What is the Privileged Access Management Market Size?

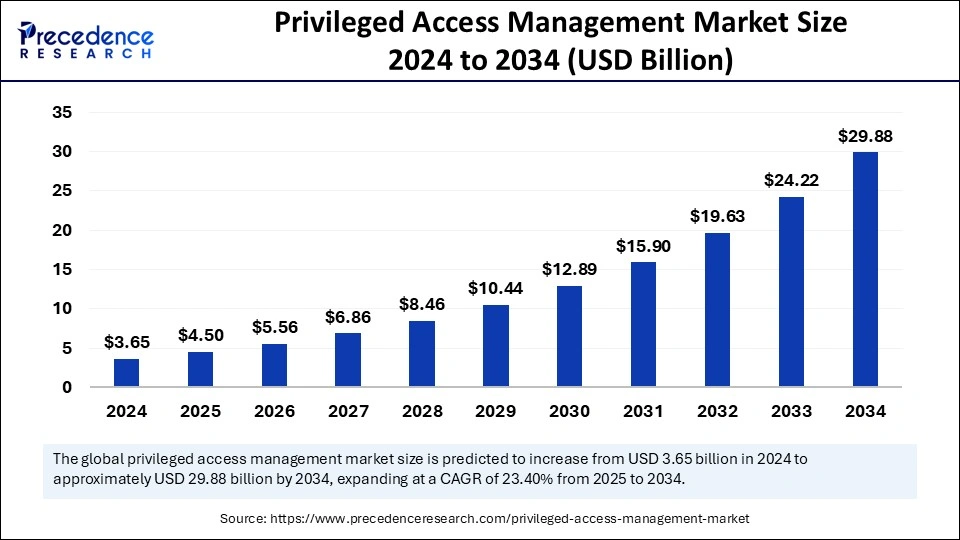

The global privileged access management market size is accounted at USD 4.50 billion in 2025 and is predicted to increase from USD 4.56 billion in 2026 to approximately USD 29.88 billion by 2034, expanding at a CAGR of 23.40% from 2025 to 2034. Rising cybersecurity threats, such as insider attacks and data breaches, are the key factors driving the growth of the market. Also, strict regulatory requirements and compliance policies, coupled with the growing focus on access management (IAM), can fuel market growth further.

Privileged Access Management Market Key Takeaways

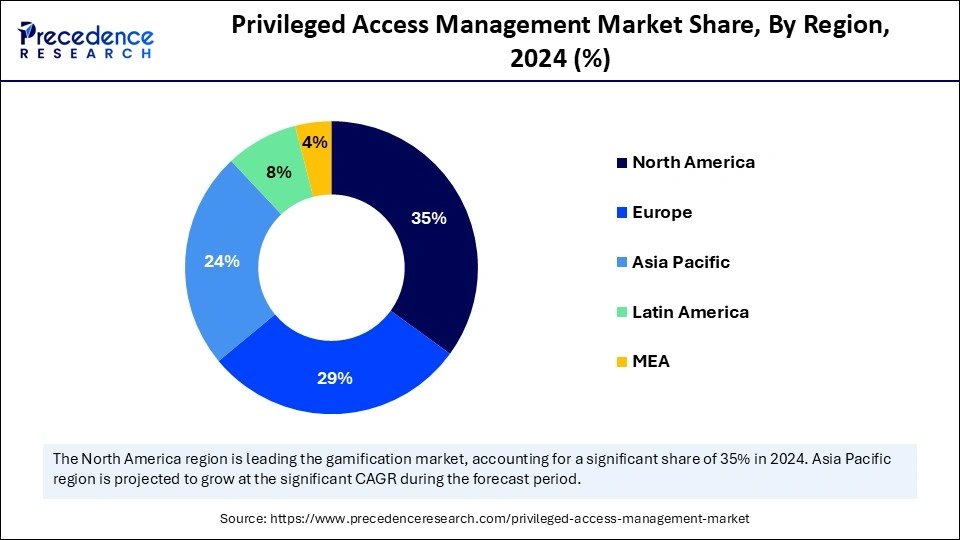

- North America dominated the market with the largest share of 35% in 2024.

- Asia Pacific is expected to grow at the fastest rate over the forecast period.

- By deployment model, the on-premises segment held the biggest market share in 2024.

- By deployment model, the cloud segment is expected to grow at the fastest rate over the forecast period.

