February 2025

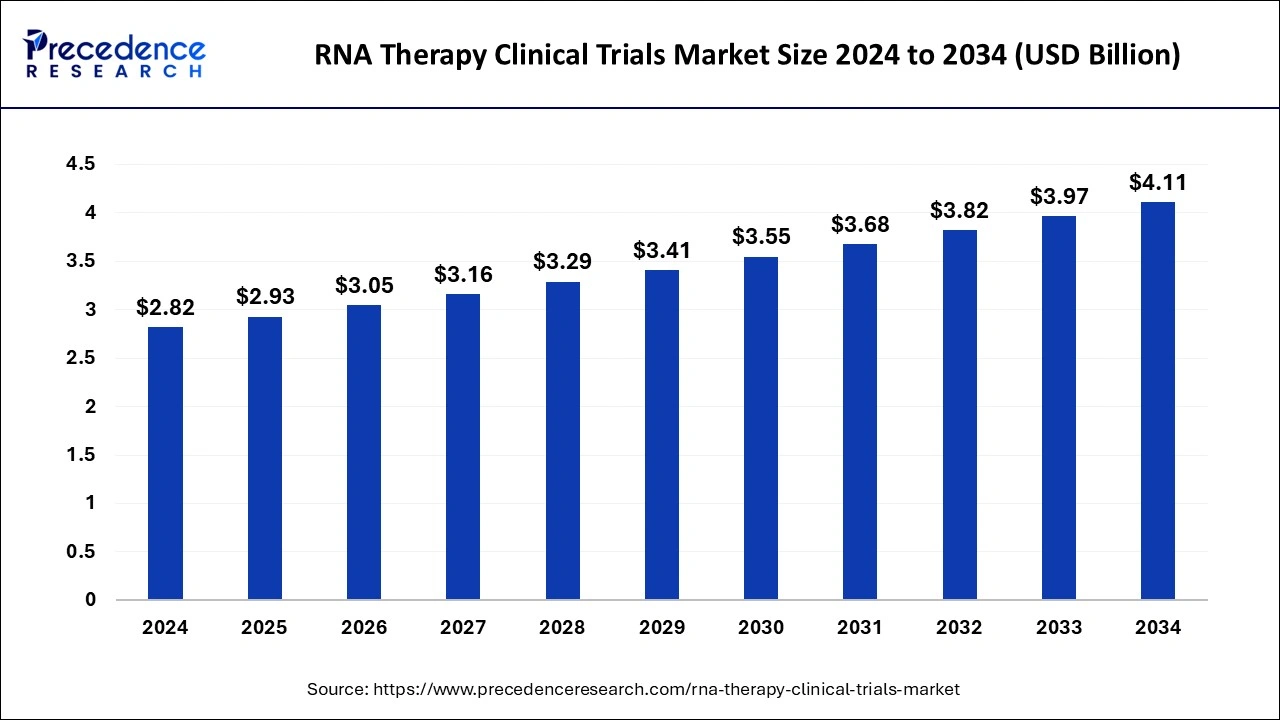

The global RNA therapy clinical trials market size is calculated at USD 2.93 billion in 2025 and is forecasted to reach around USD 4.11 billion by 2034, accelerating at a CAGR of 3.84% from 2025 to 2034. The North America RNA therapy clinical trials market size surpassed USD 1.04 billion in 2024 and is expanding at a CAGR of 3.87% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global RNA therapy clinical trials market size was estimated at USD 2.82 billion in 2024 and is predicted to increase from USD 2.93 billion in 2025 to approximately USD 4.11 billion by 2034, expanding at a CAGR of 3.84% from 2025 to 2034. The RNA therapy clinical trials market growth is majorly driven by the growing prevalence of genetics and rare diseases.

