August 2024

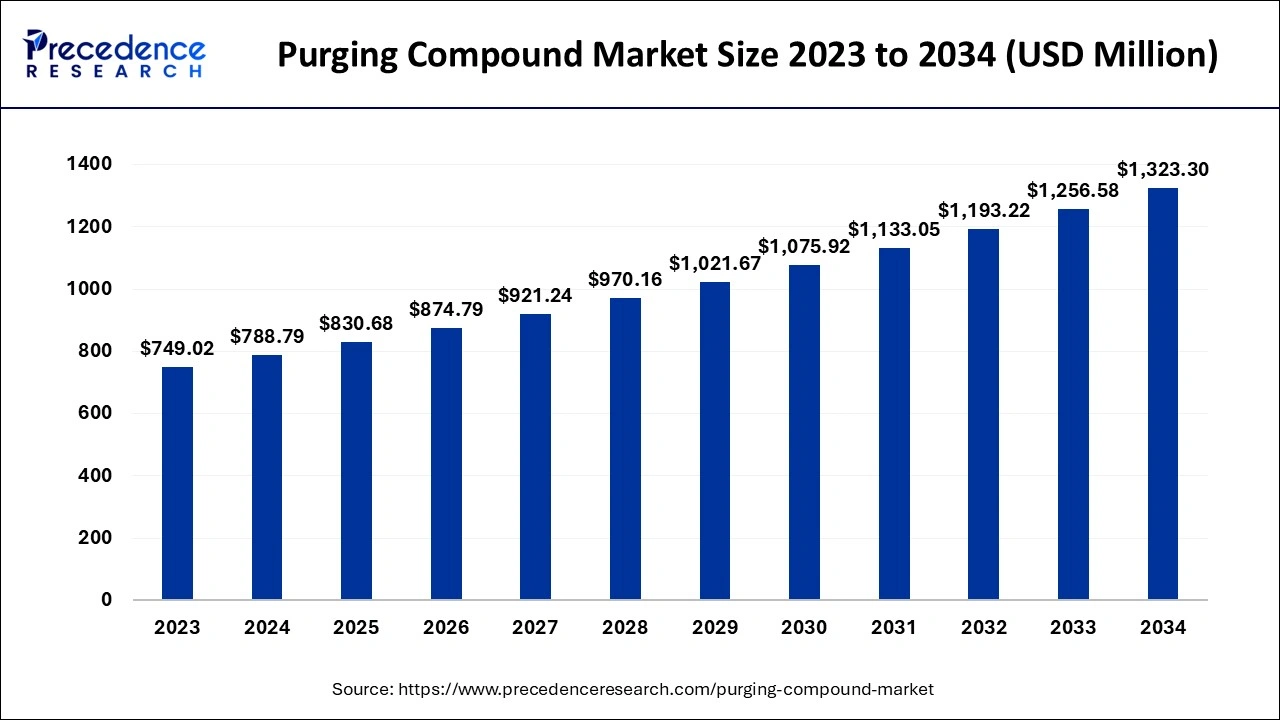

The global purging compound market size is calculated at USD 788.79 million in 2024, grew to USD 830.68 million in 2025 and is projected to reach around USD 1,323.30 million by 2034. The market is expanding at a CAGR of 5.31% between 2024 and 2034. The Asia Pacific purging compound market size is evaluated at USD 291.85 million in 2024 and is estimated to grow at a fastest CAGR of 5.43% during the forecast period.

The global purging compound market size is accounted for USD 788.79 million in 2024 and is expected to be worth around USD 1,323.30 million by 2034, growing at a CAGR of 5.31% from 2024 to 2034. The purging compound market is experiencing significant demand due to the rapid growth of the plastic industry that grabs the attention towards producing high-quality products. Many companies are adopting purging compounds to enhance their manufacturing capabilities and manage expenses.

