Produced Water Treatment Market Size and Forecast 2025 to 2034

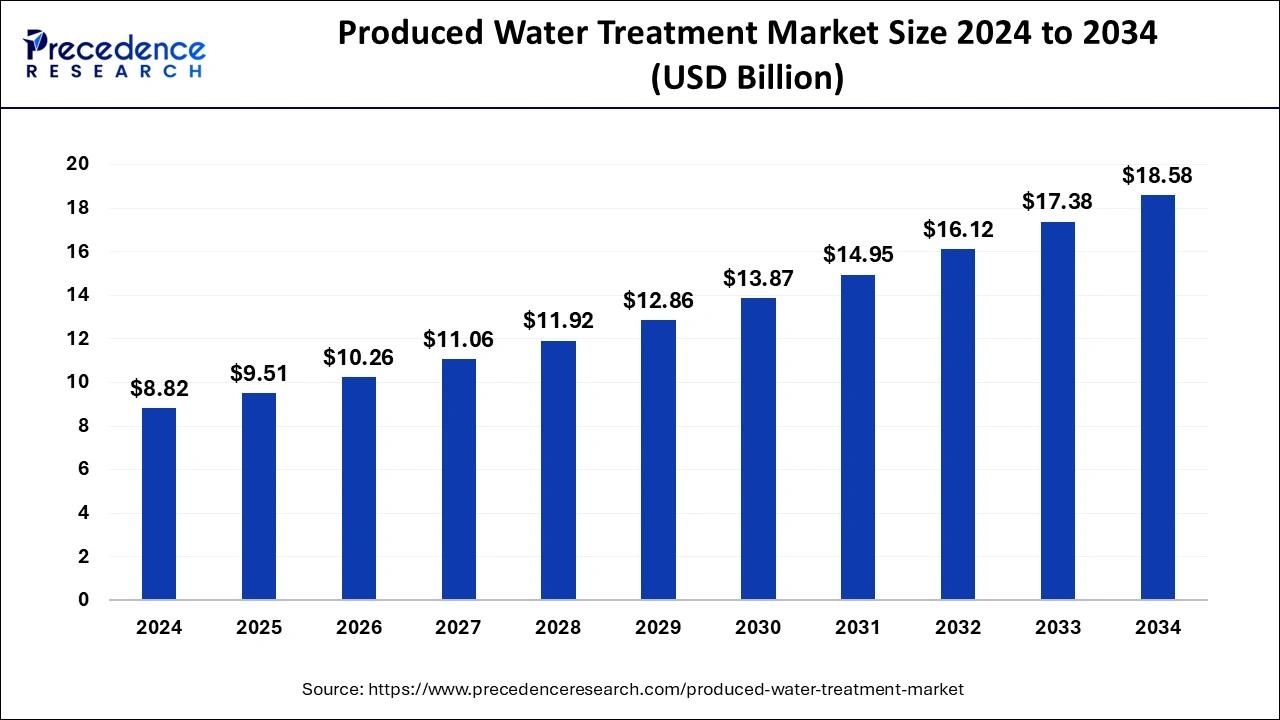

The global produced water treatment market size was estimated at USD 8.82 billion in 2024 and is predicted to increase from USD 9.51 billion in 2025 to approximately USD 18.58 billion by 2034, expanding at a CAGR of 7.73% from 2025 to 2034. The amount of produced water is increasing in tandem with the ongoing need for gas and oil. This makes effective treatment methods necessary in order to handle and reuse this water.

Produced Water Treatment Market Key Takeaways

- In terms of revenue, the global produced water treatment market was valued at USD 8.82 billion in 2024.

- It is projected to reach USD 18.58 billion by 2034.

- The market is expected to grow at a CAGR of 7.73% from 2025 to 2034.