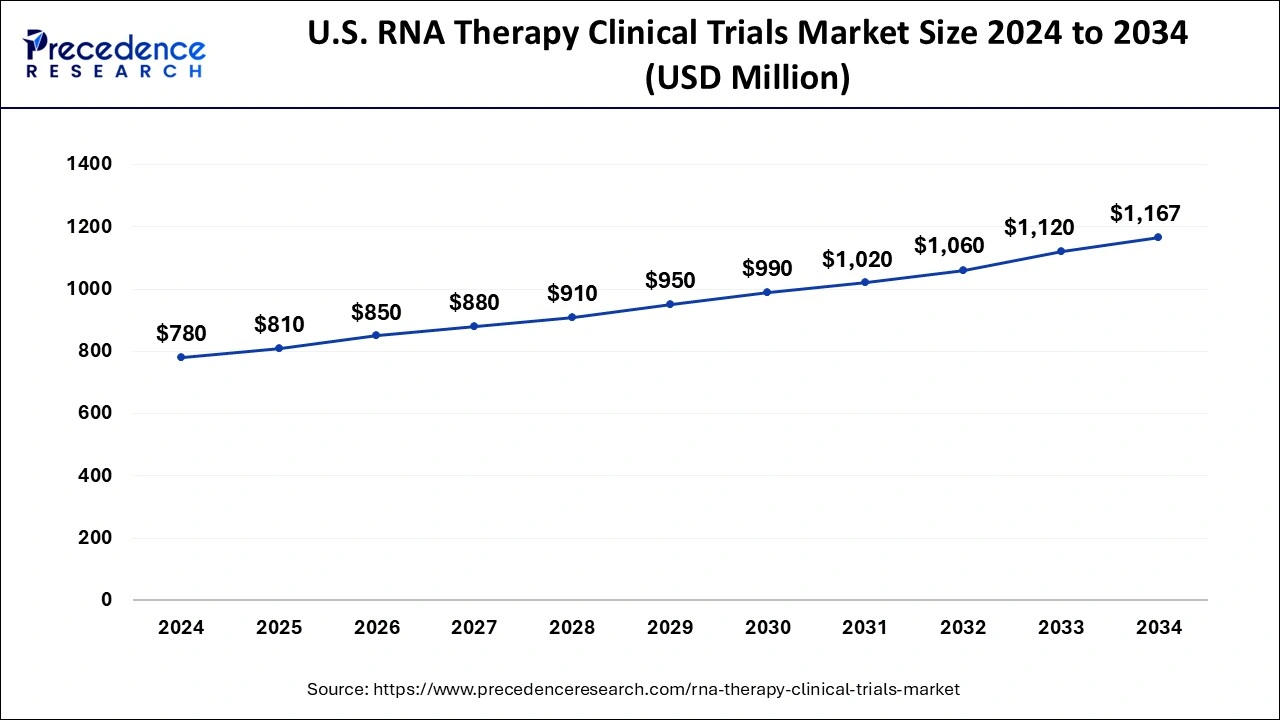

The U.S. RNA therapy clinical trials market size was exhibited at USD 780 million in 2024 and is projected to be worth around USD 1,167 million by 2034, poised to grow at a CAGR of 4.11% from 2025 to 2034.

