January 2025

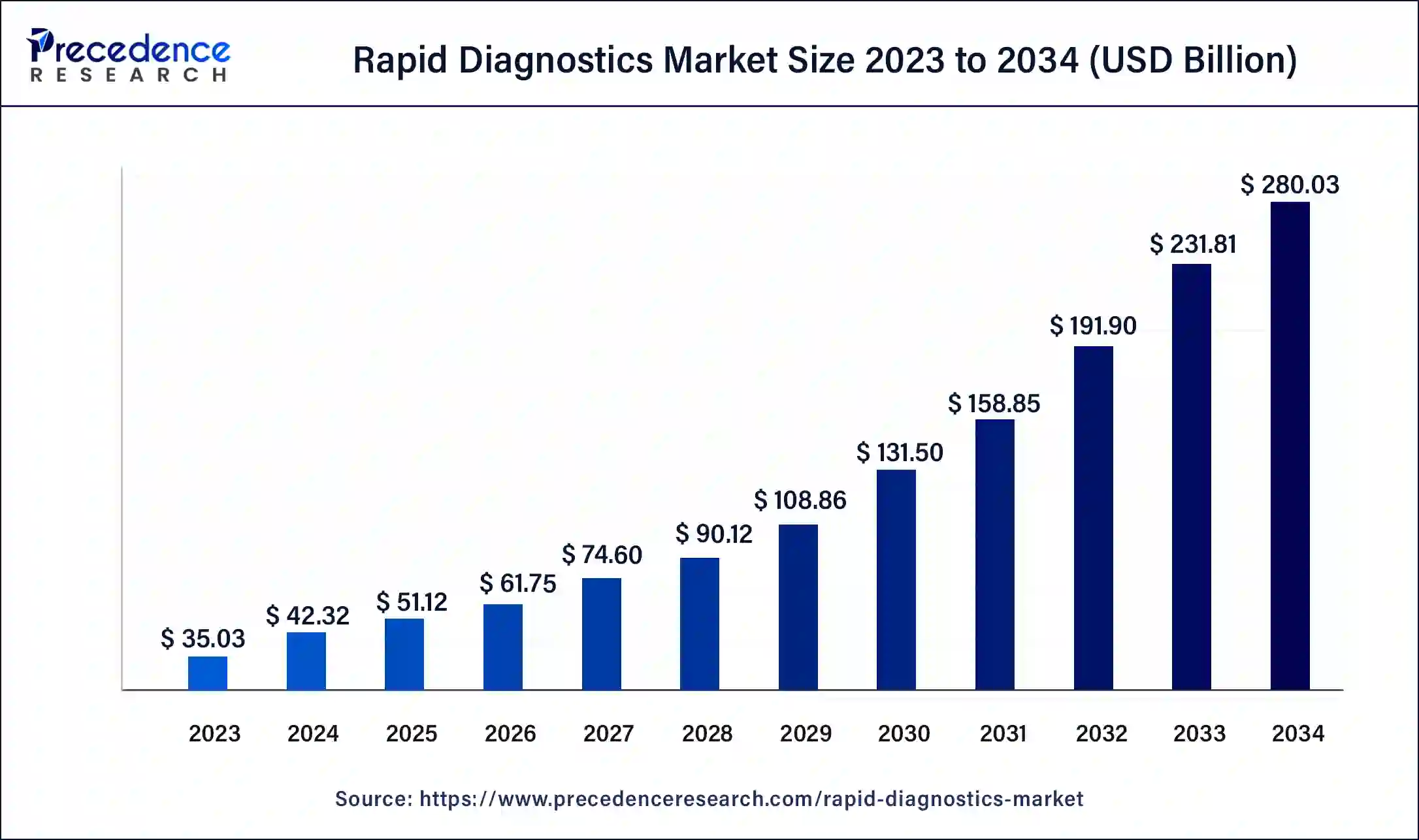

The global rapid diagnostics market size was USD 35.03 billion in 2023, calculated at USD 42.32 billion in 2024 and is expected to reach around USD 280.03 billion by 2034, expanding at a CAGR of 20.8% from 2024 to 2034.

