February 2025

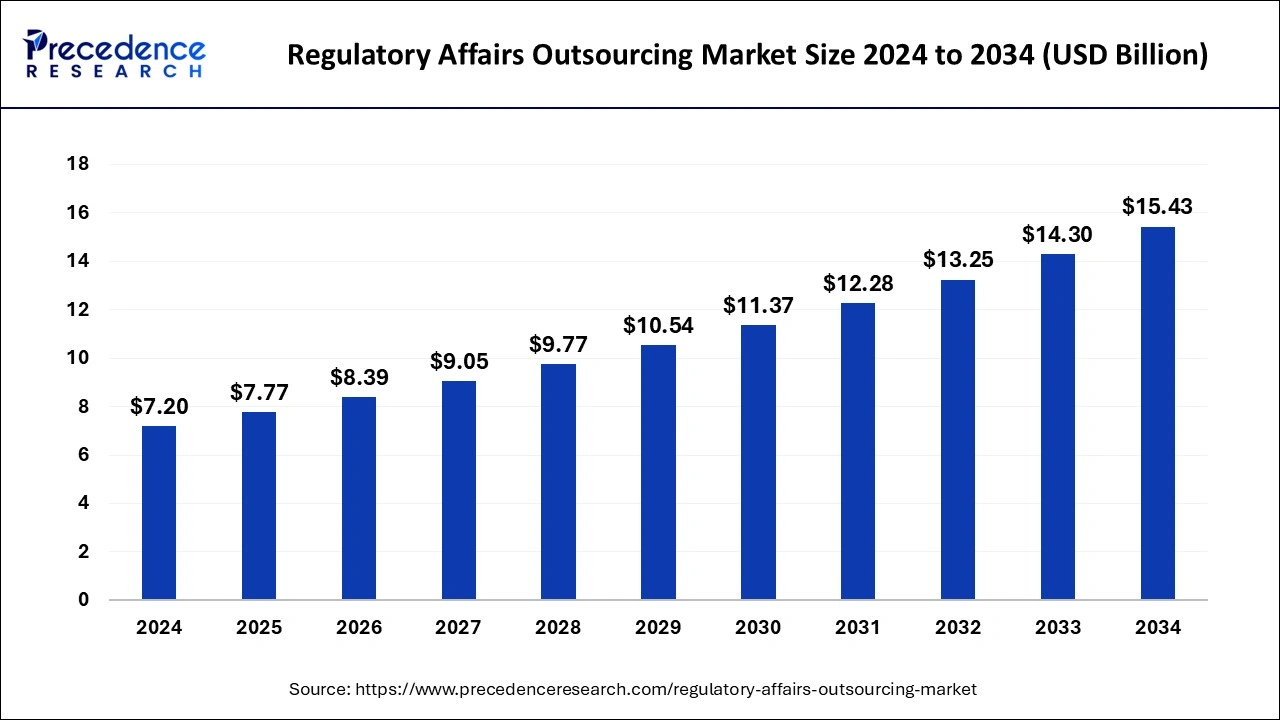

The global regulatory affairs outsourcing market size is calculated at USD 7.77 billion in 2025 and is forecasted to reach around USD 15.43 billion by 2034, accelerating at a CAGR of 7.92% from 2025 to 2034. The Asia Pacific regulatory affairs outsourcing market size surpassed USD 3.18 billion in 2025 and is expanding at a CAGR of 7.94% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global regulatory affairs outsourcing market size was estimated at USD 7.2 billion in 2024 and is anticipated to reach around USD 15.43 billion by 2034, expanding at a CAGR of 7.92% from 2025 to 2034. Rising clinical trial applications, an increase in the R&D activities, and increase in geographical expansion activities by companies which help the growth of the regulatory affairs outsourcing market.

Artificial intelligence (AI) can analyze high amount of data quickly and accurately, identifying trends and patterns, that may be missed by a person. This can also help in predicting regulatory changes and assessing their potential impact in the organization. AI tools can be applied to automate regulatory processes like quality management, the implementation of regulations, auding, data extraction, dossier filling, and administrative work. These factors help the growth of the regulatory affairs outsourcing market.

