List of Contents

Real-World Data (RWD) Market Size and Forecast 2025 to 2034

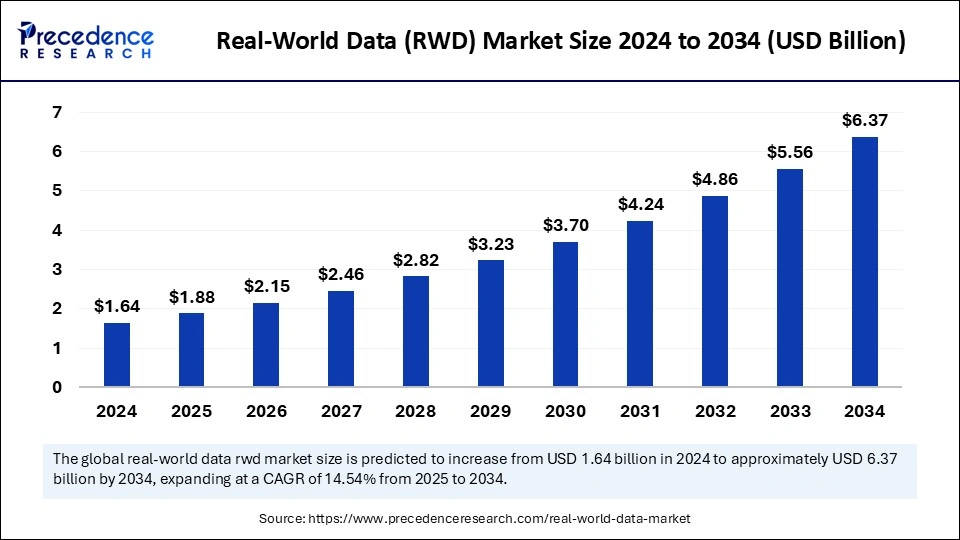

The global real-world data (rwd) market size was estimated at USD 1.64 billion in 2024 and is predicted to increase from USD 1.88 billion in 2025 to approximately USD 6.37 billion by 2034, expanding at a CAGR of 14.54% from 2025 to 2034. The market growth is attributed to the increasing adoption of real-world data in clinical research and personalized healthcare solutions.

Real-World Data (RWD) Market Key Takeaways

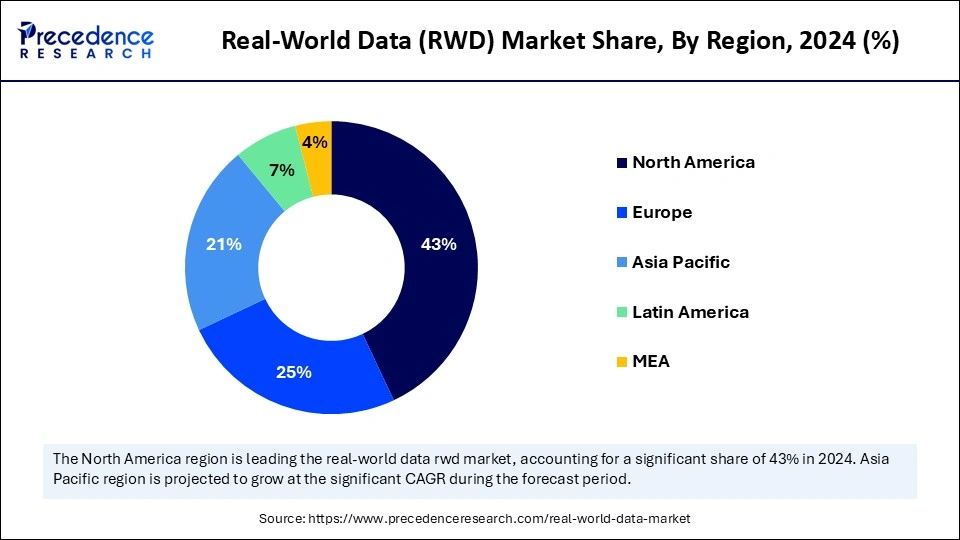

- North America led the market by holding 43% of market share in 2024.

- Asia Pacific is projected to grow at a solid CAGR of 11% in the coming years.

- By component, the services segment held a dominant presence in the market in 2024.

- By component, the datasets segment is expected to grow at the fastest rate during the forecast period of 2024 to 2034.

- By application, the drug development and approvals segment accounted for a considerable share of the market in 2024.

- By application, the post-market surveillance segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By end-user, in 2024, the pharmaceutical and medical device companies segment led the global market.

