November 2024

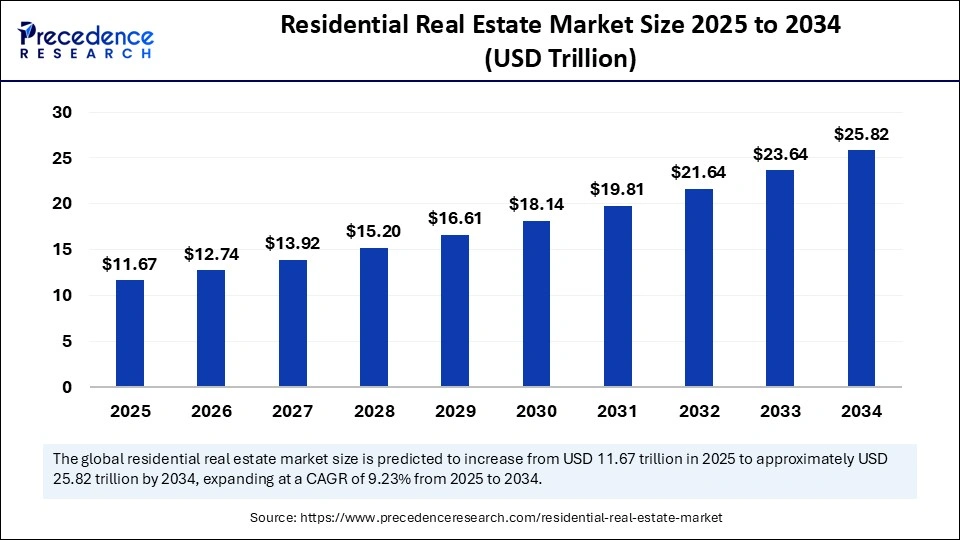

The global residential real estate market size is calculated at USD 11.67 Trillion in 2025 and is forecasted to reach around USD 25.82 Trillion by 2034, accelerating at a CAGR of 9.23% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global residential real estate market size accounted for USD 10.68 Trillion in 2024 and is predicted to increase from USD 11.67 Trillion in 2025 to approximately USD 25.82 Trillion by 2034, expanding at a CAGR of 9.23% from 2025 to 2034. The market is expanding due to urban population growth, home ownership preference, sustainable housing investments, and the need for smart home technologies and integrated living spaces, aligning with modern lifestyle preferences and technological advancement.

Artificial Intelligence (AI) is transforming the residential real estate market by simplifying processes, boosting customer interactions, and refining decision-making. Important uses include real estate assessment, forecasting analytics, client interaction, virtual walkthroughs, smart home connectivity, and property administration. Tools powered by AI examine past sales data, predict housing requirements, and offer assistance at all times. AI further improves marketing and content development, making properties more appealing to technology-inclined buyers.

Residential real estate relates to properties intended for personal dwelling, including single-family houses, apartments, condominiums, townhomes, and villas. It constitutes the foundation of the housing industry, catering to individuals, families, investors, and developers in search of residences. The residential real estate market refers to that part of the real estate sector that purchases, sells, leases, and develops properties intended for residential use. This market plays a crucial role in the economy, affecting financial stability, consumer trust, and the general economic well-being of a region or nation.

| Report Coverage | Details |

| Market Size by 2034 | USD 25.82 Trillion |

| Market Size in 2025 | USD 11.67 Trillion |

| Market Size in 2024 | USD 10.68 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.23% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Property, Buyer Demographics, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rapid urbanization

Rapid urbanization is fueling the residential real estate market globally. As individuals move to cities seeking improved jobs and living conditions, the need for housing in urban and suburban regions increases. This trend is especially evident in developing countries, straining the current housing infrastructure and prompting developers to launch new projects. This demand is driven by wealthy individuals and prosperous local purchasers.

Affordability barrier

The residential real estate market is experiencing a restraint in affordability caused by increasing property costs, elevated mortgage rates, and stagnant growth in incomes. This has rendered homeownership inaccessible for a significant portion of the population, especially for first-time and moderate-income purchasers. Essential elements leading to this restraint consist of increasing real estate prices, soaring building expenses, high interest rates, and a restricted availability of affordable housing. Developers have decreased the availability of affordable housing units because of diminished profit margins and regulatory hurdles.

Increasing requirement of smart homes and sustainable living

The residential real estate market is witnessing growth in eco-friendly and intelligent housing projects. This expansion is fueled by an emphasis on sustainable design, energy-saving structures, and LEED-accredited initiatives. Smart homes and the integration of technology are boosting the attractiveness of contemporary residential properties, especially in the high-end market. The growth of integrated townships, driven by increasing disposable incomes and urbanization, is generating new growth areas. The efforts of the government, including the Smart Cities Mission, are encouraging the creation of intelligent and eco-friendly housing developments.

