January 2025

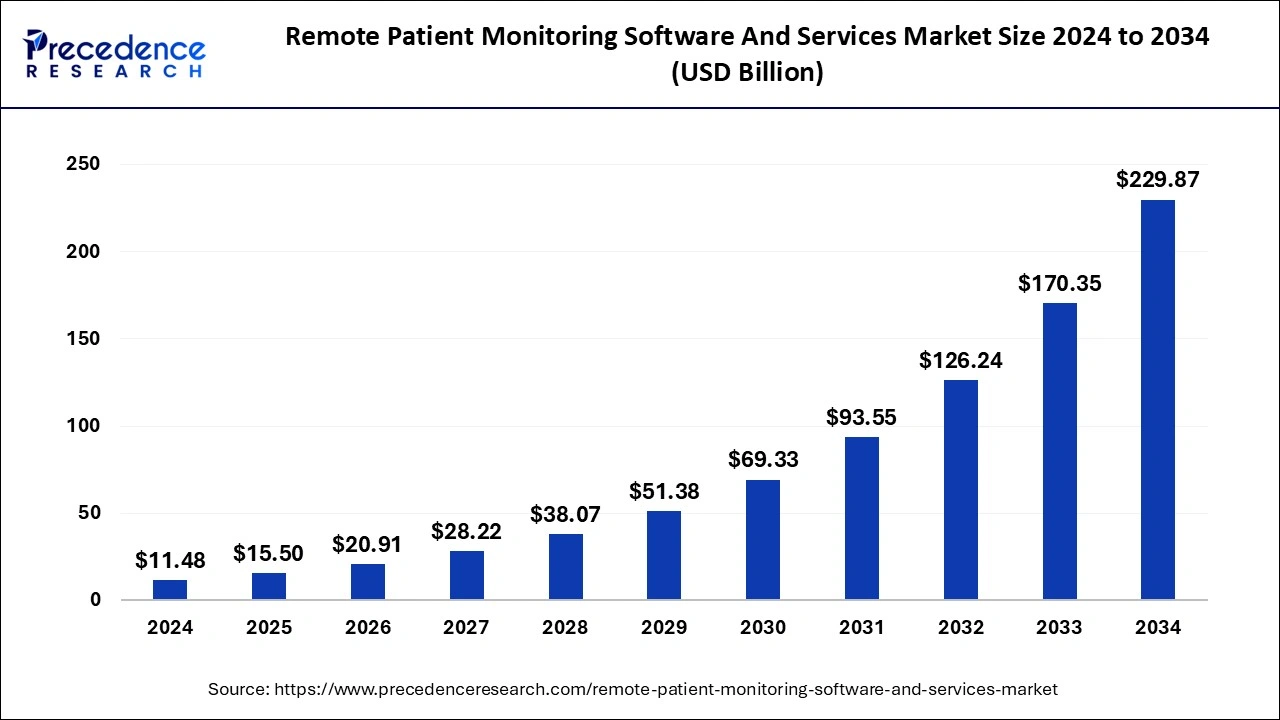

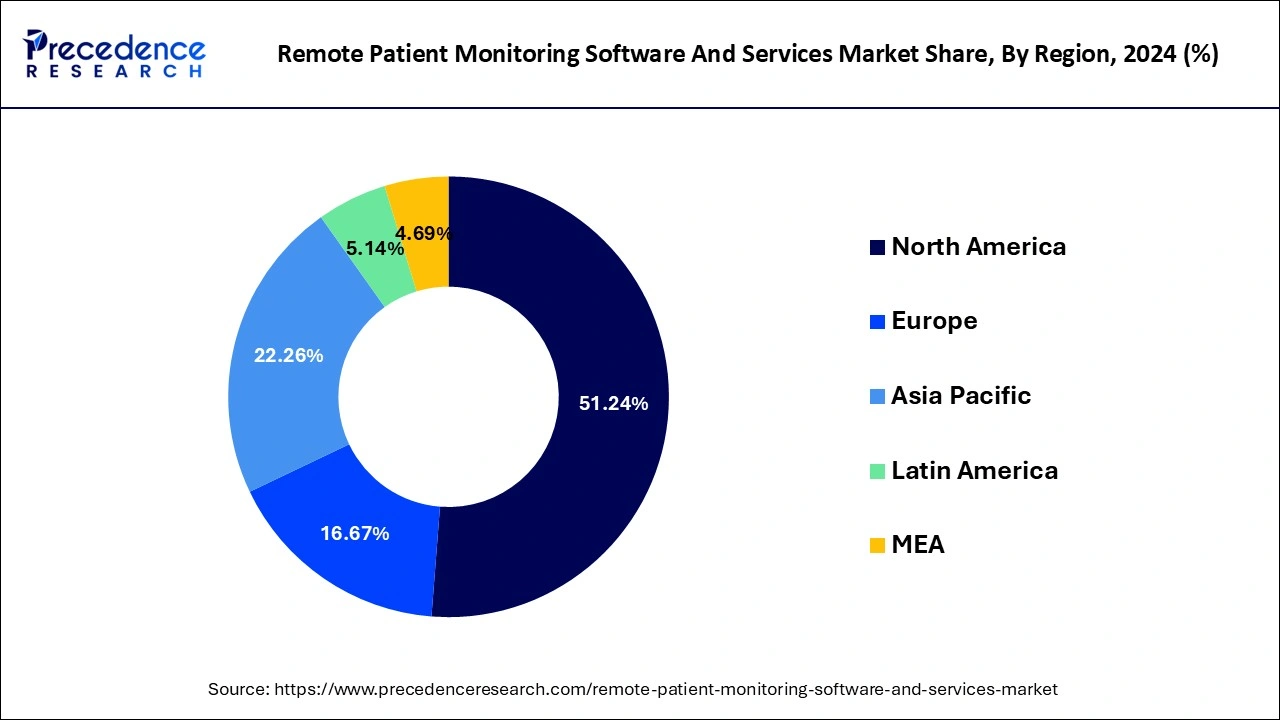

The global Remote Patient Monitoring Software and Services market size is calculated at USD 15.50 billion in 2025 and is forecasted to reach around USD 229.87 billion by 2034, accelerating at a CAGR of 34.94% from 2025 to 2034. The North America Remote Patient Monitoring Software and Services market size surpassed USD 5.88 billion in 2024 and is expanding at a CAGR of 34.95% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global remote patient monitoring software and services market size was worth around USD 11.48 billion in 2024 and is anticipated to reach around USD 229.87 billion by 2034, growing at a CAGR of 34.94% from 2025 to 2034. The growing need for healthcare in rural and remote areas is driving the remote patient monitoring software and services market.

Remote patient monitoring software and services collect medical and other types of health data like clinical data, patient registry, and patient current health status is transmitted to a healthcare provider using digital technologies. In order to save money on treatment and hospitalization, the information might be collected at the patient's home.

AI in remote patient monitoring has ushered in a new era of customized healthcare. Through the analysis of extensive patient data, such as vital signs, medical history, and lifestyle decisions, AI algorithms are able to provide personalized treatment plans and patient care. These care plans take into account the individual features of each patient, allowing medical professionals to give individualized interventions and treatments. Better chronic care management and increased patient satisfaction are the outcomes. AI has the ability to completely transform remote patient monitoring as it develops, breaking down barriers and guaranteeing that everyone has access to effective, patient-centered healthcare.