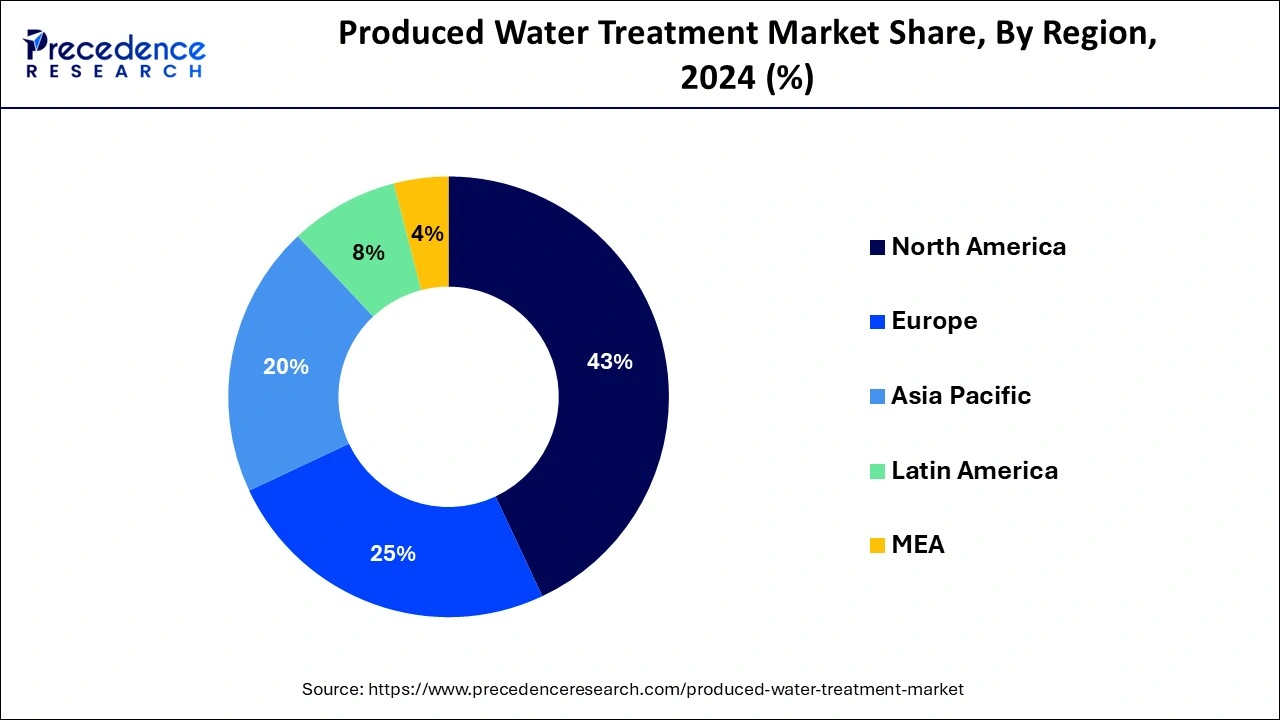

- North America dominated the market with the largest revenue share of 43% in 2024.

- Europe is expected to host the fastest-growing market during the forecast period.

- By application, the on-shore segment has held a major revenue share of 72% in 2024.

- By application, the off-shore segment is expected to witness the fastest growth in the market.

