January 2025

Recycled Paper Bags Market (By Type: Sewn Open-mouth Bags, Pinched Bottom Open-mouth Bags, Pasted Valve, Pasted Open Mouth, Flat Bottom; By Thickness: 1-ply, 2-ply, 3-ply, >3-ply; By End-user: Commercial, Individual/Household) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

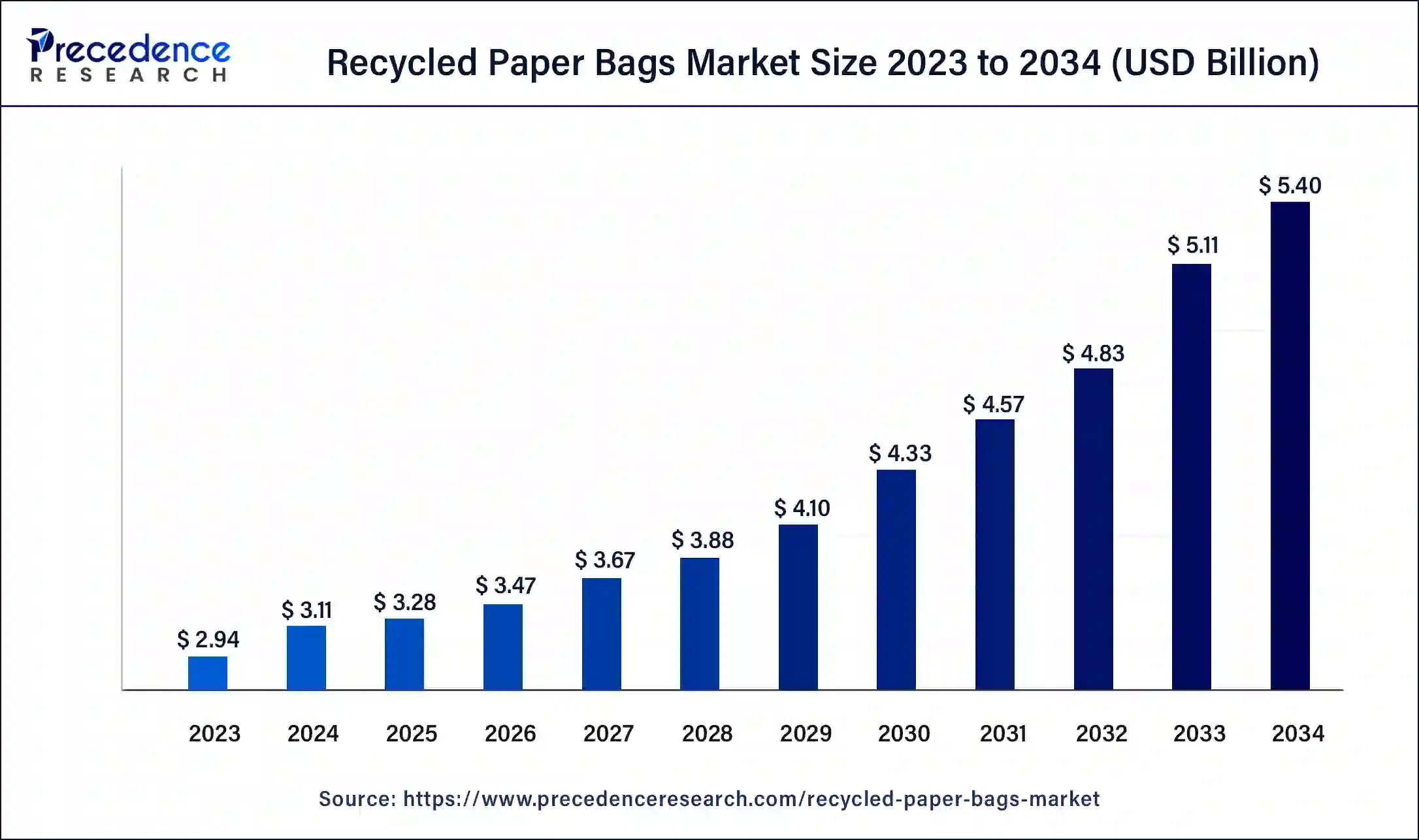

The global recycled paper bags market size was USD 2.94 billion in 2023, calculated at USD 3.11 billion in 2024 and is expected to reach around USD 5.40 billion by 2034, expanding at a CAGR of 5.68% from 2024 to 2034. The rising demand for cost-efficient and sustainable packaging material drives the growth of the recycled paper bags market.

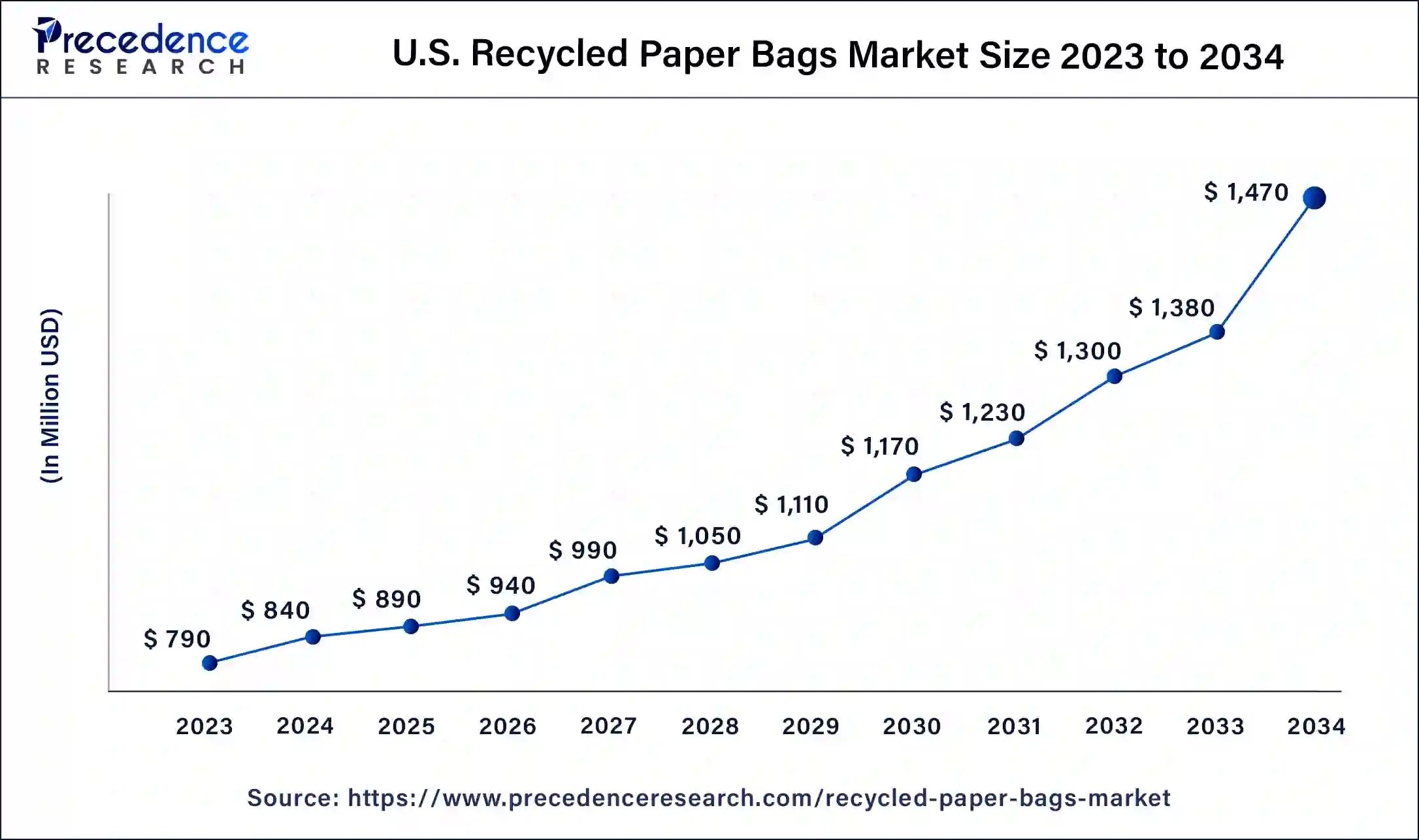

The U.S. recycled paper bags market size was exhibited at USD 790 million in 2023 and is projected to be worth around USD 1,470 million by 2034, poised to grow at a CAGR of 5.80% from 2024 to 2034.

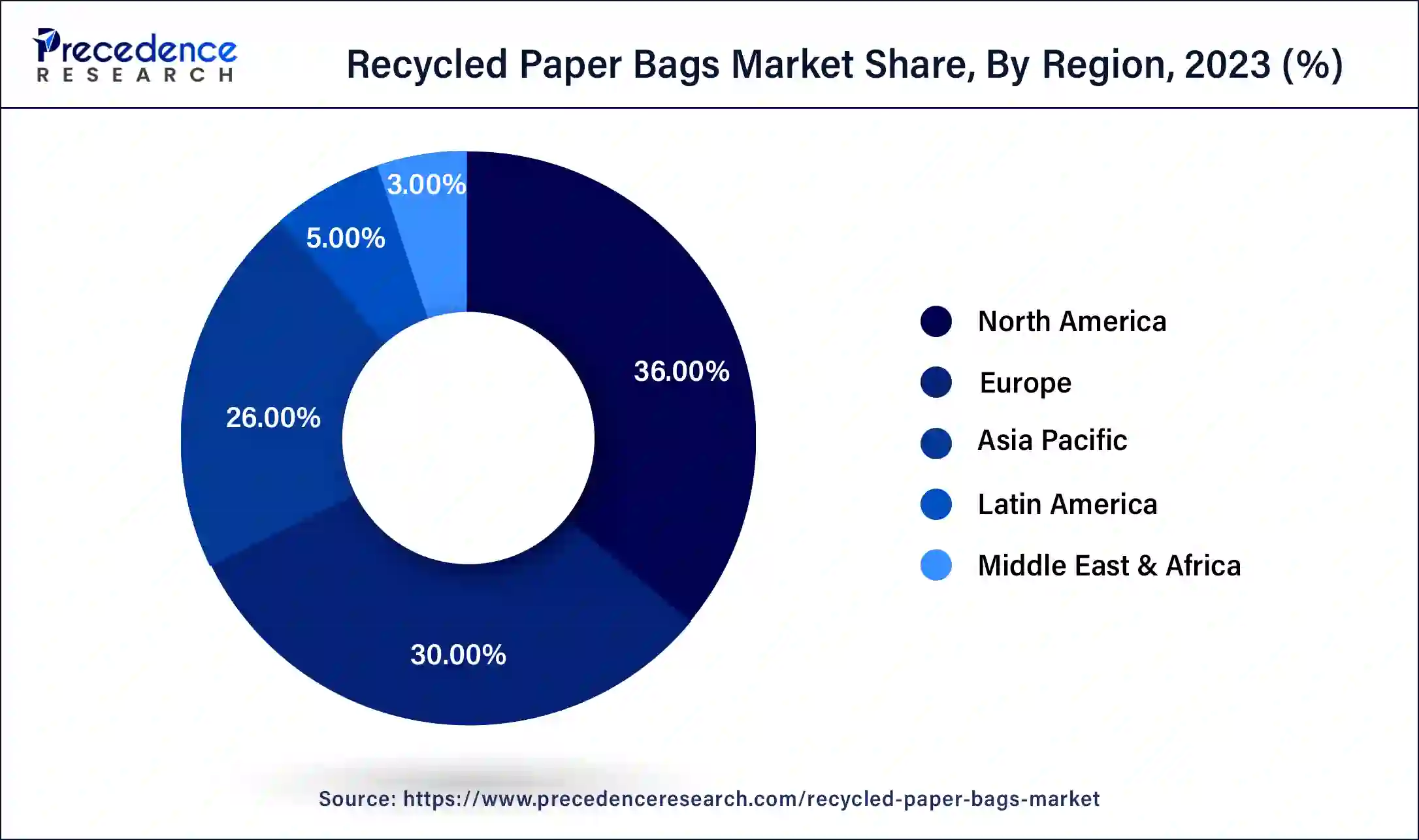

North America led the global recycled paper bags market in 2023. The growth of the market in the region is attributed to the rising industrialization and the rising demand for packaging materials, which are driving the growth of the market. The increasing retail and commercial sectors are creating a major demand for affordable and sustainable packaging material, which accelerates the demand for paper packaging material and drives the growth of the market. Additionally, the rising government initiatives for limiting plastic use and the initiatives for sustainable materials use drive the demand for the market in the region.

Asia Pacific is expected to witness the fastest growth in the recycled paper bags market during the forecast period. The growth of the market in the region is increasing due to the rising population and the increasing consumer base that drives the increasing demand for packaging materials, as well as the rising environmental issues associated with the rising plastic pollution that drives the growth of the market. The increasing government participation in the plastic-free environment and the rising awareness about the usage of sustainable products and materials drive the growth of the market in the region.

Paper bags are considered the best alternative for plastic-based packaging materials. Unlike plastic bags, paper bags are 100% biodegradable and recyclable material, and they can be used several times for recycling. It does not harm the environment and does not cause any kind of pollution in the environment. The paper bags come in various designs and shapes that allow more space for storing goods. Paper bags are goods for the printing of brand names, high-quality images, and designs for the branding process.

Recycling reduces the waste of paper. There is increasing awareness regarding the plastic-based pollution that harms oceans and rivers and creates huge environmental pollution due to the lack of biodegradability in nature. Additionally, the rising government initiatives for minimizing plastic use in every aspect are also further propelling the demand for recycled paper bags in the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.40 Billion |

| Market Size in 2023 | USD 2.94 Billion |

| Market Size in 2024 | USD 3.11 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.68% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Thickness, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising demand from the food packaging industry

The increasing demand for paper bag packaging from the food packaging industry is due to the rising awareness about the growing plastic wastes that drive the demand for recycled paper bags. Paper and paperboard were the first materials used in the packaging of food products, milk and milk-based products, dry powders, beverages, bakery products, confectionery, etc. The increasing industrialization and the rising e-commerce industry are also propelling the demand for efficient, cost-effective, and sustainable packaging material, which has contributed to the growth of the paper bags and recycled paper bags market.

Lack of awareness

Despite its immense potential, the recycled paper bags market growth is impeded due to a lack of awareness about the products and their related technologies. The majority of the population prefers the more robust alternatives to paper bags. Several new innovations in recent years have been able to overcome the drawbacks associated with recycled paper bags. However, a lack of awareness amongst the consumer base negatively impacts the market.

Regularity support

The increasing government support and initiative for a plastic-free environment and the rising concern towards the types of environmental pollution are diverting the focus towards sustainable materials as an alternative to plastic products and materials. The increasing awareness of the environment in the population drives the higher demand for paper-made bags and other product packaging that contributes to the growth of the recycled paper bags market.

The increasing environmental concern drives the recycling of materials like paper, glass, and plastics from waste products that are highly beneficial for the environment and limit global warming. Thus, the increasing focus on recyclable products and packaging materials will drive the growth opportunity for the recycled paper bags market in the upcoming period.

The sewn open-mouth segment dominated the recycled paper bags market in 2023. The growth of the segment is attributed to the rising adoption of sewn open-mouth recycle paper bags by industries such as materials and construction for the packaging of fertilizers, a range of bulk solids, seeds, and pet foods. The open-mouth bags are factory-closed on one side of the tube, and the other side is closely sealed or sewn. The open-mouth bags are made of multi-layered paper or poly-woven material that is closely sewn.

The open-mouth bags are cost-effective and also save equipment costs. They have characteristics like fibrous and non-free-flowing and prevent the use of valve-type bag fillers. These types of bags are leakproof and do not open to the infestation. There are some other terms associated with mouth bags are adhesion, adhesive-hot melt, aluminum foil lamination, back seam woven bags, basic weight, biodegradable, biaxially oriented polypropylene (BOPP), cap sac, bursting strength, coextrusion, cold seal, cure time, delaminating, drop test, density, extrusion, fill end, face width, flexible packaging, flush cut top, guage, gusset, sheat seal, lamination, etc.

The 1-ply segment dominated the recycled paper bags market in 2023 and is projected to witness the highest growth during the forecast period. The growth of the segment is attributed to the higher adoption of the 1-ply thickness paper bags as the shopping bags and the increasing demand from the consumer goods industry is driving the growth of the segment. The rising adoption of the 1-ply thickness bags for food and grocery retails, supermarkets, shopping complexes, food materials, etc., is driving the demand for the 1-ply thickness paper bags. It is less expensive and 20% lighter in weight than 2-ply thickness paper bags. 1-ply thickness bags require low materials and give higher-speed filling to several powered goods and other consumer goods. Thus, all these factors are collectively contributing to the growth of the 1-ply thickness paper bags segment.

The commercial segment held the largest share of the recycled paper bags market in 2023. The growth of the segment is attributed to the increasing demand for paper bags in commercial applications, packaging, and shopping goods, which are driving the expansion of the market. The rise in the commercial sector, such as supermarkets, hypermarkets, and e-commerce industries, and the rising demand for the packaging industries are all contributing to the expansion of the paper bags market. Additionally, the rising awareness about environmental pollution and increasing demand for cost-efficient and sustainable packaging materials in the packaging industries and for various consumer goods are driving the demand for the market.

Segments Covered in the Report

By Type

By Thickness

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

November 2023

May 2024