- By enterprise size, the large enterprise segment accounted for the largest market share in 2024.

- By enterprise size, the SME segment is anticipated to grow at the fastest rate over the forecast period.

- By industry vertical, the BFSI segment contributed the highest market share share of 29% in 2024.

- By industry vertical, the IT and Telecom segment is expected to grow at the fastest rate over the projected period.

Strategic Overview of the Global Privileged Access Management Industry

The privileged access management market is a cybersecurity discipline that secures and governs privileged accounts, such as admin accounts, and their activities, including working with sensitive data. The market mainly encompasses cybersecurity solutions and initiatives that emphasize securing and managing access to crucial data and systems by monitoring and controlling access to privileged accounts and activities to ensure only authorized persons can access specific resources.

Artificial Intelligence: The Next Growth Catalyst in Privileged Access Management

Artificial intelligence (AI) plays an important role in the privileged access management market by improving security, enhancing user experience, and streamlining operations through adaptive authentication, automated threat detection, and intelligent access control. Furthermore, AI can analyze the user environment and context to determine the proper level of authentication needed, ensuring that access is available to those who need it and why. AI can also detect anomalies, including unexpected privilege escalations or unusual login locations, which can potentially indicate a threat.

- In August 2024, Veza, the identity security company, announced the launch of Access AI™, a generative AI-powered solution to maintain the principle of least privilege at the enterprise scale. With Access AI, security and identity teams can now use an AI-powered chat-like interface to understand who can take what action on data, prioritize risky or unnecessary access, and remove risky access quickly for both human and machine identities.

Market Outlook

- Market Growth Overview: The privileged access management market is expected to grow significantly between 2025 and 2034, driven by the escalating cybersecurity threats, digital transformation and cloud adoption, and remote work and third-party access.

- Sustainability Trends:Sustainability trends involve ethical governance and risk management, responsible data handling and privacy, and operational efficiency and resource conservation.

- Major Investors: Major investors in the market include IBM Corporation, CyberArk Software LTD., BeyondTrust Corporation, and Broadcom Inc.

- Startup Economy:The startup economy is focused on cloud-native solutions, AI and Automation, identity-centric security, and machine identities.

Privileged Access Management Market Growth Factors

- Increasing demand to tackle high-profile data breaches is expected to boost privileged access management market growth soon.

- The growing adoption of Software As A Service-based solutions by many organizations can propel market expansion shortly.

- The rising emphasis on the zero-trust security model requires PAM solutions, which will likely contribute to market growth over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 29.88 Billion |

| Market Size by 2026 | USD 4.56 Billion |

| Market Size by 2025 | USD 4.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 23.40% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Model, Enterprise , Industry Vertical, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing adoption of cloud services

Organizations are increasingly shifting their applications and infrastructure to the cloud, which directly leads to the growing demand for privileged access management (PAM) tools. These tools are crucial for securing privileged access across multi-cloud and hybrid environments. In addition, they ensure detailed monitoring and control, protecting confidential data and critical systems in the landscape of cloud computing.

- In November 2024, Xage Security, a vendor of zero-trust access and protection solutions, announced the launch of its Extended Privileged Access Management (XPAM) solution, setting a new benchmark for cybersecurity by replacing legacy PAM with an innovative, holistic approach. Driven by customer demand, Xage XPAM is the latest product addition to Xage Security's Xage Fabric Platform.

Restraint

Diversity and complexity of privileged accounts

Privileged accounts encompass an extensive range of types, such as service accounts, administrator accounts, cloud accounts, application accounts, and more. Moreover, each type has distinct access levels, permissions, and lifecycle requirements. Hence, managing this diversity can be challenging, particularly in landscapes with heterogeneous systems and platforms.

Opportunity

Raised adoption of the BYOD concept

In the privileged access management market, cloud-oriented strategies have become crucial for companies as they allow employees to work remotely utilizing different digital tools. With the rising shift towards bring your own device (BYOD) policies, a substantial number of employees are accessing the company's resources and data. Furthermore, this trend has become widely acceptable due to the pandemic, which has impelled many companies to adopt work-from-home models.

- In March 2025, Eviden, the Atos Group business leading in digital, cloud, big data, and security, announced the launch of Evidian Orbion, its next-generation Identity-as-a-Service (IDaaS) solution. Evidian Orbion integrates Identity Governance and Administration (IGA), Access Management (AM), and Privileged Access Management (PAM) into a single-as-a-service solution designed for hybrid environments.