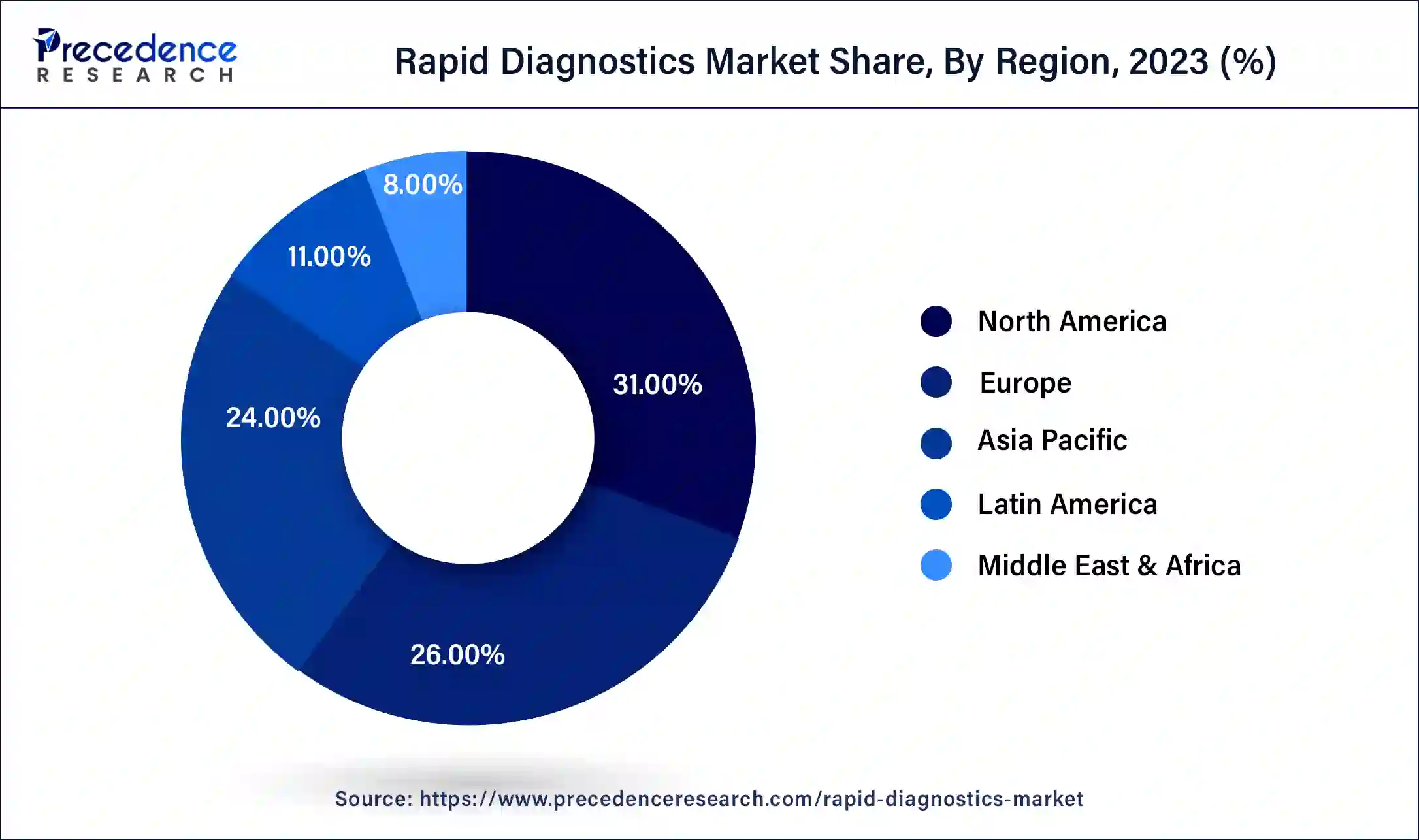

The global rapid diagnostics market size accounted for USD 42.32 billion in 2024 and is expected to reach around USD 280.03 billion by 2034, expanding at a CAGR of 20.8% from 2024 to 2034. The North America rapid diagnostics market size reached USD 10.86 billion in 2023.