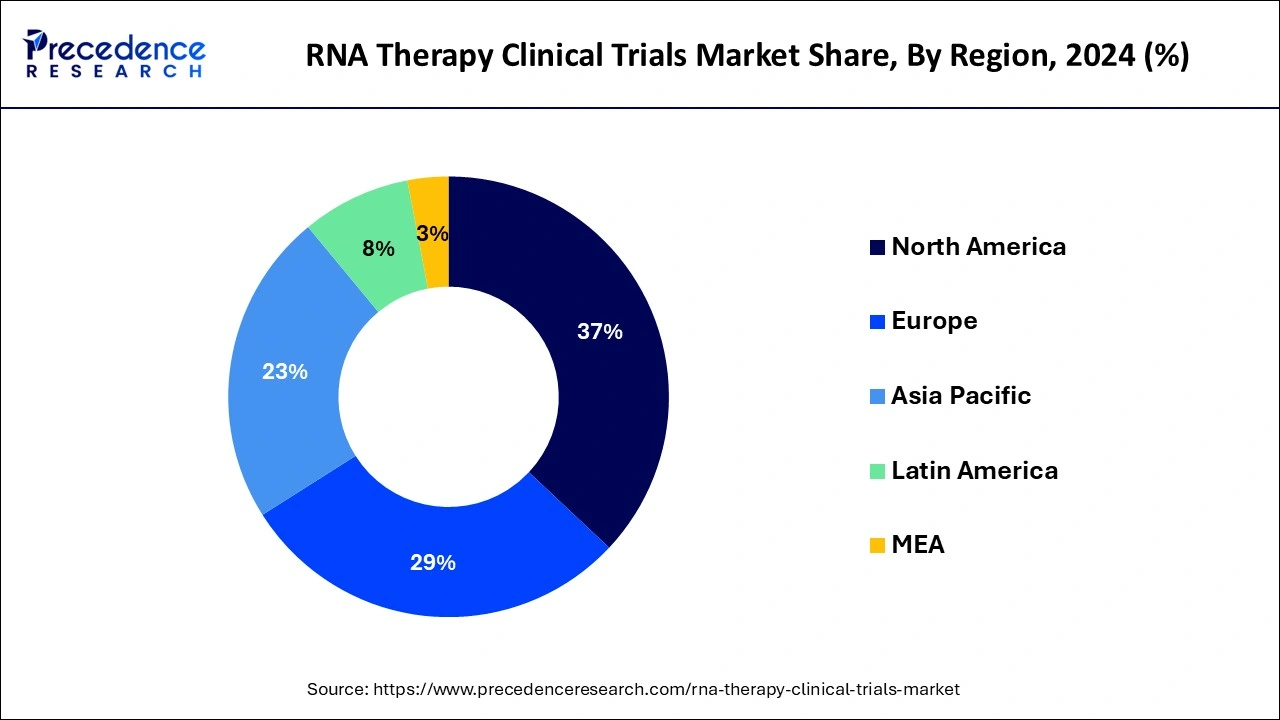

North America was the leading region for RNA therapy clinical trials in 2024. The U.S. Food and Drug Administration (FDA) has been actively promoting the development of RNA-based medicines and has established fast-track approval processes for certain RNA treatments, particularly those targeting unmet medical needs. Additionally, research efforts for RNA-based therapeutics are expanding in North America due to the development of robust research infrastructure, substantial funding, and increasing government initiatives. These elements are anticipated to propel the market growth for RNA-based therapeutics.

Asia Pacific is expected to host the fastest-growing RNA therapy clinical trials market during the period studied. The region's growth is driven by increasing government initiatives to promote clinical research, rising healthcare expenditure, and a growing focus on precision medicine. Additionally, the large and diverse patient population in Asia-Pacific provides significant opportunities for clinical trials to investigate the efficacy and safety of RNA-based therapies across various disease contexts.

Synthetic mRNA molecules are introduced into cells to instruct them to produce specific proteins in mRNA therapy. This approach can be used to provoke an immune response against infectious pathogens or generate therapeutic proteins for treating various disorders. The success of mRNA-based COVID-19 vaccines (Pfizer-BioNTech and Moderna vaccines) demonstrated the effectiveness of RNA technology in triggering a robust immune response. Regulatory agencies like the United States Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have expressed a commitment to expediting the evaluation and approval of promising RNA medicines. This support has accelerated the development of RNA-based treatments.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.11 Billion |

| Market Size in 2025 | USD 2.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.84% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Modality, Clinical Trials Phase, Therapeutic Areas, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rapid advancement in RNA technology

The global RNA therapy clinical trials market has been significantly propelled by rapid advancements in RNA technology, which have revolutionized medical research and healthcare. These breakthroughs are leading to the development of innovative RNA-based therapies capable of addressing a broad range of diseases and conditions. Technological innovation is a major driving force within this market, bringing about transformative advancements that are reshaping medical research and the development of therapies.

Process complications

A major challenge in the RNA therapy clinical trials market is the effective and precise delivery of RNA molecules to specific cells or tissues. It is important to develop safe and efficient delivery technologies that can protect RNA from degradation and ensure targeted delivery for successful RNA therapy outcomes. Extensive research and development efforts are necessary for the creation of RNA therapeutics. Protecting intellectual property rights can be challenging, especially when multiple companies and researchers are working on similar technologies.

Supportive regulatory environment

Regulatory agencies have been encouraging pharmaceutical and biotechnology companies to invest more in the development of RNA therapy. This encouragement has led to an increase in clinical trials in this field. The creation of regulatory guidelines and expedited pathways for RNA-based therapeutics demonstrates the commitment of regulatory agencies to promoting innovation in this area. The supportive regulatory environment has played a crucial role in driving the growth of the RNA therapy clinical trials market.

The rare diseases segment dominated the global RNA therapy clinical trials market in 2024. The growth is driven by the increasing prevalence of various rare diseases and the R&D investments by market players. For non-oncology rare disorders, the most targeted conditions include cystic fibrosis, Duchenne muscular dystrophy, and amyotrophic lateral sclerosis.

The anticancer segment is expected to grow at the fastest rate in the RNA therapy clinical trials market during the forecast period. The rapid development of the Pfizer/BioNTech and Moderna COVID-19 vaccines leveraged each company's expertise in cancer vaccines. Personalized vaccines are created using the molecular structures of patients' tumors to identify genetic changes that could produce neoantigens. Algorithms are employed to predict whether these neoantigens will bind to T-cell receptors and trigger an immune response.

