November 2024

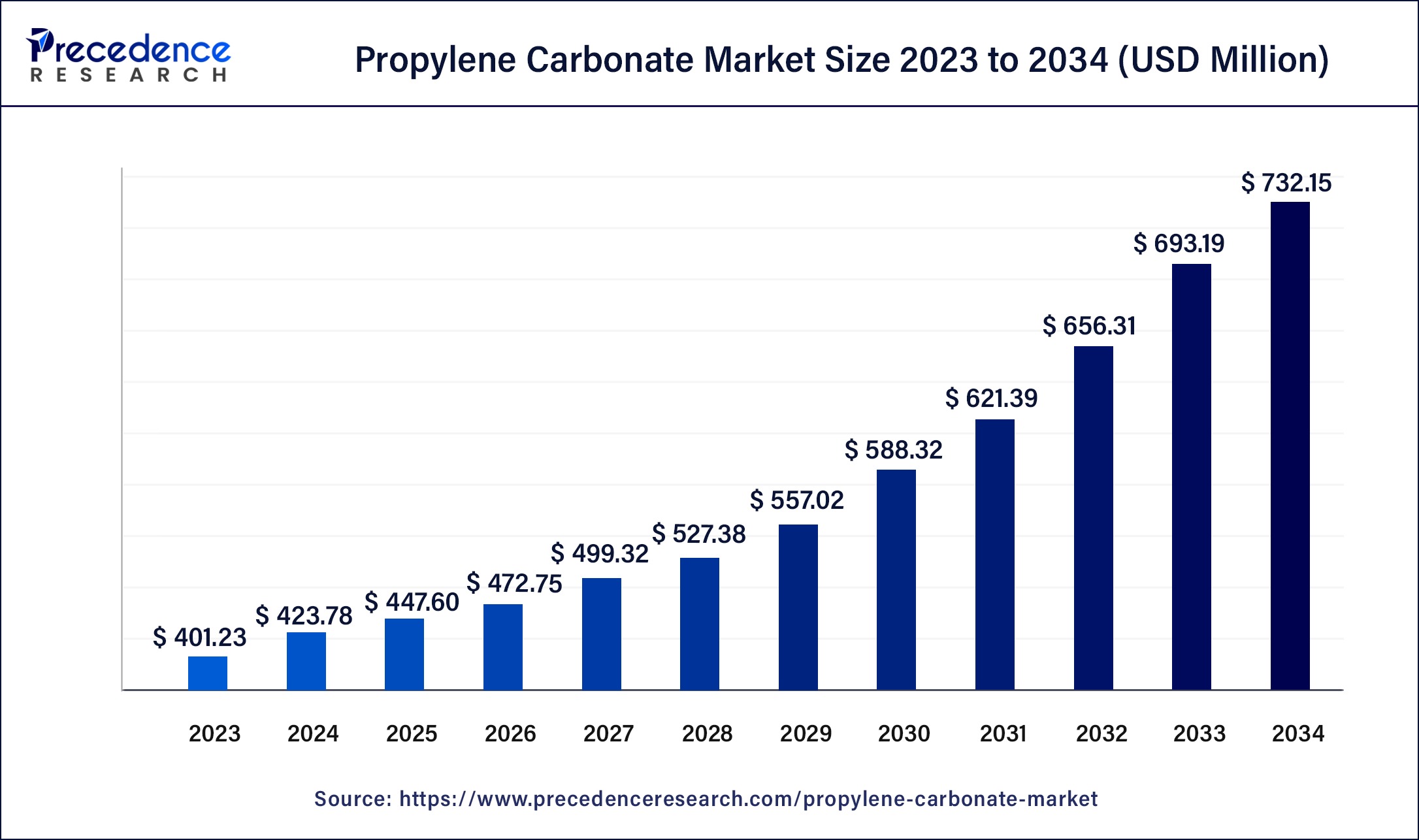

The global propylene carbonate market size surpassed USD 401.23 million in 2023 and is estimated to increase from USD 423.78 million in 2024 to approximately USD 732.15 million by 2034. It is projected to grow at a CAGR of 5.62% from 2024 to 2034.

