October 2024

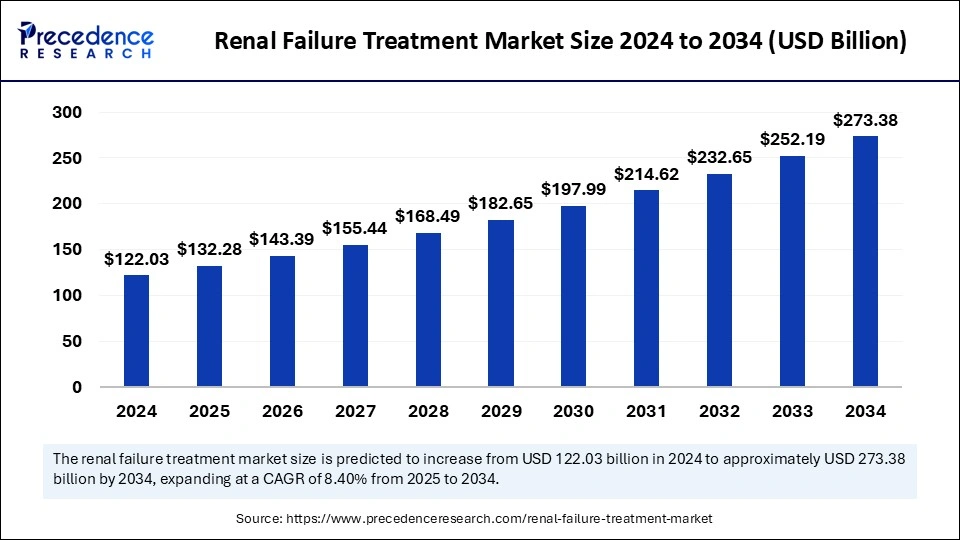

The global renal failure treatment market size is calculated at USD 132.28 billion in 2025 and is forecasted to reach around USD 273.38 billion by 2034, accelerating at a CAGR of 8.40% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global renal failure treatment market size was estimated at USD 122.03 billion in 2024 and is predicted to increase from USD 132.28 billion in 2025 to approximately USD 273.38 billion by 2034, expanding at a CAGR of 8.40% from 2025 to 2034. The Renal Failure Treatment Market is witnessing high growth because of the increasing incidence of chronic kidney diseases and end-stage renal disease. The need for early diagnosis and effective treatments has hastened the progress in renal care solutions. The market is growing because of the focus on individualized treatments and new technologies, such as wearable dialysis devices, which are intended to enhance patient outcomes and quality of life.

Artificial intelligence is transforming renal failure treatment by enhancing diagnosis, treatment planning, and monitoring of patients. AI algorithms review patient information to forecast the development and progression of chronic kidney disease (CKD) and complications. AI also enhances medical imaging and diagnosis by automatically analyzing renal biopsies and ultrasounds. AI also helps tailor treatment plans through the analysis of patient-specific data to suggest optimal dialysis parameters, drug dosage, and lifestyle modifications. AI makes it possible to diagnose diseases earlier, enhances the accuracy of treatment, and enhances patient outcomes. Predictive models based on AI assist medical professionals in individualizing therapies, optimizing drug doses, and decreasing side effects.

AI is revolutionizing renal treatment with technologies such as automated kidney segmentation and renal ultrasound disease prediction, enhancing diagnostic accuracy and minimizing errors. Fresenius Medical Care, for instance, applies AI software such as DHRP to reduce hospitalization levels in dialysis facilities through early interventions. Such developments underscore the growing role of AI in boosting efficiency, accuracy, and patient outcomes in treating renal failure.