- By end-user, the healthcare providers segment is projected to expand rapidly in the coming years.

Impact of Artificial Intelligence (AI) on the Real-World Data (RWD) Market

The modern industry benefits from artificial intelligence through its capabilities to improve efficiency, together with automation of difficult operations, and creative advancements. Businesses use AI-driven analytics to direct better decisions while improving client interactions and enhancing operational processes. Advanced machine learning models study a massive collection of data to recognize patterns together with trend forecasting capabilities for productivity improvements. Furthermore, AI brings business efficiency through personal marketing capabilities for fraud detection and predictive maintenance, which drives inter-sectoral competition.

U.S. Real-World Data (RWD) Market Size and Growth 2025 to 2034

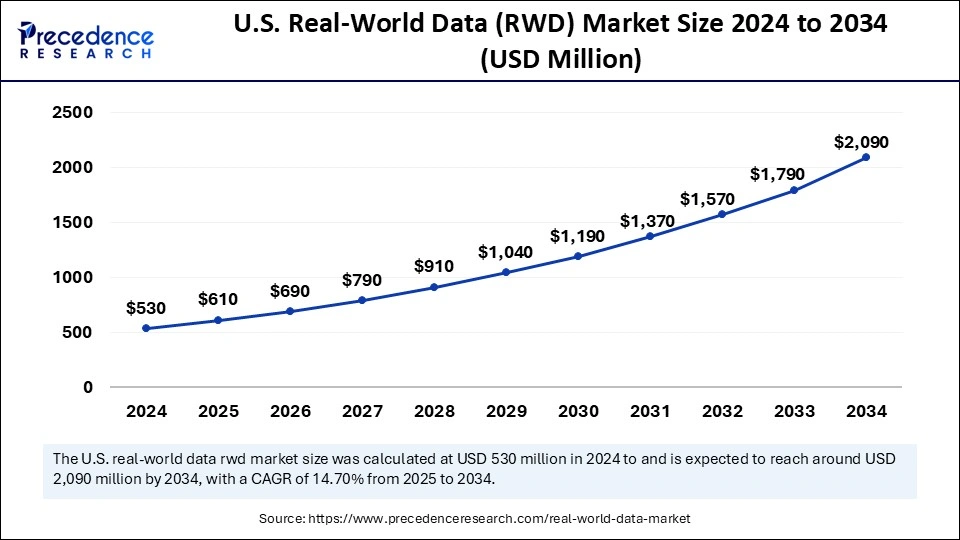

The U.S. real-world data (rwd) market size was exhibited at USD 530 million in 2024 and is projected to be worth around USD 2,090 million by 2034, growing at a CAGR of 14.70% from 2025 to 2034.

North America led the real-world data (RWD) market, capturing the largest revenue share in 2023 due to its strong medical facilities and wide implementation of electronic health record systems. The U.S. Food and Drug Administration (FDA) in 2024 pushed to use RWD as a tool for boosting drug development processes and monitoring the medications after-market release. The RWD market leadership of North America received additional support from healthcare providers and technology company collaborations, which optimized data sharing and analytics processes.

Asia Pacific is projected to host the fastest-growing real-world data (RWD) market in the coming years, owing to the rapid digitalization process in Chinese and Indian healthcare systems, which has resulted in the massive creation of health data. The implementation of government initiatives that focus on healthcare results and cost reduction has driven healthcare providers toward data-driven decision applications. The growing frequency of chronic diseases throughout the region makes RWD an essential resource that enhances healthcare solutions to benefit patient care needs.

India has established itself as one of the primary data center centers in Asia Pacific by surpassing established locations, such as Singapore, Australia, South Korea, Japan, and Hong Kong, in their installed capacity. Furthermore, the data center market in Johor province continues to increase in Southeast Asia, with Malaysia investing in data centers to boost its economy. Data centers pose risks to existing resource problems because they consume significant amounts of electricity and water, according to expert warnings.

India becomes an essential power in the Asia-Pacific data center environment, as its current installed capacity of 950 MW will be expanded to 850 MW by 2026.

Market Overview

The real-world data (RWD) market demonstrates strong expansion as organizations increasingly use RWD to bolster their drug development through approvals, market access programs, and post-market surveillance programs. Health-related information obtained from medical records maintained in electronic health records databases, insurance claims databases and patient registry systems fall under the term RWD.