The global propylene carbonate market size is anticipated to reach around USD 732.15 million by 2034 from USD 423.78 million in 2024, at a CAGR of 5.62% from 2024 to 2034. Increasing demand for portable electronic devices and expanding electric vehicle (EV) market is expected to boost the propylene carbonate market.

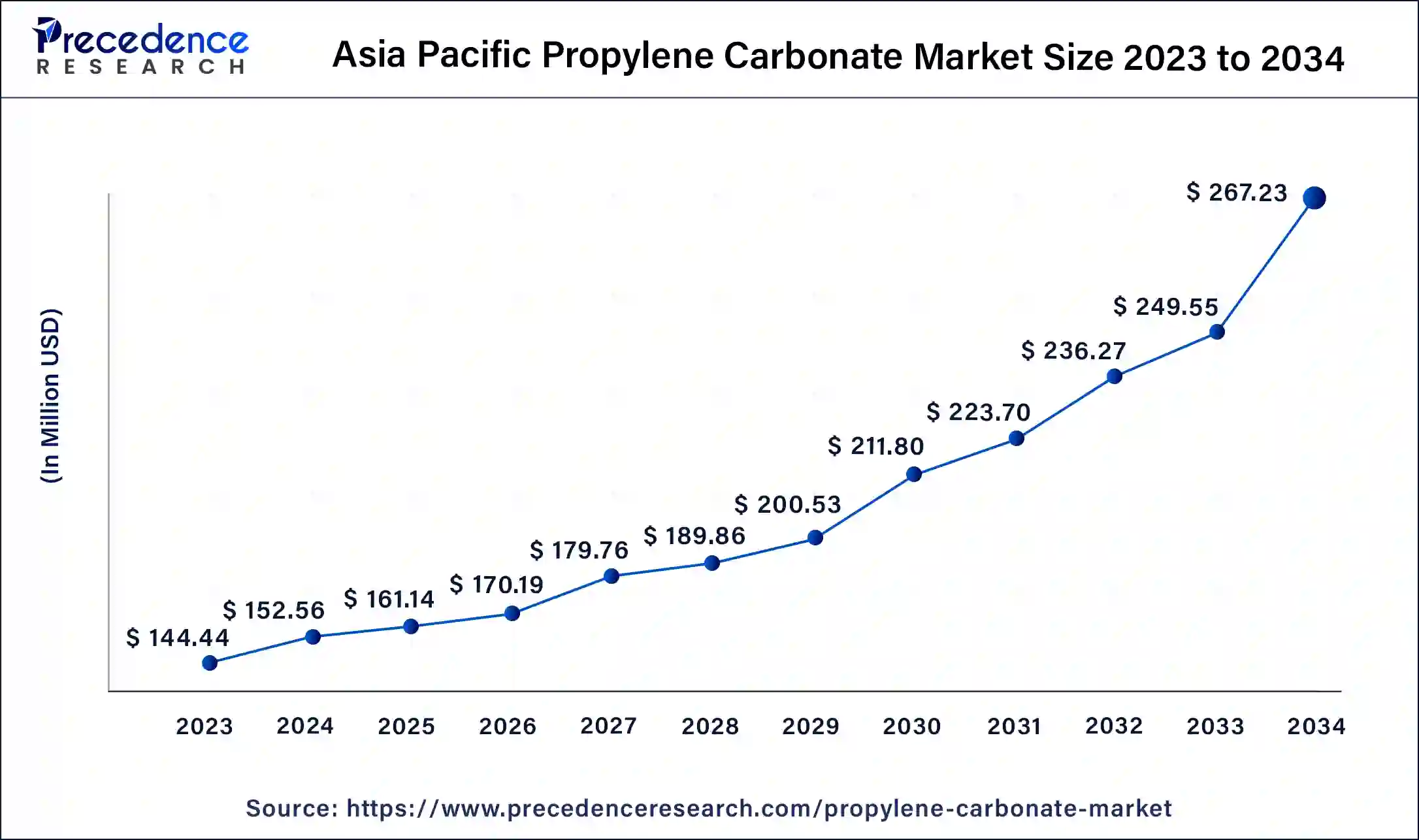

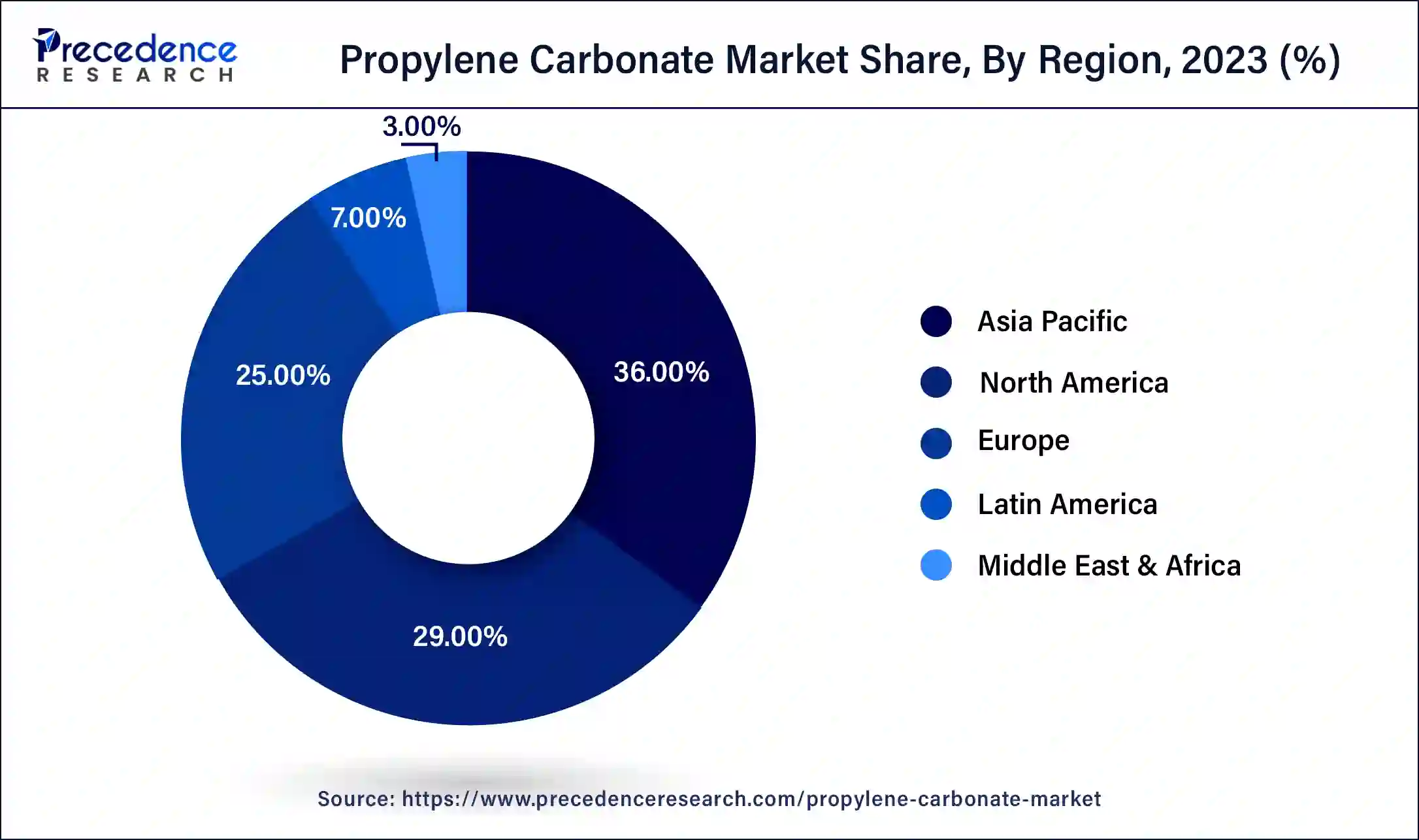

The Asia Pacific propylene carbonate market size was exhibited at USD 144.44 million in 2023 and is projected to be worth around USD 267.23 million by 2034, poised to grow at a CAGR of 5.75% from 2024 to 2034.

Asia Pacific dominated the global propylene carbonate market in 2023. The growth of the market in the region can be linked to the increasing demand for propylene carbonate driven by technological advancements and rapid industrialization in countries like China, Japan, and South Korea. China is witnessing robust growth due to the growth in methyl ethyl carbonate production and EV battery manufacturing.

