September 2024

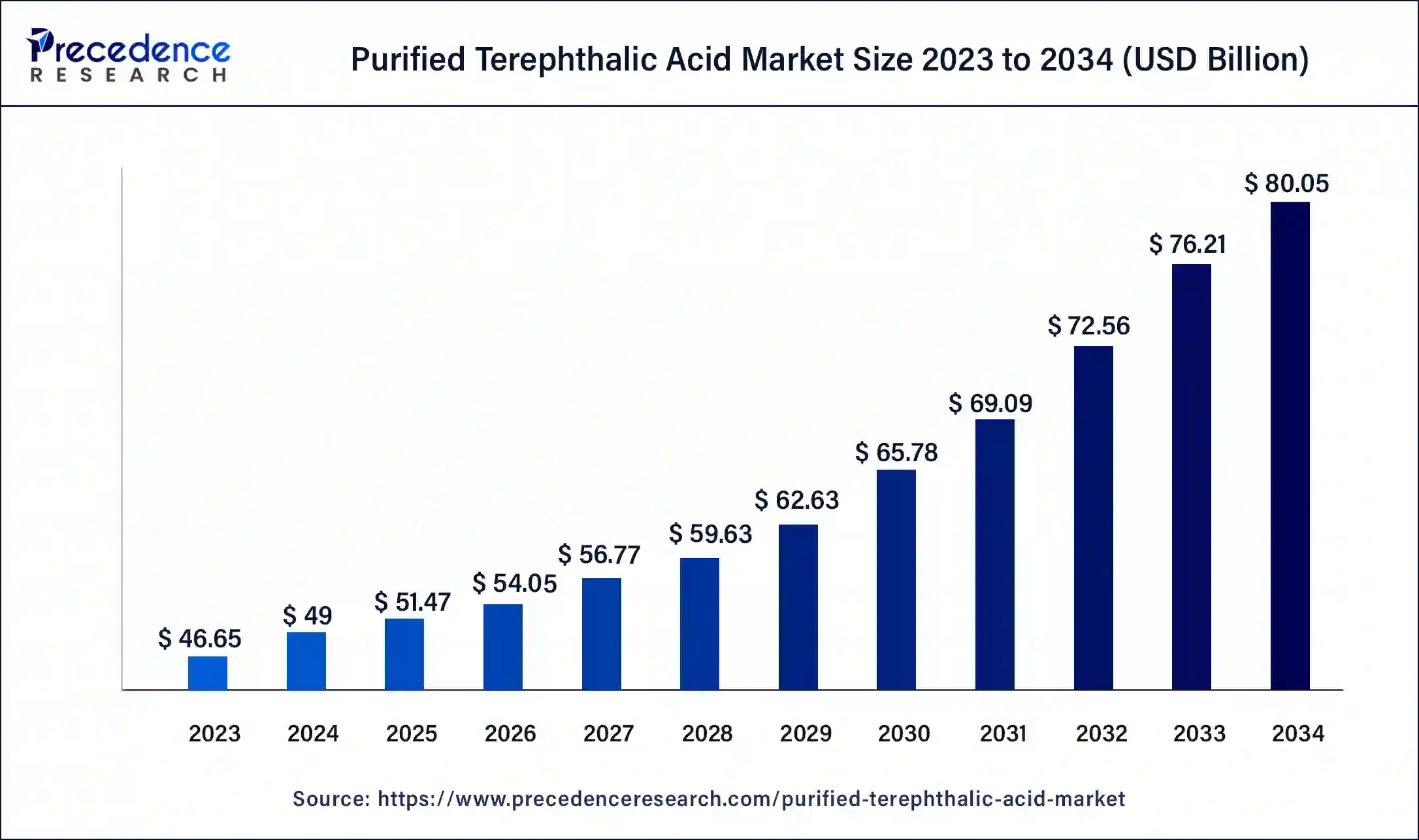

The global purified terephthalic acid market size was USD 46.65 billion in 2023, calculated at USD 49 billion in 2024 and is expected to be worth around USD 80.05 billion by 2034. The market is slated to expand at 5.03% CAGR from 2024 to 2034.

The global purified terephthalic acid market size is projected to be worth around USD 80.05 billion by 2034 from USD 49 billion in 2024, at a CAGR of 5.03% from 2024 to 2034. The increasing demand for polyester fibers from the automotive industry has driven the growth of the purified terephthalic acid market.