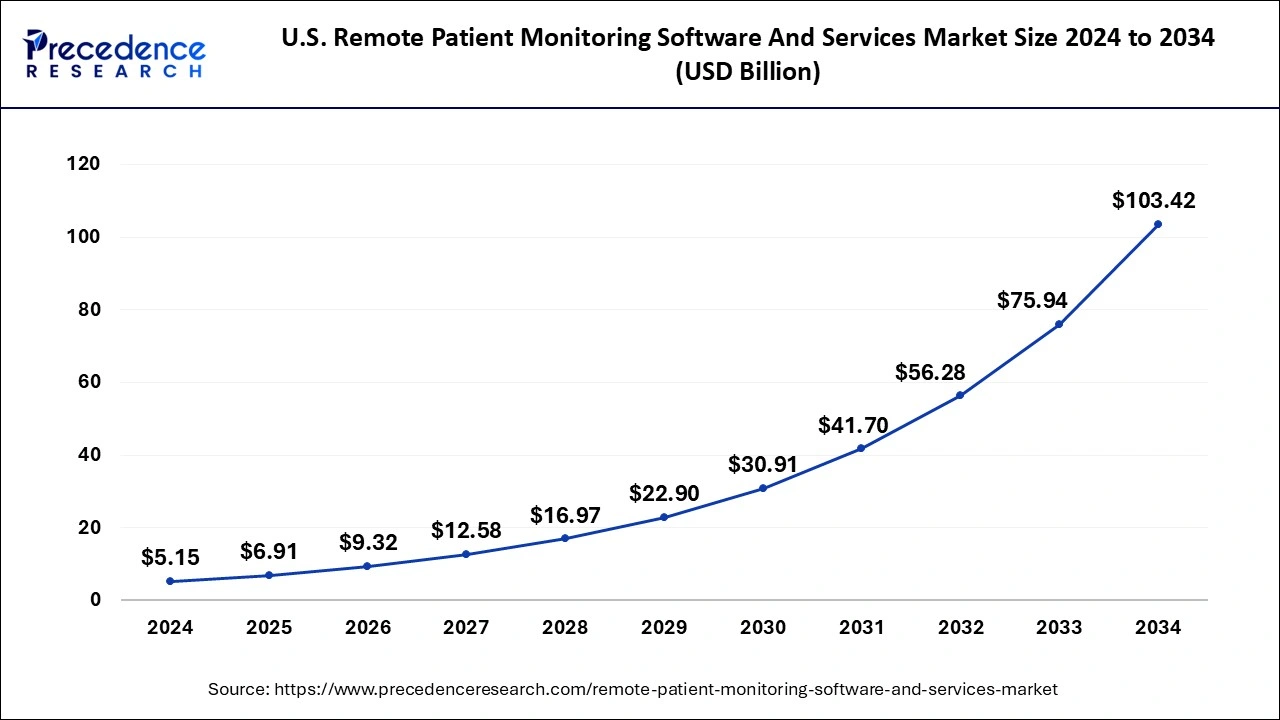

The U.S. remote patient monitoring software and services market size was evaluated at USD 5.15 billion in 2024 and is predicted to be worth around USD 103.42 billion by 2034, rising at a CAGR of 34.98% from 2025 to 2034.

North America dominated the market globally with the highest revenue share in 2024. The region's market is expected to increase as a result of factors including the use of remote patient monitoring services and the accessibility of digital infrastructure. The regional government's initiatives are also anticipated to accelerate the use of RPM solutions.

For instance, the Rural Remote Monitoring Patient Act was presented by U.S. lawmakers in June 2021; it is anticipated that the measure would establish a virtual health pilot program to assist in the provision of remote patient monitoring software and services in rural regions of the U.S. The law will aid in enhancing patient access to remote patient monitoring and assisting healthcare professionals in providing better patient care.

The USAID Digital Health Position Paper 2024-2029 is a new policy paper that outlines the organization's initiatives in digital health. The four goals outlined in the Digital Health Vision are reaffirmed in this document, which also identifies six evidence-based strategies to help USAID operationalize these priorities. Last but not least, USAID plays a significant role in building the ability required to organize and oversee telemedicine and other digital health systems at the national level. The Digital Health program is still being developed and delivered by USAID.

As healthcare expenses rise and the frequency of chronic illnesses like type II diabetes and hypertension rises, the Middle East and Africa area is expected to experience considerable increase throughout the projection period. Additionally, it is projected that the use of RPM to lighten the load on healthcare institutions together with rising expenditures by public and private entities to develop the digital healthcare system would accelerate industry growth in the area. For instance, 30% of hospital spending in the Middle East and North Africa would go toward virtual care, artificial intelligence, and remote patient monitoring, according to a Healthcare IT News story from June 2022.

| Report Coverage | Details |

| Market Size in 2025 | USD 15.50 Billion |

| Market Size by 2034 | USD 229.87 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 34.94% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