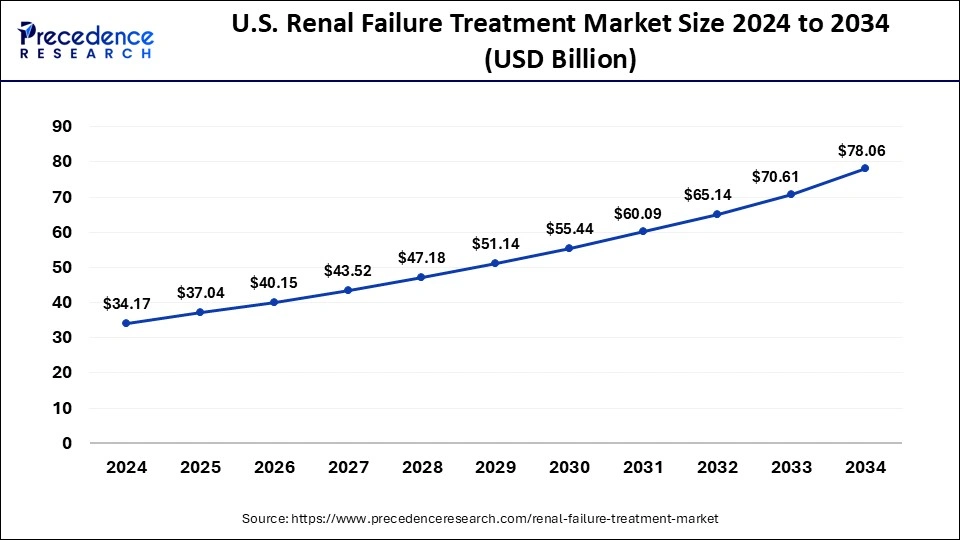

The U.S. renal failure treatment market size was exhibited at USD 34.17 billion in 2024 and is projected to be worth around USD 78.06 billion by 2034, growing at a CAGR of 8.61% from 2025 to 2034.

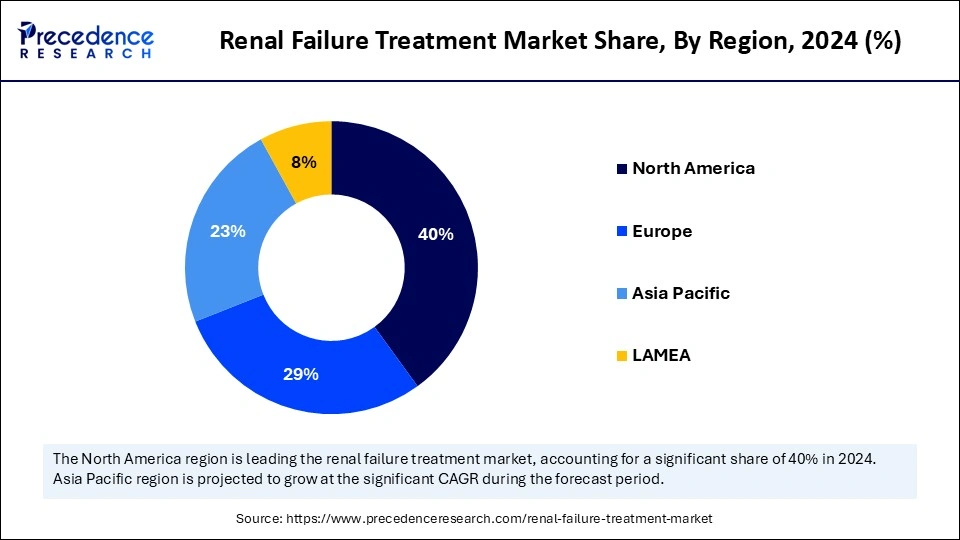

North America boasts the largest revenue share in the renal failure treatment market in 2024, primarily because of the high incidence of CKD and sophisticated healthcare infrastructure. With an estimated 4 million Canadians suffering from CKD, the healthcare burden in the region is high. Sophisticated technologies such as home dialysis systems and telemedicine solutions also enhance the dominance of North America. Firms are also busily working on the development of advanced renal replacement treatments and robotic kidney transplant procedures.

Government programs, including the End-Stage Renal Disease Quality Incentive Program by the U.S. and investments in developing kidney care facilities and telehealth initiatives by Canada, also contribute to the dominance of the region in the management of renal failure treatment demands. The FDA also approved vadadustat in March 2024 to treat anemia in adult patients on dialysis for at least three months. The development of hemodialysis therapy, such as hemodiafiltration, portable devices, wearable artificial kidneys, and bioartificial kidneys, has greatly enhanced the quality of life for patients with renal failure.

The worldwide renal failure treatment market is growing because of the increase in chronic kidney disease as well as an improvement in technology. In the U.S., drivers include an aging population base and growing awareness of kidney health. The FDA approval of FILSPARI by Travere Therapeutics in February 2023 points to the emphasis on innovative therapies for challenging kidney diseases. Innovations such as wearable dialysis and robotic kidney transplants are transforming renal treatment, while programs such as USD 6.4 billion investment by Medicare reflect a dedication to enhancing dialysis access.

Asia Pacific is witnessing growing demand in the renal failure treatment market between 2025 and 2034 as the prevalence of hypertension and diabetes continues to rise, which are also the leading reasons for CKD. Technological advancements, including portable and automated dialysis machines for home dialysis, are making therapies more convenient and accessible to patients. Government programs like the Pradhan Mantri National Dialysis Program by India and funding of renal care facilities by Australia are further fueling growth in the market. These programs, combined with subsidized dialysis procedures and upgrades in healthcare facilities, are raising the availability of care for CKD patients in the region. Overall, the region is observing a dramatic turnabout in the market for the treatment of renal failure.

