November 2024

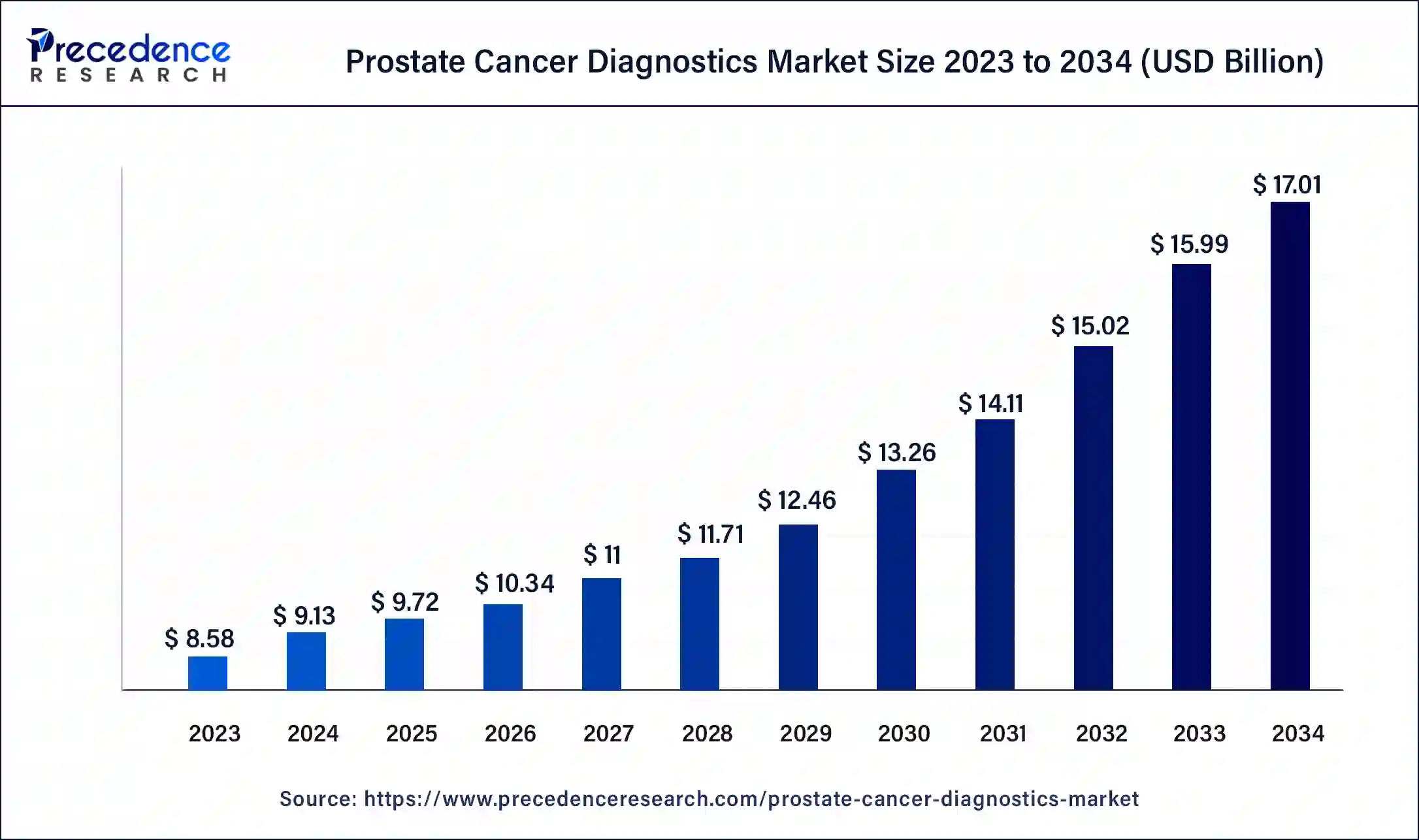

The global prostate cancer diagnostics market size surpassed USD 8.58 billion in 2023 and is estimated to increase from USD 9.13 billion in 2024 to approximately USD 17.01 billion by 2034. It is projected to grow at a CAGR of 6.42% from 2024 to 2034.

The global prostate cancer diagnostics market size is projected to be worth around USD 17.01 billion by 2034 from USD 9.13 billion in 2024, at a CAGR of 6.42% from 2024 to 2034. The increasing cases of transitional cell (or urothelial) cancer across the world are driving the growth of the prostate cancer diagnostics market.

