October 2024

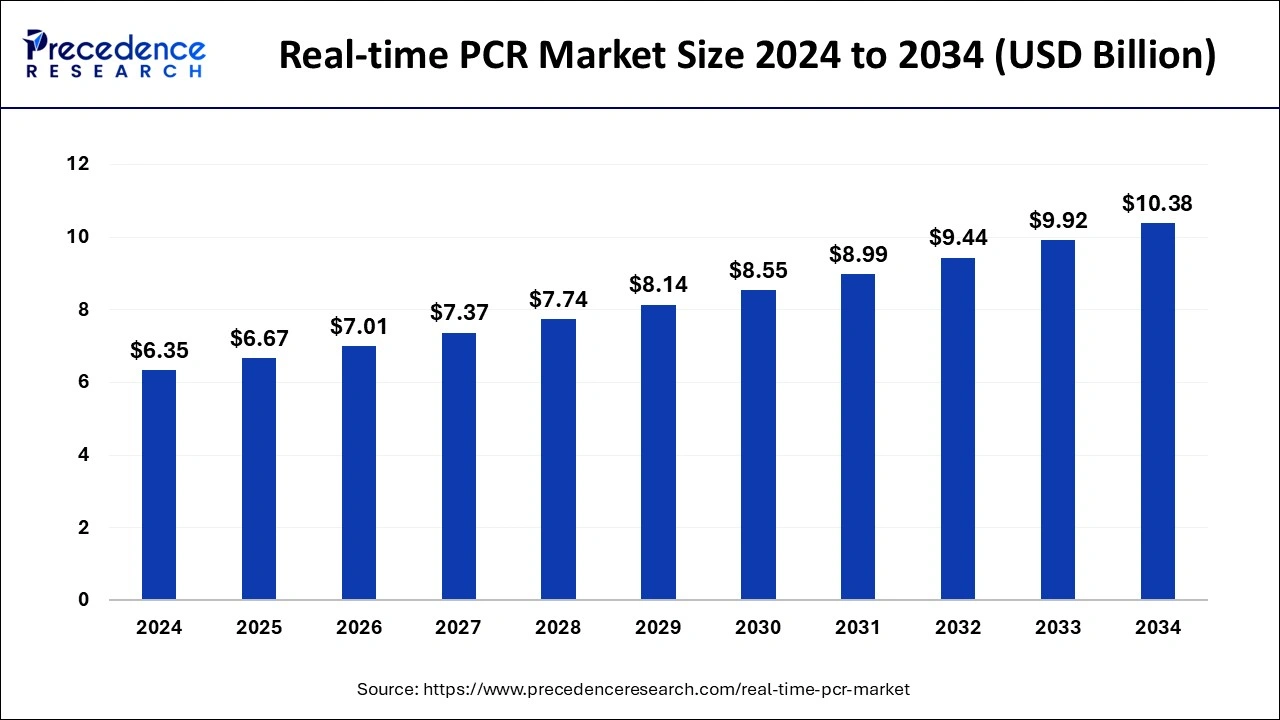

The global real-time PCR market size is calculated at USD 6.67 billion in 2025 and is forecasted to reach around USD 10.38 billion by 2034, accelerating at a CAGR of 5.04% from 2025 to 2034. The North America real-time PCR market size surpassed USD 2.67 billion in 2024 and is expanding at a CAGR of 5.08% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global real-time PCR market size was calculated at USD 6.35 billion in 2024 and is expected to reach around USD 10.38 billion by 2034, expanding at a CAGR of 5.04% from 2025 to 2034. The rise in genetic disorders and rare diseases in human beings has increased the demand for real-time PCR (real-time Polymerase Chain Reaction), which is estimated to drive the growth of the real-time PCR market over the forecast period.