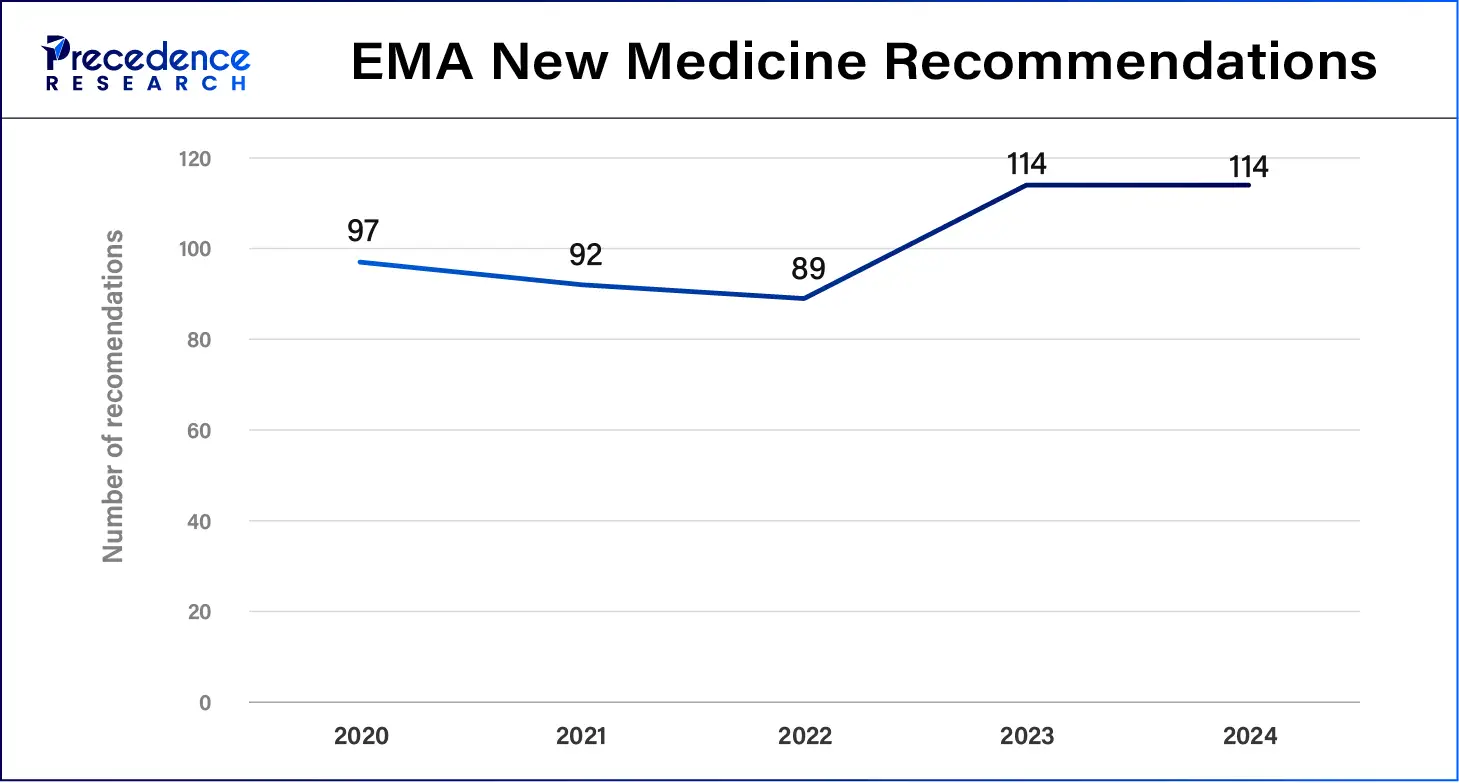

The health information contained in real-world data helps clinical staff and regulatory entities make decisions through valuable, actionable data points from genuine patient healthcare environments. The U.S. Food and Drug Administration, in its 2024 report, recognizes RWD plays a significant role in healthcare decisions because of its rising importance. The European Medicines Agency (EMA) explores patient registries for regulatory functions while following an international movement toward implementing RWD into healthcare assessment systems.

Real-World Data (RWD) Market Growth Factors

- Expanding adoption of telehealth services: The growing use of virtual care platforms is anticipated to generate vast amounts of real-world data, strengthening its role in tracking treatment effectiveness, patient adherence, and long-term health outcomes in the real-world data (RWD) market.

- Rising demand for decentralized clinical trials: Increased reliance on remote patient data collection is expected to drive the need for robust real-world data sources, supporting pharmaceutical companies in accelerating drug development and regulatory submissions.

- Increasing integration of genomic data: The incorporation of genetic insights into real-world data frameworks is projected to enhance precision medicine initiatives, leading to improved personalized treatment strategies and expanding market applications.