North America is expected to grow at a significant rate in the propylene carbonate market over the projected period. This growth is supported by strict environmental regulations and a rising preference for sustainable chemical solutions. Moreover, The U.S. is experiencing notable growth driven by increasing demand for propylene carbonate in the cosmetics, automotive fluids, and pharmaceuticals industries.

Top 10 CO2-emitting countries in the world (Total CO2 in Mt)

| Country | Total CO2 emission per capita 2022 |

| China | 12,667 |

| United States | 4,854 |

| India | 2,693 |

| Russia | 1,909 |

| Japan | 1,083 |

| Indonesia | 692 |

| Iran | 686 |

| Germany | 674 |

| South Korea | 636 |

| Saudi Arabia | 608 |

Propylene carbonate is a colorless organic liquid compound created by the reaction of propylene oxide. and carbon dioxide. It has a molecular weight of 102.089 g/mol and molecular formula C4H6O3. Its boiling point ranges from 235°C to 245 0 °C, and its IUPAC name is 4-methyl-1,3-dioxolan-2-one. It contains characteristics such as low decomposition temperature, non-corrosiveness, and superior adhesion. It also serves as an oxygen barrier and high flash point. By using the process called transesterification, propylene carbonate can be transformed into carbonate esters.

Role of AI in the Propylene Carbonate Market

Artificial intelligence (AI) can play a crucial role in enhancing the current propylene carbonate market by opening the doors for new conversion opportunities along with optimizing efficiency and site performance based on changing norms. Furthermore, AI can quickly process and analyze large databases, react to real-time feedback, and manage interconnected systems' efficeilty. AI can also stimulate the vast potential of many catalyst chemistries.

| Report Coverage | Details |

| Market Size by 2034 | USD 732.15 Million |

| Market Size in 2023 | USD 401.23 Million |

| Market Size in 2024 | USD 423.78 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.62% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand from the pharmaceutical industry

The global pharma industry is thriving, and the propylene carbonate market plays an assisting role in those advancements. Propylene carbonate is a great solvent with excellent solubility properties for active pharmaceutical ingredients (API) in different drug delivery systems. Additionally, the requirement for propylene carbonate is expected to rise in sync with the increasing demand for innovative medicines by major pharmaceutical companies.

The requirement for high initial investment

The high costs involved in the primary stage of production are anticipated to create a challenge in the propylene carbonate market as it becomes harder for the population with middle-revenue startups to include pressure-sensitive adhesives in the utilization of varied processes.

Diversification of applications

The propylene carbonate market is increasing beyond lithium-ion batteries and solvents in terms of end-user application. Propylene carbonate is utilized in numerous industries because of its key qualities, such as its ability to produce miscibility with a wide range of chemicals and its strong solvency power. Furthermore, due to its nonirritating properties and gentle nature, it can also be used in the cosmetic industry and as a cleaning agent in the electronics industry.

The solvent segment led the propylene carbonate market in 2023 and is expected to grow at the fastest rate over the forecast period. The growth and dominance of the segment can be attributed to the increasing use of propylene carbonate as a solvent in many products, such as paints, coatings, adhesives, and degreasers. Moreover, the product is extensively utilized as a solvent in coatings and paints due to its low volatility, high solvency power, and capability to dissolve a wide range of resins and pigments.

The utilization of this product as a solvent in sealant formulations and adhesives helps enhance the flexibility, adhesion strength, and moisture resistance of adhesives, which makes it suitable for construction, automotive, and electronics applications.

The paints & coatings segment dominated the propylene carbonate market in 2023. The growth of the segment can be linked to the rising utilization of solvents in adhesive promoters and formulations in this industry. Propylene carbonate is widely used as a solvent in coatings and paint formulations, particularly in high-performance and waterborne coatings. Also, as an adhesive promoter, it helps in improving flexibility, adhesion properties, and coating integrity, especially in aerospace and automotive applications.

The pharmaceutical segment is expected to grow at the fastest rate in the propylene carbonate market over the forecast period. This is due to the growing use of propylene carbonate in pharmaceutical formulations due to its low toxicity and solvency. Additionally, increasing aging populations and growing healthcare spending are expected to fuel the demand for this product in the pharmaceutical industry.

Segments Covered in the Report

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

January 2025

November 2024