 2023, Tesla launched the restyled Model 3 in North America. Model 3 is an electric vehicle that comes with AWD and torque vectoring systems to enhance driving experience and range.

- In July 2024, the U.S. government announced that it would invest US$ 1.7 billion. This investment is done to allow the moto workers to support EV manufacturing across the country.

- In July 2024, Ford launched Ford Edge in the U.S. Ford Edge is a powerful SUV that is equipped with several features such as torque vectoring and traction control.

- In May 2024, BorgWarner launched the electric Torque Vectoring and Disconnect (eTVD) system. This system will be used in battery electric vehicles (BEVs) to increase stability, enhance traction, and provide superior dynamic performance.

North America: U.S. Torque Vectoring Market Trends

The U.S. market is projected to grow rapidly, driven by increasing integration of advanced vehicle stability technologies. Hardware components dominate the market, as OEMs incorporate electronic control units, sensors, and actuators to support torque-vectoring systems. Active torque-vectoring systems are the fastest-growing segment due to their superior performance and handling advantages. The rise of electric vehicles is a key enabler, as precise motor control in EVs enhances efficiency and driving dynamics.

What made Europe grow Rapidly in the Torque Vectoring Market?

Growth in Europe was forecasted to be strong due to stringent emissions laws, high market penetration of EV technology, and a growing consumer appetite for safer and better-performing vehicles. The auto industry in the region had many of its leaders focusing on lightweight drivetrains, as well as a more efficient system of torque. Premium brands in Germany, the UK, and Italy took the lead in innovation. Europe offered several opportunities for suppliers to develop next-generation electric axles, expand partnerships with luxurious OEMs, and take advantage of government incentives intended to support cleaner mobility and advanced vehicle control systems.

Germany Torque Vectoring Market Trends

Germany represented the leading country within the region for its strong luxury car industry and focus on advanced automotive engineering. Some major brands have placed significant investments into torque vectoring to help improve performance, stability, and efficiency in electric vehicles. Several research centers and testing facilities were situated there, providing rapid development support. Germany offered suppliers opportunities to partner with higher-end manufacturers, which included piloting new technologies and supplying premium drivetrains for electric sports cars and other high-performance SUVs employing precise torque control.

Why has Latin America grown significantly in the torque vectoring market?

Latin America grew significantly in the torque vectoring market due to a rise in SUV demand, road safety policies, and the adoption of modern drivetrain systems. Brazil and Mexico were growing their vehicle production facilities and were importing more advanced technologies. There appeared to be opportunities for suppliers to introduce cost-effective torque vectoring systems, support the local assembly plants, and address the growing interest in stable, fuel-efficient vehicles. The growth was also supported by the increased investments from global automakers that were entering the region.

Brazil Torque Vectoring Market Trends

Brazil is leading this trend due to the size of the automotive industry and the increase in SUV sales. Automakers are starting to deploy torque vectoring systems for better handling and compliance with safety regulations. There is a significant level of interest in advanced stability technology for the market. Brazil represents opportunities for suppliers that are working with local plants, providing affordable torque vectoring units, and supporting the market's desire for hybrid vehicles.

Why were the Middle East and Africa projected to grow at a rapid rate in the torque vectoring market?

The Middle East and Africa were projected to see rapid growth due to the increase in demand for SUV sales, improved road infrastructure, and growing interest in modern vehicle safety systems. Countries with strong luxury car markets enhanced vehicle adoption, but growth was also winner based on EV plans in the Gulf region. The region presented opportunities for suppliers to provide heat torque vectoring units, collaborate with premium car importers, and bolster introductory EV programs launching in the UAE, Saudi Arabia, and South Africa.

The UAE Torque Vectoring Market Trends

The UAE led the region due to the strong demand for luxury cars and high-performance vehicles. As drivers wanted to drive vehicles with superior stability and handling, interest in torque vectoring increased. Governments' plans for additional EV chargers encouraged the increase in more. The UAE represented an opportunity for suppliers to partner with premium dealers for performance SUVs, introduce advanced torque systems, and support upcoming electric vehicle projects that enhance sustainability and modernize the transportation system.

Torque Vectoring Market Companies

- Eaton Corporation

- Univance Corporation

- BorgWarner

- ZF Friedrichshafen AG

- Dana Incorporated

- Continental AG

- Jtekt Corporation

- Bosch Ltd

- GKN Automotive Limited

- American Axle & Manufacturing, Inc.

Recent Developments

- In May 2024, Lamborghini launched a new electric torque vectoring system. This system is used in Lamborghini Urus SE to switch from a pure mechanical torque-based four-wheel drive system to an electric torque vectoring system.

- In May 2024, JAECOO launched Torque Vectoring Four-Wheel Drive technology. This system provides superior maneuverability, strong extrication, enhanced comfort, and full adaptability.

Segments Covered in the Report

By Clutch Actuation Type

- Hydraulic Clutch

- Electronic Clutch

By Vehicle Type

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Passenger Car

By Propulsion

- Front Wheel Drive (FWD)

- Rear Wheel Drive (RWD)

- All Wheel Drive/Four Wheel Drive (AWD/4WD)

By Technology

- Active Torque Vectoring System (ATVS)

- Passive Torque Vectoring System (PTVS)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting