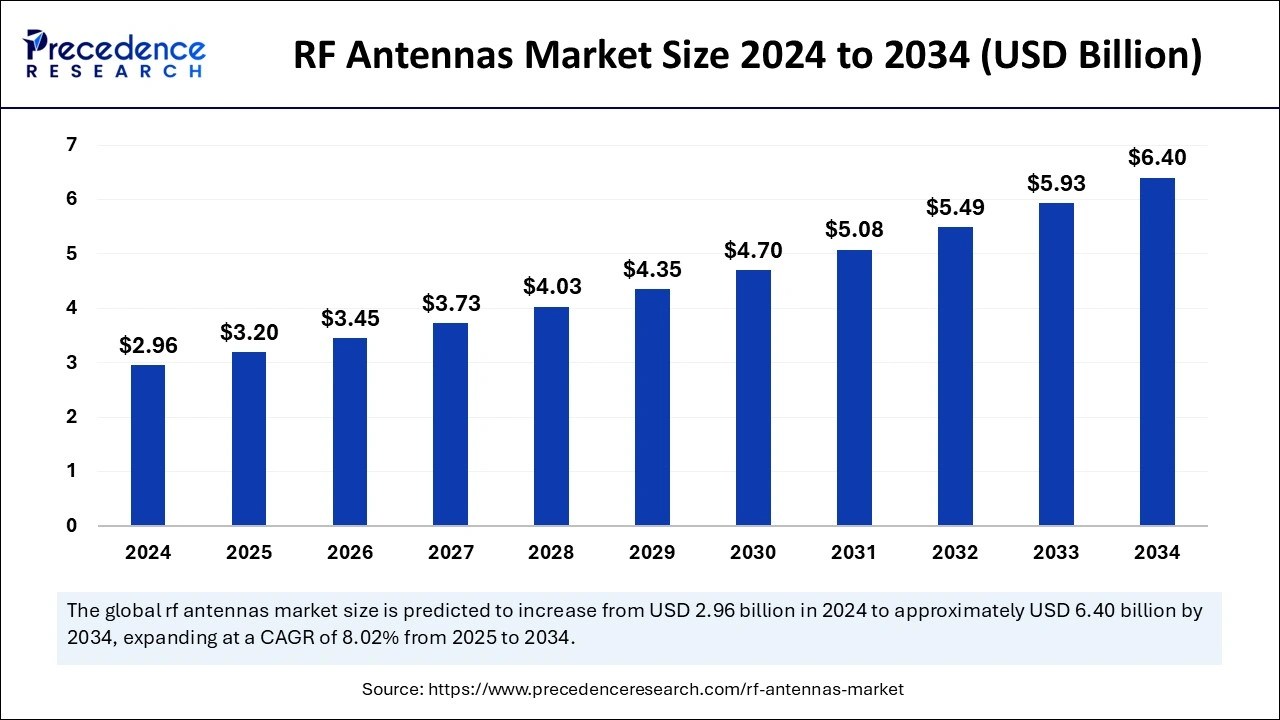

The global rf antennas market size is accounted at USD 3.20 billion in 2025 and is forecasted to hit around USD 6.40 billion by 2034, representing a CAGR of 8.02% from 2025 to 2034. The Asia Pacific market size was estimated at USD 1.21 billion in 2024 and is expanding at a CAGR of 8.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global rf antennas market size was estimated at USD 2.96 billion in 2024 and is predicted to increase from USD 3.20 billion in 2025 to approximately USD 6.40 billion by 2034, expanding at a CAGR of 8.02% from 2025 to 2034. The market growth is attributed to the increasing demand for high-speed, reliable communication systems across various industries, including telecommunications, defense, and IoT.

The RF antenna market is transforming through artificial intelligence systems that enhance both design techniques and operational performance improvements. Engineers use AI algorithms to study electromagnetic signals while finding the best antenna shapes and hiding system performance in different situations which saves both development and production funds. Advanced artificial intelligence tools help factories produce better results by acting faster and reporting problems sooner. Machine learning technology helps network operators create smooth 5G, satellite communication, and Internet of Things (IoT) connections by improving the performance of RF antennas.

