December 2024

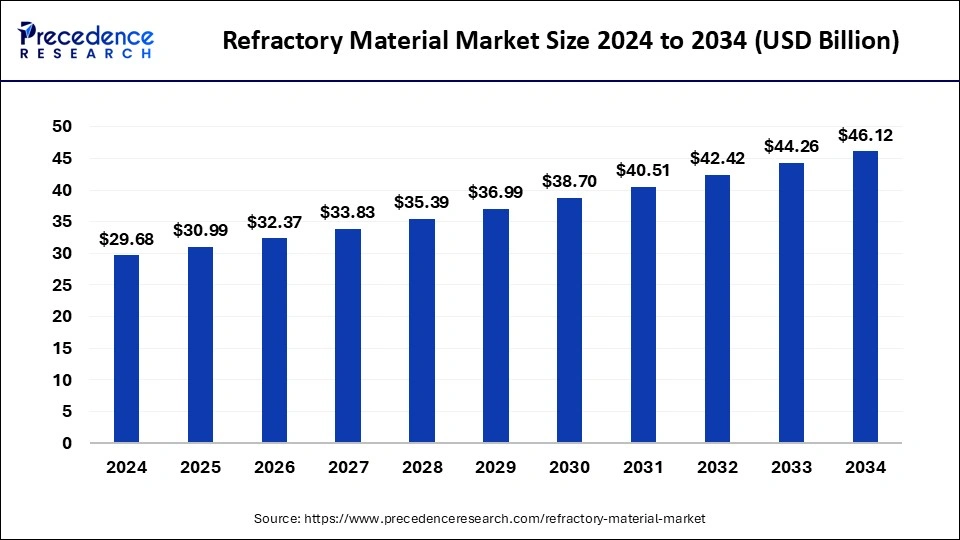

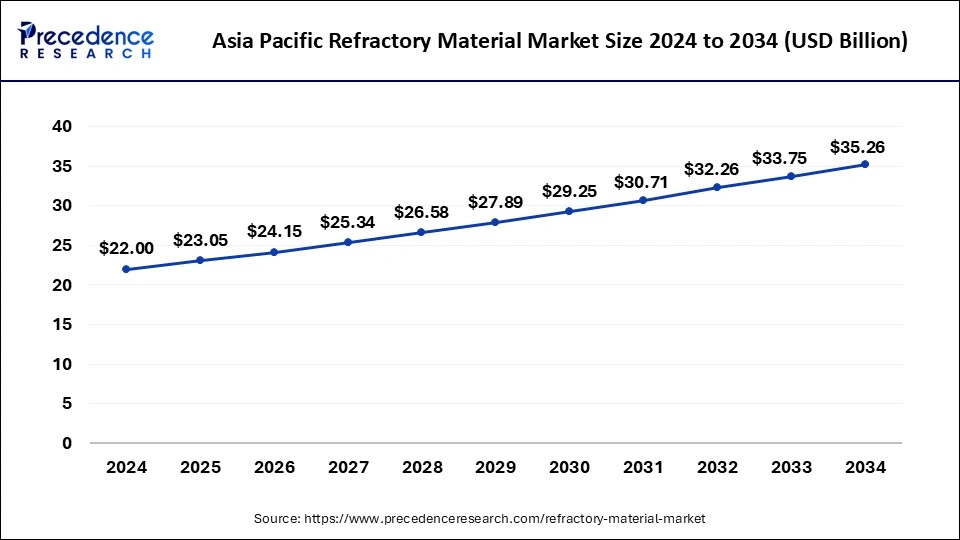

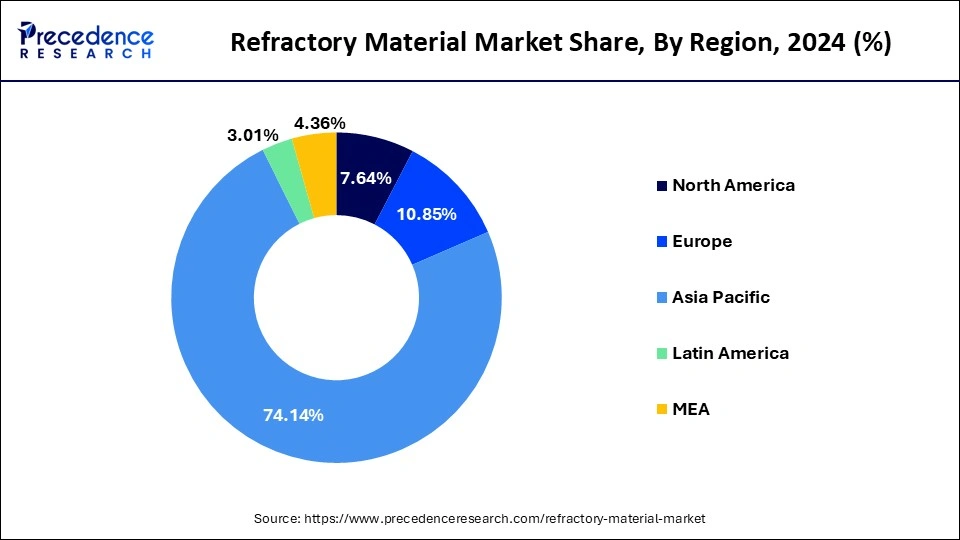

The global refractory material market size accounted for USD 30.99 billion in 2025 and is forecasted to hit around USD 46.12 billion by 2034, representing a CAGR of 4.52% from 2025 to 2034. The Asia Pacific market size was estimated at USD 22.00 billion in 2024 and is expanding at a CAGR of 4.83% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global refractory material market size was estimated at USD 29.68 billion in 2024 and is predicted to increase from USD 30.99 billion in 2025 to approximately USD 46.12 billion by 2034, expanding at a CAGR of 4.52% from 2025 to 2034.

The Asia Pacific refractory material market size was exhibited at USD 22.00 billion in 2024 and is projected to be worth around USD 35.26 billion by 2034, growing at a CAGR of 4.83% from 2025 to 2034.

The Asia-Pacific region's market for refractory materials, which had 74.14% of the worldwide market share in 2024, is anticipated to grow at the highest CAGR of 4.83% during the projected period. This is a result of an increase in production capacity among iron and steel producers where refractory materials are frequently used for temperature stability reasons due to the growing demand for iron and steel from a wide range of end industries, including all of the industrial, constructing and infrastructure, automotive, and others. According to a study published by the India Brands Equity Foundation, 230 metric tons (MT) of finished steel would be used in India by 2030–31, rising from 93.43 tons (MT) in 2020–21. Additionally, the rapidly expanding Chinese cement industry has compelled producers of refractory materials to create high-quality refractory materials for use in furnaces, kilns, incinerators, and other high-temperature applications. For instance, according to a data released by the World Cement Association, China's output of cement clinker was 1.579 billion tons in 2020 and increased by 3.07% year over year.

Refractory materials are high-tech ceramic materials that can endure severe chemical corrosion at high temperatures as well as thermal and mechanical damage. By offering mechanical strength, corrosion resistance, and thermal insulation they play an essential but often underappreciated role in the everyday operations of practically every sector. For a variety of sectors to create important manufacturing processes, including iron and steel, glass, other metals, paper and pulp, cement, and petrochemicals, these goods have proved crucial.

In some sectors, like steel and other metals, these goods are regarded as consumables, and they must be changed periodically to maintain their function. On the other hand, since they may do their task for up to 10 years, sectors like glass and cement take their capital investment into consideration. The cost of refractory products makes up less than 3% and frequently less than 1% of the cost of produced goods, according to the World Refractory Association. However, refractory product applications and designs that are optimized can cut operational costs for end-use industries by up to 20%. Refractory materials are crucial for the development of the various end-use industries since they are produced in a non-toxic manner and over 90% of them are recycled or used again. However, the market for refractory materials has suffered as a result of the COVID-19 epidemic because of its reliance on the manufacture of cement, glass, steel, and metals, as well as mining, heavy industry, oil and gas, and other industries.

