November 2024

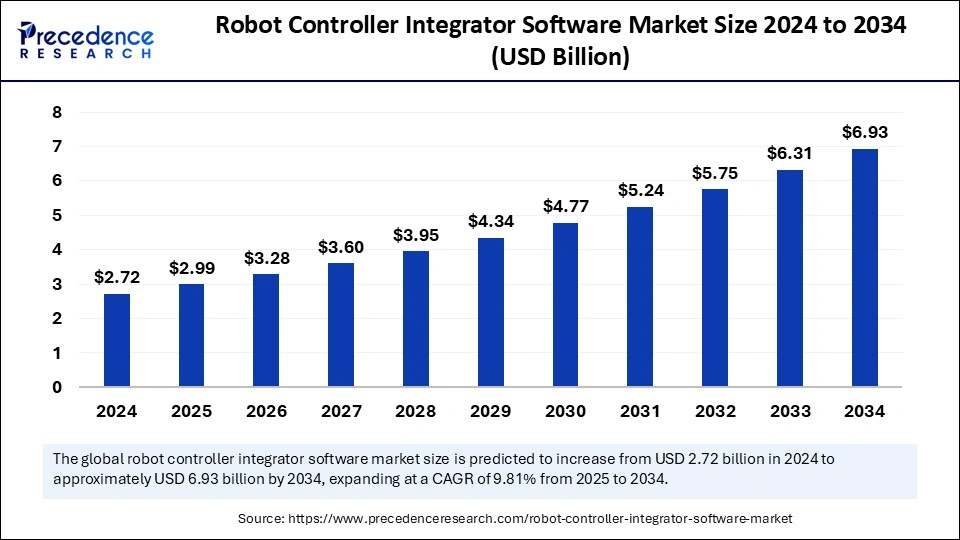

The global robot controller integrator software market size is calculated at USD 2.99 billion in 2025 and is forecasted to reach around USD 6.93 billion by 2034, accelerating at a CAGR of 9.81% from 2025 to 2034. The North America market size surpassed USD 1.22 billion in 2024 and is expanding at a CAGR of 9.95% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global robot controller integrator software market size accounted for USD 2.72 billion in 2024 and is predicted to increase from USD 2.99 billion in 2025 to approximately USD 6.93 billion by 2034, expanding at a CAGR of 9.81% from 2025 to 2034. The adoption of Industry 4.0 technologies drives the global market. The demand for improved efficiency and productivity is driving the adoption of solutions in various industries.

Artificial Intelligence is significantly influencing robot controller integrator and software solutions by providing autonomous decision-making, real-time adaptation, and complex task execution. AI is a transformative tool that improves automation capabilities. AI-enabled robot controllers can optimize production processes, increase efficacy, and reduce downtime. AI is providing enhanced flexibility and predictive maintenance to this solution.

The growing emphasis on safety standards and reactive measurements to prevent accidents has shifted the focus toward AI integration. Manufacturing industries have driven an emphasis on smart production and quality control, which has increased the demand for AI technology. Industries are rapidly investing in and initiating AI in robot controllers, integrators, and software solutions.