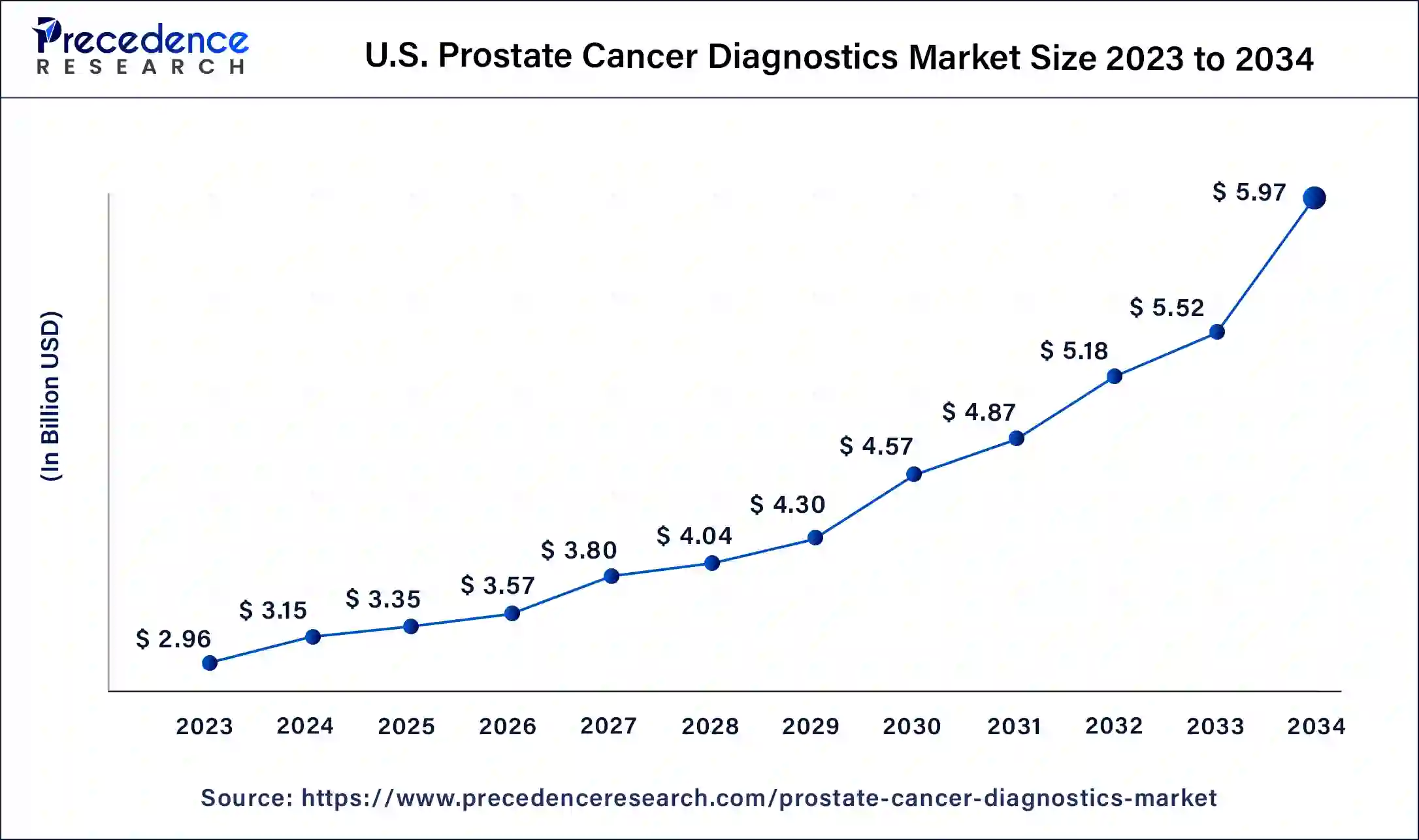

U.S. Prostate Cancer Diagnostics Market Size and Growth 2024 to 2034

The U.S. prostate cancer diagnostics market size was exhibited at USD 2.96 billion in 2023 and is projected to be worth around USD 5.97 billion by 2034, poised to grow at a CAGR of 6.58% from 2024 to 2034.