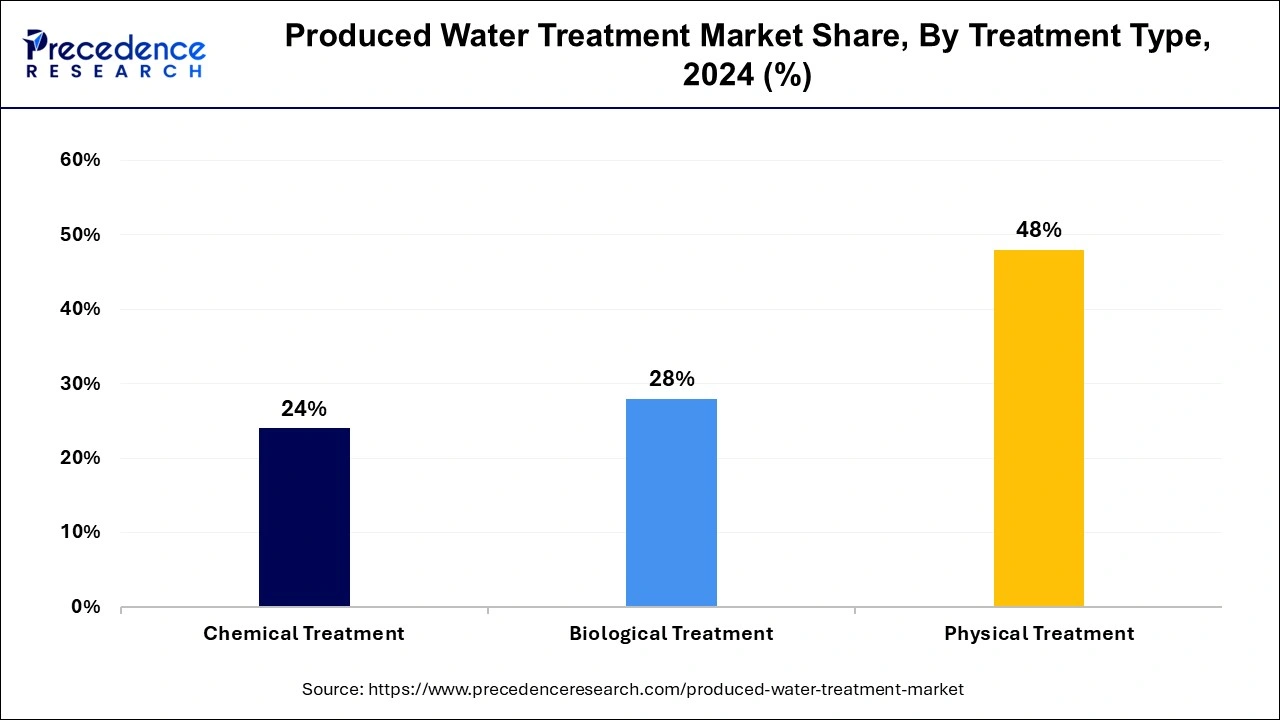

- By treatment, the physical treatment segment has contributed more than 48% of revenue share in 2024.

- By treatment, the chemical treatment segment is expected to expand rapidly in the market during the forecast period.

U.S. Produced Water Treatment Market Size and Growth 2025 to 2034

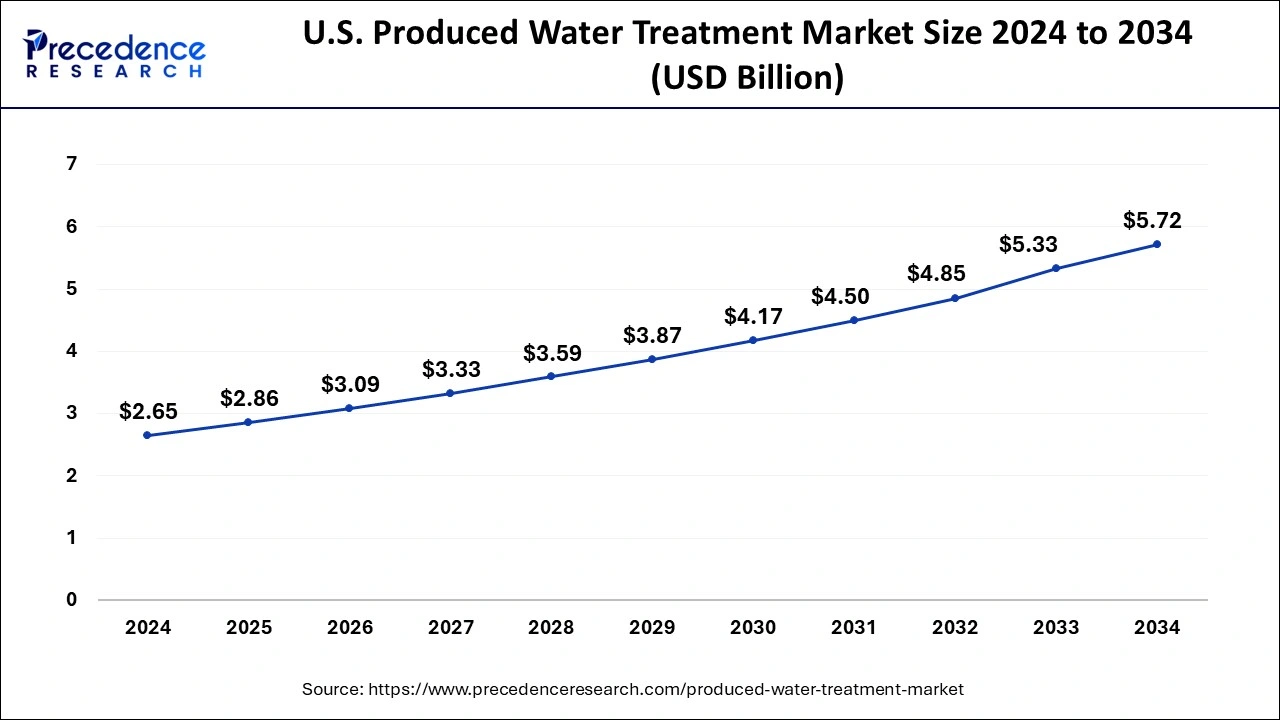

The U.S. produced water treatment market size surpassed USD 2.46 billion in 2024 and is projected to attain around USD 5.33 billion by 2034, poised to grow at a CAGR of 8.03% from 2025 to 2034.

