January 2025

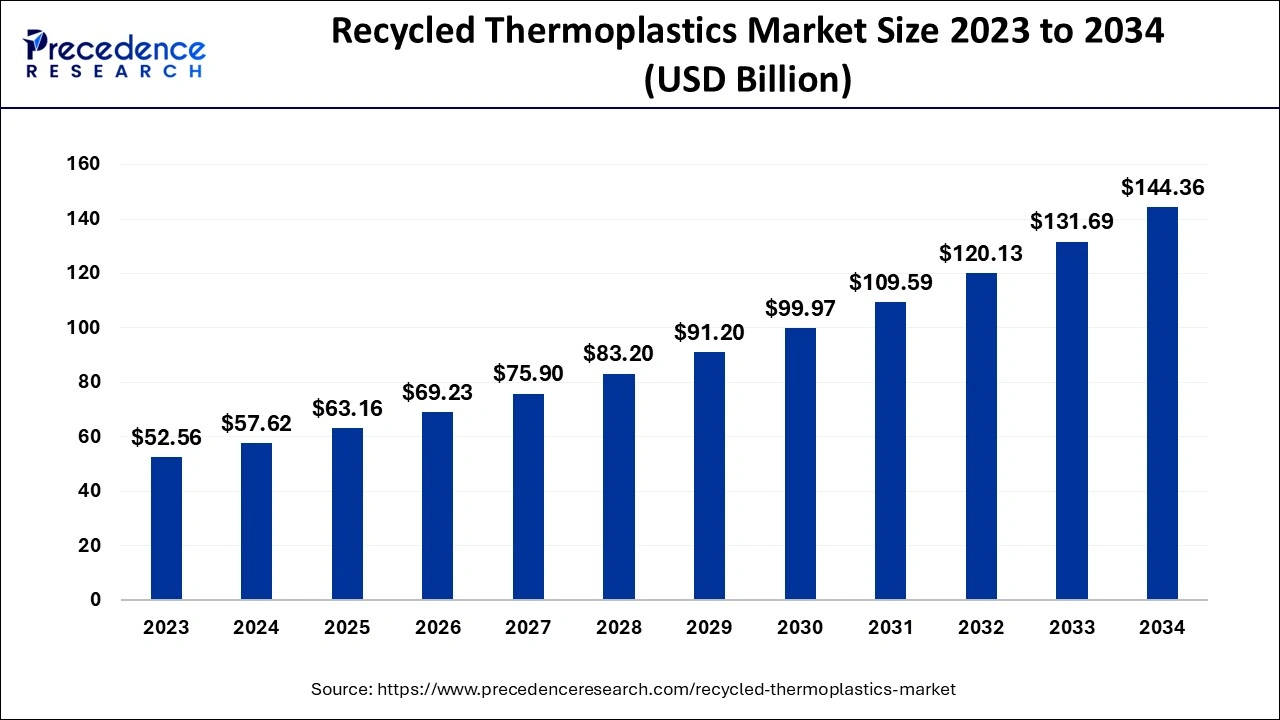

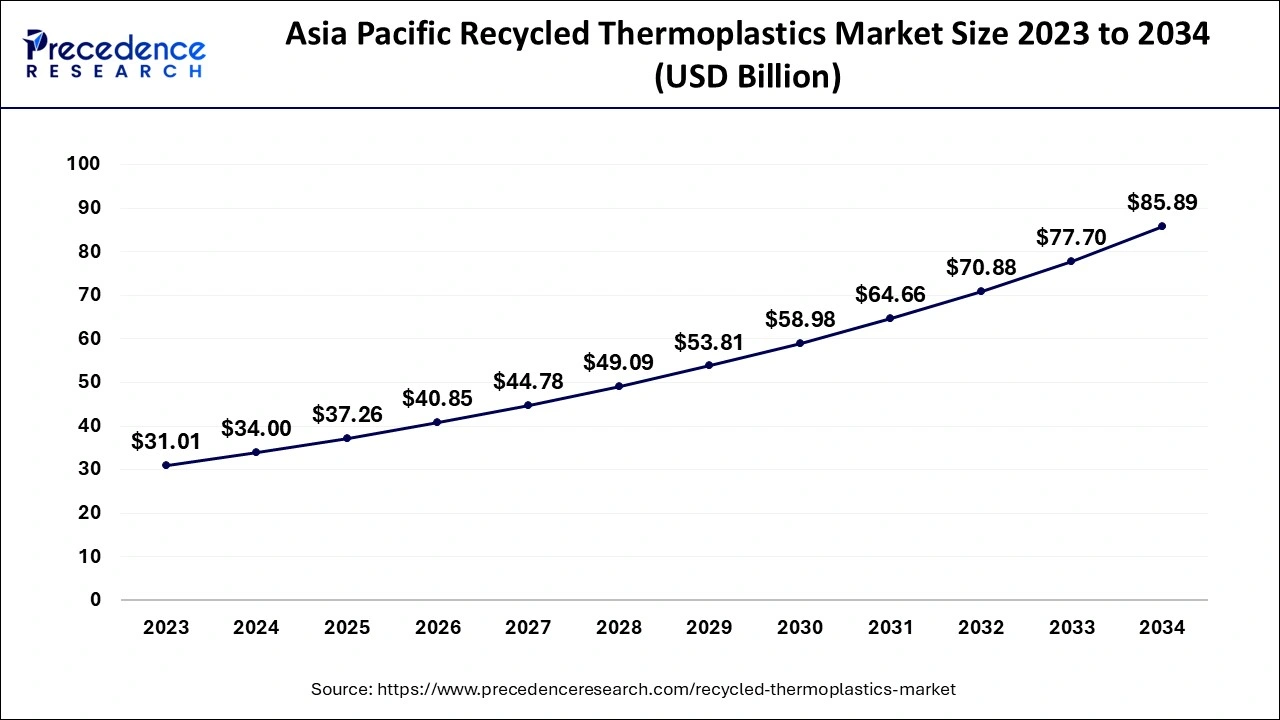

The global recycled thermoplastics market size accounted for USD 57.62 billion in 2024, grew to USD 63.16 billion in 2025 and is expected to be worth around USD 144.36 billion by 2034, registering a CAGR of 9.62% between 2024 and 2034. The Asia Pacific recycled thermoplastics market size is calculated at USD 34.00 billion in 2024 and is expected to grow at a CAGR of 9.70% during the forecast year.

The global recycled thermoplastics market size is calculated at USD 57.62 billion in 2024 and is projected to surpass around USD 144.36 billion by 2034, expanding at a CAGR of 9.62% from 2024 to 2034. The recycled thermoplastics market is growing due to global concerns regarding environmental conservation, technological improvements, and the desire to reduce the proliferation of plastics to develop environmentally friendly products, creating a huge amount of investment and development.

The Asia Pacific recycled thermoplastics market size is evaluated at USD 34.00 billion in 2024 and is projected to be worth around USD 85.89 billion by 2034, growing at a CAGR of 9.70% from 2024 to 2034.