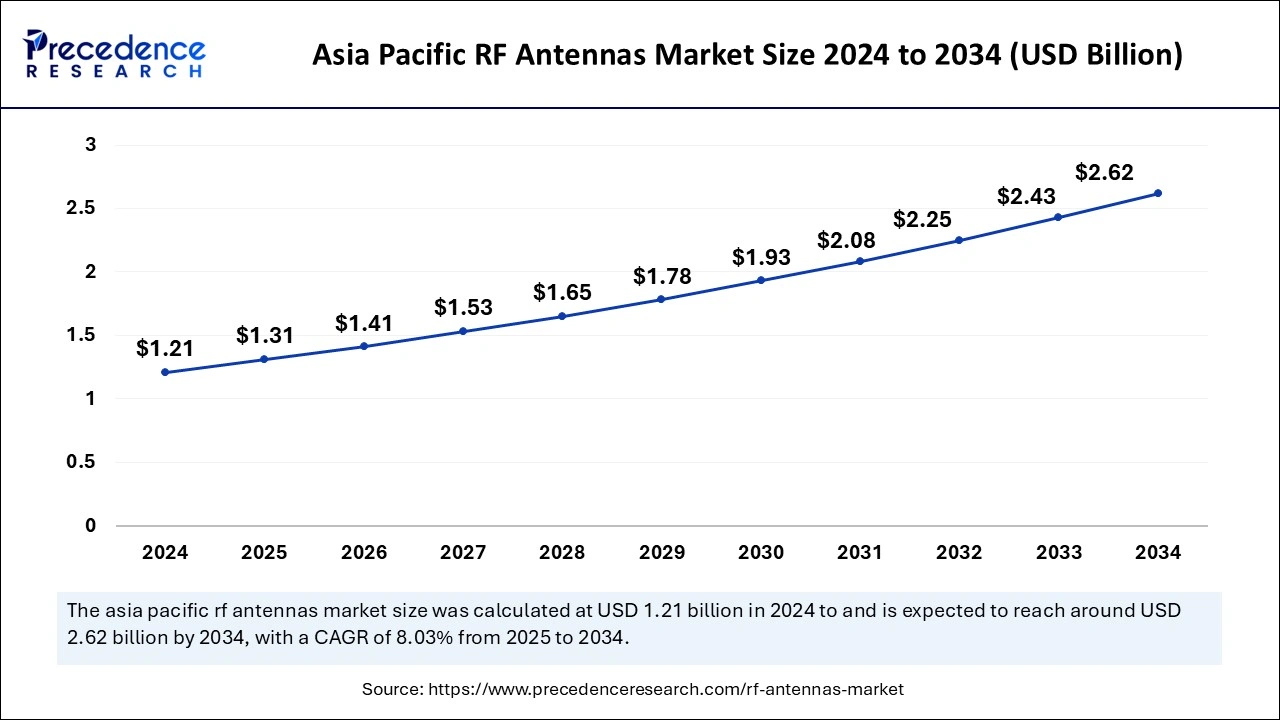

The Asia Pacific rf antennas market size was exhibited at USD 1.21 billion in 2024 and is projected to be worth around USD 6.40 billion by 2034, growing at a CAGR of 8.03% from 2025 to 2034.