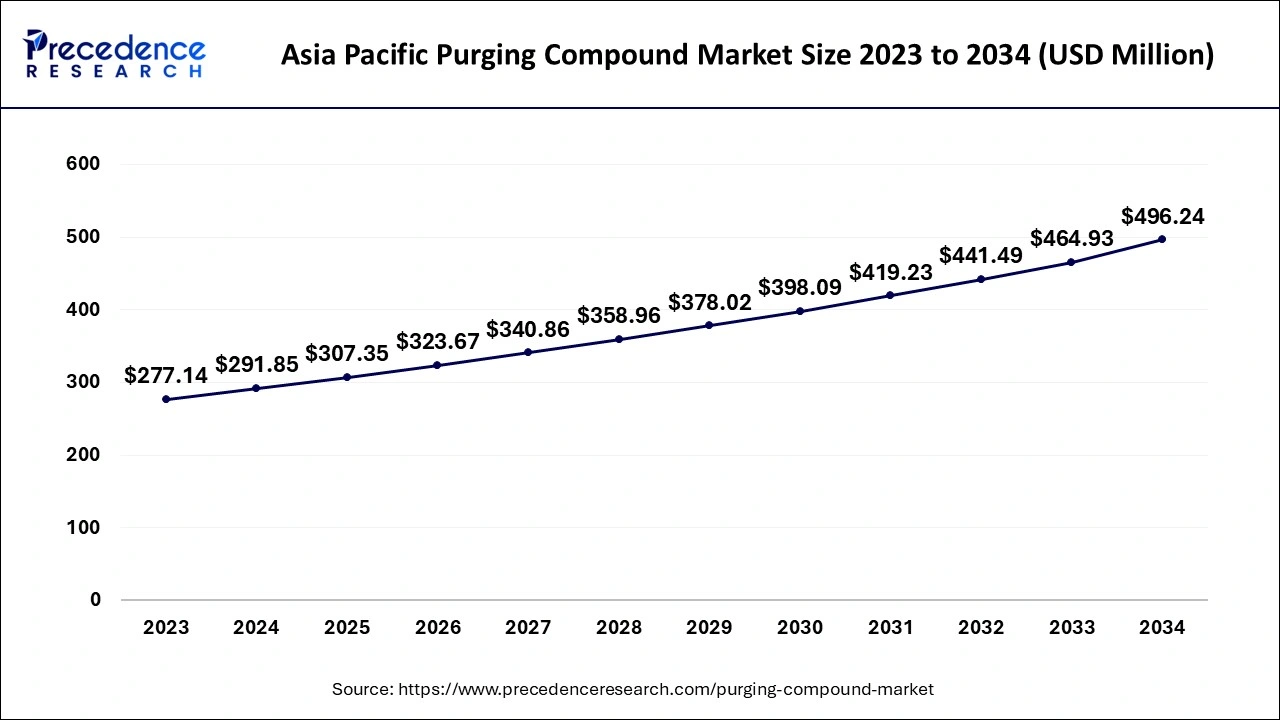

The Asia Pacific purging compound market size is exhibited at USD 291.85 million in 2024 and is predicted to hit around USD 496.24 million by 2034, growing at a CAGR of 5.43% from 2024 to 2034.

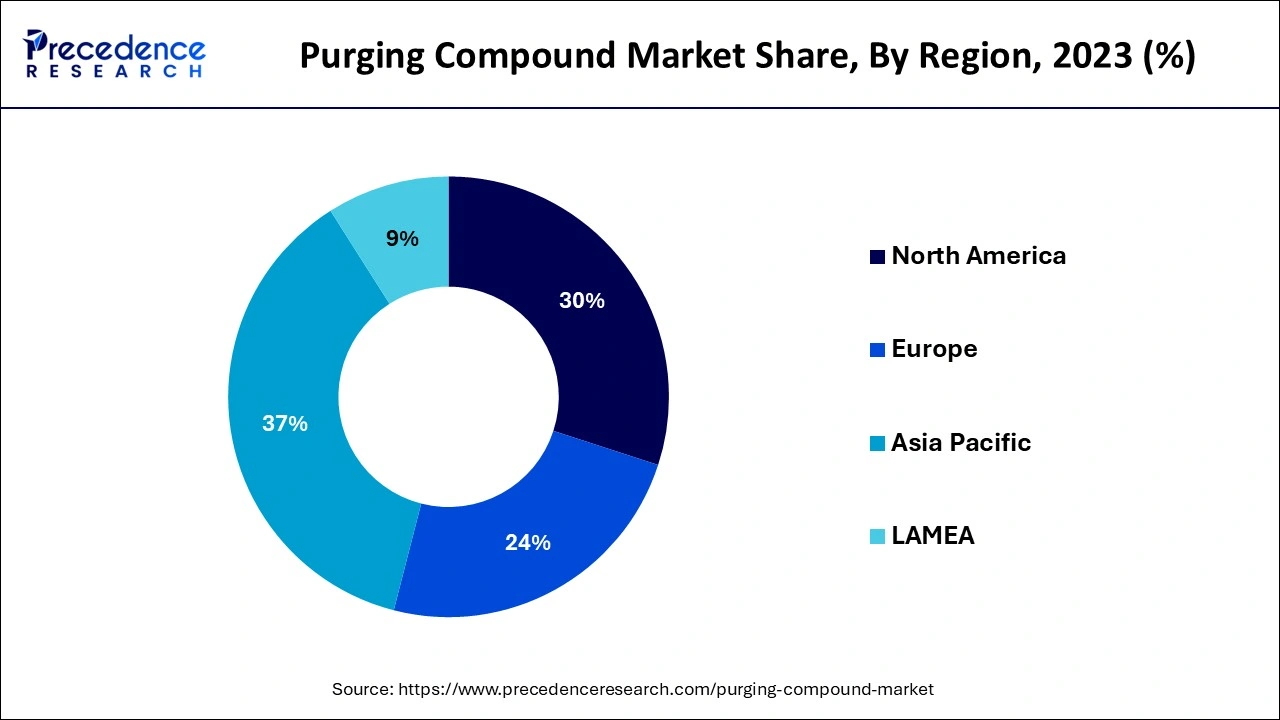

Asia Pacific dominated the global purging compound market in 2023. The dominance of the region is attributed to the rapid industrialization in countries like India, China, and Japan. These countries have a higher demand for plastic in various industries like automotive and healthcare.