One factor is the rise of wearable patient monitoring devices

Shortages of experts in the healthcare sector

The emphasis has changed due to rising healthcare expenses

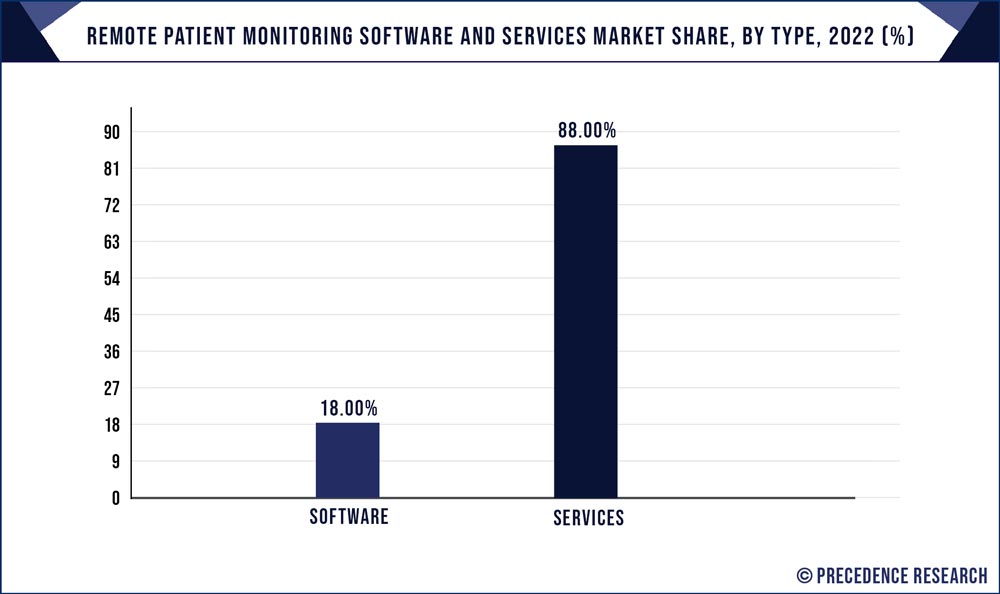

The services type segment was the highest revenue holder in 2023. The greater implementation of RPM software and services to lower hospital admissions is responsible for the large share of this market. The utilization of emergency response systems, medication management, and data-driven patient engagement solutions are a few of the services offered. Reduced response times and proper hospital allocation are made possible by emergency response systems, which benefit patients by enabling them to get better care.

On the other hand, the projected period is expected to see the fastest increase in the software category. Smartphone and internet usage are becoming more widespread, which is helping the category develop. For instance, according to information made public by bankmycell, there were 6.05 billion cell phones worldwide in 2020 and 6.37 billion in 2021. This is expected to accelerate the uptake of RPM solutions. During the projected period, it is predicted that recent advancements in 4G and 5G networks and video conferencing systems would propel the segment's growth.

The provider segment has held the largest revenue share in 2023. Hospitals, clinics, doctors, and clinicians are some of the providers. The providers' increased use of remote patient monitoring services is one factor that is projected to fuel the segment's expansion. For instance, 53% of doctors expressed interest in employing remote monitoring services to care for their patients in 2021, according to a poll by the American Medical Association.

During the projection period, this is likely to provide the category a significant boost. During the projection period, the patients' sector is predicted to see the quickest CAGR. During the projected period, it is predicted that factors like more usage of the services to cut healthcare expenses and improved doctor interaction would fuel segment expansion. Industry surveys predict that in 2021, 4 out of 5 Americans would support using remote monitoring to provide medical care. According to the research, 85% of those who employed remote patient monitoring for medical purposes were between the ages of 18 and 34.

By application, the other segment led the market in 2023. The segment is expected to be driven by the usage of RPM software and solutions for remote monitoring of chronic illnesses, such as Alzheimer's, arthritis, hypertension, and paralysis. Key elements that are projected to fuel sector expansion during the forecast period include the rising prevalence of these illnesses globally and the growing geriatric population. Patients with ailments including arthritis and paralysis experience mobility challenges, which is predicted to increase demand for these services and support the segment's expansion.

During the projected period, the diabetes category is expected to increase at the quickest rate. Blood glucose levels must be continuously monitored for diabetes, which can be done remotely. The functioning of the liver, eyes, heart, and kidneys can all be impacted by diabetes. In the next years, this is expected to fuel category expansion. Partnerships between public and commercial companies to offer remote diabetes monitoring are predicted to further fuel the industry.

For instance, the University of Mississippi Medical Center and North Mississippi Primary Health Treatment collaborated to expand access to remote monitoring for diabetic care. In eight American cities, including Corinth, Ashland, Booneville, Oxford, New Albany, Ripley, Tishomingo, and Walnut, the initiative hopes to engage at least 1,000 individuals.

By Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

February 2025

February 2025