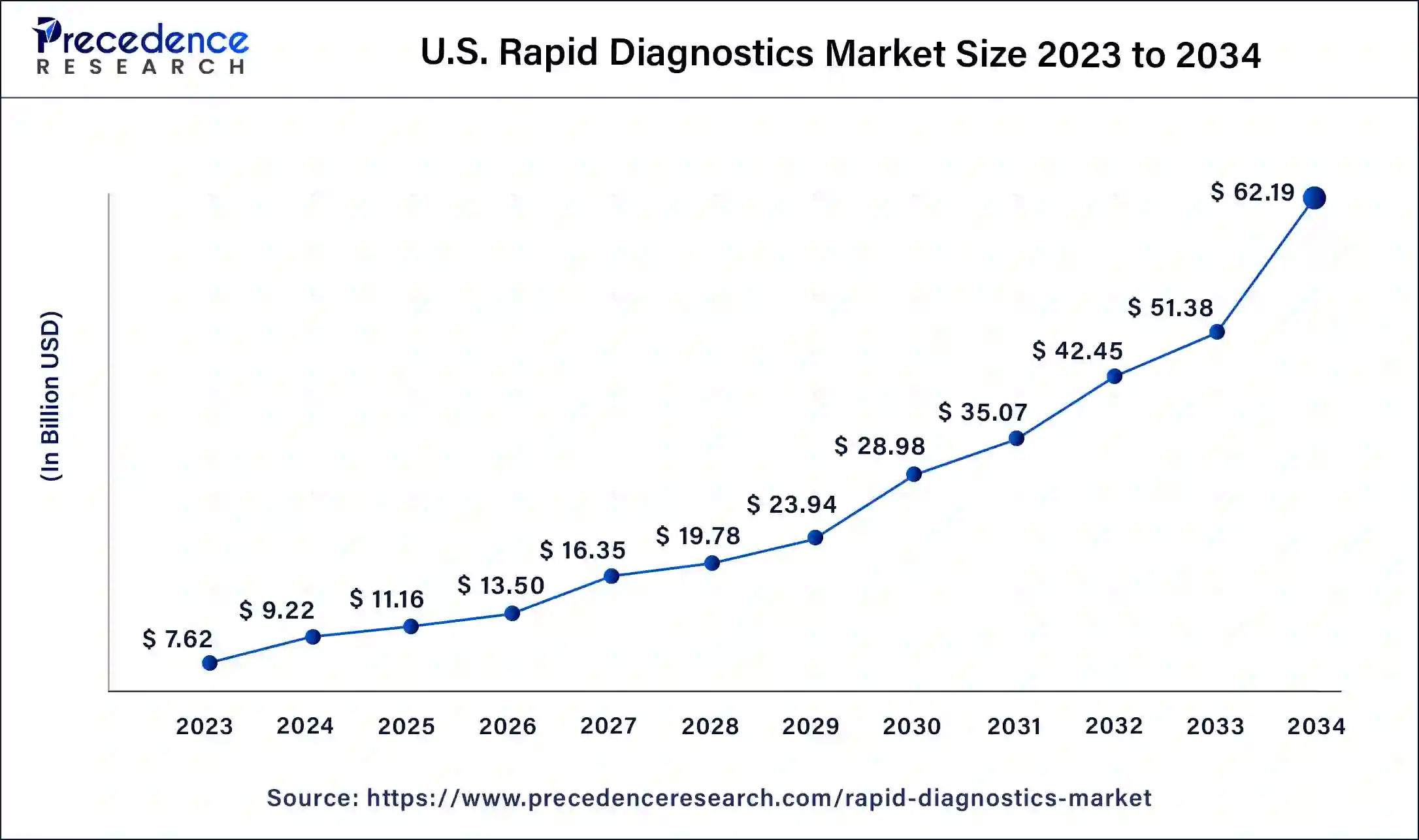

The U.S. rapid diagnostics market size was estimated at USD 7.62 billion in 2023 and is predicted to be worth around USD 62.19 billion by 2034, at a CAGR of 21% from 2024 to 2034.

North America overwhelmed the market in 2023 with a portion of over 31% and is supposed to keep up with its lead from 2024 to 2034. The U.S. rised as the key income-creating portion in 2023. Various diagnostics organizations are engaged with the improvement of novel COVID-19 quick demonstrative tests and are endeavoring to acquire endorsement from the FDA to send off these tests in the U.S.

Latin American region is projected to select the most raised advancement during the figure time given government tries to increase care about the early disclosure of ailments and standard prosperity check-ups, further propelling sign of-care devices. Likewise, growing clinical benefits utilization, extending the number of crisis facilities and clinical demonstrative labs, and growing facilitated endeavors among players in the district is moreover expected to drive market improvement.

The Latin American market integrates Brazil, Mexico, and other Latin American countries like Argentina, Chile, Peru, Colombia, Venezuela, and Bolivia. The speedy advancement of geriatric people in a couple of Latin American countries is one of the main issues supporting the improvement of the PoC diagnostics market in Latin America. Moreover, the pace of a couple of overpowering diseases, similar to wilderness fever, flu, and AIDS, is extending around here. This, subsequently, is empowering a strong interest in overwhelming disorder diagnostics.

The market for rapid diagnostics is set to pick up speed before long inferable from the rising need and mindfulness concerning the fast clinical assessment of constant sicknesses, developing interest for point of care (POC) diagnostics, a high convergence of convenient fast testing gadgets on the lookout, ascend in the number of irresistible infection cases, and extending geriatric populace base. The European Center for Disease Prevention and Control, the WHO, and the CDC effectively participated in planning information on the occurrence and predominance of irresistible sicknesses to methodically control the illness. Cooperative endeavors of the public authority bodies with nearby specialists to accomplish general control of treatment and the board of infectious illnesses are supposed to enhance the reception of fast tests.

| Report Coverage | Details |

| Market Size in 2023 | USD 35.03 Billion |

| Market Size in 2024 | USD 42.32 Billion |

| Market Size by 2034 | USD 280.03 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 20.8% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, Application, and End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Over-the-counter (OTC) units overwhelmed the market in 2023 with a portion of 56%. This is credited to the way that these tests are not difficult to use in the "close understanding setting" and is a financially smart option in contrast to costly research center testing. These tests are regularly utilized in-home consideration settings, giving a simple and financially smart option in contrast to research facility testing. Fast Diagnostic Tests (RDTs) generally utilize salivation, pee, and blood to analyze infections.