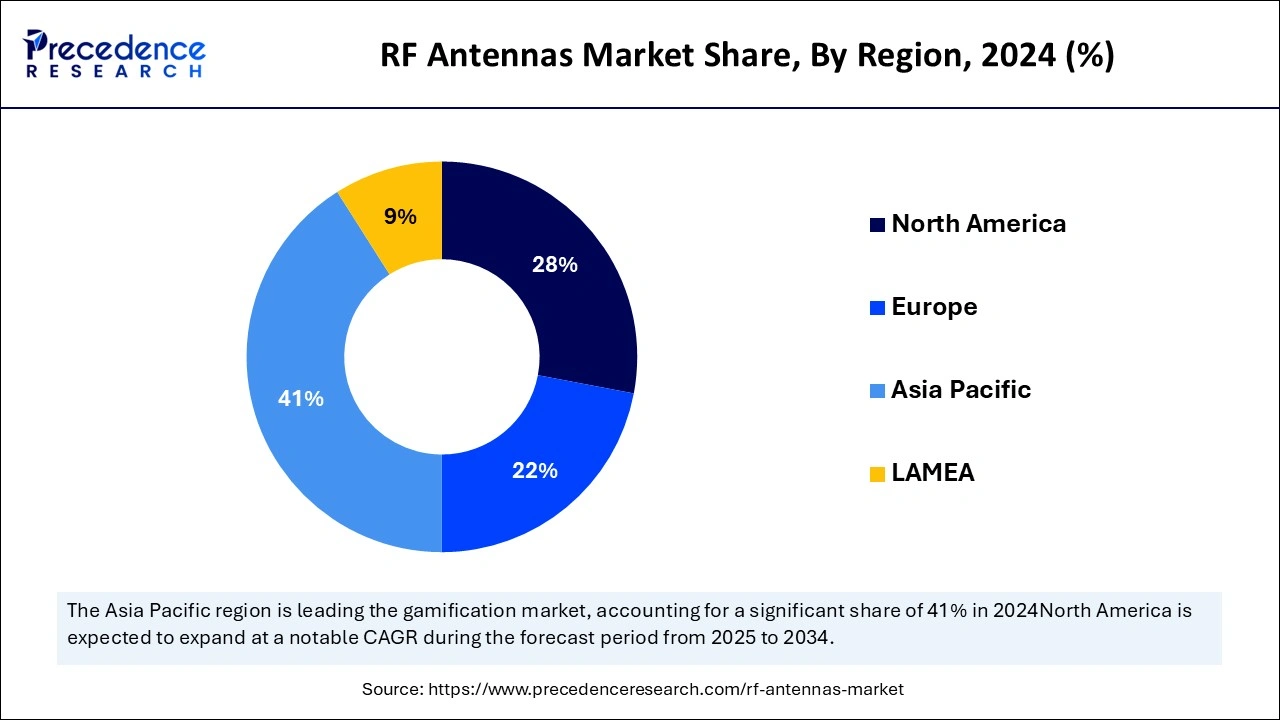

Asia Pacific dominated the global RF antenna market in 2024, as it experiences fast 5G network development as the industry grows with advanced technology. China joins Japan South Korea and India in fast implementing 5G technologies that create an expanding market for RF antennas used in mobile communication systems. The region advances smart cities plus autonomous cars while expanded satellite communication needs push RF antennas to develop. Major RF component producers in Asia Pacific create strong local demand for RF antennas, as the region produces these components.

North America is projected to host the fastest-growing RF antenna market in the coming years, due to excessive spending on modern communication technology and network construction throughout the United States and Canada. North America leads in RF antenna usage, with fast 5G network implementation and sustained work on defense projects plus widespread adoption of IoT devices. According to the FCC, the 5G network expansion in North America needs advanced RF antenna technology based on FCC data. North America leads defense and military technology use with U.S. Department of Defense investments in reliable military networks satellites and radar systems, which further cates the demand for advanced military-grade RF antennas in this region.

A high number of organizations are adopting 5G technology which increases market opportunities for the RF antenna market. RF antennas help 5G networks work at high frequencies with low delays, which are majorly used in support of self-driving vehicles and Internet-connected city systems across industries. ITU forecasts that 5G connectivity support half of the world's population by 2025 which is expected to generate rising demand for sophisticated antenna systems. Furthermore, ongoing technology advancements in RF technology for better signal transmission systems further fuel the market in the coming years.

| Report Coverage | Details |

| Market Size by 2024 | USD 2.96 Billion |

| Market Size in 2025 | USD 3.20 Billion |

| Market Size in 2034 | USD 6.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.02% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Frequency Band, Industry Vertical, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

