March 2024

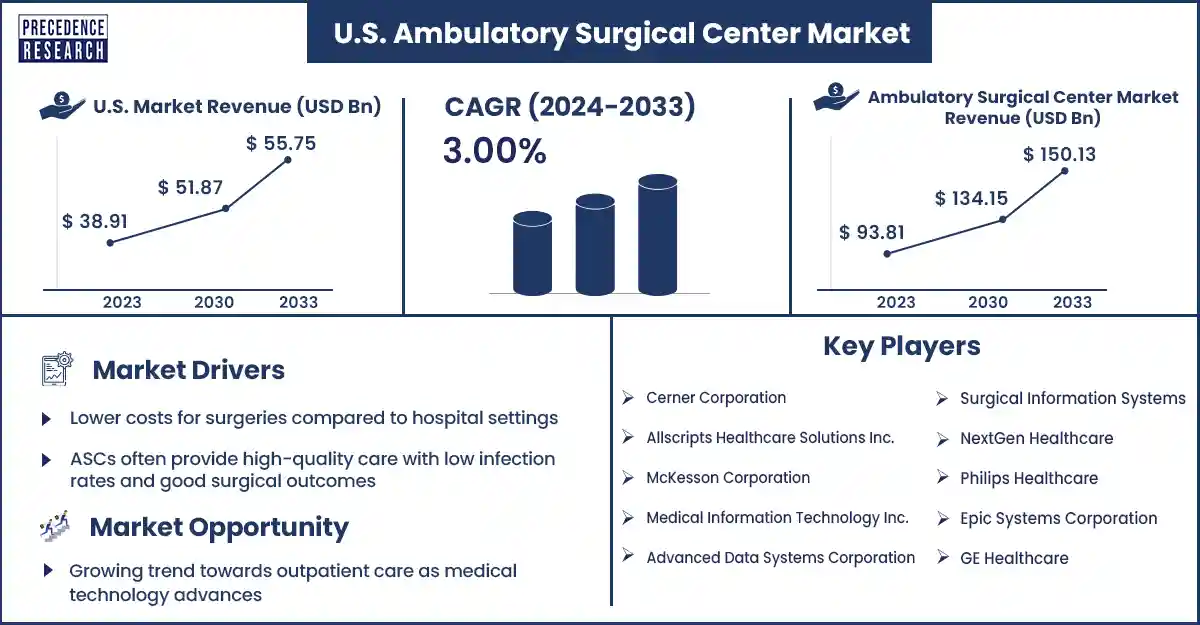

The global U.S. ambulatory surgical center market surpassed USD 38.91 billion in 2023 and is predicted to cross around USD 55.75 billion by 2033, growing at a CAGR of 3% during the forecast period. As for technological advancements in medicine, many surgical treatments are now safer and less intrusive, making them appropriate for outpatient settings like ASCs. ASCs are now the site of many private health insurance policies that cover a variety of surgical procedures. Bundled payments, which link payment to the total cost of a patient's episode of care, are one initiative that encourages physicians to use more economical locations, such as ASCs.

The industry consisting of healthcare facilities that offer same-day surgical care, including diagnostic and preventive procedures, to patients who do not require hospital admission is known as the ambulatory surgical center (ASC) market in the United States. ASCs are autonomous, freestanding medical institutions that provide a variety of operations and treatments. Most of these procedures are performed under local or regional anesthesia, enabling patients to go home the same day.

The growing ASC industry can be attributed to technological medical developments that make it possible to safely undertake increasingly complex treatments outside hospital settings. The need for additional surgical procedures as the population ages is another factor driving this development. The growth of ASCs has caused a change in the way that surgical treatment is provided in the United States, with an increasing focus on outpatient surgery.

Changes in Medicare reimbursement have increasingly favored ASCs is driving the U.S. ambulatory surgical center market

Medicare has added more treatments to its list of approved procedures that ASCs can bill for in recent years. This includes more intricate procedures that are often saved for hospital inpatient settings. Due to this increase, ASCs can provide Medicare patients with a greater range of services, boosting their patient base and market share. The modifications in Medicare reimbursement have also increased investment in ASCs.

Due to the realization that ASCs are profitable under the current reimbursement structure by private equity firms and healthcare organizations, new centers are being developed and old ones are being expanded. The U.S ambulatory surgical center market has grown even more due to this capital inflow.

Recent Innovation in the U.S. Ambulatory Surgical Center Market by McKesson Corporation

| Company Name | McKesson Corporation |

| Headquarters | Irving, Texas, United States |

| Development | In June 2022, McKesson Corporation and HCA Healthcare, Inc agreed upon a joint venture combining McKesson's US Oncology Research (USOR) and HCA Healthcare's Sarah Cannon Research Institute (SCRI). |

Recent Innovation in the U.S. Ambulatory Surgical Center Market by ValueHealth LLC

| Company Name | ValueHealth LLC |

| Headquarters | Overland Park, Kansas |

| Development | In January 2022, Penn State Health and ValueHealth LLC established a joint venture in which Penn State Health purchased a portion of the Surgery Center of Lancaster. This collaboration highlights the expanding significance of Ambulatory Centers of Excellence (ACE) and promotes improved healthcare delivery models, a significant development in the ambulatory healthcare environment. |

In addition to raising the rates at which certain services are reimbursed, the Centers for Medicare & Medicaid Services (CMS) have broadened the range of procedures that can be carried out in ASCs. This regulatory backing has encouraged the move of more surgical procedures from hospitals to ASCs. Advances in anesthetic protocols and post-operative pain control have expedited patient recuperation, increasing the viability of same-day discharge from ASCs. Patients are choosing outpatient operations more frequently because of ASCs' convenience, decreased risk of infection, and quicker recovery periods. More treatments are being carried out in these clinics due to patient demand.

Advances in medical technology

Minimally invasive surgeries (MIS) are now more common and successful due to the development of advanced devices like robotic-assisted surgical systems, high-definition cameras, and precision instruments. Because MIS operations may frequently be completed as an outpatient procedure and usually involve reduced recovery time, ASCs are well-positioned to use these technologies. Telemedicine and remote monitoring help ASCs cut expenses without sacrificing care quality by eliminating the need for follow-up visits and in-person discussions.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 41.13 Billion |

| Market Revenue by 2033 | USD 55.75 Billion |

| CAGR | 3% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Ownership

By Surgery Type

By Specialty Type

By Service

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/4921

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

March 2024

March 2024

July 2024

February 2024