January 2025

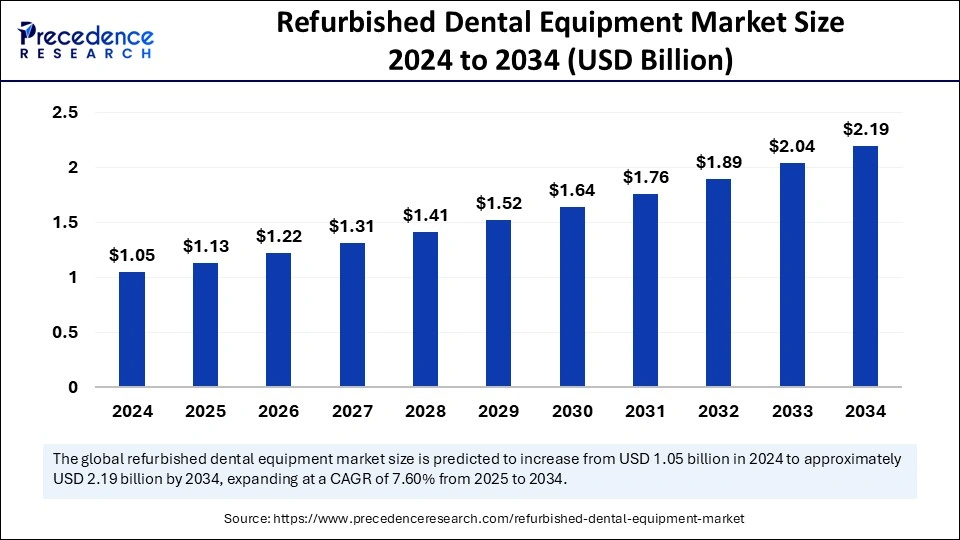

The global refurbished dental equipment market size is calculated at USD 1.13 billion in 2025 and is forecasted to reach around USD 2.19 billion by 2034, accelerating at a CAGR of 7.60% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global refurbished dental equipment market size accounted for USD 1.05 billion in 2024 and is predicted to increase from USD 1.13 billion in 2025 to approximately USD 2.19 billion by 2034, expanding at a CAGR of 7.60% from 2025 to 2034. Refurbished dental equipment offers a cost-effective, eco-friendly solution for growing dental clinics. With rising dental visits and better quality checks, demand is increasing, making it a preferred choice for many professionals.

The refurbished dental equipment market is being transformed by artificial intelligence (AI) to enhance quality assessments, predictive maintenance, and operational efficiency. In 2024, the integration of AI-powered diagnostic tools into refurbished imaging systems (CBCT scanners) will increase confidence that they meet performance levels. Machine learning is being used by companies to identify wear and predict optimal parts replacement frequency, achieving failure rates reduced by as much as 30%.

In a recent case in the U.S., evidence of the impact AI-assisted refurbishment can have at reducing downtime noted equipment downtime reduced by 40%; this is expected to push further adoption of refurbished equipment in dental clinics. AI predictive analytics are enabling suppliers to monitor inventory more efficiently, reducing periods of shortage. Increased regulation will prompt further AI utilization to improve and streamline compliance monitoring and keep refurbished units adherent to changes in industry standards. All of the above will lead to generated trust and improved viability of the refurbished dental equipment space.

The refurbished dental equipment market is centered around the restoration and resale of used dental instruments that have been analyzed, repaired, and certified for quality. This verifies that used equipment that has passed certification meets functionality, safety, and durability standards outlined by the dental and dental hygiene communities.

Rising operational costs, increasing patient inflow, and a desire for funding have all influenced market dynamics. Investing in refurbished equipment is based on cost versus benefit; while purchasing refurbished equipment may be less expensive initially, ultimately, it may require more expense from reliability and maintenance costs.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.19 Billion |

| Market Size in 2025 | USD 1.13 Billion |

| Market Size in 2024 | USD 1.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.60% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising dental visits and disease prevalence

The refurbished dental equipment market is mainly driven by the increasing occurrence of oral diseases. Around 3.7 billion people worldwide have oral diseases, and 49% of older people have dental caries. According to the World Health Organization (WHO), more than 2.3 billion people have permanent tooth decay, and more than 530 million children have decay of their primary teeth.

The rising global burden of oral disease has resulted in increased dental visits, thereby creating further demand for refurbished dental equipment and affordable solutions. Many clinics, especially in developing economies, are happy to use refurbished devices as a cheaper alternative to new equipment without losing any quality. The growing geriatric population and infrastructure of dental care are also fuelling the continued development of the refurbished dental equipment market, which has become an important part of modern-day dentistry.

Quality and reliability concerns hindering market growth

The refurbished dental equipment market has a significant limiting factor, which is the concern related to the quality and reliability of used equipment. Many dentists are reluctant to buy refurbished equipment because they are concerned about malfunction, the length of use before the piece of equipment fails, or that the equipment would not have a warranty. The problems of lack of refurbishment standards or no certifications of resellers are added concerns.

Industry data proposes that nearly 30-40% of dentists prefer new equipment instead of refurbished equipment to avoid potential complications. Moreover, the potential lack of consistency in the refurbishing process and variability in the compliance with regulations in various geographical markets create trust issues for buyers. In some areas, there may be a lack of certifications or traceability to guarantee the safety and performance of used dental equipment. In order to facilitate growth in the used dental equipment market, a combination of regulatory restrictions, refurbishing processes, and potential for longer warranties will provide the industry the ability to address these issues.