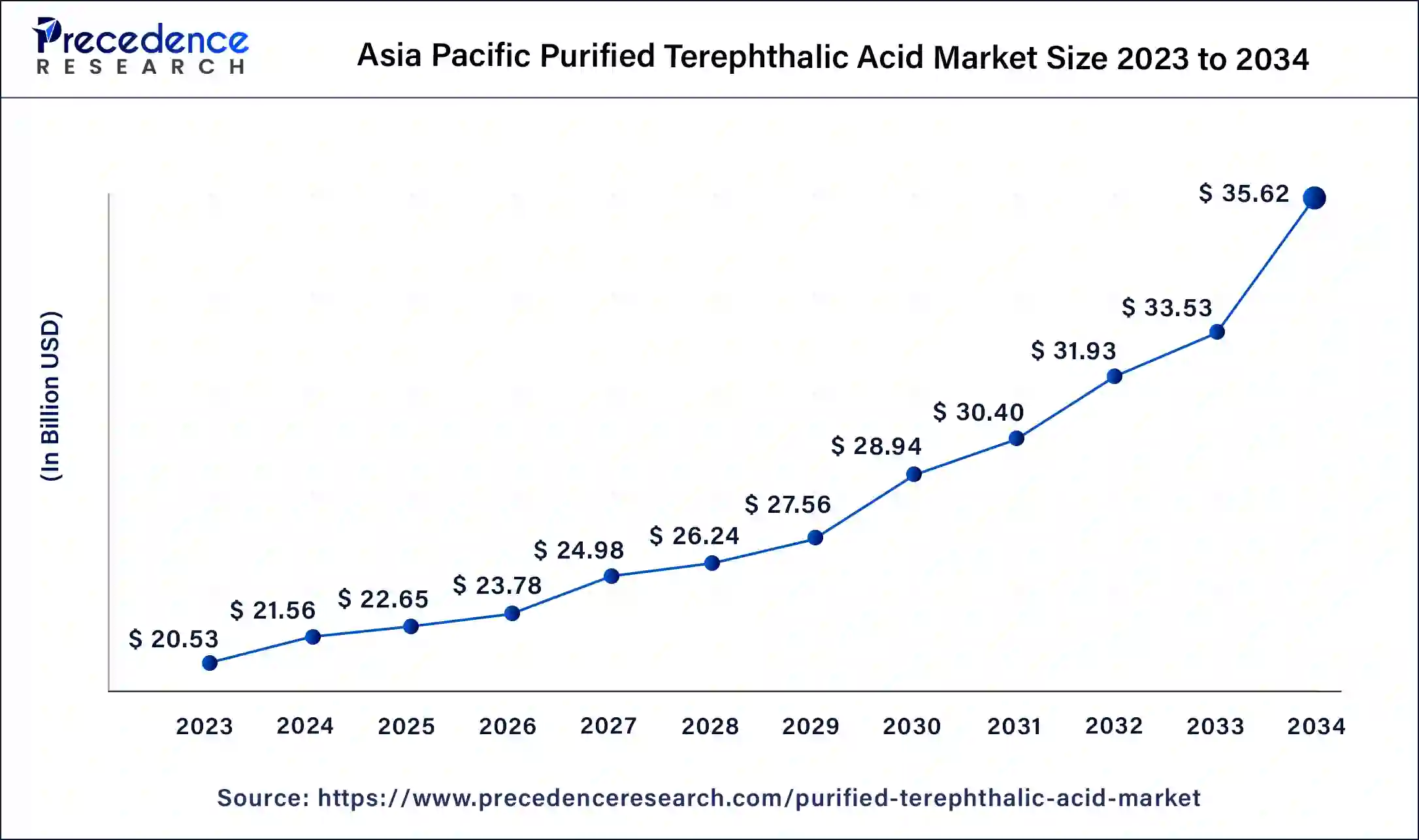

The Asia Pacific purified terephthalic acid market size was exhibited at USD 20.53 billion in 2023 and is projected to be worth around USD 35.62 billion by 2034, poised to grow at a CAGR of 5.13% from 2024 to 2034.

