November 2024

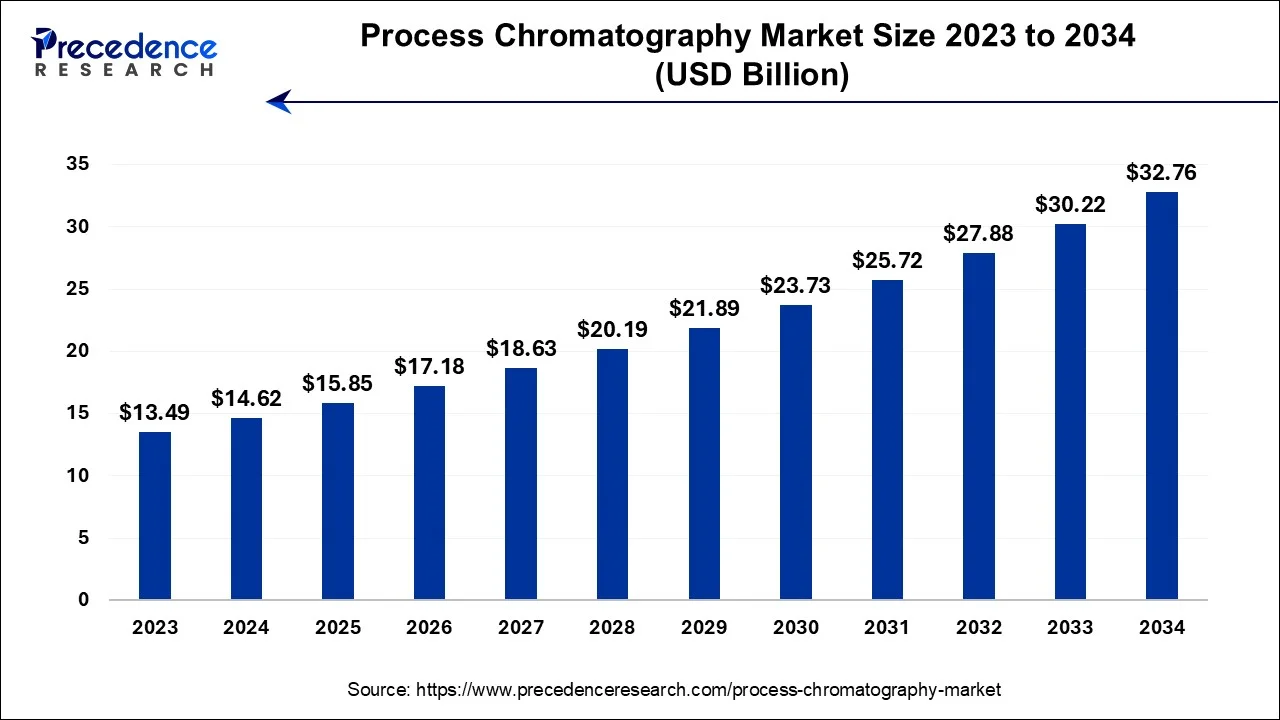

The global process chromatography market size accounted for USD 14.62 billion in 2024, grew to USD 15.85 billion in 2025 and is projected to surpass around USD 32.76 billion by 2034, representing a healthy CAGR of 8.40% between 2024 and 2034. The North America process chromatography market size is calculated at USD 5.26billion in 2024 and is expected to grow at a fastest CAGR of 8.41% during the forecast year.

The global process chromatography market size is estimated at USD 14.62 billion in 2024 and is anticipated to reach around USD 32.76 billion by 2034, growing at a CAGR of 8.40% between 2024 and 2034.