As indicated by the Consumer Healthcare Products Association, clinical expense reserve funds added up to over USD 77 billion inferable from the low estimating of OTC analytic items. These tests likewise help in the location of different irresistible and persistent sicknesses with restricted or no side effects, working with early therapy and decreasing different difficulties related to the infection. While these tests are most frequently utilized in-home consideration settings, these tests are likewise utilized in clinics, centers, and symptomatic labs.

Proficient fast demonstrative test packs represented a huge income share in 2023. These tests most frequently utilize procedures, like PCR and atomic diagnostics, giving higher test awareness and particularity. Proficient research center tests are commonly performed after a positive RDT has been acquired to affirm infection analysis. As RDTs have low awareness, they frequently give bogus negatives, consequently, the utilization of expert tests is viewed as the highest quality level in symptomatic settings.

The lateral flow innovation fragment represented the biggest income portion of 36% in 2023. The low advancement cost and simple assembling of horizontal stream examines have prompted the extension of these tests into a few quick testing applications. Lateral flow tests are generally embraced across subjective and quantitative ID of explicit antigens, quality intensification items, and antibodies in clinics, facilities, and symptomatic research centers, along these lines further adding to the fragment development.

Growing utilization of parallel stream tests in the early recognition of COVID-19 has been seen as of late. For example, in March 2020, Ozo Life declared the send-off of its OZO COVID-19 Rapid Test Kits-a plastic upgraded parallel stream immunoassay, which guarantees testing of the SARS-CoV-2disease with improved responsiveness. In addition, an expansion in people in general and private associations for the advancement of novel horizontal stream tests focused on COVID-19 findings is set to move the fragment development.

The solid-phase technology fragment represented a critical income share in 2020. These are utilized to identify different focuses in a solitary test, expanding the utilization of the patient example. The presence of a wide range of biomarkers, microorganisms, and ecological toxins is identified by horizontal stream testing, bringing about the rising interest in these items.

The infectious disease testing fragment held the biggest income portion of almost 43% in 2023. The episode of the novel Covid (COVID-19) has encouraged a pressing interest for its fast demonstrative arrangements as it is a foundation of the administration of the COVID-19 pandemic. As of January 2021, a bigger number than 99 million COVID-19 patients have been accounted for across the globe, adding to the section's income age limit.

Nations including the U.S., Brazil, Russia, the U.K., Spain, Italy, India, Germany, Turkey, and Colombia have detailed the biggest number of COVID-19 cases. Mass testing has expanded to deal with this pandemic. To satisfy this developing need, various diagnostics organizations are zeroing in on R&D exercises for the advancement of novel COVID-19 quick clinical symptomatic units and acquiring endorsement from various administrative bodies.

The blood glucose testing section is expected to enroll the quickest development rate during the estimated time frame. The sheer volume of fast blood glucose tests promoted and presently underutilization is a vital supporter of the section development. Plus, plentiful reception of these tests for the prompt estimation of raised blood cholesterol levels across helped to reside focuses, home consideration, facilities, and labs is supposed to support the section development.

In 2023, clinics and hospitals held the biggest portion of 51% as they act as essential consideration settings for the determination and treatment, everything being equal. Moreover, expanding hospitalization because of the flare-up of COVID-19 is supposed to help section development. Consistent changes in the medical care industry have prompted an expansion in the requirement for emergency clinics with improved symptomatic administrations.

An ascent in medical care consumption all around the world has likewise altogether added to the development of the market. As clinics keep up with and gather information on illness pervasiveness, administrative bodies frequently work together with them for infection observation. Then again, with the appearance of POC diagnostics or at-home analysis, there has been a consistent ascent in the quantity of fast indicative tests being performed around the world.

The home care end-use section is supposed to observe huge development over the figure time frame. Most fast flu analytic packs that are Clinical Laboratory Improvement Amendments (CLIA) postponed are ordinarily utilized in POC settings. Horizontal stream fast antigen measure that distinguishes pregnancy at home is generally utilized, hence driving the interest for home use units. Blood glucose testing strips are likewise usually utilized at home, which is a protected, simple, and reasonable method for actually looking at diabetes. The previously mentioned factors are cooperatively set to add to the development of the home consideration end-user section.

Segments Covered in the Report

By Product

By Technology

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

December 2024

December 2024