August 2024

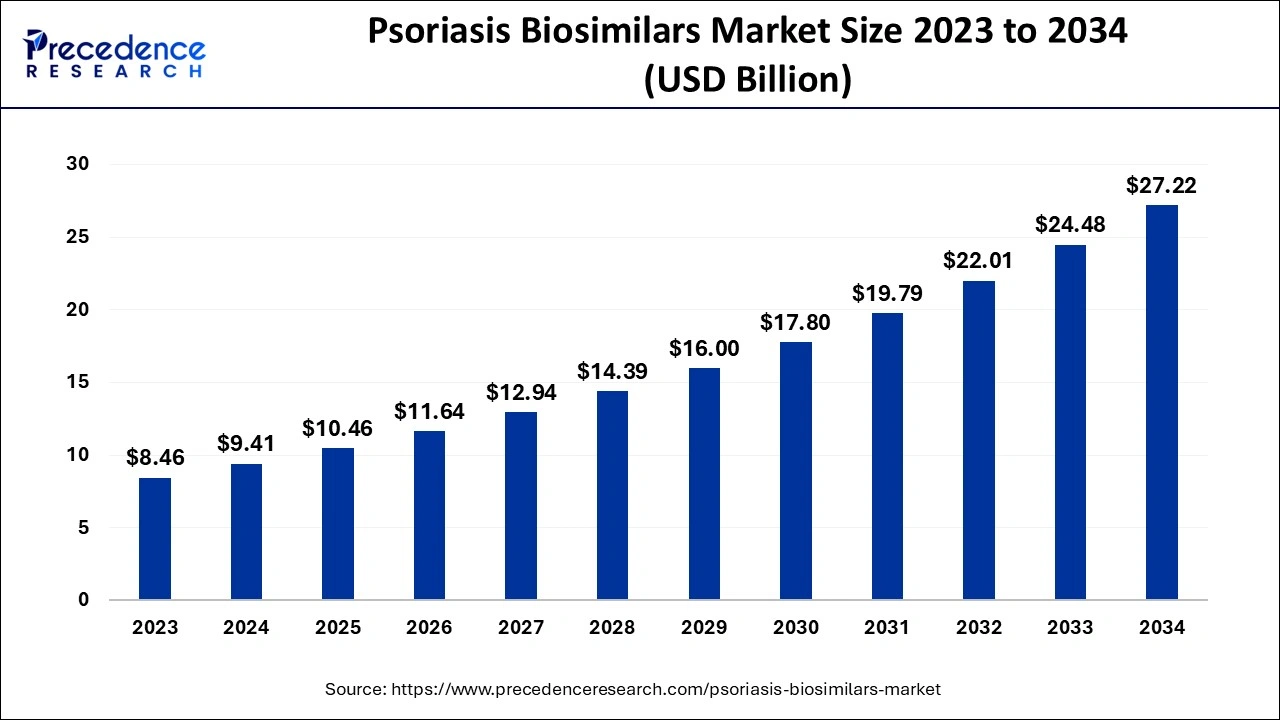

The global psoriasis biosimilars market size accounted for USD 9.41 billion in 2024, grew to USD 10.46 billion in 2025 and is expected to be worth around USD 27.22 billion by 2034, registering a solid CAGR of 11.21% between 2024 and 2034.

The global psoriasis biosimilars market size is calculated at USD 9.41 billion in 2024 and is projected to surpass around USD 27.22 billion by 2034, expanding at a CAGR of 11.21% from 2024 to 2034.

The pharmaceutical industry's division devoted to creating, manufacturing, and selling biosimilar medications to treat psoriasis is known as the psoriasis biosimilars market. Biosimilars are biologic medications that, while frequently less expensive, are very similar to previously approved reference biologics in terms of efficacy, safety, and quality. Due to the evolution of biosimilars, more patients can afford the latest biologic medicines, improving access to care in fields with limited insurance coverage.

For biopharma companies seeking to join the dermatology industry with a less expensive option to branded biologics, the psoriasis biosimilars market offers a profitable potential to increase market share while satisfying a critical medical need.

How is AI Helping Psoriasis Biosimilars Market Growth?

A great deal of biological data can be analyzed by AI systems to forecast which biosimilar compounds will be most effective in treating psoriasis. This speeds up identifying promising candidates for the development of biosimilars. AI-powered solutions, such as wearable technology and smartphone apps, enable psoriasis patients to be continuously monitored. This immediate data collection optimizes dosing schedules and enhances adherence to biosimilar therapy. In the psoriasis biosimilars market, by collecting and analyzing the data sets needed for regulatory submissions, artificial intelligence can help expedite the process. It helps biosimilars meet the stringent safety, effectiveness, and equivalence requirements set by originator biologics.

| Report Coverage | Details |

| Market Size by 2034 | USD 27.22 Billion |

| Market Size in 2024 | USD 9.41 Billion |

| Market Size in 2025 | USD 10.46 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Drug Class, Indication, Route of Administration, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing incidence of psoriasis

Rapid skin cell development that causes scaling on the skin's surface is a hallmark of psoriasis, a chronic autoimmune disease. It is frequently accompanied by itching and discomfort and might result in red regions covered in thick, silvery scales. Because biosimilars are less expensive than their reference biologics, a broader spectrum of patients can now obtain treatment. This is especially vital as the prevalence of psoriasis rises, and there is a greater need for efficient treatment solutions.