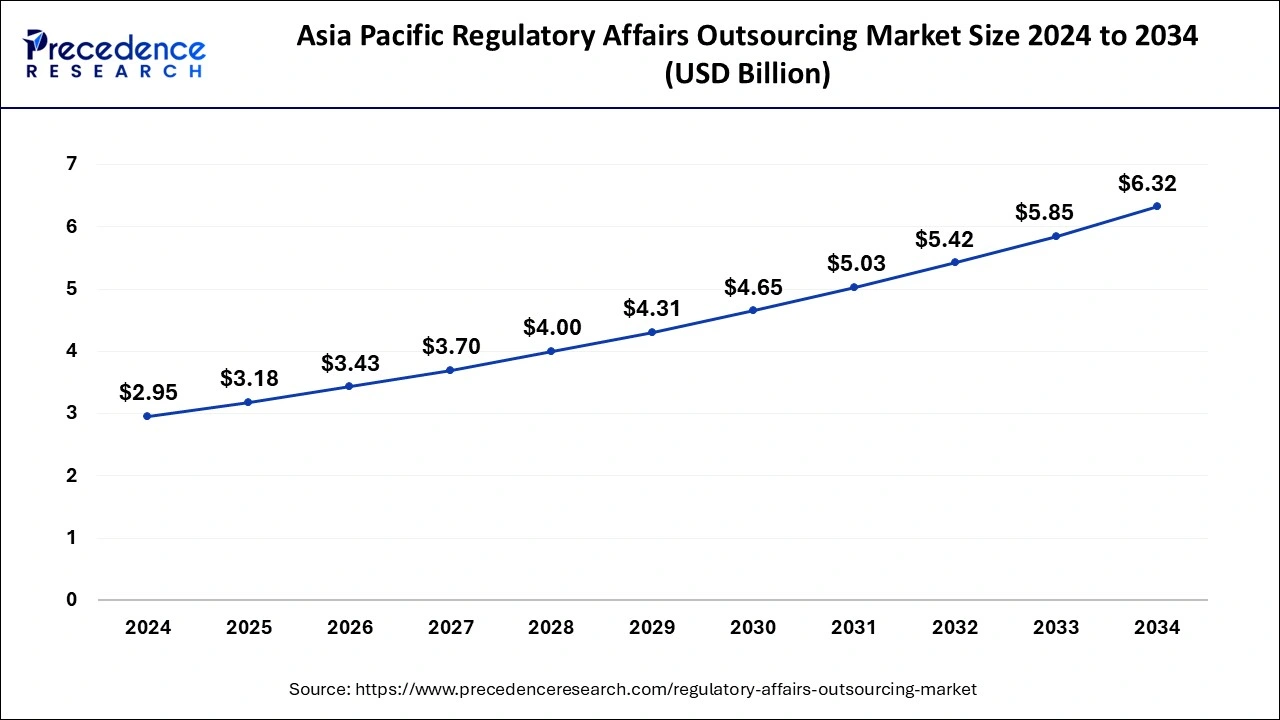

The Asia Pacific regulatory affairs outsourcing market size was evaluated at USD 2.95 billion in 2024 and is predicted to be worth around USD 6.32 billion by 2034, rising at a CAGR of 7.94% from 2025 to 2034.