North America held the largest share of the produced water treatment market in 2024. The rising oil and gas industry, especially in the United States and Canada, is driving a major increase in the produced water treatment market in North America. The main driver of this market's growth is the significant amounts of produced water that are left over after the extraction of oil and gas.

One of the main motivating factors is the requirement for effective treatment methods to satisfy strict environmental standards and handle water scarcity issues. Large volumes of generated water are created when hydraulic fracturing (fracking) is expanded in shale formations, requiring the use of sophisticated treatment technology to manage the growing volumes of wastewater.

Europe is expected to host the fastest-growing market during the forecast period. The necessity for sustainable water management techniques and strict environmental restrictions are driving a considerable increase in the produced water treatment industry in Europe. According to estimates, the market size in Europe will keep growing due to a number of factors, including improvements in treatment methods and rising R&D spending.

Among the major European markets are Germany and the UK. The UK is the market with the quickest rate of growth, fueled by significant offshore exploration operations and technological advancements in water treatment, while Germany maintains the greatest market share because of its robust industrial base and strict environmental regulations.

Market Overview

A by product of the extraction of oil and gas is produced water. It comprises a range of organic and inorganic particulate and dissolved contaminants that must be treated before disposal or reuse. Produced water treatment is essential for both regulatory compliance and environmental preservation.

Due to growing oil and gas development operations, strict environmental restrictions, and the growing need for water reuse in water-scarce locations, the produced water treatment market has been growing significantly. Stricter environmental laws governing produced water treatment and disposal. Reusing and recycling water is becoming more and more necessary due to concerns about water scarcity.

The produced water treatment market is expected to increase rapidly because of factors like rising environmental awareness, regulatory pressure, and technological advancements. Businesses in this field are concentrating on innovation and environmentally friendly methods to meet the difficulties and seize the chances given by this crucial facet of the oil and gas business.

A greater focus should be placed on minimizing the impact that produced water treatment operations have on the environment. Navigating various areas' complex and strict environmental standards. Advanced treatment technologies demand substantial investment. A sophisticated procedure that recovers 100% of the water while leaving the pollutants as a solid residue.

Produced Water Treatment Market Growth Factors

- The increasing demand for energy worldwide is driving up the volume of produced water that needs to be managed and treated as a result of increased activity in the oil and gas production sector.

- Globally, governments and environmental agencies are enforcing stricter rules on the release of produced water, which is forcing businesses to use cutting-edge treatment technologies.

- The effectiveness and economics of generated water treatment systems are increasing thanks to technological advancements in water treatment, such as membrane filtration, biological treatment, and sophisticated oxidation processes.

- The need for water recycling and reuse is being driven by growing concerns about water scarcity. Reusing treated-generated water for a variety of uses, such as industrial processes and agricultural irrigation, encourages the use of sustainable water management techniques.

- Oil and gas industries find treated-generated water to be a desirable alternative since it can save money by minimizing the demand for fresh water and disposal expenses.

- By improving monitoring, control, and optimization through the use of digital technologies like IoT and AI in produced water treatment processes, more dependable and efficient systems are being created.

- Partnerships between water treatment technology suppliers, environmental organizations, and oil and gas firms are stimulating innovation and growing the produced water treatment market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.82 Billion |

| Market Size in 2034 | USD 18.58 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.73% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Treatment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Corporate social responsibility

In the produced water treatment market, corporate social responsibility, or CSR, refers to the moral and environmentally friendly business practices used by businesses. This market deals with treating water that is produced as a waste product when gas and oil are extracted. CSR initiatives are essential to ensuring that businesses reduce their ecological footprint while promoting community welfare and regulatory compliance because of their potential impact on the environment.

Businesses in the produced water treatment market make investments in cutting-edge technologies that lessen the impact of water treatment on the environment. This covers techniques that reduce the amount of energy and chemicals used. Releasing regular CSR reports that include information on community involvement initiatives, environmental performance, and advancements made toward sustainability targets.

Restraint

Waste disposal

Diverse technologies and services are available in the produced water treatment market for waste disposal, with the goal of handling and treating the wastewater created during the extraction of oil and gas. As a consequence of extracting oil and gas, produced water is contaminated with heavy metals, dissolved sediments, and oil. To help remove impurities more easily, chemical treatments like oxidation, flocculation, coagulation, and precipitation are applied.