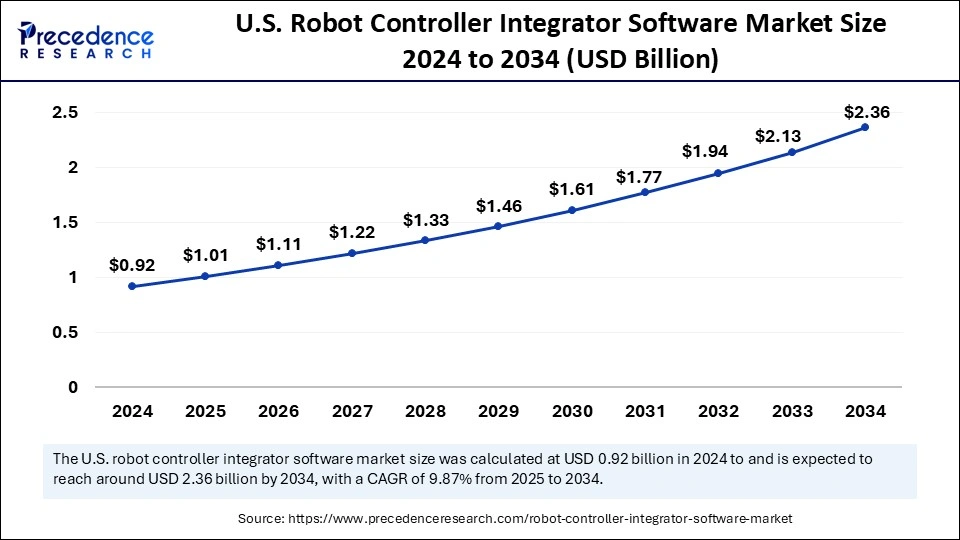

The U.S. robot controller integrator software market size was exhibited at USD 920 million in 2024 and is projected to be worth around USD 236 billion by 2034, growing at a CAGR of 9.87% from 2025 to 2034.

North America's Early Adopter of Edge Technologies

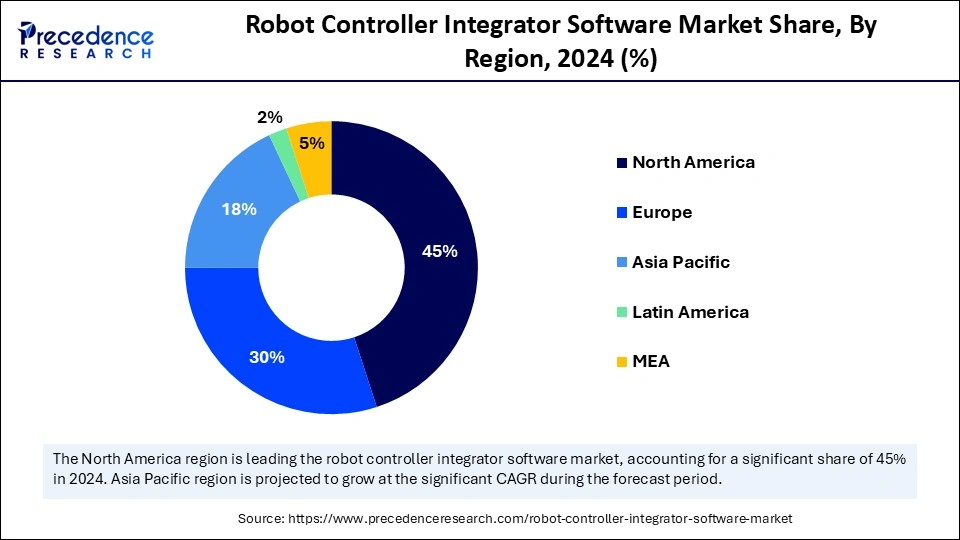

North America dominated the robot controller integrator software market with the largest share in 2024 due to various factors like the presence of key market vendors, high adoption of automation in industries, and strong research and development activities. North America is the early adopter of automotive technologies, including robotics and AI. Strong research and development activities are you nabbing innovations and researching robotics and AI. Regional industries have witnessed high adoption of automation to improve productivity, safety, and efficacy concerns.

Robots Manufacturing Industries Driving Market in United States

The United States is leading the North American market, driven by the existence of established industries like automotive, healthcare, logistics, and electronics. The United States has witnessed robust robot installation in manufacturing companies, as automotive and electronic companies are rapidly investing in automation. The aerospace and automotive industries of the United States are other rapid adapters of robotics. The presence of key industries and market players is robusting the innovations and adaptations of these technologies.

Rapid Industrialization Driving in Asia Market

Asia Pacific is anticipated to grow at the fastest CAGR in the robot controller integrator software market during the forecast period due to rapid industrialization and government initiatives. Expanding industries like automotive, healthcare, and consumer electronics are driving demand for automation technologies such as robotics and AI. The high consumer base and rising demand for customized solutions are the factors driving the need for automation technologies in these industries. Government initiatives to boost countries' manufacturing capabilities are promoting the adoption of these technologies. Additionally, rising investments in electronics and automotive industries in robot controller integrators and software solutions are accelerating the growth.

Government Initiatives to Boost the Chinese Market

China is leading the regional market, driven by rapid electronic and automotive industries. The country has witnessed rapid adoption of robotics in the automotive and semiconductor industries. The trend of Industry 4.0 has increased in the country due to the emphasis on I couldn’t stand efficacy from my driving the market. Furthermore, government initiatives like ‘Made in China 2025’ encourage the adoption of cutting-edge technologies like robotics and AI.