The Japanese renal failure treatment market is growing at a fast pace with the adoption of sophisticated dialysis technologies, precision medicine, and favorable regulatory policies. The MHLW accelerates the approval of new treatments, allowing quicker market entry. The aging population and high prevalence of CKD in Japan fuel the demand for customized renal care solutions. The devotion of Japan to innovation can be seen through partnerships between Japanese and foreign businesses like Toray Industries and a U.S. firm collaborating in 2023 to create next-generation dialyzers. This reflects the position of Japan as a world leader in the treatment of renal failure.

The renal failure treatment market in China is experiencing rapid growth due to several key factors. The increasing rates of diabetes and hypertension, major risk factors for kidney disease, are significantly contributing to the rising prevalence of CKD. This condition particularly affects older adults, placing a substantial burden on the healthcare system. Furthermore, the introduction of advanced dialysis machines and the development of healthcare facilities in both urban and rural areas are enhancing access to renal care and driving market expansion. Government initiatives aimed at improving access to kidney replacement therapies also play a crucial role in supporting this growth.

Europe is observed to grow at a considerable growth rate in the upcoming period in the renal failure treatment market with the rising incidence of CKD and an emphasis on the enhancement of treatment accessibility. The UK and France, for example, are introducing government programs that seek to improve healthcare services, encouraging e-health solutions and care integration models. The high prevalence of diabetes and hypertension, key risk factors for CKD, fuels the demand for renal care.

Europe is also experiencing an innovation boom with new dialysis technologies and new drugs such as Empagliflozin being approved by the European Medicines Agency in 2023. The implementation of e-health solutions and telemedicine platforms in rural and underserved communities, coupled with massive investments in research and development, positions Europe at the forefront of renal care.

The renal failure treatment market involves a range of therapeutic interventions, medical equipment, and pharmaceutical treatments for acute and chronic renal failure management. Renal failure is an inability of the kidneys to filter waste products and excess fluids efficiently, resulting in serious health consequences. Treatments focus on recovering kidney function, avoiding further impairment, and enhancing the patient's quality of life. Solutions of key interest include dialysis kidney transplant and supportive pharmacological treatment.

The market further consists of treatments and products as well as services for the control of chronic kidney disease and end-stage renal disease (ESRD). An increasing number of aging populations is increasing the size of the chronic kidney disease treatment market due to its increased vulnerability towards developing and further advancing the disease, which needs higher-level treatment.

| Report Coverage | Details |

| Market Size by 2034 | USD 273.38 Billion |

| Market Size in 2025 | USD 132.28 Billion |

| Market Size in 2024 | USD 122.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.40% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Treatment, End-Use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased Prevalence of Renal Disease

The market for renal failure treatment is growing globally due to the rising incidence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) caused by diabetes, hypertension, and aging populations. This created an imperative need for efficient treatments like dialysis, kidney transplants, and high-level pharmacological treatments since the prevalence of these diseases is high and encumbers the population as well as the healthcare system. The trend is boosting the kidney disease market.

AstraZeneca's Farxiga (dapagliflozin) gained FDA approval in May 2023 to decrease the risk of cardiovascular death, hospitalization due to heart failure, and emergency heart failure visits in patients with heart failure. The approval increased the number of treatment options for heart failure patients and those at risk of cardiovascular events, including those with chronic kidney disease.

Growing Need for Organ Transplants

The increasing incidence of End Stage Renal Disease has substantially added to the number of patients listed for transplantation. This increase has stimulated the need for newer transplantation methods and immunosuppressive strategies to enhance graft survival and prevent complications. Transplantation science is continuing to advance, with the development of xenotransplantation and regenerative medicine as potential solutions to bridge the acute organ shortage and respond to escalating demand.

High Cost of Treatment

One of the major restraints in the renal failure treatment market is the prohibitive cost of advanced therapies and treatments. The prohibitive cost of advanced renal failure therapy, including dialysis and transplantation, may place it out of reach for patients in poor areas or without proper insurance. Donor organ shortages and immunosuppressive medication costs after transplant further compound this problem. The expense of treatment is high and a strong barrier to accessing it, especially in low- and middle-income nations.

Advancement and implementation of regenerative medicine and artificial kidney technologies

The growth and uptake of regenerative medicine and artificial kidney technologies are a major future prospect in the renal failure treatment market. Stem cell research and bioengineering advances seek to restore or replace injured kidney tissue, potentially decreasing dependence on dialysis and organ transplantation. The development of wearable or implantable artificial kidneys is also a prospect that could transform treatment by providing patients with increased mobility and enhanced quality of life.