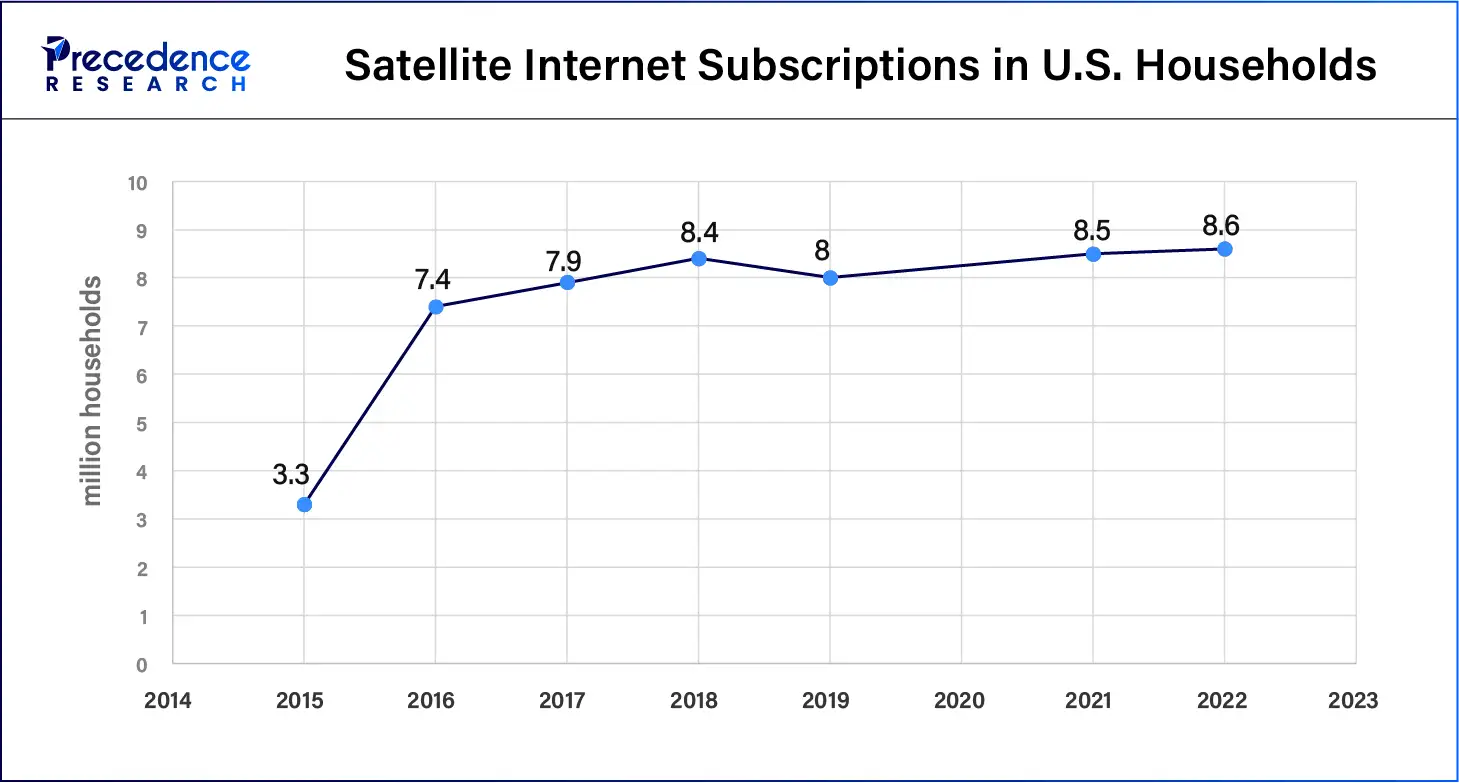

Surging satellite communication demands

Surging satellite communication needs are projected to boost the RF antenna's market technology development, thus fuelling the market in the coming years. Growing demand for satellite communication drives companies to enhance their radio frequency antenna production lines. The increasing use of small satellites including CubeSats confirms the present market evolution. Through its CubeSat Launch Initiative NASA launched 162 small satellites by September 2023 to educate and research institutions about space missions. Since 2013 ESA led several mission flights for in-orbit CubeSat tests to enhance small satellite technology.

New space technology requires enhanced RF antennas to provide uninterrupted signal transmission between satellites and ground stations. Beamforming technology through phased array antennas creates better transmission signals that stay focused and run without interruptions. Moreover, the rising use of small cost-effective CubeSats demands antennas that work well in different extreme settings while staying small and affordable.