European Robust Automation and Manufacturing Industries Boosting the Market

The European robot controller integrator software market is growing at a considerable CAGR with strong automation and manufacturing industries. Europe is home to major leading automotive and manufacturing companies driving the need for robot controller integrators and software solutions. The existence of key market players and government support are the factors contributing to this growth. Government initiatives and investments in research and development are enabling advanced robot controller integration and software solutions. Europe has witnessed rapid demand for customized solutions, contributing to the demand for robot controllers, integrators, and software solutions.

Germany Market Trends

Germany is the largest market in Europe, driven by advanced routine manufacturing industries. Government initiatives such as Industry 4.0 promote the adoption of automation technologies. Countries emphasize providing advancements in recent market competition, fueling automation areas. The growing robotics and automation industry is fueling market expansion in Germany.

The robot controller integrator software market has witnessed significant growth across the world as industries are placing emphasis on providing solutions for controlling, integrating, and programming industrial robots. Digitalization has taken place all over the world. Industries are rapidly adopting automation solutions to enhance efficacy, safety, safety standards accuracy, and overall productivity. As the shift toward Industry 4.0 technologies rises, the need for report controller integrators and software is also fueling.

Increasing labor cost shortage issues are the major factors drawing the attention of industries toward these solutions. Robots have proven spectacular benefits in improving difficulties and productivity; the integration of controller integrators and software technologies is fueling capabilities. The market is likely to witness further expansion as the trend of technological advancements, such as AI integration, machine learning, and Internet of Things capabilities, is rising.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.93 Billion |

| Market Size in 2025 | USD 2.99 Billion |

| Market Size in 2024 | USD 2.72 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.81% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Industry, Functionality, Application, Deployment Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Shift toward industry 4.0

Increased automation adoption in various industries, such as automotive, electronics, and logistics, fuels trends of Industry 4.0. Companies are seeking solutions to preoperational efficiency, precision, and accuracy, driving demand for advanced robot control, integrator, and software solutions. Market competition is further fueling the adoption of robust robot controller, integrators, and software solutions in the industries. This solution optimizes production processes to improve productivity and reduce costs. Digital transformation in the industries drives a shift toward industry 4.0 concerns.

Lack of specialized expertise

Lack of specialized expertise is the major restraint to the robot controller integrator software market. This solution requires specialized knowledge and skills. The complex nature of robot control systems requires specialized expertise in automation, robotics, and software development. The rapid technological advancements in robot control and software require skilled professionals to update their skills, which can be challenging for the manufacturing and optimization of solutions.

Rising adoption of automation in industries

The robot controller integrator software market has witnessed a significant rise due to the rising adoption of Industry 4.0 and the high demand for efficiency and productivity. Various industries, including automotive, electronics, and healthcare, have expanded the adoption of robot controller integrators and software solutions. The healthcare industry is seeking automation to enhance the safety, efficacy, and accuracy of drug development and manufacturing procedures.

Automotive industries are major adopters of these solutions to enhance productivity and manufacturing. The robot controller integrator and software are significant tools in improving high-speed and precise manufacturing in the consumer electronics industry. The growing demand for customized solutions is the major factor driving an industrial shift toward the adoption of these solutions. Manufacturing industries are rapidly adopting automation to improve productivity.