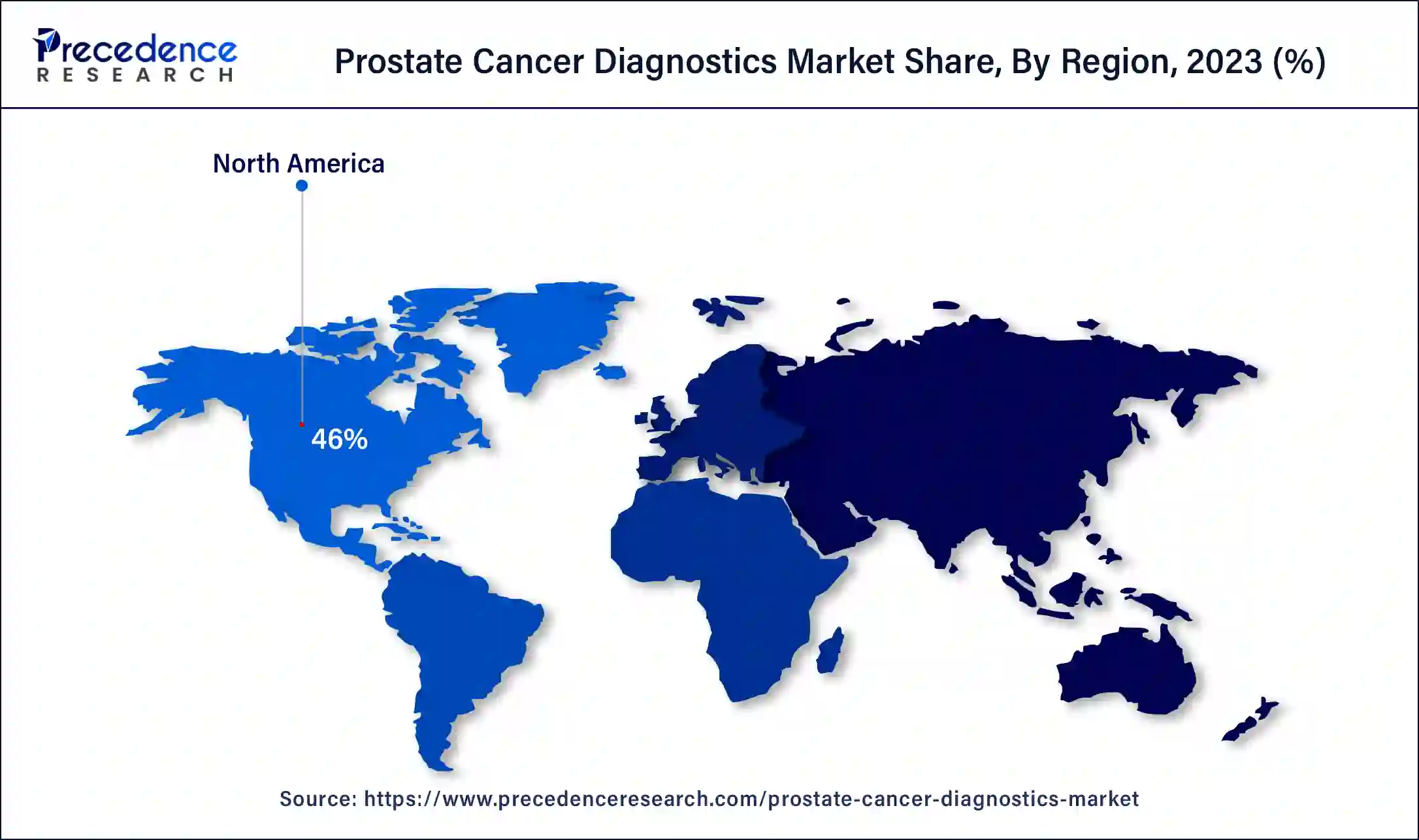

North America held the highest market share of 46% in 2023. The growth of the market in this region is mainly driven by the rising advancements in the healthcare sector along with increasing investment by the government in countries such as the U.S. and Canada for developing the cancer diagnosis and treatment sector.

The growing developments in artificial intelligence technology, along with the increasing number of outpatient facilities related to prostate cancer diagnosis, have driven the market growth. Also, the rising cases of prostate cancer in the U.S. and Canada have increased the demand for diagnosis methodologies associated with it, thereby driving the market growth to some extent.