Segment Insights

Deployment Model Insights

The on-premises segment dominated the privileged access management market in 2024. The dominance of the segment can be attributed to the increasing demand for solutions that offer granular visibility, ensure compliance, and enforce least-privilege policies. Additionally, there is a raised emphasis on integrating cloud services with on-premises solutions. This approach necessitates smooth access management across different landscapes.

The cloud segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing cloud adoption and the requirement for strong security in decentralized environments. Also, many companies are increasingly prioritizing cloud services and digital agility, where PAM plays a crucial role in ensuring confidentiality, data integrity, and compliance.

- In March 2024, Unified identity security company One Identity LLC announced the general availability of One Identity Cloud PAM Essentials, a software-as-a-service solution for simplified privileged access management, with a specific focus on cloud applications and infrastructure. PAM Essentials has been designed to empower security teams with robust controls.

Enterprise Insights

The large enterprise segment held the largest privileged access management market share in 2024. The dominance of the segment can be linked to the high regulatory compliance requirement, complex IT environments, and the raised risk of cyberattacks, which requires robust PAM solutions for securing access controls and sensitive data. In addition, large enterprises face strict regulatory requirements and require robust auditing and access control, which PAM solutions facilitate.

The SME segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by growing cybersecurity threats, the rise of cloud adoption, and growing regulatory compliance pressures, boosting the demand for secure access control and management. Moreover, PAM solutions are becoming more accessible and affordable for SMEs, with SaaS and the cloud-based offering, which makes them an effective way to improve security.

Industry Vertical Insights

In 2024, the BFSI segment led the privileged access management market by holding the largest share. The dominance of the segment is owing to the growing emphasis on securing confidential financial data to ensure compliance with stringent regulations. Furthermore, the surge in cloud-based services and digital banking has prompted BFSI organizations to adopt more flexible and scalable solutions, impacting positive market expansion soon.

The IT and Telecom segment is expected to grow at the fastest rate over the projected period. The growth of the segment is due to the surge in remote work and cloud adoption along with growing cybersecurity threats. The sophistication and frequency of cyberattacks, including insider threats and data breaches, are increasing, which makes companies increasingly aware of the requirement for robust access control measures.

Regional Insights

U.S. Privileged Access Management Market Size and Growth 2025 to 2034

The U.S. privileged access management market size is exhibited at USD 1.18 billion in 2025 and is projected to be worth around USD 8.01 billion by 2034, growing at a CAGR of 23.61% from 2025 to 2034.

North America dominated the privileged access management market in 2024. The dominance of the region can be attributed to the increasing number of data breaches and cyber threats in the region. The robust adoption of PAM solutions by the major market players in the region showcases its proactive approach to cybersecurity, tackling emerging threats and protecting sensitive data effectively. Moreover, the growing shift to remote work and cloud environments is boosting the demand for scalable solutions that can offer real-time threat mitigation.

- In April 2023, BeyondTrust partnered with Jamf to amplify the privileged access management (PAM) solutions market by providing tailored solutions to boost productivity and corporate security simultaneously. This partnership enriches the portfolio of PAM offerings, benefiting customers seeking enhanced security measures.

U.S. Privileged Access Management Trends

In North America, the U.S. led the market owing to the robust push for strong cybersecurity measures fueled by a surge in cyberattacks and regulatory requirements. Also, market players in the region are emphasizing combining advanced security measures to safeguard sensitive customer data that comply with legal requirements.

Asia Pacific is expected to grow at the fastest rate in the privileged access management market over the forecast period. The growth of the region can be credited to the ongoing digital transformation, coupled with the growing adoption of cloud services in developing countries such as China and India. Furthermore, rising cybersecurity awareness and regulatory policies are allowing companies to invest extensively in efficient access management solutions.

China Privileged Access Management Market Trends

In Asia Pacific, China dominated the privileged access management market by holding the largest market share. The dominance of the country is due to the surge in cybersecurity threats, the expansion of cloud computing, and the need for appropriate regulatory compliance. The advancement in intelligence-based PAM solutions, which use AI and Machine Learning, is anticipated to create lucrative opportunities in the country soon.

Privileged Access Management Market Value Chain Analysis

Solution Development & Platform Design

This foundational stage involves the research, design, and continuous improvement of PAM software and platforms.