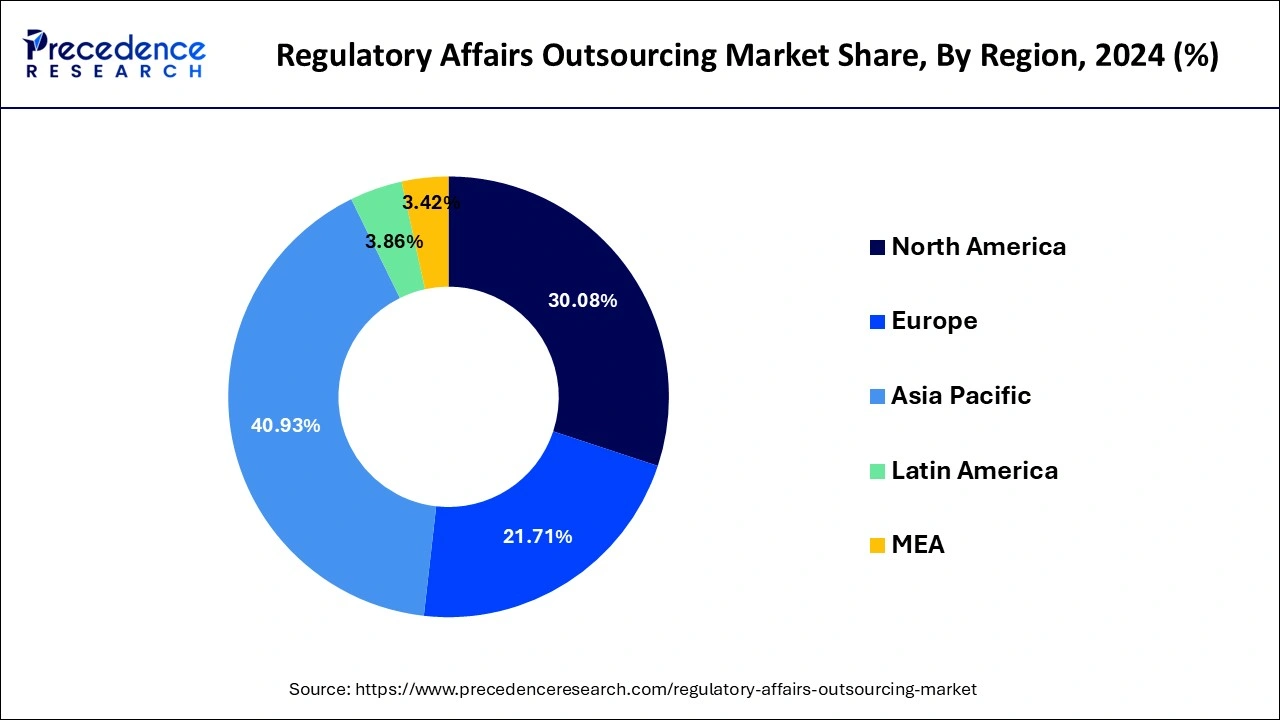

Asia Pacific region dominated the growth of the regulatory affairs outsourcing market. The growing presence of numerous pharmaceutical and medical device companies in the region owing to the easy and cheap availability of raw materials for drugs and electronic medical devices has boosted the growth of this region.

The rising investments by the government to attract FDIs are further expected to drive the growth of the market in the Asia Pacific. The countries like China, India, Indonesia, and South Korea are expected to attract investments from numerous healthcare companies that is anticipated to drive the growth of the regulatory affairs outsourcing market in the region.

The high costs associated with the operations of regulatory affairs are significant factors that drive the demand for regulatory affairs outsourcing.

Complying with the various regulatory norms of the local regulatory authorities in the major markets like North America, Asia Pacific, and Europe is a challenging task for the companies especially the multinationals.

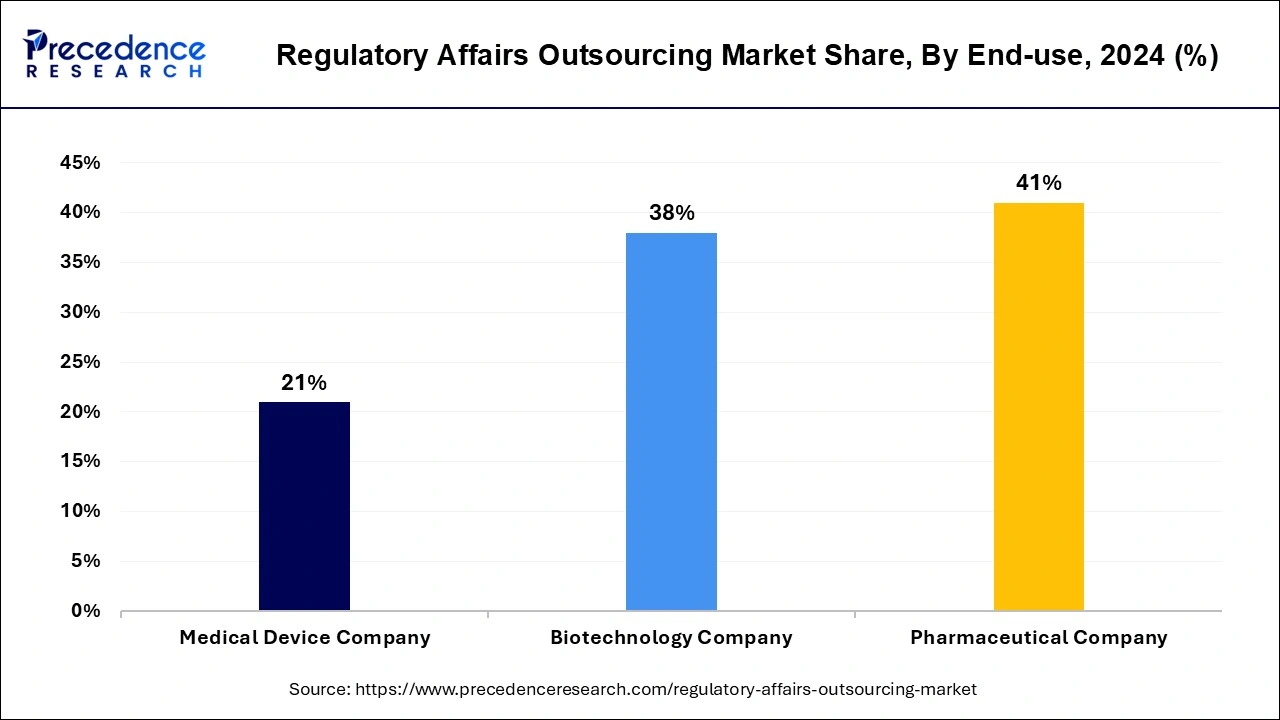

There are various companies like medical device manufacturers, pharmaceutical developers, and biotechnology companies that have increased demand for outsourcing regulatory affairs. The outsourcing of regulatory affairs has become more important owing to the expansion activities and development of new devices and drugs by the numerous companies operating in the healthcare sector.