Moreover, the presence of several local market players in prostate cancer diagnostics, such as Pfizer Inc., Myriad Genetics, Inc., Hologic Inc., and some others, are constantly engaged in the development of high-quality prostate cancer diagnostics tools and adopting several strategies such as partnerships, acquisitions, launches, and business expansions, which in turn drives the growth of the prostate cancer diagnostics market in this region.

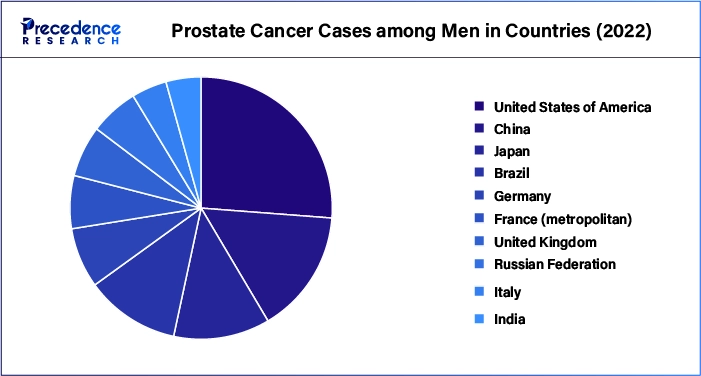

Asia Pacific is expected to be the fastest-growing region during the forecast period. The rising development in the prostate cancer industry by private and public entities, along with the growing investment by the government for opening new cancer hospitals in countries such as India, China, Japan, South Korea, and some others, is expected to drive the market growth to some extent. Moreover, the increasing geriatric population in Japan that is prone to prostate cancer has increased the demand for prostate cancer diagnostics, thereby driving the market growth. Additionally, the rise in the number of research activities associated with prostate cancer diagnostics is likely to boost the market growth to some extent.

Furthermore, various local companies in prostate cancer diagnostics, such as Chugai, Telix Pharmaceuticals, Sinotau Pharmaceutical Group, and others, are developing advanced prostate cancer diagnostics tools and systems across the Asia Pacific region, which is expected to drive the growth of the prostate cancer diagnostics market in this region.