- Key Players: CyberArk Software Ltd., BeyondTrust Corporation, and Palo Alto Networks.

Manufacturing & Hardware (if applicable)

For the most part, PAM is a software-centric market. However, some solutions might involve physical components, such as specialized security appliances or hardware security modules (HSMs) used for cryptographic key management or identity verification.

- Key Players: Thales Group, IBM, and Hewlett-Packard Enterprise (HPE)

Distribution & Sales

This stage involves marketing, selling, and distributing PAM solutions to a global clientele across various sectors, including finance, healthcare, government, and technology.

- Key Players: CyberArk, BeyondTrust, Optiv Security, GuidePoint Security, Microsoft Azure, AWS, and Google Cloud.

Top Companies in the Privileged Access Management Market & Their Offerings

- BeyondTrust: BeyondTrust offers a unified PAM platform that provides organizations with a holistic approach to managing and monitoring privileged access across their environments.

- CA Technologies (now part of Broadcom):CA Technologies, now part of Broadcom, provides identity and access management solutions that include PAM capabilities for securing privileged accounts.

- CyberArk:As a market leader, CyberArk provides a comprehensive, risk-based PAM solution that secures access for humans and machines across hybrid and cloud environments.

- Fortinet:Fortinet is a global leader in cybersecurity solutions and contributes to the PAM market through its FortiPAM product, which provides secure privileged access management within its broader security fabric ecosystem.

- HashiCorp (now acquired by IBM): HashiCorp provides infrastructure automation software, including the open-source Vault, which is widely used for managing secrets and protecting sensitive data, thereby offering key functionalities relevant to the PAM market.

- Hitachi ID Systems (now part of Ping Identity):Hitachi ID Systems, now integrated into Ping Identity's portfolio, provides a complete suite of identity and access management solutions, including PAM, identity management, and password management.

- IBM Corporation:IBM contributes to the PAM market through its security consulting services, managed security offerings, and by integrating PAM capabilities into its broader security portfolio, including the QRadar suite.

- Imprivata:Imprivata is a healthcare IT security company that provides identity and access management solutions designed to enhance workflow and security within clinical environments.

- Okta: Okta is a leader in identity for the enterprise and contributes to the PAM market through its Okta Privileged Access solution, which focuses on providing secure, identity-driven access to servers, databases, and other critical infrastructure. They aim to secure access while improving user experience and productivity.

- Optiv Security: Optiv Security is a major cybersecurity solutions integrator and provider of managed security services.

Latest Announcements by Market Leaders

- In August 2024, IBM and Intel announced a collaboration to deploy Intel Gaudi 3 AI accelerators as a service on IBM Cloud. This offering, which is expected to be available in early 2025, aims to help more cost-effectively scale enterprise AI and drive innovation underpinned by security and resiliency. This collaboration will also enable support for Gaudi 3 within IBM's Watson AI and data platform.

- In May 2024, Hitachi, Ltd. and Google Cloud announced a multi-year partnership to accelerate enterprise innovation and productivity with generative AI. Hitachi will form a new business unit focused on helping businesses solve industry challenges with Gemini models, Vertex AI, and other cloud technologies, and it will also adopt Google Cloud's AI to enhance its own products and services.

Recent Developments

- In November 2024, CyberArk and Wiz announced a strategic partnership to enhance cloud security for organizations operating in multi-cloud environments. This collaboration aims to provide improved visibility and control over both human and machine identities, addressing the complexities and risks of managing privileged access in large-scale cloud infrastructures.

- In April 2023, BeyondTrust's collaboration with Moro Hub in the U.A.E strengthens the privileged access management (PAM) solutions market by offering customizable PAM solutions. This partnership aims to cater to enterprises' security needs, enhancing PAM offerings for businesses operating in the U.A.E.

- In April 2023, Saviynt announced that it teamed with world technology and consulting giants like IBM to introduce New Saviynt, thus bringing to market Solution Exchange. It is a Hospitality Store of Ready-to-Improve Solutions that Help Organizations Scale Cloud Identity Security Eventually.

Segments Covered in the Report

By Deployment Model

- On-Premises

- Cloud

By Enterprise Size

- Large enterprises

- SME

By Industry Vertical

- BFSI

- IT and telecom

- Government and public sector

- Healthcare

- Manufacturing

- Energy and Utilities

- Retail and e-commerce

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content