The single-family homes segment held a dominant presence in 2024 because of strong demand for homeownership, the desire for personal space and privacy, and the plead of owning a property that can be customized and inherited, offering a long-term investment opportunity and a sense of legacy. Recent advancements and collaborations in the sector emphasize technological innovation, such as smart home technologies and AI-driven construction, and strategic partnerships between developers and technology companies to enhance the home-buying and living experience.

The condominium segment is expected to grow at the fastest rate in the upcoming years because of low maintenance, which offers ease of ownership, increasing urban populations, and the rise of smart living concepts, coupled with increasingly integrated technology such as smart home systems and integrated conveniences to appeal to modern homebuyers. Moreover, with the demand for remote work and flexible lifestyles, individuals are mostly focusing on having a comfortable and commodious living space, further propelling the need for single-family homes. The collaboration between government and private developers on affordable housing initiatives is being addressed by imposing government schemes like Pradhan Mantri Awas Yojana to address the growing housing demand.

The baby boomers dominated the residential real estate market with the highest share in 2024 due to their significant wealth accumulation, large population, representing a significant portion of the population, and evolving needs and preferences. They are also a prime demographic for investment properties, downsizing, and retirement living, influencing demand for certain types of home features and locations, coupled with seeking a balance of value, purchasing decisions, and reliability.

The millennials segment is expected to witness the fastest rate of growth during the predicted timeframe because of their demand for financial security and asset building, the rise of remote work and flexible lifestyles, low interest rates, and the increasing availability of tech-driven real estate platforms. Their preferences and priorities, like focus on affordable housing, technology-based transactions, and sustainable living driving the market. This is apparent in the rise of co-living spaces, shared accommodations, and rental options, as well as developers incorporating smart technologies and sustainable practices that are becoming increasingly popular in new construction and renovations.

Development of New Residential Projects Supporting North American Dominance

North America dominated the residential real estate market in 2024 owing to its powerfully economic strength, high population density in urban areas, and robust construction industry. Therefore, by providing a strong and stable foundation for real estate investment, employment opportunities, and well-developed infrastructure, including transportation networks, utilities, and communication systems, along with strong construction industry support, the rapid development of new residential projects, and government support and funding, drove the market in North America.

The U.S. dominates the North American market due to its large and diverse economy, favorable financing options, and a strong culture of homeownership. The U.S. market also has a well-established mortgage market with various loan options and competitive interest rates, making properties more accessible and thus benefiting from a diverse landscape offering various housing options, from suburban homes to urban apartments and major cities known for high-end properties.

Government Initiatives Drive the Asia Pacific Market

Asia Pacific is anticipated to grow at the fastest rate during the forecast period due to a combination of rapid urbanization, sustained economic growth, leading to increased disposable incomes for middle-class families. Large and rapidly growing population countries like China and India are experiencing a surge in housing demand. This is further driven by government initiatives, such as public-private partnerships and investments in infrastructure and collaborations between industry and academia, along with the utilization of technology, such as online property portals and digital platforms attract investors and stimulate growth in the market.

India plays a crucial role in the residential real estate market. This is due to rapid urbanization in India, infrastructure advancement, government support, and affordable housing programs that have boosted connectivity and the need for residential properties. Initiatives such as the Prime Minister Awas Yojana and tax incentives have made it easier to own a home. The support of the Reserve Bank's monetary policy has boosted economic growth, making home loans more accessible. Innovations in technology have simplified the home-buying experience and drawn in tech-oriented audiences.

China is enacting policy initiatives to boost the housing market, such as reducing the minimum down payment and abolishing mortgage interest rate caps. Efforts consist of affordable rental homes and city development. Increasing population, government initiatives, and urban development are propelling a possible stabilization of the market.

Europe: A Notable Region in the Residential Real Estate Market

The European residential real estate market is expected to witness significant growth in the foreseeable future. It is characterized by its economic stability, strong infrastructure, and elevated housing demand. Large cities such as London, Paris, Berlin, and Amsterdam draw global investments and talented workers, boosting the need for housing in urban regions. Europe is at the forefront of implementing sustainable housing solutions, as numerous nations concentrate on carbon-neutral structures and energy-efficient designs. Government programs and housing assistance, including affordable housing projects and advantageous mortgage regulations, enhance the accessibility of homeownership.

By Type of Property

By Buyer Demographics

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

June 2024