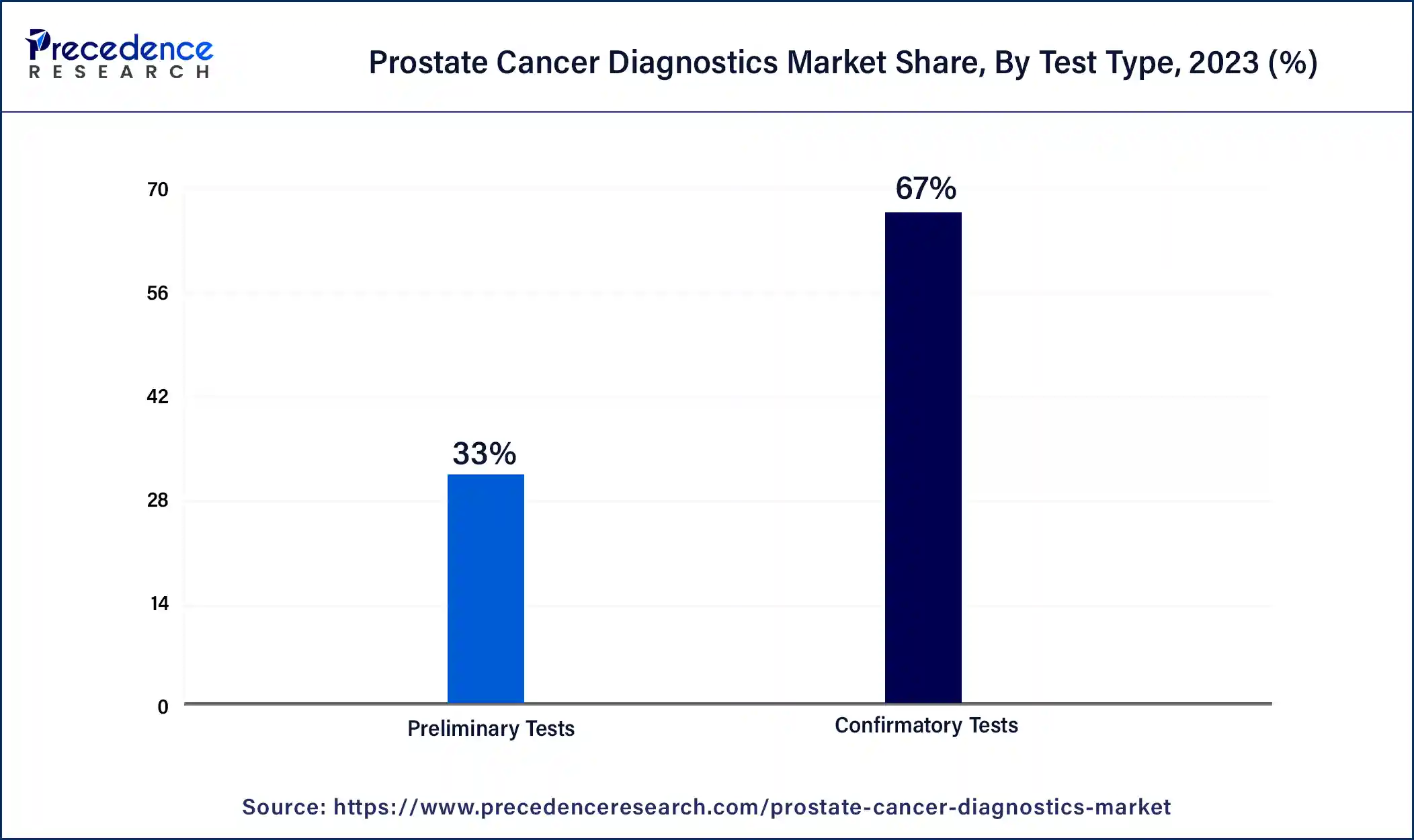

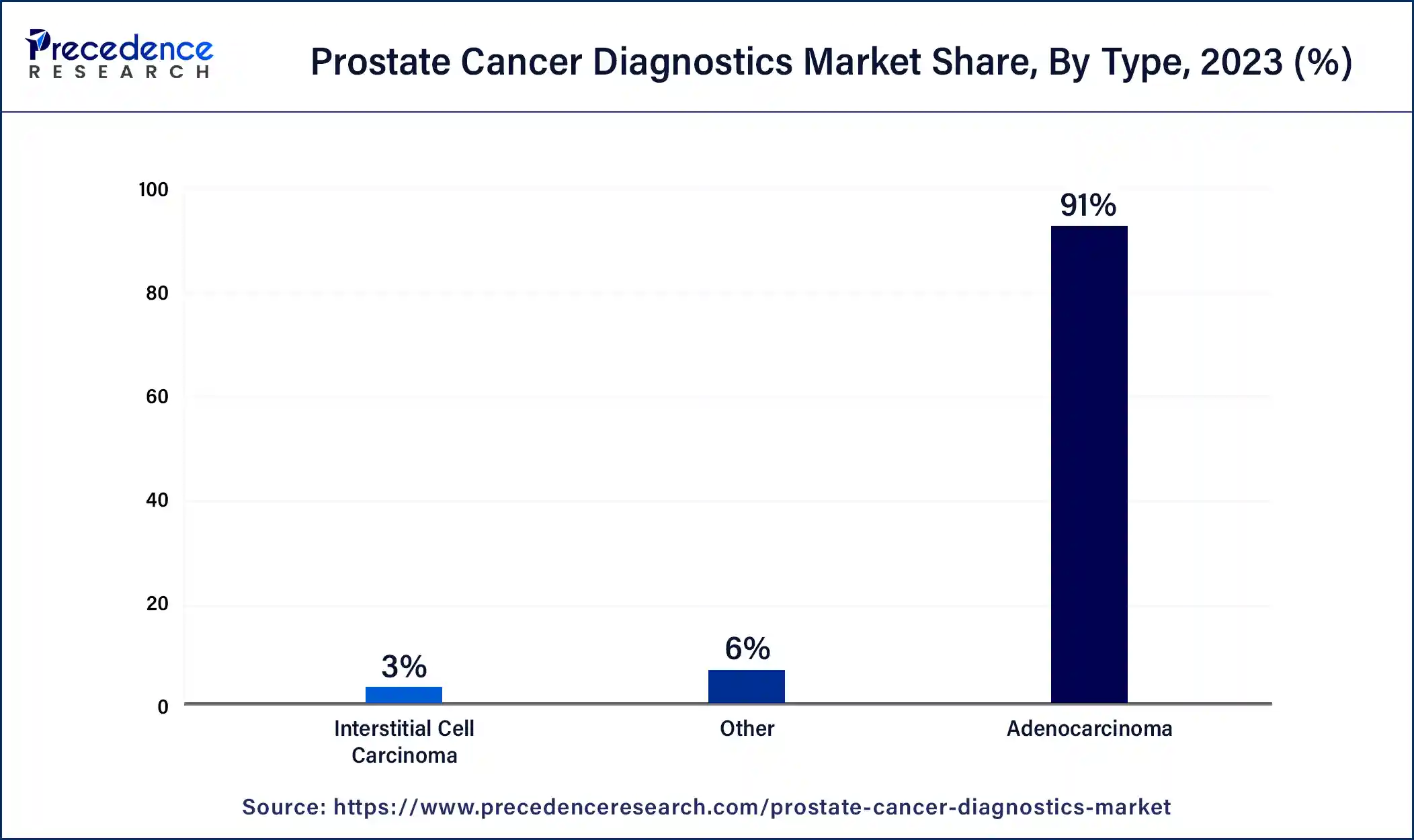

The prostate cancer diagnostics market is one of the most important industries in the healthcare sector. This industry deals in the development and distribution of prostate cancer diagnostics methodologies for detecting prostate cancer across the world. This industry comprises various tests that mainly include preliminary tests and confirmatory tests. These tests are performed for the detection of several types of prostate cancers, such as adenocarcinoma, interstitial cell carcinoma, and some others. There are several end-users of this industry, mainly including hospitals, home care, outpatient facilities, research & manufacturing, and some others. This market is expected to grow significantly with the growth in the clinical diagnostics industry.

How is AI shaping the Prostate Cancer Diagnostics Industry?

Advancements in AI play an important role in the development of the prostate cancer diagnostics market. Nowadays, diagnostic tool companies have started integrating AI into their systems for diagnosing prostate cancer. AI can help in the detection of lesions in early stages, precise