AI technologies make real-time PCR tests faster and more precise. AI analyzes large amounts of data automatically, which helps healthcare professionals in both treatment and discovery tasks while also preventing mistakes and speeding up results. Researchers can better control testing operations to achieve higher precision by integrating AI algorithms into RT-PCR systems. AI speeds up treatment and diagnostics development by providing healthcare experts and researchers with real-time information to make faster decisions.

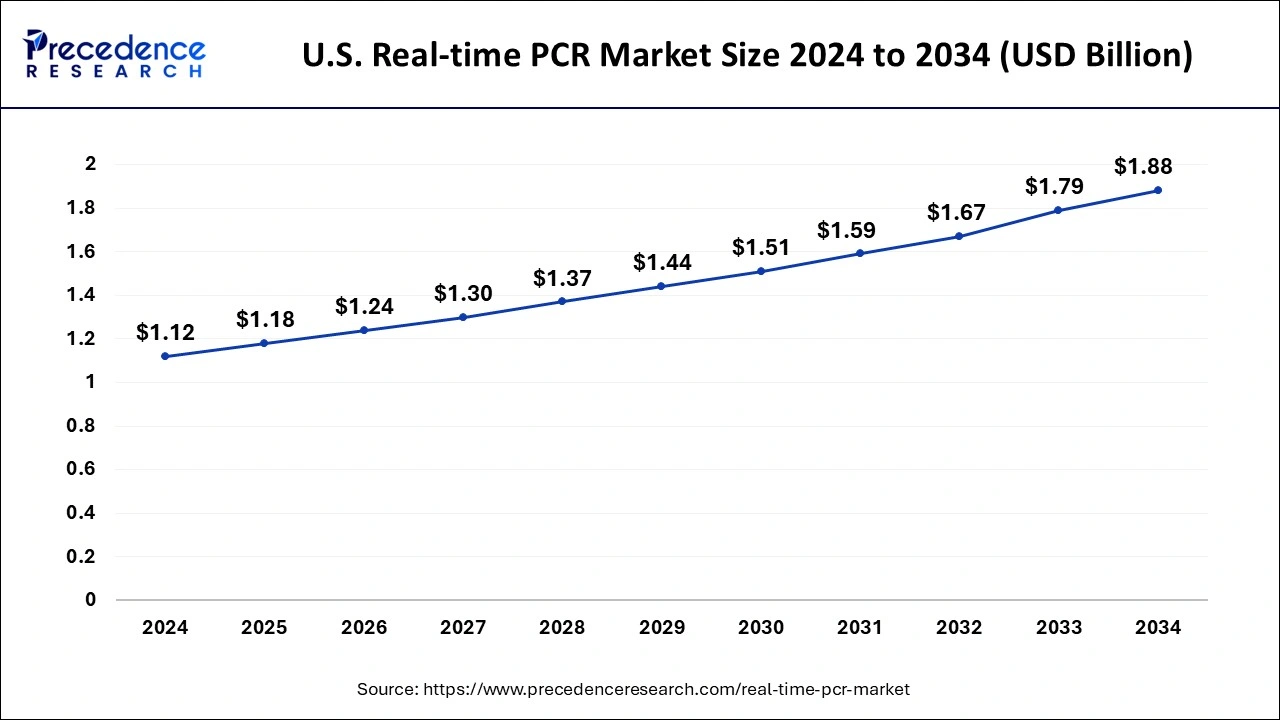

The U.S. real-time PCR market size was exhibited at USD 1.12 billion in 2024 and is projected to be worth around USD 1.88 billion by 2034, poised to grow at a CAGR of 5.32% from 2025 to 2034.