Increasing investments in the iron and steel industries are what are driving the growth of the worldwide market for refractory materials. In both developed and emerging countries, like the U.S., China, and India, where refractory materials are extensively utilized for thermal insulation reasons, iron and steel output has increased due to rapid infrastructure construction and rising demand from the automobile industry. For instance, the Indian Steel Association (ISA) forecasts that the demand for steel would increase by 7.12% between 2020 and 2021. The usage of glass-based materials for a variety of applications has also expanded as a result of features including recyclability, transparency, and low raw material prices. Refractory materials are heavily employed in the manufacture of glass to ensure thermal stability. This is expected to fuel market expansion for refractory materials.

| Report Coverage | Details |

| Market Size in 2025 | USD 30.99 Billion |

| Market Size by 2034 | USD 46.12 Billion |

| Growth Rate 2025 to 2034 | CAGR of 4.52% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Chemistry, Chemical Composition, Form, End Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Steady Growth in Steel Industries - Materials for refractories cost between two and three percent more than steel. The development of the steel sector would be fueled by expanding infrastructure, the oil and gas, and the automobile industries. Although the cement, glass, and non-ferrous sectors continue to offer prospects for refractory businesses, the steel industry has a significant impact on those businesses' success.

Three-fourths of the demand for refractories worldwide comes from the steel industry, and it is anticipated that this dominance will last the whole projection period. Although the steel sectors have also been hurt by global overproduction, there has been a gradual rebound over the past year. Additionally, since the bulk of the areas focus on self-reliance and reducing imports, investments in the steel industry are projected to rise in emerging and underdeveloped nations.

Increasing Application in the Power Generation Sector - Due to the huge need for electricity globally, the rapid expansion of renewable energy, and other factors for a sustainable future, the power generation industry has experienced significant growth. The Energy Information Administration (EIA) estimates that geothermal energy generated 15.89 billion kilowatt hours of power in 2020 as opposed to 16.22 billion kilowatt hours in 2020. In addition, the Central Electricity Authority (CEA) predicts that India's electricity demand would increase to 817 GW by 2030.

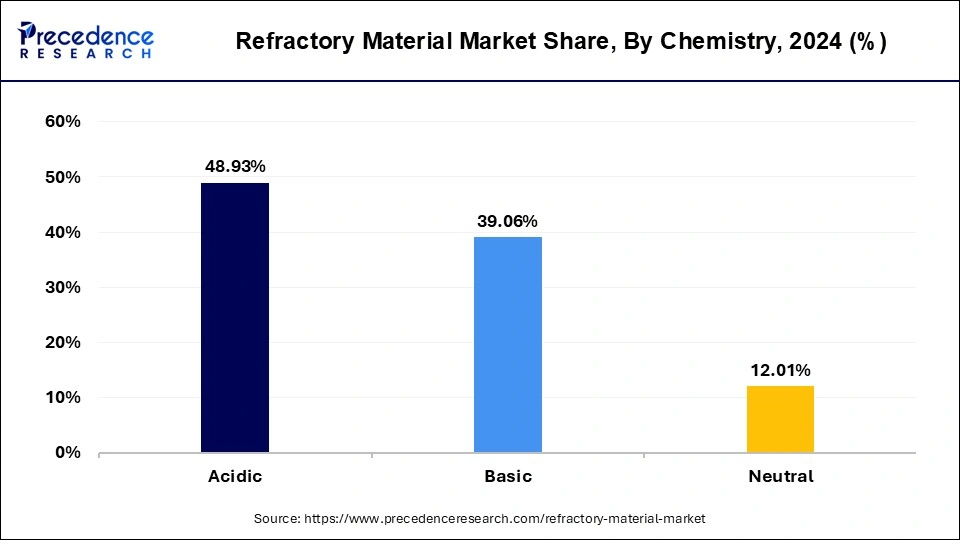

The acidic segment, which generated the most revenue in 2024. In locations where the environment and slags are in basic conditions, basic refractory materials are employed. Basic refractory materials are useful for thermal insulation reasons in both offshore and onshore structures in kilns and incinerators, chemicals manufacturing industries, and the metal fabrication industry because they are stable to alkaline materials. This drives the global market for basic refractory material to increase.

Refractory Material Market Revenue, By Chemistry, 2022 - 2024 (USD Million)

| Chemistry | 2022 | 2023 | 2024 |

| Acidic | 13,333.38 | 13,918.64 | 14,523.09 |

| Basic | 10,542.73 | 11,057.04 | 11,591.53 |

| Neutral | 3,388.23 | 3,474.67 | 3,564.78 |

The fireclay category led the worldwide market in 2024 based on chemical composition and is predicted to expand at a rapid CAGR during the projected period. This is due to the fact that fireclay refractory material, which makes up about 76% of all refractory material production and is exceedingly adaptable and affordable, is utilized in the manufacture of iron and steel, cement, and other high-temperature processes in other industries. These elements are accelerating the market's expansion for refractory materials' fireclay sector.