risk stratification, aggressiveness of cancer, and others, along with enhancing the accuracy of diagnosis. Thus, the ongoing integration of AI in prostate cancer diagnosis is shaping the prostate cancer diagnostics industry in a positive manner.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.01 Billion |

| Market Size in 2023 | USD 8.58 Billion |

| Market Size in 2024 | USD 9.13 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.42% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Test Type, Type, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

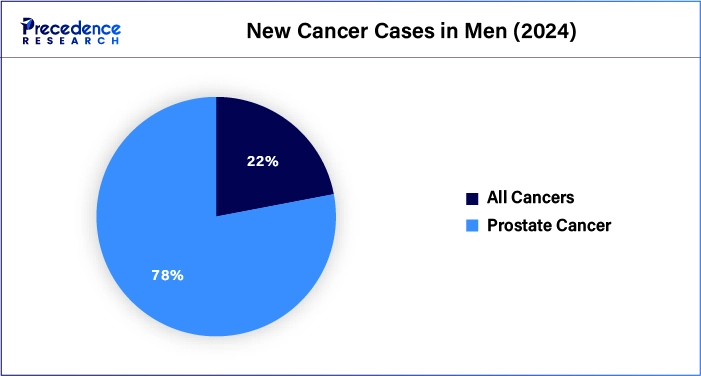

Rising incidences of prostate cancer among men

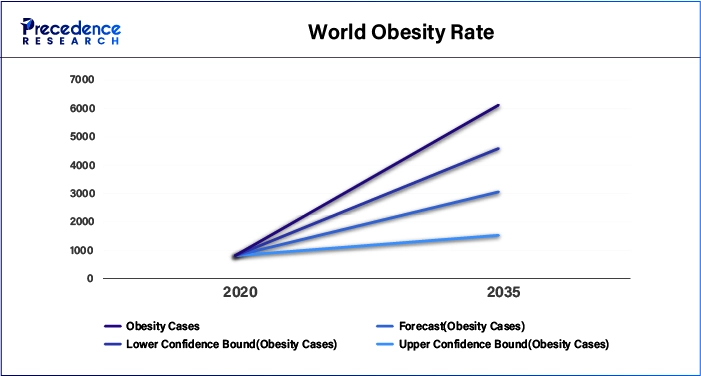

The cases of prostate cancer in men have been increasing rapidly across the world. The rising incidences of prostate cancer are mainly due to several factors such as age, diet, obesity, ethnicity, chemical exposure, genetics, prostatitis, vasectomy, and some others. Thus, with the increasing prevalence of prostate cancer, the demand for prostate cancer diagnosis increases, thereby driving the growth of the prostate cancer diagnostics market during the forecast period.