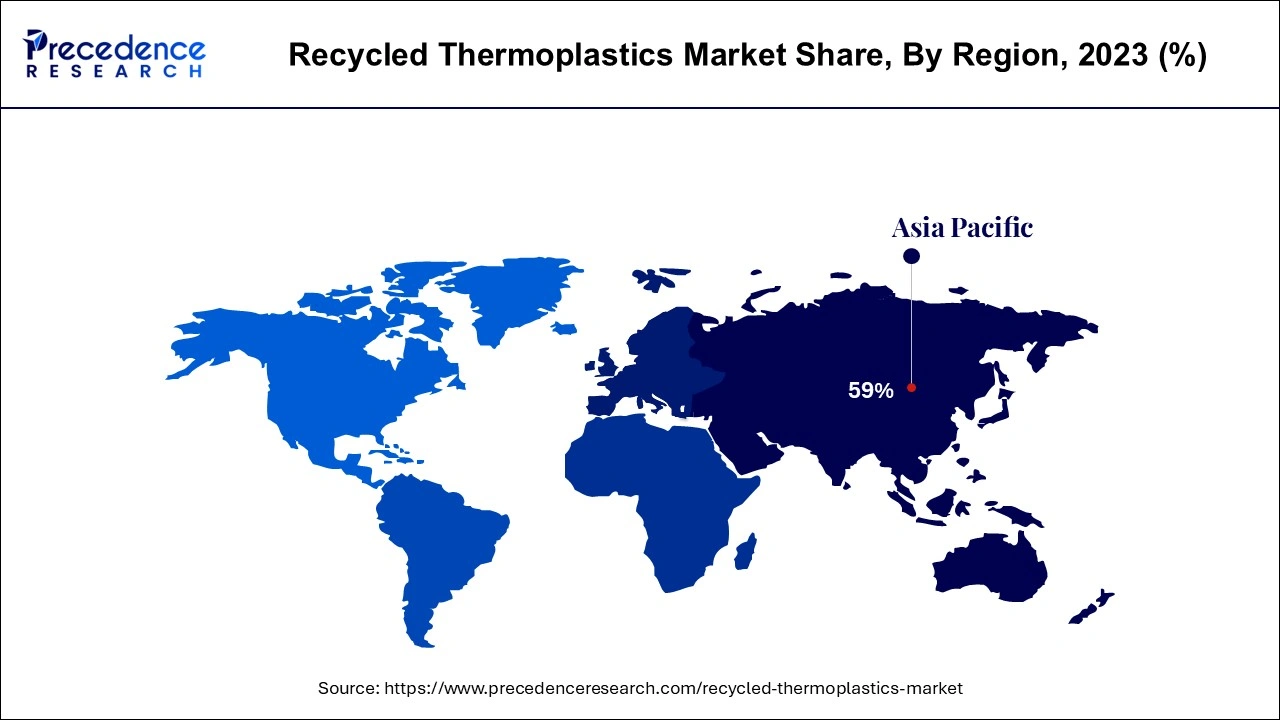

Asia Pacific accounted for the largest share of the recycled thermoplastics market in 2023. The demand for consumer goods and especially imports of consumer electronics, has grown significantly in the recent past owing to increased urbanization and disposable income, hence putting pressure on the thermoplastic recycling industry to become more responsive to the environment, promoting the effectiveness of recycling systems due to accelerated economic development and urbanization process in those countries such as China and India.

North America is anticipated to witness the fastest growth in the recycled thermoplastics market during the forecasted years. The United States and Canada contribute most to the region with innovation factors, while market progress is driven by governments and strategic investments. The region aids from well-established supply chains and increasing consumer inclinations. As countries develop more and more industries, there is a growing emphasis on the disposal of waste and, thus, a higher market for recycled thermoplastics.

Recycled thermoplastics are plastics that have been melted down and reshaped into new products. Thermoplastics are quite reusable because the material does not lose its properties after it has been melted and formed once again. They also constitute items that can be easily sorted for recycling using automated recycling tools. Thermoplastics are fully reversible and can be recycled efficiently; they can be used to make new products. This is due to their capacity to be melted and frozen several times without a loss of their properties. However, the probability of recycling thermoplastics depends on other economic and logistical factors related to collection systems, existing infrastructure, and the social trends of consumers.

How Does AI Impact on Recycled Thermoplastics Market?

Plastic sorting and processing are well done by AI-enabled robots with accurate predictions of mechanical failures for a seamless service flow in the recycled thermoplastics market. AI technologies add value in the optimization, sorting, and processing of the recycling process, resulting in better quality materials being recycled. Automation tightens processes, cutting off labor costs and speeding up the production process. Some of these technologies are useful in enhancing the efficiency of recycling plants.

| Report Coverage | Details |

| Market Size by 2034 | USD 144.36 Billion |

| Market Size in 2024 | USD 57.62 Billion |

| Market Size in 2025 | USD 63.16 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Form, Technology, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Rising Concerns About Plastic Growth

Growing concern over environmental problems and the consequences of plastic waste has encouraged a demand for sustainable materials. Using the recycled thermoplastics market products can help decrease waste and carbon footprints, leading to increased demand. There has been an increase in momentum towards a circular economy in which materials are reused and recycled. Thermoplastics are more cost-effective than virgin materials, particularly as fossil fuel prices fluctuate. Recycled thermoplastics offer a more economical option compared to new materials. Businesses might recycle materials to lower expenses and achieve sustainability objectives.

Quality issues

The variation in the quality of the recycled thermoplastics makes it difficult to use them in more challenging applications. Variability is due to several reasons, such as the origin of materials, the cycles of the recycling methodology, and interferences. Automotive and aerospace industries, in particular, demand heavy-duty and durable parts that have specific characteristics of their own. Further, lack of coordination in the regulation can lead to complications in the way business entities venture into new markets to diversify their operations and work around the peculiarities of the different regulation systems.

Adopt eco-friendly practices

The recycled thermoplastics market is an exciting one, especially with the industry focusing more and more on its environmental impact. Rising concern about environmental impacts among consumers and companies makes recycled thermoplastics the favorable substitute for virgin plastics. Also, there are enhanced quality and diversities of recycled thermoplastics due to enhancements in recycling technologies, which provide competitive challenges to virgin materials in their respective applications. Therefore, it's becoming a theme that ‘go green’ not only promotes a sustainable environment but also opens up a market with high possibilities for growth. Thermoplastics are a versatile and eco-friendly substitute for traditional plastics.

The flakes segment contributed the biggest share of the recycled thermoplastics market in 2023. Plastic waste has to be washed before it is shredded into pellets and then processed to form flakes that can be used in the manufacture of other goods. Flakes are widely used and employed in products such as plastic products such as bottles and containers, as well as textiles and fabrics. Flake-form recycled thermoplastics are relatively produced and, therefore, are affordable and competitive in large-scale recycling facilities.

The granule segment is projected to witness the fastest growth in the recycled thermoplastics market during the forecast period. Recycled plastic granules are small pellets made of recycled plastic waste material. They are generally recycled plastics because they are intermediate outputs of recycled products that act as raw materials for new plastic goods. Particles provide better control, are less likely to produce variations, and are commonly used in automotive, electronics, and packing industries. These recycled granules are much easier to work and pack, allowing manufacturers.

The extrusion segment led the global recycled thermoplastics market in 2023. Extrusion especially facilitates the production of long, tough, almost all-plastic products used in construction, packaging, and the agricultural industry. Also, the push for decreasing carbon footprints in the construction industry boosts builders to embrace recycled materials, enhancing demand for extruded recycled thermoplastics that are cost-effective and environmentally friendly.

The blow molding segment is projected to witness the fastest growth in the recycled thermoplastics market during the forecast period. Blow molding is particularly suitable for using lightweight, thin-shelled products like bottles and jars. Blow-molded articles are produced with recycled thermoplastics due to changing customer demand for environment-friendly packaging and the increasing dominance of recycling standards. Blow molding plastics is a manufacturing process where air is blown into a mold cavity to manufacture a hollow product. It is widely applied in manufacturing various parts for construction, industrial use, automobile, medical, and packaging industries, among others.

The Polyethylene segment recorded the highest share of the recycled thermoplastics market in 2023. Polyethylene is commonly used in products such as plastic bags, films, and shrink wraps and is critical in the food, retail, and e-commerce industries. Companies are increasingly being forced to limit their impacts on the environment; there is an increasing need to use polyethylene that has been recycled from other uses. Polyethylene is a thermoplastic polymer that has a crystalline structure that is more variable, although it is used in all industries. Polymer Shapes is one of the largest independently owned distributors of polyethylene plastics, providing sheets, rods, and tubes.

The Polyethylene Terephthalate (PET) segment is projected to witness the fastest growth in the recycled thermoplastics market during the forecast period. PET is the material used to make plastic bottles. It is in high demand among the companies that plan to combat plastic waste and build a circular economy. Polyethylene terephthalate (PET) polymers are a type of polyester. This compound is semi-crystalline in a stable form. This one is recyclable and has impact resistance, water resistance, and resistance to alcohols and solvents.

The packaging segment accounted for the largest share of the recycled thermoplastics market in 2023. Recycled thermoplastics are recycled polyethylene and polypropylene, and their application is in food packing materials, carrying cases for shipment, and retail bags. Thermoplastics are recycled and used mostly in bottle making, containers, and films to meet the regulatory requirements and the ever-increasing demand for environmentally friendly packaging. The recycled content in food and beverage packaging has been on the rise in recent years.

The granule segment is projected to witness the fastest growth in the recycled thermoplastics market during the forecast period. These materials can provide lightweight and high durability to the vehicles, thus ensuring that manufacturers meet stringent environmental regulations and improve vehicle performance. There is a desire for recycled thermoplastics in the automotive industry due to the development of EVs and the demand for sustainable processes. Automotive applications of recycled plastics include the manufacture of bumpers, dashboards, interior trims, and others. The benefits include reducing vehicle weight, improving fuel efficiency, and lowering emissions.

Segments Covered in the Report

By Form

By Technology

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

January 2025

December 2024