Refractory Material Market Revenue, By Chemical Composition, 2022 - 2024 (USD Million)

| Chemical Composition | 2022 | 2023 | 2024 |

| Alumina | 2,609.71 | 2,724.24 | 2,844.00 |

| Silica | 4,636.52 | 4,879.67 | 5,127.15 |

| Magnesia | 2,279.77 | 2,415.81 | 2,557.41 |

| Fireclay | 17,191.40 | 17,874.97 | 18,579.25 |

| Others | 546.94 | 555.65 | 571.58 |

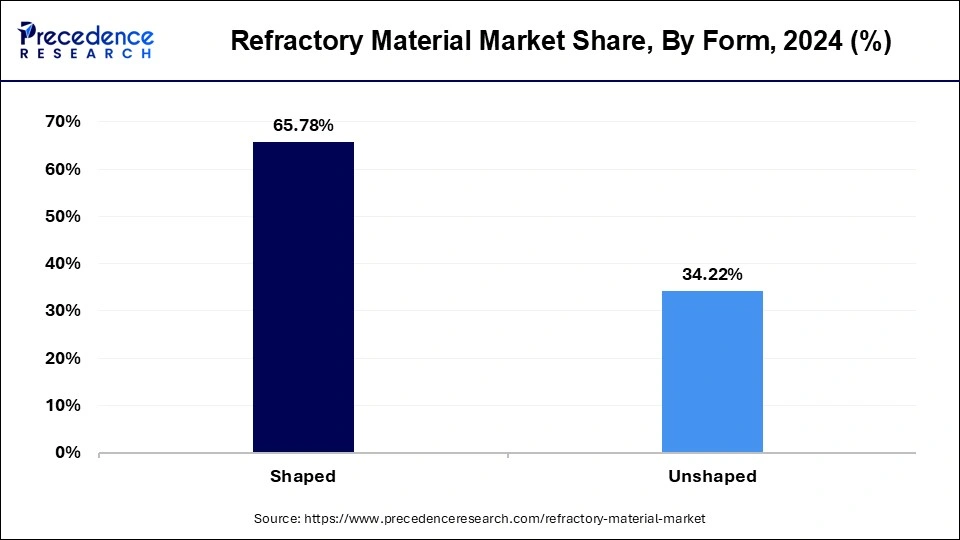

The shaped segment, which generated the most revenue in 2024. Shaped refractory materials offer supports for catalysts that are made of porous structures with large surface areas or honeycomb structures that retain the metal catalyst by allowing simple exposure to reactive gases or reactants. Shaped refractory material is used in applications that call for very effective thermal insulation solutions and catalyst support properties.

For example, shaped refractory material is preferred in the production of iron and steel, cement, glass, and other materials as well as for use as thermal insulation in furnaces, kilns, incinerators, and reactors. This element is accelerating this market segment's expansion on a global scale.

Refractory Material Market Revenue, By Form, 2022 - 2024 (USD Million)

| Form | 2022 | 2023 | 2024 |

| Shaped | 18,023.28 | 18,761.93 | 19,523.91 |

| Unshaped | 9,241.06 | 9,688.42 | 10,155.49 |

The metals & metallurgy end use category, which led the worldwide market in terms of end use in 2024. This is explained by the rise in demand for iron and steel in industries like the automotive, infrastructural, industrial, railway, and others that frequently employ refractory materials to endure high temperatures.

Refractory Material Market Revenue, By End Use, 2022 - 2024 (USD Million)

| End Use | 2022 | 2023 | 2024 |

| Metals & Metallurgy | 18,409.80 | 19,138.31 | 19,893.54 |

| Cement | 2,013.88 | 2,106.43 | 2,203.61 |

| Glass & Ceramics | 3,461.24 | 3,670.57 | 3,889.95 |

| Power Generation | 2,554.56 | 2,688.83 | 2,829.18 |

| Others | 824.86 | 846.19 | 863.12 |

By Chemistry

By Chemical Composition

By Form

By End Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

April 2025

August 2024