Tech-driven refurbishment

The accelerated growth of refurbishment technology is transforming the refurbished dental equipment marketplace, allowing new opportunities to occur for customers and sellers. Improvements in refurbishment practices are improving the quality and durability of pre-owned equipment, allowing refurbished products to adhere to prevalent industry standards. This shift is increasing the level of trust dental professionals have towards refurbished equipment, making pre-owned equipment a feasible and economic option compared to new purchases.

Refurbished dental chairs now incorporate a new AI-based positioning system to adjust angles automatically, which helps lessen practitioner strain while improving patient comfort. The increasing availability of upgraded refurbished dental equipment is creating significant opportunity for the market to grow. Improved reliability and performance in refurbished products are helping with greater adoption rates in dental clinics, and smaller practices can participate in the ongoing advancement of high-tech product performance.

The specialized dental equipment segment held the largest share of the refurbished dental equipment market due to demand for CBCT systems, CAD/CAM technology, surgical microscopes, and 3D imaging systems utilized in cutting-edge dental procedures. These high-cost tools provide the ability to perform accurate diagnoses and treatments, and refurbished options provide a new, more cost-effective option to hospitals and specialty clinics. As digital dentistry and practice operations advance, the options for refurbished intraoral cameras and dental lasers, unique to the refurbished sector, continue to grow, providing value without the relocation costs associated with technological advancement.

The essential dental equipment segment is the fastest growing sector due to frequent equipment replacements, as well as increasing adoption rates within independent clinical practices. Dental chairs, operatory lights, sterilization units, X-ray imaging systems, and handpieces are necessary pieces of equipment for a dental practice each day. Refurbished products allow cost-conscious providers the ability to augment their efficiency, especially those in emerging and developing markets. The increased scrutiny around infection control and ergonomics is also leading to a greater number of purchase replacements, while still wanting to source reliable, high-quality refurbished equipment solutions in support of growing small and mid-sized practices.

The hospital segment dominates the refurbished dental equipment market, primarily driven by their need for high-quality diagnostic and surgical equipment to treat all types of dental cases. Therefore, while hospitals limit their spending, they also make investments in refurbished Cone Beam Computed Tomography scanners, CAD/CAM systems, and dental lasers to provide advanced treatment options without paying for new equipment. As the demand for complex dental surgeries and orthodontic procedures rises throughout the industry, hospitals will need reliable and compliant equipment, and refurbished dental equipment will play an important role in reducing overall costs while maintaining a high degree of patient care.

While Ambulatory Surgical Centers (ASCs) are currently the fastest-growing end-user choice due to increasing demand for cost-effective outpatient dental treatment, they adopt refurbished CBCT systems, surgical microscopes, dental lasers, and X-ray imaging equipment to practice advanced procedures at affordable pricing. ASCs value efficiency, precision, and affordability; thus, they often choose refurbished dental equipment over brand-new items. Increasingly, ASCs will incorporate refurbished dental tools using the trend of minimally invasive surgeries, or endodontic procedures, as well as the increased utilization of insurance for outpatient dental continued care, which can result in the continued use of refurbished dental tools in ASCs.

North America is the most dominated region for the refurbished dental equipment market due to its strong dentist industry, growing emphasis on cost-effective options, and commitment to sustainability. About 36% of dental practitioners in North America now consider refurbished equipment a promising alternative to new equipment. Further, the Environmental Protection Agency (EPA) has issued a guidance to facilitate more reuse of medical devices to decrease electronic waste and satisfy the growing market for refurbished dental equipment.

The demand for refurbished products is spurred on by cost savings of 20-40% when comparing refurbished products to new products. Leading industry companies, including Dentsply Sirona, Henry Schein, and Patterson Companies Inc., developed refurbished lines of products, including sterilizers, dental chairs, and imaging systems.

The United States leads the North American market, with an estimated 200,000 dental offices generating demand for inexpensive equipment solutions. The FDA not only regulates the use of refurbished medical devices but is also government-funded, which suggests a level of quality and safety associated with refurbished devices. Increased adoption of advanced dental equipment, such as digital x-ray systems and CAD/CAM equipment, also provides more options in the marketplace for high-quality refurbished devices.

Asia Pacific is estimated to expand the fastest CAGR in the market between 2025 and 2034 due to rising investments in healthcare, the growth of dental tourism, and an increasing number of dental professionals. The World Health Organization (WHO) reports that over half of the adults in the region suffer from oral diseases, contributing to the demand for affordable dental care. Furthermore, improvements in technology and quality have made refurbished equipment more dependable and of good quality for clinics and hospitals.

China has become a significant player in the Asia Pacific refurbished dental equipment market, driven by an expanding dental industry and changes in healthcare. Government programs promoting oral health, such as free dental check-ups for students and rural populations, are increasing the demand for more cost-effective and advanced equipment. Another demand driver is the booming dental tourism in China, e.g., in Shenzhen and Beijing, along with newer private chains such as Arrail Dental, that are seeking high-quality refurbished dental equipment.

The refurbished dental equipment market in Europe is experiencing gradual growth as dental practitioners are more budget-conscious and want to promote sustainability. Around 40% of dental clinics in Europe consider refurbished equipment in order to lower expenses and still deliver high-quality care. EU regulations, such as MDR 2017/745, further boost buyers’ confidence to buy refurbished equipment. Refurbished equipment has a longer useful life, which helps mitigate electronic waste.

Germany emerges as an important market, with more than 70,000 practicing dentists fueling demand for innovative, cost-conscious solutions. Additionally, Germany is known for its strict quality standards, which also makes high-end refurbished dental chairs and X-ray units, sterilization units, and even a refurbished unit of infection control incredibly popular. Germany has been very forward-thinking with government organizations promoting efficiency, such as the German Resource Efficiency Program (ProgRess), which helps with sustainable procurement.

By Product

By End User

By Regions

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023