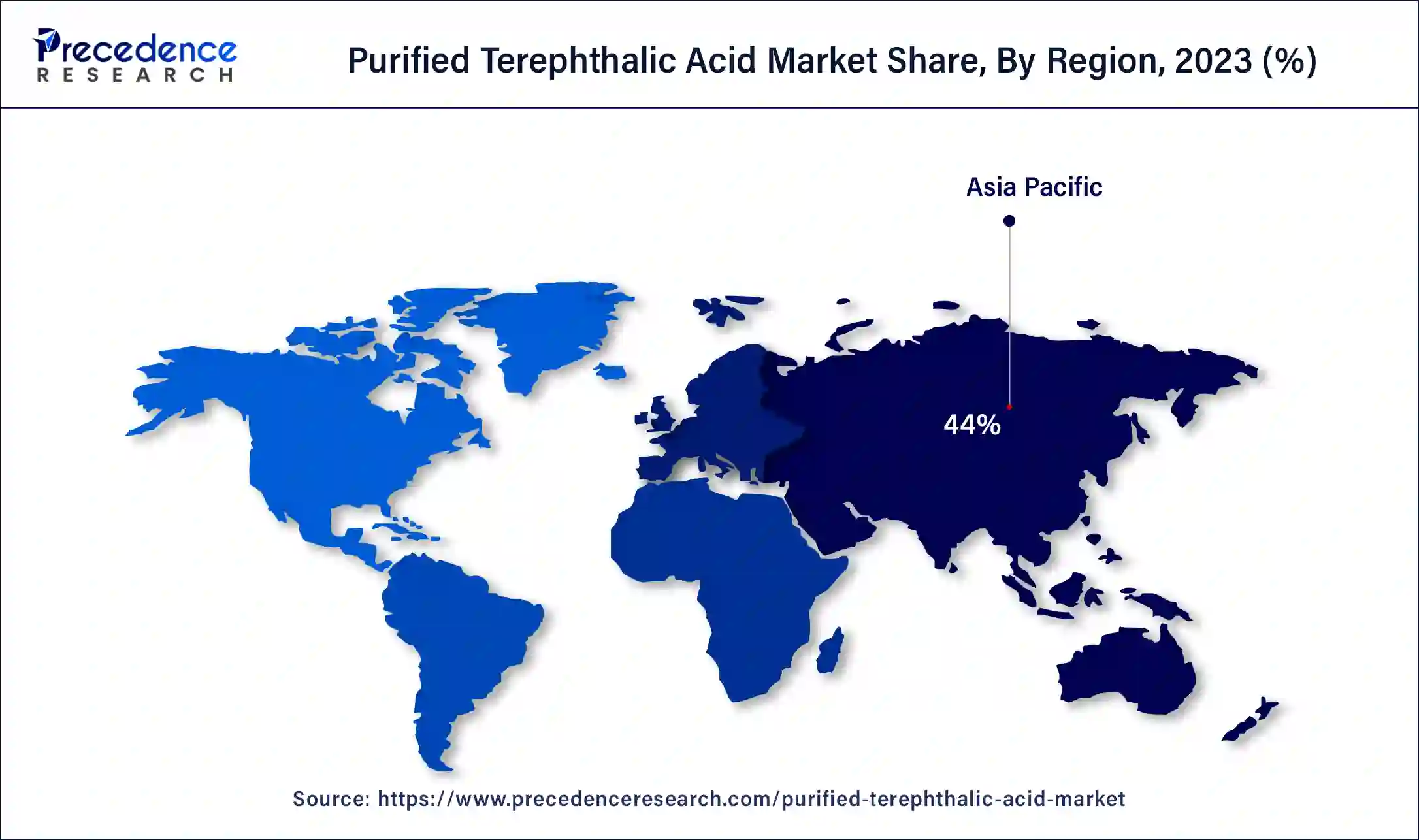

Asia Pacific held the largest share of the purified terephthalic acid market. The growing development in the chemical sector in countries such as China, India, Japan, South Korea, and others drives market growth. Also, the growing demand for polyester resins in the clothing industry has shaped the industry in a positive way. The rising development in the electronics and electrical industry, especially in China, Japan, and South Korea, has further increased the demand for PTA. Additionally, the growing investment by the governments of several countries in developing the textile industry in this region is driving industrial growth.

Asia-Pacific consists of various local companies related to purified terephthalic acid, such as Reliance Industries Limited, Zhejiang Yisheng New Material, Indorama Ventures, BP Chemicals, Mitsubishi Chemical Group, Yisheng Petrochemical, Hengli Petrochemical and some others are constantly developing high-grade purified terephthalic acid to maintain the demand-supply chain in Asia Pacific region which in turn is expected to drive the growth of the purified terephthalic acid market.

North America is expected to be the fastest-growing region during the forecast period. The rising development in the automotive industry, along with several companies such as Ford, Rivian, Cadillac, Tesla, and Chevrolet, has increased the demand for PTA to perform several operations, thereby driving market growth. The food & beverage industry in the U.S. and Canada is highly developed, which increases the demand for PET-based packaging, which in turn drives the market growth. Also, the rising demand for purified terephthalic acid from the coatings and the construction sector is likely to boost the purified terephthalic acid market growth.

This region consists of local market players of purified terephthalic acid (PTA) such as Eastman Chemical Company, DuPont, Dow, ExxonMobil Olin Corporation, and some others that are constantly engaged in manufacturing superior grade PTA use in different industries and adopting several strategies such as partnerships, acquisitions, collaborations, launches, and business expansions, which in turn drives the growth of the purified terephthalic acid market in this region.