The regular efforts for the development of new drugs and equipment result in an increased number of approvals regarding the preclinical and clinical trials. Therefore, in order to focus on the core activities and efficiently handle the regulatory affairs at low cost, the companies are increasingly adopting for the regulator affairs service providers, thereby boosting the demands for the services across the globe.

| Report Highlights | Details |

| Market Size in 2025 | USD 7.77 Billion |

| Market Size by 2034 | USD 15.43 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.92% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Category, End User, Indication, Stage |

| Regional Scope |

North America, Europe, Asia Pacific, LAMEA |

The product registration and clinical trial segment accounted for the highest market share of 27% in 2024 and is projected to sustain its dominance during the forecast period. Regulatory writing and publishing is considered to be an integral part of the research. A wide variety of documents are produced throughout the clinical trial phases. Further, the regulatory writers are considered to be an essential communicator between the drug developers and the approving regulatory authorities such as FDA and EMA. The regulatory writers also play an important role in the advertising of any new drug or medical device. Hence, the significance of the regulatory writing and publication activities has made this the leading segment across the globe.

The legal representation services segment is projected to grow at a healthy CAGR of 9.1% during the forecast period. The legal representation segment is expected to be the most opportunistic segment owing to the rising penetration and expansion activities of the numerous biopharmaceutical and medical device companies across various nations of the globe. For instance, a biopharmaceutical company, based in the US, may require legal representation in order to get the market authorization and sell its products in India. Globalization is the major driver of this segment.

The drugs segment has held a major market share of 41% in 2024. and is expected to sustain its dominance during the forecast period. The rising demand for innovative medical devices across the hospitals and clinics has led the medical devices companies to focus on their core activities and outsource the regulatory affairs activities. The medical devices companies are constantly engaged in the development of the latest and innovative diagnostic and medical devices and hence are increasingly adopting the regulatory affairs services to increase its operational efficiencies.

The medical device segment is expected to expand at the fastest CAGR of 8% during the forecast period. This is attributed to the rapid growth of the biologics industry across the globe, owing to its rising popularity of various life-saving drugs. The increasing investments on the research & development of the various new biologic drugs require frequent preclinical and clinical approvals and regulatory writing services in order to get approval and market authorization across various countries.

The pharmaceutical company segment contributed the highest market share of 41% in 2024 and is expected to sustain its dominance during the forecast period. This can be attributed to the rapid growth and popularity of biopharmaceuticals and the rising adoption of biosimilar, personalized drugs, and orphan drugs among the population. The rapidly expanding biopharmaceutical industry is expected to further drive the growth of this segment in the upcoming future.

The medical device company is expected to register the highest CAGR during the forecast period. The rising investments in the growth of the medical devices companies are fueling the growth of this segment. The rising research and development activities of the medical device companies is expected to drive the growth of this segment owing to the increasing need for regulatory writing and publication activities, in the forthcoming years.

The oncology segments contributed the biggest market share of 35% in 2024 and is predicted to sustain its dominance during the forecast period. The development of the various therapeutics and drugs for the treatment of cancer in the past years has had significantly impacted the growth of this segment. Moreover, the surging popularity of personalized medicines is expected to drive the demand for regulatory affairs outsourcing in the upcoming years.

On the other hand, neurology is estimated to be the fastest-growing segment. The rising prevalence of neurological disorders among the population has attracted increased investments in the development of new neurological medicines and medical equipment, which will increase the regulatory affairs related activities such as product registration, regulatory writing, and legal representation. This factor may propel the growth of this segment during the forecast period.

The clinical segment recorded the biggest market share of 48% in 2024 and is predicted to sustain its dominance during the forecast period. This can be attributed to the increasing number of clinical trials. According to ClinicalTrials.gov, around 326,000 clinical trials were registered in 2019 in the US which increased to more than 347,000 clinical trials in 2020. Therefore, the rising number of clinical trials is expected to retain the dominance of this segment throughout the forecast period.

The preclinical segment is projected to grow at a CAGR of 9.02% during the forecast period. The rising activities relating to the new product developments by the pharmaceutical and medical device companies are the primary factors that are expected to drive the growth of this segment in the foreseeable future.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In 2019, Accell and Syntax collaborated to expand their client reach in Europe. The various developmental strategies like collaborations, mergers, acquisitions and partnerships foster market growth and offers lucrative growth opportunities to the market players.

By Service

By Category

By End User

By Indication

By Stage

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

February 2024

January 2025