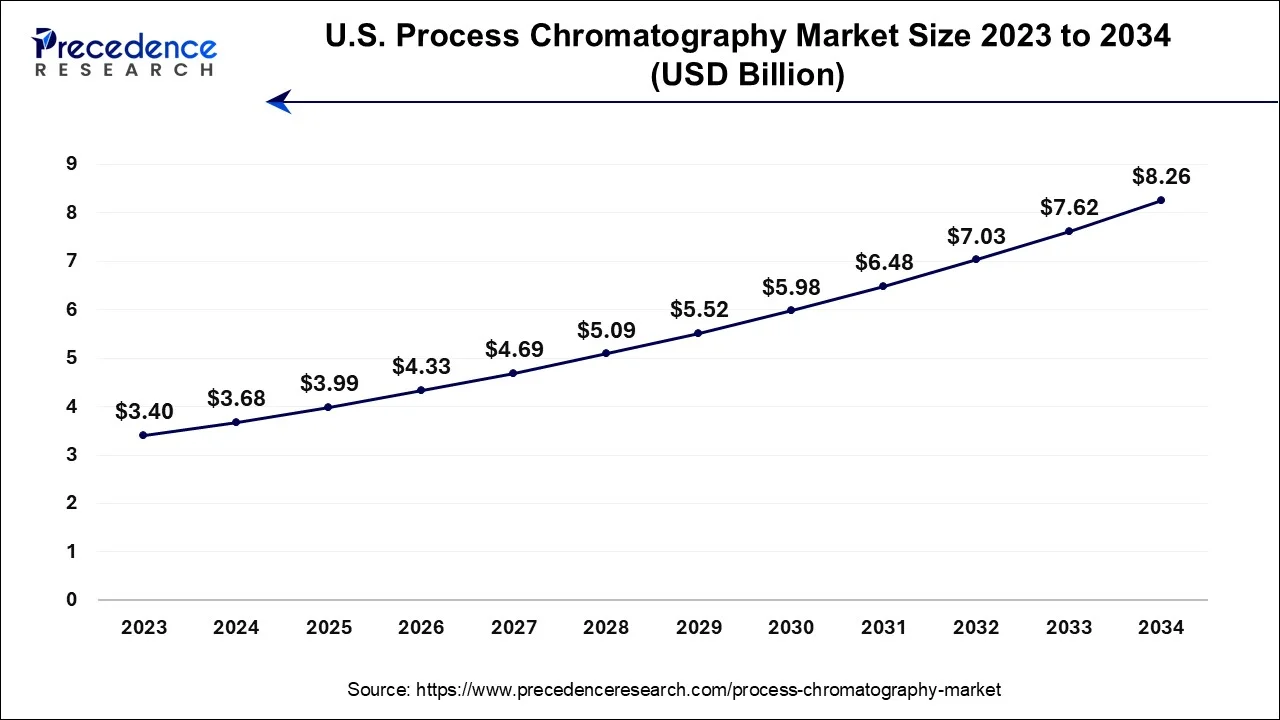

The U.S. process chromatography market size is estimated at USD 3.68 billion in 2024 and is expected to be worth around USD 8.26 billion by 2034, at a CAGR of 8.42% from 2024 to 2034.