Patient demand for alternatives

Advocacy groups and patient organizations spread the word about biosimilars and other therapeutic choices. They promote dialogue between patients and medical professionals, which increases demand for substitutes. Studies have shown numerous biosimilars to be as safe and effective as their reference biologics. Due to shared experiences, demand rises when patients have favorable results with biosimilars.

Regulatory hurdles

Biosimilars must show similarities to their reference biologics through extensive clinical research, including immunogenicity, pharmacokinetics, and pharmacodynamics evaluations. Psoriasis biosimilars market entry is delayed because these trials frequently demand a significant investment of time and money. Regulatory obstacles may cause patients and professional providers to doubt the safety and effectiveness of biosimilars compared to their reference biologics. This notion may hamper the adoption and application of biosimilars in clinical practice.

Rising demand for personalized medicine

Since biosimilars are less expensive than biological medicines, a larger patient base can now obtain them. This cost-cutting measure supports the customized care paradigm by removing financial obstacles to individualized treatment strategies. Doctors are becoming more and more interested in individualized treatment plans. Adoption and use can be increased by informing medical professionals about the advantages of biosimilars in providing individualized treatment. Opportunities for the psoriasis biosimilars market are presented by emerging markets' increased knowledge of personalized medicine. The demand for biosimilars may rise as these markets embrace tailored techniques more easily as healthcare infrastructure improves.

The TNF-alpha inhibitors segment dominated the psoriasis biosimilars market in 2023. The tumor necrosis factor-alpha (TNF-α) is essential to the inflammatory processes of psoriasis and is the target of TNF-alpha inhibitors. By inhibiting TNF-α, these inhibitors lessen inflammation and the skin cell proliferation that psoriasis patients experience. When the patents on initial biologics such as Enbrel and Humira expired, biosimilars appeared on the market, providing equivalent therapeutic efficacy at lower costs. The availability of TNF-alpha inhibitors has increased since the introduction of biosimilars, which have significantly reduced the price burden on individuals and healthcare systems. This price advantage reinforced the market supremacy of TNF-alpha inhibitor biosimilars in the psoriasis market.

The plaque psoriasis segment led the global psoriasis biosimilars market in 2023. About 80% to 90% of all psoriasis cases globally are of the most prevalent type, plaque psoriasis. There is a great need for efficient therapies because of the high prevalence. Healthcare professionals are now more comfortable prescribing biosimilars for plaque psoriasis as clinical evidence for their safety and effectiveness has increased. Real-world data shows comparable patient results across biosimilars, and their biologic equivalents lend additional credence to this.

The psoriatic arthritis segment will witness rapid growth in the psoriasis biosimilars market during the forecast period. People with psoriasis can develop psoriatic arthritis (PsA), a chronic inflammatory disease. According to studies, up to 30% of psoriasis sufferers go on to develop psoriatic arthritis. The incidence of PsA rises in tandem with the frequency of psoriasis. Initially, physicians and patients questioned whether biosimilars were as safe and useful as the original biologics. Furthermore, it treats psoriatic arthritis and reference biologics without compromising their safety or therapeutic outcomes, according to mounting data and clinical trial studies. This has a major impact on patients' lifestyles and is directly linked to mobility issues, joint stiffness, and excruciating pain.

The topical segment holds the largest share of the psoriasis biosimilars market. Using topical treatments directly to the skin, psoriasis plaques can be treated locally. Compared to systemic treatments such as injections or oral drugs, which need physician monitoring or have more serious side effects, this delivery route is non-invasive and simpler for patients to employ. In general, topical biosimilars are less expensive than systemic treatments. Because biosimilars are less expensive than name-brand biologics, a broader range of patients can now obtain them.

The retail pharmacy chains segment held a significant share of the psoriasis biosimilars market in 2023. Retail pharmacy chains often have vast distribution networks that allow them to serve many patients in various geographic areas. This broad reach ensures that psoriasis biosimilars are easily accessible locally, increasing their accessibility for needy patients. There is a smooth supply chain for these drugs due to pharmacy chains such as CVS, Walgreens, Rite Aid, and others, which have thousands of locations around the country, some of which are international.

North America dominated the psoriasis biosimilars market in 2023. Patients and healthcare professionals in North America are becoming more aware of and receptive to biosimilars. Clinicians' confidence in prescribing biosimilars has increased because of educational activities from regulatory agencies such as the FDA and biopharmaceutical companies. The usage of biosimilars to treat psoriasis has risen as medical professionals gain more details of its safety and effectiveness.

Asia Pacific is observed to host the fastest-growing psoriasis biosimilars market during the forecast period. In the past, psoriasis was frequently misdiagnosed or treated inadequately, particularly in rural or underdeveloped areas. As knowledge grows, more patients seek therapy, which increases the potential market for biosimilars. Due to their high cost, patients, particularly those in underdeveloped nations, have limited access to traditional biologics used to treat psoriasis. Biosimilars are becoming more widely used since they provide a more affordable choice. For instance, Biocon and Celltrion are leading the way in the development of biosimilars. Their ability to produce cost-effective, high-quality biosimilars has greatly aided the business's expansion.

Segments Covered in the Report

By Drug Class

By Indication

By Route of Administration

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

February 2025

August 2024