High cost of diagnosis along with a lower number of positive trials

The prostate cancer diagnostics industry has gained prominent attention with the rising cases of adenocarcinoma and small cell carcinoma around the world. Although there are several advantages of prostate cancer diagnostics tools, there are various problems in this industry. Firstly, the diagnosis of prostate cancer is relatively higher as compared to the diagnosis of other types of cancers. Secondly, most of the clinical trials associated with prostate cancer diagnosis come with a lower success rate. Thus, the high diagnosis cost associated with prostate cancer, along with the lower success rate of clinical trials, is expected to restrain the growth of the prostate cancer diagnostics market during the forecast period.

Developments associated with the MPS2 test to change the future

Diagnostics centers around the world are using different types of diagnostics methodologies for the detection of prostate cancer. Nowadays, the research and development activities associated with the MPS2 test are growing rapidly to avoid unnecessary biopsies and other testing for detecting prostate cancer. Thus, advancements in MPS2 tests associated with prostate cancer diagnosis are expected to create ample opportunities for the market players in the upcoming future.

Top Hospitals Associated with Prostate Cancer Diagnoses (U.S.)

The confirmatory tests segment dominated the market with the highest market share of 67% in 2023. The rising incidence of small cell prostate cancer and neuroendocrine tumors among men has driven market growth. Also, the rising application of the PCA3 test in detecting various types of prostate cancer is likely to boost the market growth to some extent. Moreover, the growing adoption of transrectal ultrasound systems for creating video images of the prostate gland is expected to drive the growth of the prostate cancer diagnostics market during the forecast period.

The preliminary segment is estimated to exhibit a significant growth rate during the forecast period. The rising prevalence of squamous cell carcinoma and adenocarcinoma across the world has increased the demand for preliminary tests associated with prostate cancer, thereby driving market growth. Also, the growing adoption of PSA (prostate-specific antigen) tests for screening prostate cancer will likely boost the market growth to some extent. Moreover, the increasing application of free PSA tests for detecting early stages of prostate cancer is expected to propel the growth of the prostate cancer diagnostics market during the forecast period.

The adenocarcinoma segment accounted for a major market share of 91% in 2023. The increasing cases of adenocarcinoma among people across the world have boosted the market growth. Also, the rising incidences of acinar adenocarcinoma and ductal adenocarcinoma in men have increased the demand for diagnostics methodologies associated with it, thereby driving the market growth to some extent. Moreover, the growing application of positron emission tomography (PET) scan and magnetic resonance imaging (MRI) for the detection of adenocarcinoma is expected to drive the growth of the prostate cancer diagnostics market during the forecast period.

The interstitial cell carcinoma segment is estimated to exhibit a significant growth rate during the forecast period. The increasing cases of testicular tumors due to the growing prevalence of obesity has increased the demand for prostate cancer diagnostics, thereby driving the market growth. Also, the rising application of PSA tests and transrectal ultrasonography (TRUS) for detecting interstitial cell carcinoma in the prostate gland is likely to boost market growth to some extent. Moreover, the growing demand for non-invasive imaging systems to diagnose interstitial cell carcinoma is expected to propel the growth of the prostate cancer diagnostics market during the forecast period.

The outpatient facilities segment held a dominant share of the market in 2023. The rising number of clinics that allow doctor consultations related to prostate cancer has driven the market growth. Also, the availability of prostate cancer diagnostics tools in outpatient facilities is likely to boost the market growth to some extent. Moreover, the advantages of outpatient facilities, such as flexibility, low cost, convenience, patient satisfaction, and some others, are expected to boost the growth of the prostate cancer diagnostics market during the forecast period.

The hospitals segment is expected to grow at a significant CAGR during the forecast period. The rise in the number of cancer hospitals across the world has boosted the market growth. Also, the growing emphasis by the governments of several countries on developing medical facilities associated with prostate cancer diagnostics and treatment is likely to boost market growth to some extent. Moreover, several hospitals are integrating prostate cancer diagnostics tests and engaged in clinical trials to help patients suffering from prostate cancer, thereby driving the growth of the prostate cancer diagnostics market during the forecast period.

Segments Covered in the Report

By Test Type

By Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

September 2024

September 2024