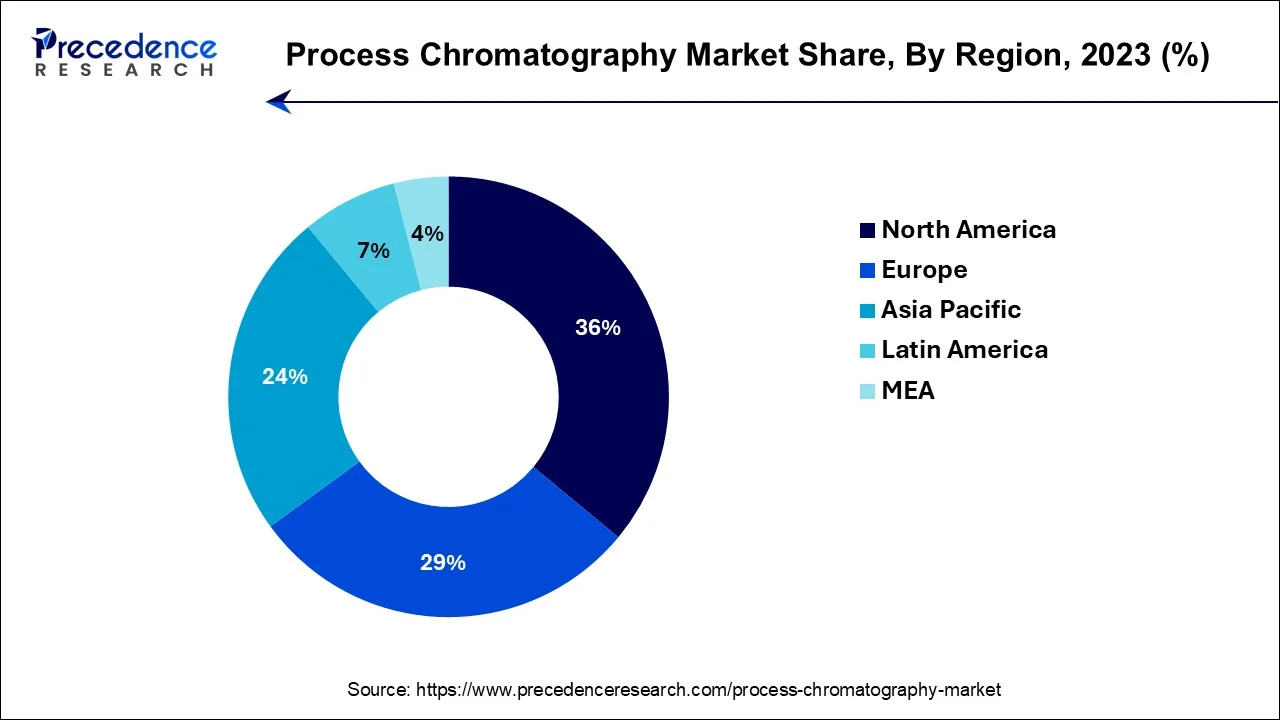

North America has held the largest revenue share 36% in 2023. In North America, the process chromatography market continues to flourish due to the strong presence of pharmaceutical and biotech industries. Growing investments in drug development, particularly in biopharmaceuticals, drive the demand for advanced chromatography technologies. There's a noticeable shift towards single-use systems for cost-efficiency and flexibility. Additionally, the emphasis on personalized medicine and stringent regulatory standards sustains market growth, with the increasing adoption of innovative chromatography solutions.

Asia-Pacific is estimated to observe the fastest expansion in the Asia-Pacific region, the process chromatography market is experiencing robust expansion. The rising pharmaceutical manufacturing activities, especially in countries like China and India, are propelling demand. Emerging markets prioritize cost-effective, scalable chromatography solutions, making it a hotspot for market growth. The region also witnesses increased research and development initiatives, technological advancements, and a growing awareness of the benefits of chromatography in bioprocessing, further stimulating market trends.

Several notable trends mark Europe's process chromatography market. There's a growing emphasis on sustainability and environmental considerations in chromatography processes. European countries are increasingly adopting green chromatography techniques, reducing solvent usage and waste generation, and aligning with stringent environmental regulations. Moreover, there's a rising demand for biopharmaceuticals in Europe, fueling the need for advanced chromatography solutions.

The region is witnessing increased investments in biomanufacturing facilities, driving the adoption of high-efficiency chromatography systems. Moreover, Europe is a hub for pharmaceutical innovation, which further stimulates the development and adoption of cutting-edge chromatography technologies for drug purification and bioprocessing.

Process chromatography is a separation technique used in industries like pharmaceuticals and biotechnology to purify and separate complex mixtures of molecules. It involves passing a mixture through a column filled with a stationary phase, where different components interact differently with the stationary phase and mobile phase (usually a liquid). This results in the components moving at different rates through the column, leading to their separation.

Process chromatography is crucial for isolating and purifying proteins, drugs, and other biomolecules on a large scale, ensuring product purity and quality in various applications, including drug manufacturing, food processing, and environmental analysis.

Process chromatography is an essential technique used in various industries, such as pharmaceuticals and biotechnology, for purifying and separating complex mixtures of molecules. It employs a column filled with a stationary phase and a mobile phase to separate components based on their interaction with these phases. The global process chromatography market has been steadily growing due to several key drivers and industry trends. One significant growth driver is the increasing demand for biopharmaceuticals, which rely heavily on chromatography for purification.