The rising urban population in the region is also increasing the demand for plastic, especially in food packaging, which makes them popular and contributes to the growth of the purging compound market. The region is also improving its plastic production capabilities, which requires lower production costs and attracts large-sized companies. The increasing governmental support for the companies is playing a crucial role in adopting new technologies.

Europe is anticipated to register significant growth in the purging compound market during the forecast period of 2024 to 2034. The growing popularity of the purging compound market in the region is attributed to the rising preference for green manufacturing, which reduces the waste generated during the production process. European countries are investing heavily in improving product quality while maintaining market standards. Additionally, the growth of the packaging industry in countries like Germany and the UK is expected to contribute to the market.

The purging compound is a resin-based cleaning material used to clean plastic molding machines like injection molding machines, blow molding machines, and extruders used for plastic processing. The motive behind the machine design is to remove the leftover additives, colors, and other particles that tend to cause damage to the machines. Purging compounds play a vital role in removing residual contaminants like degraded polymers and carbonized residues, which could protect the quality of the final products. The purging compound market is gaining significant popularity due to the ability of these machines to reduce downtime during material changes. The traditional process of machine cleaning takes hours and slows down the whole process.

How Can AI Help the Purging Compound Market?

The emergence of AI has significantly boosted the production rate and efficiency in the purging compound market. AI can analyze data that is considered to be beneficial in optimizing the production process by tracking machine performance and cleaning cycles. This could also be beneficial in the predictive maintenance of the machines, which could help save additional costs. Since the development of these technologies, AI has been playing a crucial role in analyzing the datasets and coming up with productive decisions, stating the capabilities of various machines in different environments. Additionally, the powerful vision of AI is expected to assess multiple parts per minute.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,323.30 Million |

| Market Size in 2024 | USD 788.79 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.31% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Process, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for automation in the manufacturing process

Increasing technologies and changing lifestyle dynamics are two major factors that are responsible for the increasing demand for quick manufacturing in the plastic processing industry. The purging compound market is gaining popularity due to its higher productivity rate, which helps in the mass production of plastic that too without the need for a huge human workforce.

The emergence of flexible manufacturing systems is one of the major reasons that help fulfill the consumer demand for plastic in the market. Many companies are using the purging compound market due to the increasing use of plastic in multiple industries.

Rising demand for cost-efficient solutions

Plastic manufacturing companies are focusing on improving their business by adopting solutions that help manage their expenses. The adoption of purging compounds has increased because of multiple factors, such as saving additional labor costs in the purging compound market. Adopting these solutions can also benefit in other ways, such as reducing waste and enhancing the quality of these final products. The massive demand for plastic leads to the adoption of purging compounds due to their longevity.

Higher cost of advanced purging compounds

The purging compound market has seen significant growth in recent years, but there are some factors that tend to hamper the market growth. Adopting these systems often requires a higher initial investment which could not be beneficial for the new market companies. Purging compounds are usually expensive compared to traditional cleaning methods.

Rising adoption of green manufacturing

The increasing environmental concerns are one of the major factors that have led to the increasing adoption of green manufacturing initiatives that aim to reduce the environmental impact of plastic. This has also led to the demand for adopting eco-friendly purging compound market products made from bio-degradable materials. Implementing these purging compounds can play a crucial role in reducing the waste generated during production.

Government initiatives towards reducing carbon footprints are expected to bring many opportunities in the purging compound market in the upcoming years. These changes are influenced by the rise of global trends supported by international organizations like the United Nations (UN), which promote clean and green energy.

Rising demand for plastic in healthcare

The healthcare sector has witnessed massive growth since the outbreak of the Covid-19 pandemic. This rising demand has played a crucial role in the development of the plastic processing industry, where plastics are used in producing medical devices, syringes, and other necessary equipment. This increases the demand for efficient purging compounds with efficient performing skills. The healthcare sector has witnessed demand for single-use medical products like masks, gloves, and many other essentials.