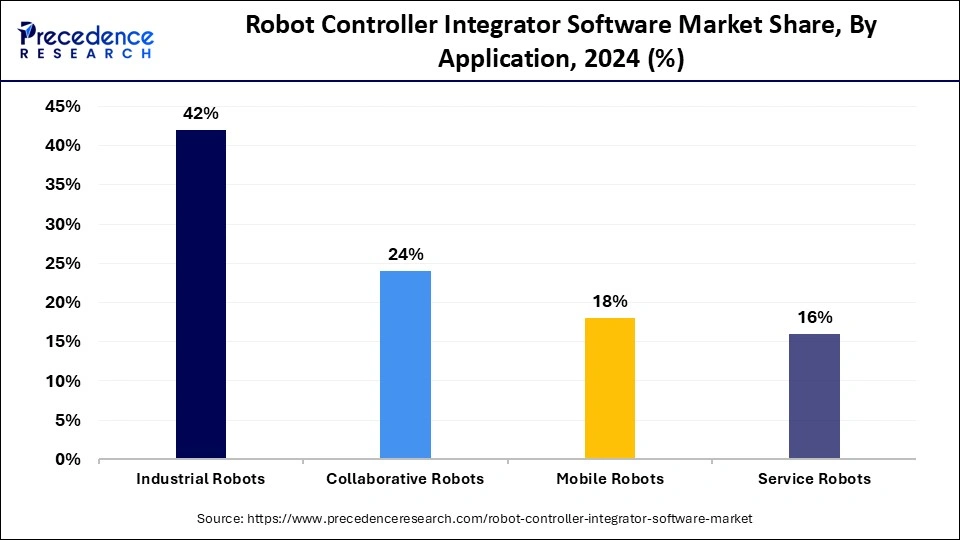

The manufacturing segment held a significant robot controller integrator software market share in 2024. Manufacturing industries such as automotive, consumer electronics, aerospace and defense, food and beverage, and pharmaceutical companies have increased the adoption of robotics, driving demand for robot controllers, integrators, and software solutions. Automotive industries are driving the adoption of this solution for applications in assembly and inspection. Electronics and aerospace industries are driving adoption for inspection, testing, and assembly inspection. Additionally, the food and beverage and pharmaceutical industries are driving the adoption of packaging, labeling, and inspections.

The healthcare segment is projected to grow with the fastest CAGR during the forecast period, driven by the rapidly increasing adoption of robots and AI in the healthcare industry. The healthcare industry uses robots for surgery, rehabilitation, patient care, assistance, medication management, and laboratory and diagnostic testing. Rapid decentralization is driving further needs for automation in healthcare. The rising robotic adoption is driving demand for advanced robot controllers, integrators, and software solutions.

The motion control segment generated the largest robot controller integrator software market share in 2024, driven by increased demand for precise robotic movements and automation in industries. The rising need for high speed and high accuracy in industrial robots is driving segment expansion. Motion control systems of robots can enable multi-axis control and integrate with other systems to enable more complex and sophisticated applications. Advanced technologies like advanced sensors and communication protocols are advancing motion control solutions.

The sensor integration segment will grow at the fastest rate in the upcoming years. Sensor integration systems improve the accuracy and precision of robots. The system enables advanced solutions like predictive maintenance, intelligent automation, and collaborative robotics. Sensor integration is an advanced feature for robots to detect and respond accordingly to the environment, improving safety and reliability standards. To achieve high flexibility and adaptability, industries are surging for the integration of sensor systems with their robotics.

The industrial robots segment captured the biggest robot controller integrator software market share in 2024. The rising demand for automation and advanced technologies in industries is increasing the adoption of industrial robots. Manufacturing industries such as automotive, electronics, aerospace, and defense are the major adopters of industrial robots. This adoption increases the need for precision and accuracy, driving demand for advanced robot controllers, integrators, and software solutions.

The service robots segment is projected to expand rapidly in the coming years, driven by increased demand in the healthcare, logistics, and hospitality industries. Industries have witnessed the need to address labor shortages and cost reduction through automation. Robots are rapidly being applied in e-commerce and environmental monitoring and maintenance services.

The cloud-based segment contributed the highest robot controller integrator software market share in 2024, driven by the rising adoption of cloud-based deployments in robot controllers, integrators, and software solutions. This deployment enables great flexibility, scalability, and cost-effectiveness. Cloud-based solutions provide remote monitoring and control emphasis. The deployment can access high processing capabilities and storage for real-time data analysis. Cloud-based solutions are associated with hardware and software, which help to reduce the cost burden in IT infrastructure.

On the other hand, the on-premises segment is expected to witness the fastest growth during the predicted timeframe. On-premises deployment provides greater privacy, security, and control. Regulated industries are the major adopters of on-premises deployment in their robotics to maintain long-term cost savings and enhanced visibility. On-premises provide low latency and real-time control, which is essential for industrial robotics.

By Industry

By Functionality

By Application

By Deployment Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

August 2024

July 2024

August 2024