Additionally, advancements in chromatography technology, such as high-throughput and automated systems, are boosting market expansion. The industry is also seeing a surge in the adoption of single-use chromatography systems, reducing costs and enhancing flexibility.

However, the industry faces challenges like the high cost of equipment and the need for skilled operators. Strict regulatory compliance and the need for continuous innovation are other hurdles. Nevertheless, these challenges also present business opportunities, as companies offering cost-effective solutions and innovative technologies can thrive in this market. Expansion into emerging markets and catering to the growing demand for personalized medicine are avenues for growth.

The process chromatography market is driven by the rising demand for biopharmaceuticals and technological advancements, but it faces challenges related to cost and regulation. Companies can capitalize on opportunities by offering cost-effective solutions and expanding into emerging markets.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 8.4% |

| Market Size in 2024 | USD 14.62 Billion |

| Market Size by 2034 | USD 32.76 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Type, and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Biopharmaceutical growth and drug development

Biopharmaceutical growth and drug development play pivotal roles in surging the demand for the process chromatography market. Biopharmaceuticals, which include complex molecules like monoclonal antibodies and gene therapies, have witnessed a remarkable surge in demand due to their efficacy in treating various diseases.

However, these biologics require meticulous purification processes to meet stringent quality standards. Process chromatography serves as a critical tool in this regard, enabling the separation and purification of these intricate biomolecules. As the biopharmaceutical industry continues to expand, the demand for process chromatography equipment and consumables rises proportionally.

Concurrently, the relentless pursuit of innovative drugs fuels the demand for process chromatography. Pharmaceutical companies are constantly developing novel compounds, often involving complex chemical structures. These compounds must undergo rigorous purification to ensure their safety and efficacy. Process chromatography offers the precision required to separate and purify these compounds effectively. Consequently, as drug development pipelines remain robust, the process chromatography market experiences sustained growth, serving as an indispensable component of the pharmaceutical and biotechnology sectors in the quest for safer and more effective medications.

Concerns about the possibility of errors in complex battle situations

Regulatory compliance and column lifespan constraints significantly impact the demand for the process chromatography market. Firstly, stringent regulatory requirements in pharmaceuticals and biotechnology necessitate rigorous adherence to quality and safety standards. This leads to increased scrutiny of chromatography processes, requiring companies to invest in high-quality equipment and validate their processes thoroughly. Consequently, the cost of compliance can be substantial, deterring smaller players and increasing the barrier to entry.

Moreover, column lifespan is a critical factor limiting market growth. Columns in process chromatography have a finite lifespan, often determined by factors like the sample load, column material, and operating conditions. Replacing columns frequently can incur substantial operational costs and downtime, making it a significant concern for end-users. Innovations in column materials and technologies that extend lifespan are thus crucial for reducing operational expenses and enhancing market demand. In summary, the process chromatography market faces challenges related to regulatory compliance costs and the need to extend column lifespan to maintain cost-efficiency and competitiveness in the industry.

Single-use systems and process intensification

Single-use systems (SUS) and process intensification are two pivotal factors propelling the demand for process chromatography in the market. SUS have emerged as a game-changer in the biopharmaceutical and biotechnology sectors. They offer a more cost-effective and flexible alternative to traditional stainless-steel systems. SUS reduces the need for cleaning and validation, minimizing the risk of cross-contamination and saving significant time and resources. This enhances the efficiency of chromatography processes, particularly in the production of biopharmaceuticals, where product purity is paramount.

The reduced upfront capital expenditure and the ability to quickly adapt to changing production needs make SUS an attractive choice for manufacturers, thus driving the demand for process chromatography.

Process intensification is another crucial driver, as it focuses on maximizing productivity and efficiency while minimizing resource consumption. Chromatography systems designed for process intensification can achieve higher throughput and productivity within the same footprint, reducing operational costs and increasing overall process efficiency.