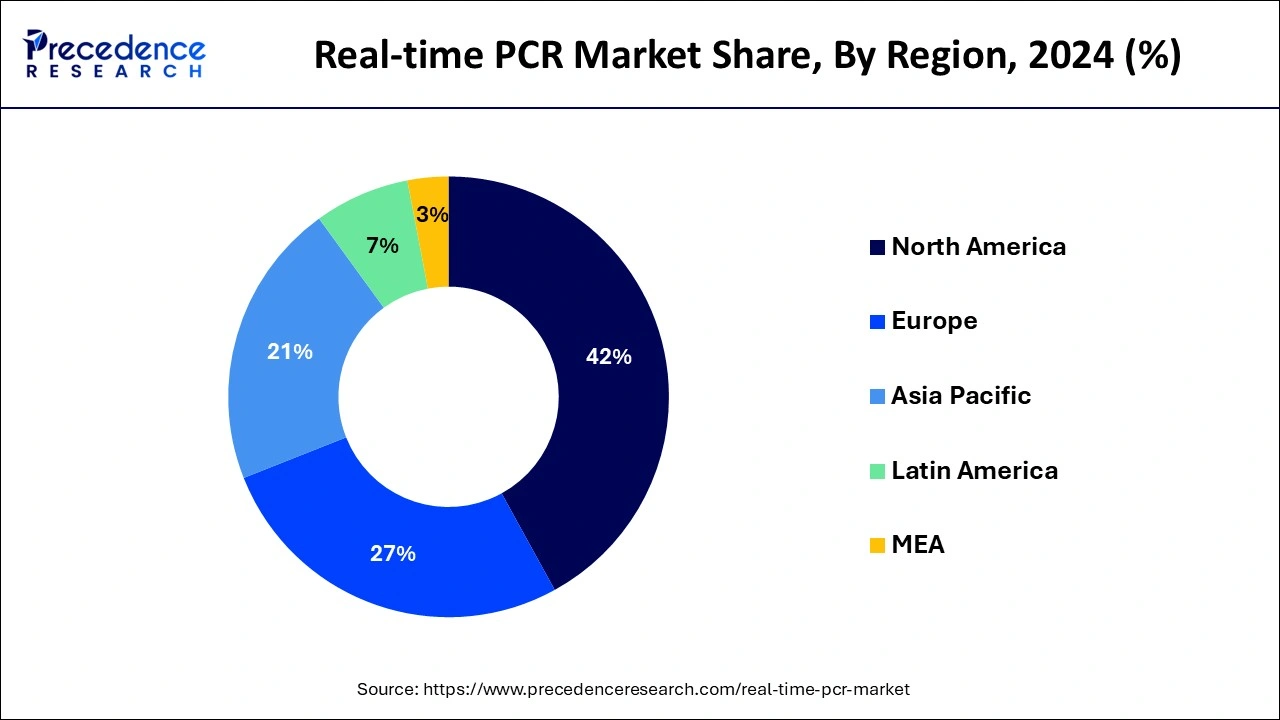

North America witnessed the highest revenue share in 2024. The increasing launch of real-time polymerase chain reaction kits by the key players operating in the North American market is estimated to fuel the growth of the real-time PCR market in the North American region.

Moreover, increasing funding activity and initiatives by the government of Canada is expected to drive the growth of the real-time PCR market in the Canadian region.

Asia Pacific is estimated to be the fastest-growing during the forecast period, significantly driven by the launch of new products by the key players operating in the real-time PCR market to meet high clinical needs.

Polymerase chain reaction (PCR) is a temperature-dependent nucleic acid amplification method that is used to enzymatically amplify DNA (Deoxyribonucleic acid) or RNA (Ribonucleic acid) in vitro. Polymerase chain reaction (PCR) products can be accurately detected and quantified with the use of real-time polymerase chain reaction (PCR), which is a valuable tool. Quantitative polymerase chain reaction (qPCR), a molecular biology laboratory technique based on the polymerase chain reaction (PCR), is another name for real-time polymerase chain reaction (PCR). In contrast to the traditional polymerase chain reaction (PCR) approach, which allows analysis only after the process is finished, the phrase "real-time" refers to the ability to track the amplification's progress while it is taking place.