Competition from alternative technologies

Competition from alternative technologies is expected to hamper the RF antenna market. Alternative communication technologies that use light transmissions limit RF antenna expansion, especially in particular markets. Modern optical communication systems that move data faster and carry flow attract users building high-speed networks and satellite platforms. Using optical systems for high-performance tasks cut into the demand for basic RF antennas. RF antennas continue to play essential roles within multiple communication systems while evolving under pressure from advanced industry alternatives.

High military and defense investments

High military and defense investments are expected to create opportunities for key players in the RF antenna market. Secure communication systems grow with defense spending as military units search for better ways to send data securely using advanced RF antennas. Governments across all nations are investing in their defense budgets to create more powerful military forces with better secure connections. Antenna manufacturers should expect strong market demand to expand their offerings for secure wireless communication in tough conditions. The increasing demand from military operations and intelligence operations for dependable connections will continue to support the development of advanced RF antenna technology.

The monopole segment held a dominant presence in the RF antenna market in 2024, due to the users rely on them in mobile networks and for wireless communication plus smart device applications. Monopole antenna demand continues to lead because 5G infrastructure projects keep increasing worldwide. The report from GSMA forecasts global 5G connections hit 1.8 billion by 2025 which drives the need for lower-cost efficient wireless antennas, including monopoles. Monopole antenna use in smartphones and wireless tech boosts market expansion, as regions with fast 5G adoption trends need these products.

The patch segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034, owing to the modern communication systems requiring advanced antennas. The rising need for satellite services creates a strong demand for patch antennas, as these small antennas offer outstanding performance in minimal space. Furthermore, the high demand for smaller electronic devices and better communication systems further fuels the patch antennas segment.

The VHF/UHF segment accounted for a considerable share of the RF antennas market in 2024, due to its vast utilization in communication systems because television stations and military forces rely on it plus satellite operators depend on it. The VHF/UHF radio spectrum offers suitable frequencies for creating straight-line-radio signals which emergency responders and military depend on. Global expansion of 5G networks using UHF frequencies leads to rising demands for RF antennas in this sector. Furthermore, VHF/UHF is used in numerous communication systems for public safety and broadcasting needs, thus fuelling its segment growth in the coming years.

The S band segment is anticipated to grow with the highest CAGR during the studied years, owing to its operating range between 2 GHz and 4 GHz provides both strong transmission distances and high data speeds useful for satellite and weather operations and air traffic control. As the global need for satellite broadband services grows in distant areas the S-Band helps to make these services possible. Developed economies want more powerful communication networks for both military and air travel which boosts S Band usage.

In 2024, the aerospace and defense segment led the global RF antenna market, as they handle all military networks plus space and radar functions. The aerospace defense sector needs high-performance RF antennas for clear secure communication during harsh conditions. Through satellite communication and radar development programs, the Department of Defense says their ongoing investment in communication systems supports higher RF antenna demand. Furthermore, the governmental focus on advancing defense programs creating demand for secure communications facilitates the market in this sector.

The healthcare/medical segment is projected to expand rapidly in the market in the coming years. The growth comes from medical facilities using more wireless healthcare equipment and telehealth systems plus enhancing their diagnostic capabilities. Medical technology growth of remote patient monitoring devices and wearable heart rate monitors produces substantial demand for reliable RF antennas in medical settings. The continuous development of wireless body area networks (WBANs) requires medical devices that use specialized RF antennas to process data quickly and operate with little power.

January 2025 – Company

CSO – Norbert Muhrer

Announcement - Quectel Wireless Solutions, a leading provider of IoT solutions, is showcasing its comprehensive product portfolio at CES 2025, held at LVCC, North Hall – Booth 9863. The exhibition highlights several innovative offerings, including the compact LS550G GNSS module, which will be available in Q2 2025. This module features multi-constellation support and an advanced SIP design, delivering exceptional performance in applications demanding high accuracy, low power consumption, and compact form factors.

By Component

By Frequency Band

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client