The dialysis segment dominated the renal failure treatment market in 2024 with the largest share because of its pivotal position in controlling ESRD and CKD. The rising incidence of kidney disorders has boosted demand for hemodialysis and peritoneal dialysis as lifesaving interventions. Advances in technology, including high-efficiency machines, automated peritoneal dialysis devices, and wearable dialysis pumps, have enhanced treatment success and patient comfort. Portable hemodialysis units have increased patient mobility and dialyzer technology has optimized treatments as more efficient and less invasive.

The growing incidence of kidney diseases, largely caused by diabetes and hypertension, drives the need for dialysis procedures, with advancements such as high-efficiency equipment, automated devices, and wearable devices improving treatment effectiveness and patient convenience. Fresenius Medical Care introduced Hemodiafiltration in U.S. markets in 2025 is an indication of the leadership of the dialysis segment based on technological advances and the growth in the adoption of cost-saving and convenient home dialysis products. The leadership of the market for the segment is also provided by the NxStage VersiHD with GuideMe Software introduced in September 2024, which is designed to ease treatment and provide a better user experience, showing the efforts of the company to enhance patient convenience and effectiveness of care.

The favorable healthcare policies and the expanding use of home dialysis solutions are anticipated to grow at a remarkable CAGR between 2025 and 2034. Government programs like the ESRD Quality Incentive Program and Kidney Care Choices model in the U.S. focus on increasing access to sophisticated dialysis treatments, especially in underserved areas. Fistula and CAPD markets like Japan and Germany are investing heavily in renal care infrastructure and rolling out new dialysis technologies, driving the strong growth of the segment. All these programs lay a lot of stress on value-based care that promotes healthcare service providers to innovate dialysis therapy to improve outcomes of patients but at lower prices. Japan is a pacesetter in home dialysis uptake with state subsidies and patient-oriented policies, and Germany is increasing access by way of public-private collaborations and wearable technology developments.

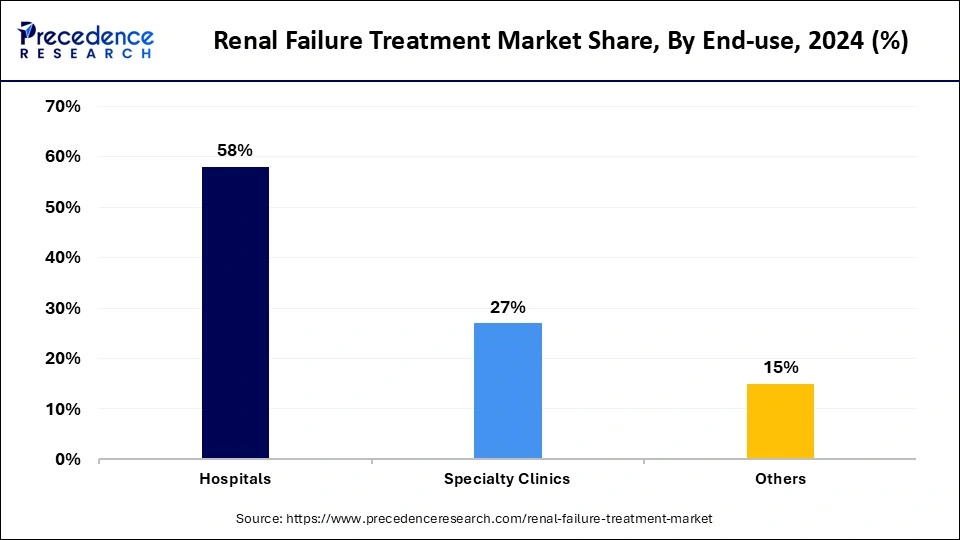

The hospital segment dominated the market for renal failure treatment in 2024, mainly attributed to its contribution to the full treatment of severe renal conditions. Hospitals are centers of advanced procedures such as dialysis and kidney transplantation, bolstered by Innovative technology and qualified medical professionals. The rising incidence of CKD has increased the need for advanced care facilities, making hospitals the first preference for patients who need intensive and advanced renal treatment. The main drivers are the growing incidence of CKD, the requirement for advanced treatment options, and the inclusion of advanced dialysis technologies. Hospitals are becoming more dominant because of favorable reimbursement for renal therapies and the growing number of patients with CKD and ESRD.

Additionally, Robot-assisted kidney transplants are becoming more and more incorporated into hospitals in the U.S. and Europe, adding accuracy and shortening recovery times. This is a major reason for the leading segment in the renal failure treatment market. They were leaders in groundbreaking procedures, including an initial robotic kidney transplant in Minnesota by the Mayo Clinic and a robotic-assisted bilateral kidney transplant by the Cleveland Clinic in March 2024.

By Treatment

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

October 2024

January 2025

May 2024