The messenger RNA segment dominated the RNA therapy clinical trials market in 2024. mRNA-based therapies show great promise by directly encoding specific proteins in the body, with potential applications in vaccines, cancer immunotherapy, and protein replacement therapies. The success of mRNA-based COVID-19 vaccines in triggering targeted immune responses has sparked significant interest and investment in clinical trials by exploring its therapeutic potential.

The RNA interference segment is expected to grow at a significant CAGR in the RNA therapy clinical trials market during the forecast period. RNAi-based therapies offer a promising approach by interfering with the expression of disease-causing genes. Additionally, the oligonucleotide segment, which includes non-antisense and non-RNAi therapies, has experienced steady growth, encompassing other innovative RNA-based therapeutic modalities that fall outside traditional categories.

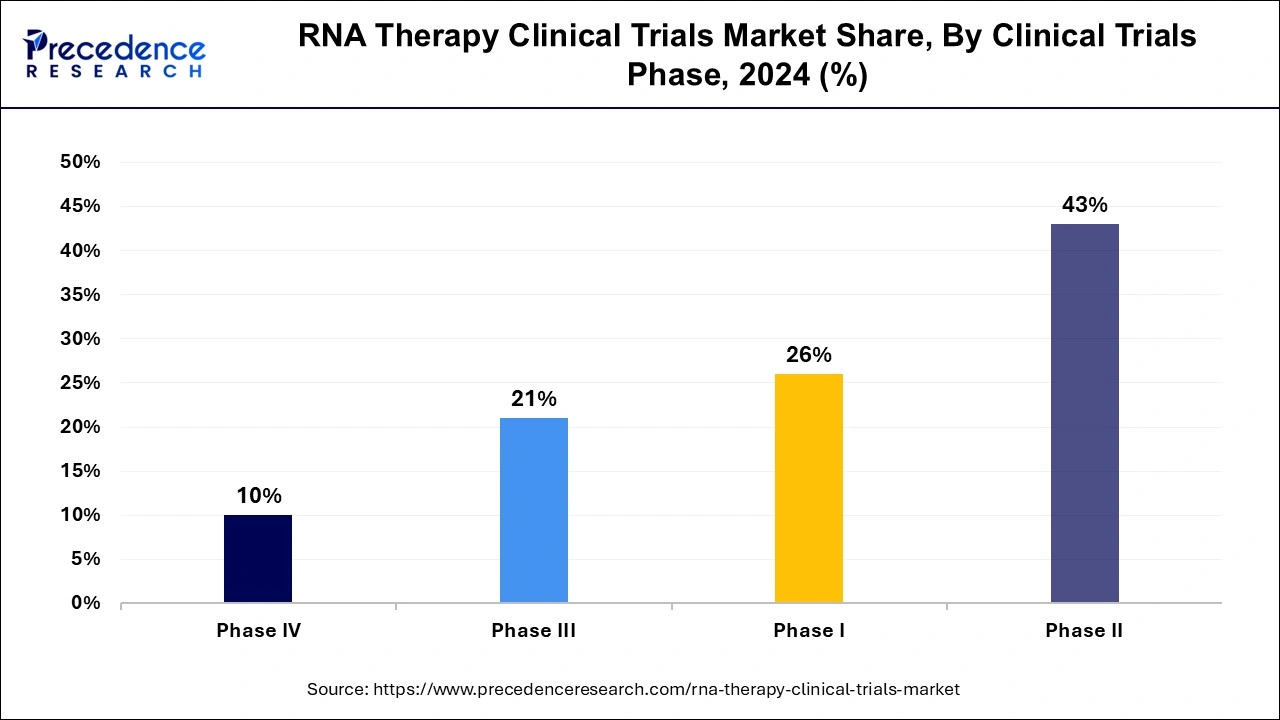

The phase II segment dominated the RNA therapy clinical trials market globally in 2024. The effectiveness and safety of RNA therapy will drive segment growth, as they are crucial in determining the optimal dose and dosing regimen for these therapies. Rising R&D investment and the increasing number of both industry-sponsored and non-industry-sponsored phase II clinical trials are significant contributing factors. Phase II studies are essential for establishing the ideal dose and dosing regimen for RNA therapies.

The phase I segment is expected to grow substantially in the RNA therapy clinical trials market during the forecast period. Regulatory bodies, such as the U.S. FDA, require data from phase 1 clinical trials to advance RNA therapies into later-stage trials. Phase 1 trials provide essential safety data for regulatory submissions, including Investigational New Drug (IND) applications, which are necessary to progress to the next stages of clinical research.

By Modality

By Clinical Trials Phase

By Therapeutic Areas

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025

February 2025

January 2025