October 2023

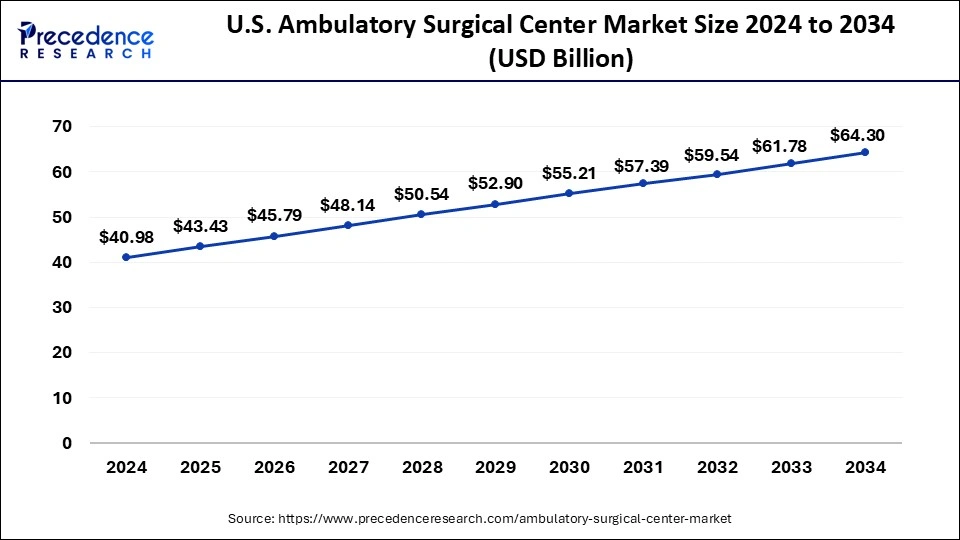

The U.S. ambulatory surgical center market size was USD 38.91 billion in 2023, calculated at USD 41.13 billion in 2024 and is expected to be worth around USD 55.75 billion by 2033. The market is slated to expand at 3% CAGR from 2024 to 2033.

The U.S. ambulatory surgical center market size is projected to be reach around USD 55.75 billion by 2033 from USD 41.13 billion in 2024, at a CAGR of 3% from 2024 to 2033. The U.S. ambulatory surgical center market is driven by the surgery moving from hospitals to these facilities.

Modern healthcare facilities specializing in same-day surgical care, including diagnostic and preventive procedures, are known as ambulatory surgery centers, or ASCs. Surgical operations can be performed more affordably in ASCs than in traditional hospital settings. Their reduced administrative expenses, streamlined operations, and concentrated approach are the reasons behind their cost efficiency. This frequently results in cheaper out-of-pocket costs for patients and less financial strain on the healthcare system. ASCs relieve hospitals of a considerable workload by performing a large percentage of outpatient surgery. This increases the efficiency of the healthcare system by allowing hospitals to concentrate on more difficult and urgent situations.

How AI is Used for Ambulatory Care?

With the integration of artificial intelligence, the ambulatory clinics are observed to offer evolved services for patients. The similar integration is seen to support under-resourced organizations that are focused on improving patient outcomes. The ambulatory surgical care centers, especially in advanced and well-established healthcare areas are seen adopting the advantages of artificial intelligence while integrating chatbots for patient engagement and services.

Additionally, generative AI in ambulatory care centers can customize large language models or data to support existing workflows. For instance, in July 2023, Google Cloud and Care Cloud started working together with the integration of generative AI to leverage the application of machine learning in order to help small and medium-sized healthcare providers.

| Report Coverage | Details |

| U.S. Market Size by 2033 | USD 55.75 Billion |

| U.S. Market Size in 2023 | USD 38.91 Billion |

| U.S. Market Size in 2024 | USD 41.13 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 3% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Ownership, Surgery Type, Specialty Type, Service |

Strict medicare certification requirements, which have been developed to guarantee patient safety and high-quality care, must be fulfilled by ASCs. For ASCs to get Medicare reimbursement, which makes up a sizable amount of their revenue, they must have this accreditation. To make ASCs financially viable for a broader range of surgical specialties, Medicare has progressively increased the list of procedures that qualify for reimbursement. ASCs now provide a wider range of specializations, including pain treatment, ophthalmology, gastroenterology, orthopedics, and standard outpatient operations. These days, many ASCs are multispecialty facilities that house a variety of treatments under one roof, improving patient convenience and healthcare provider efficiency.

Lower costs for surgeries compared to hospital settings

ASCs' streamlined operations and lower overhead costs allow them to perform surgery at a lesser price than in traditional hospital settings. Unlike hospitals, which have numerous departments and services to oversee, ASCs are just concerned with doing outpatient surgery. Because of their specialty, they can work more productively, use their resources best, and bargain for affordable medical equipment and supplies.

Due to developments in medical technology, anesthetic methods, and post-operative care protocols, many surgical procedures formerly performed in hospitals can now be successfully carried out in ASCs. Because of this change, ASCs can now provide a broad range of operations in several specialties, such as pain management, ophthalmology, gastroenterology, and orthopedics. This drives for the growth of the U.S. ambulatory surgical center market.