This aligns with the industry's goal of achieving more sustainable and economical manufacturing processes, further boosting the adoption of process chromatography techniques. In essence, SUS and Process Intensification strategies are revolutionizing the way chromatography is applied in biopharmaceutical production, and their combined impact is significantly surging market demand for process chromatography.

Impact of COVID-19

The COVID-19 pandemic had a mixed impact on the process chromatography market. Initially, disruptions in supply chains and reduced lab activities led to a slowdown. However, as the pandemic underscored the importance of biopharmaceutical research and vaccine development, the market rebounded. The urgent need for diagnostics, therapies, and vaccines drove investment in chromatography equipment and consumables.

Additionally, the pandemic prompted innovations like remote monitoring and automation, boosting the market's resilience. While challenges persisted, the overall response to COVID-19 accelerated advancements in chromatography technology and emphasized its critical role in pharmaceutical and biotech research and production.

According to the product, the Process chromatography segment has held 58% revenue share in 2023. Process chromatography refers to the separation technique used to purify complex mixtures of molecules in large-scale industrial processes. It involves a column filled with a stationary phase where molecules interact differently with a mobile phase, enabling their separation.

In the process chromatography market, the trend is shifting towards automation, high-throughput systems, and single-use technologies. Companies are investing in user-friendly, efficient solutions to meet the increasing demand for biopharmaceuticals and personalized medicine, thus improving product purity, scalability, and cost-effectiveness in industrial applications.

The Preparative Chromatography segment is anticipated to expand at a significant CAGR of 12.8% during the projected period. Preparative chromatography is a subset of chromatography primarily focused on isolating and purifying specific compounds or substances for laboratory research, analysis, or small-scale production. In the preparative chromatography market, there is a growing emphasis on improved resolution, higher sample throughput, and environmentally friendly practices. Advancements in column design, selectivity, and automation are key trends, catering to research and development needs across various industries like pharmaceuticals, food, and chemicals.

Based on the type, liquid chromatography is anticipated to hold the largest market share of 29% in 2023. Liquid chromatography is a versatile separation technique in process chromatography that uses a liquid mobile phase to separate compounds based on their interactions with a stationary phase. An observable trend in the LC sector is the growing preference for high-performance liquid chromatography (HPLC) and ultra-high-performance liquid chromatography (UHPLC).

This shift is driven by the desire for improved resolution and faster separation processes, enhancing the capabilities and efficiency of LC systems. Furthermore, the incorporation of advanced detectors and automation in LC systems is enhancing efficiency and data quality, meeting the growing demands of the process chromatography market.

On the other hand, the hydrophobic interaction chromatography segment is projected to grow at the fastest rate over the projected period. A specialized form of chromatography used to separate biomolecules based on their hydrophobicity, a key trend in HIC is the development of novel ligands and resins that offer improved selectivity and capacity, enabling more efficient purification of hydrophobic molecules. As the demand for biopharmaceuticals and protein-based therapies continues to rise, HIC remains a crucial technique, driving innovation and growth in the process chromatography market.

In 2023, the pharmaceutical sector had the highest market share of 46.8% on the basis of the End Use. In the pharmaceutical sector, process chromatography is essential for purifying drugs and biopharmaceuticals. It aids in ensuring product safety and efficacy, complying with stringent regulatory standards. A notable trend in this end-use is the increasing demand for monoclonal antibodies and personalized medicine, driving the need for more efficient and scalable chromatography solutions. Furthermore, there's a growing focus on single-use chromatography systems to reduce contamination risks and improve flexibility in drug manufacturing.

The food segment is anticipated to expand at the fastest rate over the projected period. In the food industry, process chromatography plays a role in quality control and the purification of food ingredients. A notable trend is the rising demand for natural and functional food ingredients, which require advanced chromatography techniques to separate and purify complex compounds. Additionally, the industry is witnessing increased scrutiny on food safety and traceability, leading to greater adoption of chromatography for detecting contaminants and ensuring compliance with food safety regulations.

Segments Covered in the Report

By Product

By Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

November 2024

July 2024

February 2025