Real-time polymerase chain reaction (PCR) works on the same amplification mechanism as polymerase chain reaction (PCR). Yet, the reaction is observed in "real-time" as opposed to seeing bands on a gel at the conclusion of the reaction. The reaction is added to a real-time polymerase chain reaction (PCR) apparatus, which uses a camera or detector to monitor the reaction as it happens. While there are numerous methods for tracking the development of a PCR reaction, they are always similar in one way. They all relate the production of fluorescence, which can be easily seen with a camera during each polymerase chain reaction (PCR) cycle, to the amplification of DNA (Deoxyribonucleic acid). Therefore, the fluorescence grows together with the amount of gene copies during the reaction, indicating the reaction's progress. The applications of real-time PCR are mutation detection, gene expression analysis, detection and quantification of pathogens, detection of allergens, species identification, detection of genetically modified organisms, determination of parasite fitness, and monitoring of microbial degradation.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.38 Billion |

| Market Size in 2025 | USD 6.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.04% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing launch of the new real-time polymerase chain reaction system

The rise in the launch of the new real-time polymerase chain reaction system by the key market players operating in the market is expected to drive the growth of the real-time PCR market over the forecast period. The real-time polymerase chain reaction data makes it easy to conduct a fully quantitative analysis of gene expression. Therefore, in contrast to standard preparative PCR, Real-time PCR avoids "false negatives" by enabling the success of numerous polymerase chain reactions to be automatically determined after a short number of cycles without requiring individual inspection of each reaction.

Challenges and limitations associated with the real-time polymerase chain reaction

The limitations and challenges occurring with real-time polymerase chain reactions can restrict the growth of the real-time PCR market. For instance, in May 2023, according to the data published by the National Center for Biotechnology Information, it was estimated that there are various obstacles and restrictions associated with real-time polymerase chain reaction (PCR). The complexity and expense of microfabrication and detection techniques like electrochemical amplicon or fluorophore-assisted detection make point-of-care testing less feasible.

Furthermore, the PCR process's lengthy amplification time and complexity make it ineffective for diagnosing infectious infections that appear suddenly. The use of PCR in medical sciences and research is further hampered by limited access to sufficient instruments and resources, especially in underdeveloped African nations. Furthermore, bacteriological investigations must be incorporated into laboratory control schemes in order to identify species and assess the viability of microorganisms, as PCR may not be sufficient for these tasks alone. The mentioned hurdles and constraints highlight the necessity for progress in real-time polymerase chain reaction technology to overcome them and enhance its efficacy across a range of uses.

Approval by the regulatory authorities

Increasing approval of the newly innovated products by regulatory bodies is expected to create a lucrative opportunity for the growth of the real-time PCR market.

The reagents & consumables segment held the dominating share of the real-time PCR market in 2024 on account of increasing approval of the newly innovated products by the regulatory bodies.