- Growing emphasis on population health management: Healthcare systems are leveraging real-world data to track disease patterns and optimize preventive care strategies, positioning RWD as a key tool for healthcare payers, providers, and public health agencies.

- Advancements in wearable and IoT-enabled health devices:The continuous collection of patient health metrics from smart devices is likely to strengthen real-world evidence applications, creating new market opportunities in remote patient monitoring and chronic disease management.

- Government initiatives for healthcare data transparency: Policies promoting open access to anonymized health data are expected to accelerate real-world data adoption, driving market expansion through improved data accessibility for research and policy-making.

- Strengthening collaborations between pharma and tech firms: Strategic partnerships for AI-driven data analysis are anticipated to improve the accuracy and efficiency of real-world evidence generation, enhancing the market's ability to support drug safety, efficacy assessments, and value-based care models.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.37 Billion |

| Market Size in 2025 | USD 1.88 Billion |

| Market Size in 2024 | USD 1.64 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, End User and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing adoption of evidence-based medicine

Growing reliance on evidence-based medicine is anticipated to drive demand for the real-world data (RWD) market in clinical decision-making and regulatory approvals, thus fuelling the market. Healthcare providers and research teams combine big patient databases to evaluate medication outcomes and drug security status while developing personalized medical solutions.

Health regulatory institutions are adopting real-world evidence to support clinical findings to speed up approvals for new medical products. The Big Data Steering Group of 2024 noted that the Data Analysis and Real-World Interrogation Network (DARWIN EU) succeeded in growing its real-world data network, which enhanced the capability to deliver valid and reliable evidence that supports regulatory choices.

Restraint

Data standardization and interoperability challenges

The inconsistencies in data collection and lack of standardization are anticipated to limit the effective use of real-world data across healthcare systems, which further hinders the real-world data (RWD) market. The accuracy of aggregated datasets declines as the integration obstacles between electronic health records (EHRs) and patient registries with wearable device outputs.

Data format differences and diverse coding systems make it difficult to work across borders, which leads to both regulatory obstacles and large-scale analytical challenges. The reduced efficiency of clinical research and decision-making occurs as healthcare institutions lack proper interconnections, which delays smooth data transfer. Multiple steps toward creating standard data-sharing methods have started, yet widespread deployment continues to be challenging.

Opportunity

Rising investments in real-world evidence for regulatory approvals

The rising utilization of real-world evidence in regulatory decision-making is likely to create immense opportunities for the players competing in the real-world data (RWD) market. The healthcare sector reveals considerable opportunities from accelerated investments to use real-world evidence (RWE) for regulatory approvals. Furthermore, the RWE drives global healthcare progress toward data-based innovation by accelerating the process of therapy access and the development of regulatory decisions.

The U.S. Food and Drug Administration (FDA) uses real-world data (RWD) following the requirements of the 21st Century Cures Act to enhance its drug approval process. The European Medicines Agency (EMA) launched DARWIN EU as a project to provide European medical institutions with enhanced access to quality RWD, which boosts regulatory decisions. Pharmaceutical organizations team up with regulatory organizations to create solid RWE, allowing them to expand drug labels and conduct comprehensive safety observations.

Component Insight

The services segment held a dominant presence in the real-world data (RWD) market in 2024. Organizations maintain an expanding requirement for data analytics and consulting, along with support services that help healthcare organizations maximize their use of RWD. Organizations within the pharmaceutical sector and healthcare sector specifically require specialized professionals to handle data integration with expert management skills needed for interpretation, leading to better decision processes.

EMA documented sixty-one RWD research activities from September 2021 through February 2023, which studied medicine safety and usage patterns, demonstrating the indispensable function of professional services to handle RWD research needs.

The datasets segment is expected to grow at the fastest rate during the forecast period of 2024 to 2034, as healthcare organizations have better access to EHRs, claims data, and patient-generated wearables data. Combining sources of data allows researchers to perform detailed analyses, which drives clinical study progress and medical treatment improvements. Organizations are likely to increase spending on proprietary data acquisition and management as they understand its fundamental value for business control. Furthermore, the current strategy involves a transition toward both data-based administrative choices and customized healthcare remedies.

Application Insights

The drug development and approvals segment accounted for a considerable share of the real-world data (RWD) market in 2024. Pharmaceutical firms have elevated the utilization of RWD to augment standard clinical trials, thus making their drug development processes more efficient. U.S. Food and Drug Administration (FDA) reported in 2024 that regulatory bodies value RWD benefits for decision support purposes, which leads to an improved drug approval procedure. The transformed approach enables patients to receive better innovative medical therapies at higher speeds for treating unmet healthcare needs.