The purified terephthalic acid market is an important industry in the chemical sector. This market deals in the manufacturing and distribution of purified terephthalic acid (PTA) for numerous industries. This acid is mainly derived from crude terephthalic acid (CTA) purification by oxidation of P-Xylene. There are various applications of PTA, including PET resin, polybutylene terephthalate, polyester fiber, films, and intermediate. This market is driven by the rising use of PTA for home furnishing. The end-users of this industry include food & beverage packaging, construction, electrical & electronics, textiles, paints & coatings, furniture, and some others. This industry is expected to rise exponentially with the growth in the chemical industry.

What is the role of AI in the purified terephthalic acid industry?

The chemical industry is advancing rapidly with the developments in modern technologies such as AI, ML, Big Data Analytics, Blockchain, and some others. Most of the chemical manufacturing companies have started integrating AI in their production plant to increase the efficiency of the workers and automate several tasks. Nowadays, market players in purified terephthalic acid (PTA) have started using AI technology in the synthesis of terephthalic acid using Diels-Alder reactions and for analyzing the efficacy of ortho-phthalic acid. Thus, AI plays a prominent role in the development of the purified terephthalic acid market.

Top 10 PET Bottle Manufacturers

| Report Coverage | Details |

| Market Size by 2034 | USD 80.05 Billion |

| Market Size in 2023 | USD 46.65 Billion |

| Market Size in 2024 | USD 49 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.03% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, End-User Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising use of polybutylene terephthalate in electricals and automotive

The chemical industry has gained traction recently with the rising application of polybutylene terephthalate across the world. The demand for polybutylene terephthalate has increased due to several advantages such as UV resistance, weight reduction, high rigidity, heat resistance, moldability, and others. The use of PBT has increased in the electrical industry due to the growing demand for insulators. Also, the application of PBT in the automotive sector has grown due to its use in manufacturing automotive sensors, headlight bezels, pump impellers, lamp sockets, and others. Thus, the growing application of PBT in automotive and electrical is expected to drive the growth of the purified terephthalic acid market.

Environment issues and side-effects on health

The purified terephthalic acid market is retarded due to several problems associated with the use of PTA. The excessive use of PTA can act as an environmental pollutant that might cause toxic wastewater, which in turn restrains the market growth. Also, the increased application of PTA can cause lung diseases and shortness of breath, which can act as a restraining factor in the market growth of PTA.

Developments in AMOCO process and advancements Bio-based terephthalic acid

The purified terephthalic acid market is developing rapidly due to advancements in extraction methodologies associated with PTA. The rising developments in the AMOCO process that use homogeneous catalysts such as Co/Mn/Br for the oxidation of para-xylene into terephthalic acid are found beneficial for the market players. Also, the various advancements associated with bio-based terephthalic acid using Diels-Alder methods are highly adopted by the PTA manufacturers for numerous advantages. Thus, rising developments associated with the AMOCO process and bio-based terephthalic acid are expected to create ample growth opportunities for the market players in the upcoming years.

The PET resin segment dominated the market in 2023. The increasing demand for PET resin from the packaging industry due to its high strength and stiffness compared to PBT has driven market growth. Also, the advantages of PET resin, such as stability, recyclability, impact & thermal resistance, and some others that are useful in the textiles industry, are likely to propel the market growth. Moreover, the growing application of PET resin in the automotive sector for manufacturing door panels, car interior panels, and trims has boosted industrial growth. Furthermore, the increasing use of PET resin in the electronics industry for packing electronic chips is expected to drive the growth of the purified terephthalic acid market during the forecast period.

The polyester fiber segment is estimated to exhibit a significant growth rate during the forecast period. The rising demand for polyester fiber from the furniture industry for manufacturing upholstery of sofas and chairs has driven the market growth. Also, the growing use of polyester fiber from the textile industry for manufacturing jackets, trousers, shirts, jackets, and others is likely to propel the market growth.

Additionally, the increasing application of polyester fibers in the production of mouse pads, car tire reinforcements, conveyor belts, bottles, and some others has boosted industrial growth. Moreover, the growing use of polyester fabrics in manufacturing dielectric films, tarpaulin, LCDs, insulating tapes, and some others, along with its increased application in home furnishing products such as curtains, bedsheets, pillowcases, and blankets, is expected to drive the growth of the purified terephthalic acid market during the forecast period.

The textile segment held a dominant share of the purified terephthalic acid market in 2023. The rising demand for designer clothes due to numerous parties, occasions, ceremonies, and other factors has increased the demand for PTA. Also, the increasing use of PTA in the textile sector as a raw material for polyester-based staple fiber and yarn is likely to boost the market growth. Moreover, the growing demand for polyester jackets and trousers has increased the demand for PTA and is expected to drive the growth of the purified terephthalic market during the forecast period. Furthermore, the growth in the textile sectors, along with increased initiatives from the governments of several countries to develop the eco-friendly textile industry, fosters market growth.

Segments Covered in the Report

By Application

By End-User Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

December 2024

September 2024