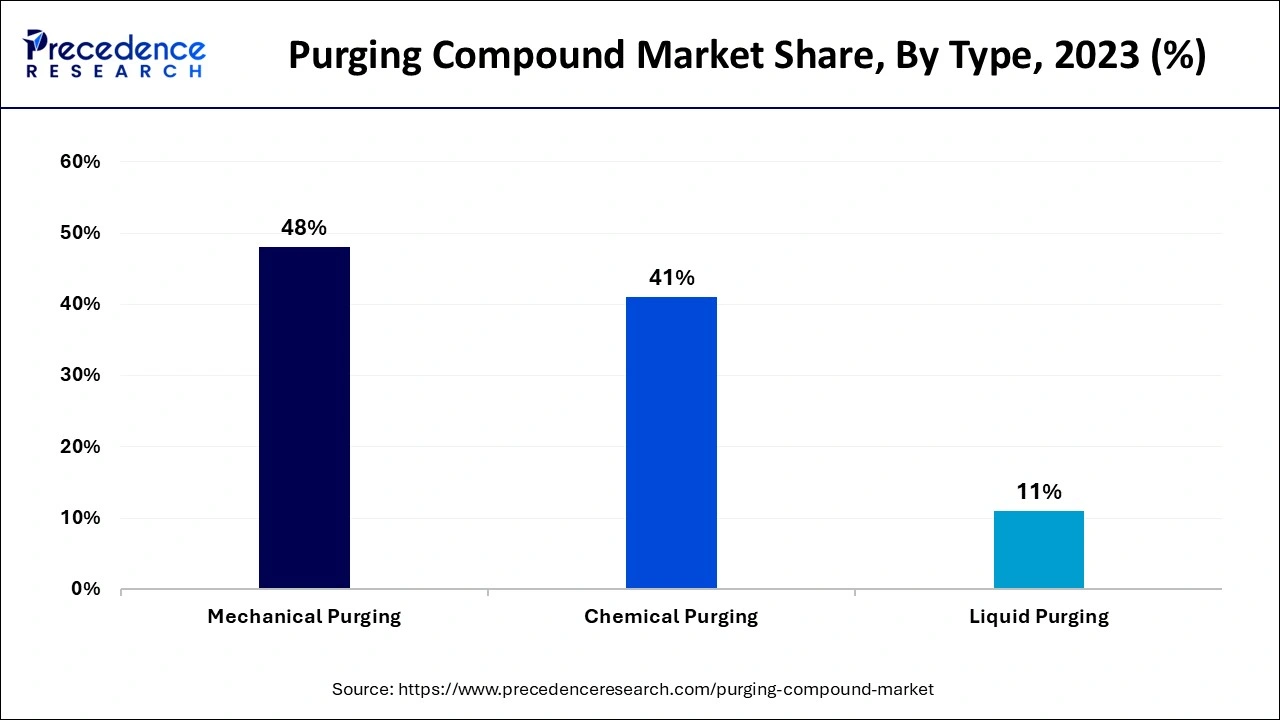

The mechanical purging segment dominated the global purging compound market in 2023. Mechanical purging is a type that involves the use of resin or a compound that scrubs and removes the contaminants from the machine. Polyethylene and polypropylene are usually used in this method, and they are considered to be effective in cleaning machines. The dominance of the segment is attributed to the affordability of the method that is preferred by most of the companies. Mechanical purging works across various machines and is user-friendly, which makes it popular in the purging compound market. Additionally, the method is gaining significant attention due to rising environmental concerns as it generates less chemical waste.

The chemical purging segment is expected to register the fastest growth in the purging compound market during the forecast period of 2024 to 2034. The method uses chemical fluids that contain active chemicals to clean the machine. The segment is gaining significant popularity due to its effective functionality that deep cleans the machine as compared to the other methods. The process also consumes less time as compared to the other methods which makes it a preferable option for the companies to match the market standards.

The extrusion segment contributed the largest share of the purging compound market in 2023. Extrusion refers to a raw plastic material manufacturing process that is in the form of granules and pellets. The dominance of the segment is attributed to the multiple functional capabilities of extrusion that produce a wide variety of shapes and sizes according to the need for applications. The process is also known for its higher productivity, which produces materials on a larger scale. This makes them a preferable option for companies as they also require less workforce, which makes them cost-effective, especially for small businesses. Automation technologies are also playing a crucial role in simplifying the use of these materials.

The injection molding segment is anticipated to grow at the fastest rate in the purging compound market during the forecast period of 2024 to 2034. The injection molding process refers to the manufacturing where molten plastic is injected into a Mold to create various shapes. The segment is gaining significant attention due to its uniqueness which gives details to various shapes and sizes. These types of plastics are mostly used in the automotive and medical devices sector, which increases their demand globally. The process is considered to be suitable for both high and low volume production which increases its use in large and small sized businesses.

Segments Covered in the Report

By Type

By Process

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

December 2024