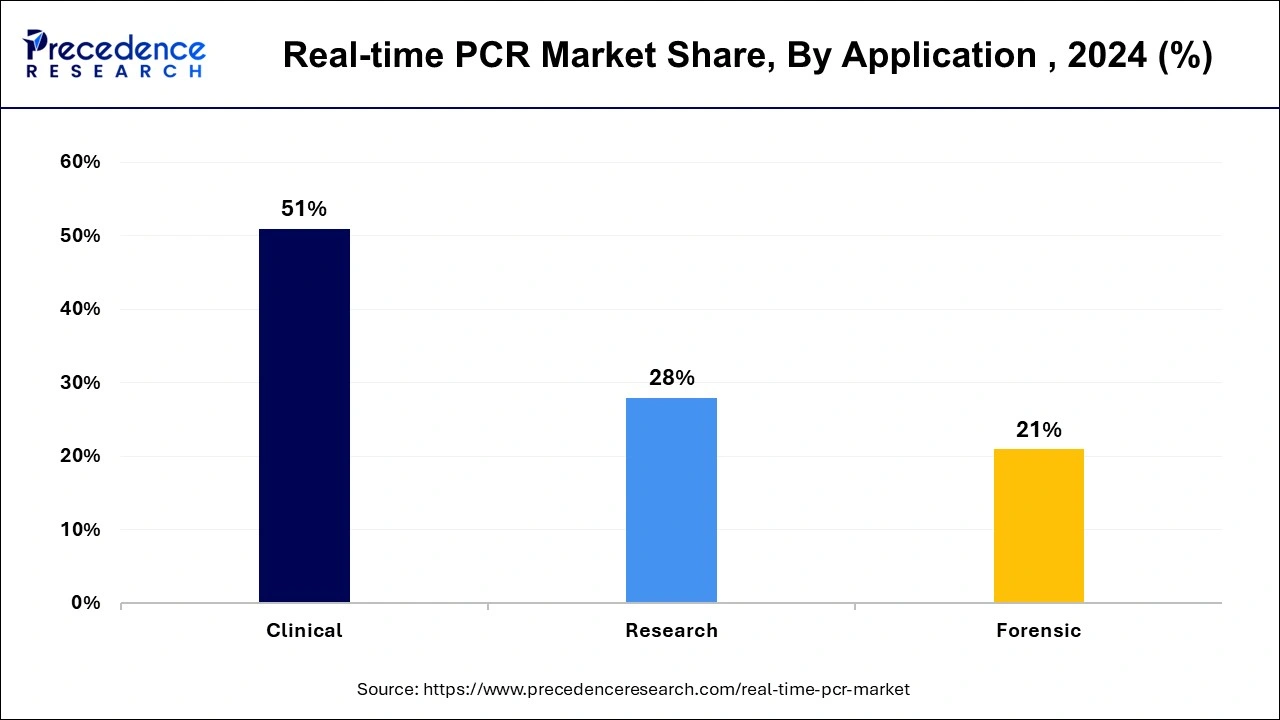

The clinical segment held the largest share of the real-time PCR market in 2024. The increasing launch of the new clinical trial center for drug development and gene therapy development is estimated to drive the growth of the segment over the forecast period.

Furthermore, the forensic segment is expected to show the fastest growth over the forecast period. Forensic genetic genealogy has become an invaluable resource for law enforcement investigations due to the proliferation of consumer DNA testing and open genetic databases. The characteristics of inherited genetics are essential to forensic genetic genealogy. The criminal justice community has benefited significantly from the use of DNA analysis done with the real-time polymerase chain reaction technique in forensic laboratories.

Increasing the launch of the reagent kit for DNA analysis by the polymerase chain reaction technique is expected to foster the growth of the segment over the forecast period. For instance, in March 2024, Promega Corporation, a biotechnology company mainly focused on manufacturing enzymes and molecular biology with a portfolio covering the fields of genetic identity, cellular analysis, genomics, protein analysis, and expression, among others, announced the introduction of the new DNA analysis kit with a different color reagent used to carry out polymerase chain reaction in Europe and used widely in the forensic labs.

The Promega Corporation introduced the PowerPlex 18E System, which combines eight-color short tandem repeat (STR) analysis chemistry to extract more useful information from difficult samples. All of the DNA markers that the European Network of Forensic Science Institutes (ENFSI), monopoly organization in the field of forensic science by the European Commission, monopoly organization in the field of forensic science by the European Commission recommends are included in the kit. Promega Corporation manufactured an eight-color chemistry kit for forensic DNA analysis.

The hospitals & diagnostic centers segment held the largest share of the real-time PCR market in 2024. The increasing prevalence of breast cancer due to changing lifestyles is raising the demand for point-of-care tests as well as oncology testing, which is expected to drive the segment growth over the forecast period. For instance, in March 2023, according to the data published by the World Health Organization, it was estimated that 670,000 deaths took place globally in the year 2022 due to breast cancer. Hence, the increasing prevalence of chronic diseases like breast cancer is raising the demand for oncology testing with real-time polymerase chain reaction techniques at hospitals & diagnostic centers.

By Product

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

July 2024

October 2023

December 2023