Convenience and patient comfort are top priorities in the design of ASCs. Patients appreciate shorter wait times, convenience in scheduling operations, and the opportunity to recuperate in familiar settings post-surgery. ASCs' outpatient format lowers the risk of hospital-acquired illnesses and enables patients to go home earlier, improving patient satisfaction in the long run.

Rigorous federal and state regulations

ASCs are required to reduce risks related to medical errors, infection control, patient care, and liability issues. Adherence to regulatory requirements is crucial for reducing legal risks and upholding patient confidence. Strict adherence to clinical guidelines, personnel training, and risk management strategies are necessary.

Guidelines for surgical techniques, infection prevention, personnel ratios, emergency readiness, and equipment upkeep are all included. Spending on personnel training, infrastructure changes, and frequent audits is frequently necessary to comply with these standards. This limits the growth of the U.S. ambulatory surgical center market.

Growing trend towards outpatient care as medical technology advances

Due to comfort and convenience, patients are increasingly favoring outpatient surgical settings. ASCs frequently offer a more individualized experience, including fewer wait times, committed nursing care, and more efficient admissions and discharge procedures. This patient-centered approach to healthcare increases customers' pleasure and loyalty. Ambulatory surgical center frequently focus on specific surgeries or medical specialties, including pain management, ophthalmology, gastroenterology, and orthopedic surgery.

By focusing on treatments, ASCs can acquire specialized knowledge and invest in facilities and equipment, improving patient outcomes and operational effectiveness.

The physician only segment dominated the market in 2023, accounting for 59.6% of the market share. The segment growth is primarily attributed to the increasing number of surgeries performed in physician outpatient departments due to the rising concern about their impact on outcomes. Physician-owned ASCs offer personalized and quality care, thereby enhancing overall patient outcomes.

Physician-owned ASCs frequently offer comparable or superior care at a lesser cost, making them a competitive substitute for hospital outpatient departments. Payers and patients are drawn to this competitive advantage. These centers can attract top-tier surgical talent by providing physicians with ownership opportunities, thereby boosting the segment.

The hospital only segment is expected to expand at the fastest growth rate during the forecast period. Hospital-owned ASCs leverage the parent hospital’s investment, resources, and infrastructure. These ASCs provide seamless healthcare within the hospital network, improving patient experience. Improvements in minimally invasive surgical methods have increased the number of operations performed in hospital OPDs, thus boosting the segment.

The ophthalmology segment generated the highest market share of 23.6% in 2023. The segment growth is attributed to the rising demand for specialized eye care services among the population. Ophthalmology ASCs provide specialized eye care for various eye conditions. The easy availability and accessibility to advanced ophthalmic surgical technology in these ASCs enhance patient outcomes. Moreover, the increasing prevalence of eye conditions among the geriatric population and the rising number of ophthalmic surgeries are likely to contribute to the segment’s growth in the coming years. For instance.

The orthopedic segment is expected to expand at the highest CAGR throughout the forecast period. The advent of minimally invasive surgical procedures has greatly changed the field of orthopedics. Compared to traditional open operations, these methods, such as arthroscopy and robotic-assisted surgeries, allow for smaller incisions, less pain, faster recovery periods, and a decreased chance of complications. Medical advancements in surgical equipment and orthopedic implants have improved orthopedic surgery results and precision. Moreover, the rising number of orthopedic procedures performed in ASCs drives the segment. For instance,

The single specialty segment held a 59.4% share of the market in 2023. Single specialty ASCs focus on a particular medical specialty, such as pain treatment, orthopedics, gastroenterology, or ophthalmology. They provide specialized care and expertise, improving outcomes and increasing patient satisfaction. Due to targeted operations and effective scheduling, patients usually wait less for their procedures. Investors are drawn to single-specialty ASCs because of their steady income streams and lower operational risk than multi-specialty centers. The rising demand for specialized care further contributed to segmental growth.

The multi-specialty segment is anticipated to grow rapidly during the forecast period. Unlike single specialty ASCs, multi-specialty ASCs offer various services under a single roof, facilitating same-day surgical care. These ASCs are better equipped to provide high-quality care across various specializations because they frequently adopt new technologies. Examples of these technologies include robotic surgery, sophisticated imaging, and electronic health records (EHRs). These advancements facilitate the expansion of multi-specialty ASCs, shortening recovery periods, enhancing patient satisfaction, and improving surgical results.

The treatment segment accounted for 72.8% of the market share in 2023, owing to the increasing demand for specialized treatment services. However, ASCs provide personalized treatment plans to individual patients. The easy availability of advanced medical technology in these facilities and favorable reimbursement policies from private insurers further encourage individuals to choose ASCs for their treatment, thereby contributing to the segment’s growth.

Segments Covered in the Report

By Ownership

By Surgery Type

By Specialty Type

By Service

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2023

March 2025

November 2024

February 2025