The Center for Devices and Radiological Health (CDRH) within the FDA reported in 2024 that patient-reported outcomes (PROs) appeared in 52% of authorized clinical studies while PROs operated as main or alternative clinical endpoints throughout 34% of studies due to rising RWD usage in regulatory frameworks.

The post-market surveillance segment is anticipated to grow with the highest CAGR in the market during the studied years, owing to the patient safety initiatives together with the extended therapy effectiveness, which require medical devices and drugs to be continuously tracked aftermarket release. Through RWD healthcare organizations track products in their natural environment across diverse population groups to both spot safety hazards and confirm adherence to safety criteria. Healthcare authorities, together with manufacturers, must increase their post-market surveillance funding to identify safety issues promptly, as they protect patient trust and limit product recalls and legal disputes.

The real-world evidence (RWE) authorization by the FDA's CDRH in 2024 for over 100 devices shows that these data strengthen post-market surveillance and maintain device safety and effectiveness.

End-User Insights

- In 2024, the pharmaceutical and medical device companies segment led the global real-world data (RWD) market due to their ability to use RWD as a development tool across their research and development framework to discover medication treatments, create trial protocols, and track medicines after approval. They collected important treatment data and patient outcome information through analyzing electronic health records, insurance claims, and patient registries.

Healthcare systems worldwide show increasing dependence on product safety and efficacy demonstrations through real-world evidence, which aligns with evolving value-based care practices in personal medicine.

- As of 2024, the U.S. Food and Drug Administration (FDA) approved more than 100 devices, which relied on real-world evidence demonstrating the expanding use of RWD in regulatory processes.

The healthcare providers segment is projected to expand rapidly in the coming years. Provider adoption of electronic health records (EHRs) together with health information exchanges allows them to access and scrutinize large patient data amounts. Through RWD use medical providers gain better clinical decision power that simultaneously enhances outcomes while minimizing expenses. Data-driven healthcare initiatives promote substantial growth of real-world data market adoption by healthcare providers.

Real-World Data (RWD) Market Companies

- Cerner Corporation

- Evidera, Inc.

- Flatiron Health, Inc.

- IBM Corporation

- IQVIA Holdings Inc.

- Optum, Inc. (a subsidiary of UnitedHealth Group)

- Palantir Technologies Inc.

- SAS Institute Inc.

- Syneos Health Inc.

- Tempus Labs Inc.

Latest Announcements by Industry Leaders

January 2025 – Clarivate Plc

President – Henry Levy

Announcement- Clarivate Plc (NYSE: CLVT), a leading global provider of transformative intelligence, has announced the launch of DRG Fusion, an innovative platform designed to support commercial analytics in the life sciences sector. Henry Levy, President of Life Sciences & Healthcare at Clarivate, stated, "Fusion showcases the robustness of our life sciences data and its extensive commercial applications. Its scalable data architecture is specifically designed to rapidly provide insights across various patient diseases and sub-population cohorts."

Recent Developments

- In May 2024, HealthVerity, a leader in synchronizing transformational technologies and real-world data (RWD) to advance scientific research, announced a strategic partnership with Castor, a leading provider of decentralized and hybrid clinical trial solutions. This partnership aims to streamline the synchronization of clinical trial data and real-world data throughout the clinical research stages.

- In October 2024, the UK Medicines and Healthcare Products Regulatory Agency launched its first Data Strategy for 2024–2027. This comprehensive plan outlines how to leverage data, digital technology, and real-world evidence to prioritize patient safety and public health and foster innovation in healthcare regulation.

- In March 2024, the Data Analysis and Real-World Interrogation Network (DARWIN EU) announced plans to enhance its capacity for real-world data studies by adding ten new data partners in 2024. Currently, the network collaborates with 20 public and private institutions from 13 European countries.

- In November 2022, Castor unveiled a new offering designed to simplify post-marketing clinical trials. This offering extends global reach, integrates real-world data (RWD), and automates trial processes, enabling a reduction in trial costs by 30% and shortening deployment timelines to an average of only 4 weeks.

Segments Covered in the Report

By Component

- Services

- Datasets

By Application

- Drug Development & Approvals

- Market Access & Reimbursement/Coverage Decisions

- Post-market Surveillance

- Clinical Research

- Other

By End User

- Pharmaceutical & Medical Device Companies

- Healthcare Payers

- Healthcare Providers

- Government Agencies

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client