Reverse osmosis and ultrafiltration are two methods used to rid the water of impurities and dissolved solids. Many factors, such as strict environmental restrictions, the volume of produced water generated globally, and the growing emphasis on water reuse and recycling in the oil and gas industry, are driving the demand for the produced water treatment market.

Opportunity

Shale gas exploration

Because of the massive amounts of water created during the extraction process, shale gas development has had a substantial impact on the produced water treatment market. The water that emerges from the earth during drilling, along with gas and oil, is known as produced water. Hydraulic fracturing, or "fracking," is a technique used in shale gas extraction in which chemicals, water, and pressure are injected into the shale formations to release trapped gas. As opposed to obtaining fresh water for fracking, recycling and reusing treated generated water can help shale gas businesses cut their operational expenses. It also lessens the logistical difficulties involved in disposing of and transporting water.

Application Insights

The on-shore segment holds the largest share of the produced water treatment market. The produced water treatment market's "on-shore application" category deals with the water produced by on-land oil and gas production activities. A mixture of oil, dissolved gasses, suspended solids, and other chemicals used in the extraction process is commonly found in produced water, which is a byproduct of oil and gas extraction operations.

In order to comply with regulations and protect the environment, treated-generated water is necessary. The treatment methods and technologies used at on-land production sites, like oilfields, well pads, and refineries, are included in the on-shore application section. In order to reduce freshwater consumption and disposal costs, several on-shore facilities use technology to purify produced water for reuse in industrial processes.

The off-shore segment is expected to witness the fastest growth in the produced water treatment market. The produced water treatment market's offshore application segment deals with treating water that is produced in conjunction with oil and gas from offshore drilling operations. When extracting oil and gas from an offshore drilling well, water is usually brought to the surface as well. This water sometimes referred to as "produced water," frequently has different impurities like oil, grease, suspended particles, dissolved metals, and other dangerous materials. The produced water treatment market's offshore segment often uses customized machinery and technologies designed to meet the particular difficulties faced by offshore operations, including space constraints, hostile marine environments, and strict legal restrictions.

Treatment Insights

The physical treatment segment held the largest share of the produced water treatment market in 2024. The techniques and equipment used to physically extract impurities from generated water are referred to as physical treatment in the produced water treatment sector. As a byproduct of the extraction of oil and gas, produced water usually contains a variety of contaminants, including grease, oil, suspended particles, and dissolved metals.

Without changing the water's chemical makeup, physical treatment techniques concentrate on removing these impurities from the water using procedures including filtration, gravity separation, flotation, and others. Air bubbles connect to pollutants during flotation operations, causing the pollutants to rise to the surface and be removed. Two popular flotation techniques used in produced water treatment are dissolved air flotation (DAF) and induced gas flotation (IGF).

The chemical treatment segment is expected to expand rapidly in the produced water treatment market during the forecast period. In order to remove contaminants from generated water and allow it to be properly discharged or reused, the chemical treatment segment of the produced water treatment market is an essential part of the industry.

As a byproduct of extracting oil and gas, produced water frequently contains a variety of impurities, including grease, oil, dissolved metals, suspended particles, and organic compounds. Chemical treatment techniques generally employ a range of chemicals to aid in the isolation, elimination, and/or neutralization of impurities from generated water. Coagulants, flocculants, demulsifiers, biocides, corrosion inhibitors, scale inhibitors, and pH adjusters are a few examples of these substances.

Produced Water Treatment Market Companies

- Godrej Consumer Products Ltd.

- S. C. Johnson & Son

- Dabur India Ltd.

- Reckitt Benckiser.

- Spectrum Brands Holdings Inc.

Recent Developments

- In December 2023, In order to advance as a comprehensive water solution firm in the international market, Samyang Corporation, the pioneer in the development of ion exchange resin in Korea and a leader in the field of industrial water treatment materials, has introduced two new products and formed a specialized organization.

- In February 2023, through its Xylem Innovation Labs commercial accelerator program, multinational water technology corporation Xylem is fostering the growth of up-and-coming startups and expediting the creation of game-changing technologies. The program, which is in its second year, has just accepted ten new businesses.

Segment Covered in the Report

By Application

- Onshore

- Offshore

By Treatment

- Physical Treatment

- Chemical Treatment

- Biological Treatment

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting