November 2024

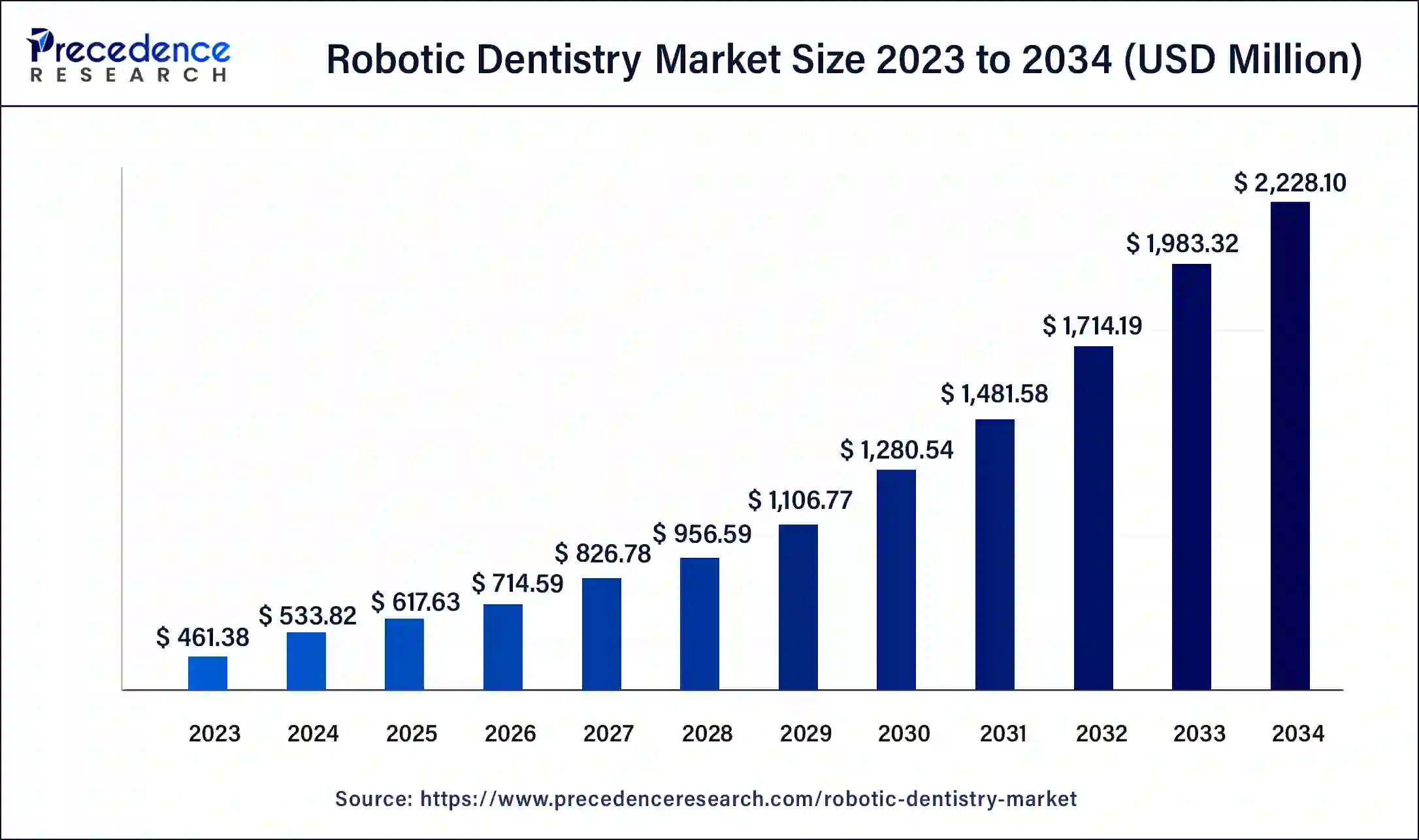

The global robotic dentistry market size was USD 461.38 million in 2023, estimated at USD 533.82 million in 2024 and is anticipated to reach around USD 2228.10 million by 2034, expanding at a CAGR of 15.36% from 2024 to 2034.

The global robotic dentistry market size accounted for USD 533.82 million in 2024 and is predicted to reach around USD 2228.10 million by 2034, growing at a CAGR of 15.36% from 2024 to 2034.

Impact of AI on the Robotic Dentistry Market

AI is revolutionizing the surgical approaches from general surgery to dentistry. Advancements in robotic technology are contributing to the growth of the robotic dentistry market. AI-powered robotic systems provide more precision in dental procedures, reducing errors and improving treatment results. They also improve patient safety by lowering the risks of manual mistakes during dental work. Additionally, AI-powered robotic-assisted procedures enhance patient comfort, attracting those who may be hesitant to traditional dental treatments.

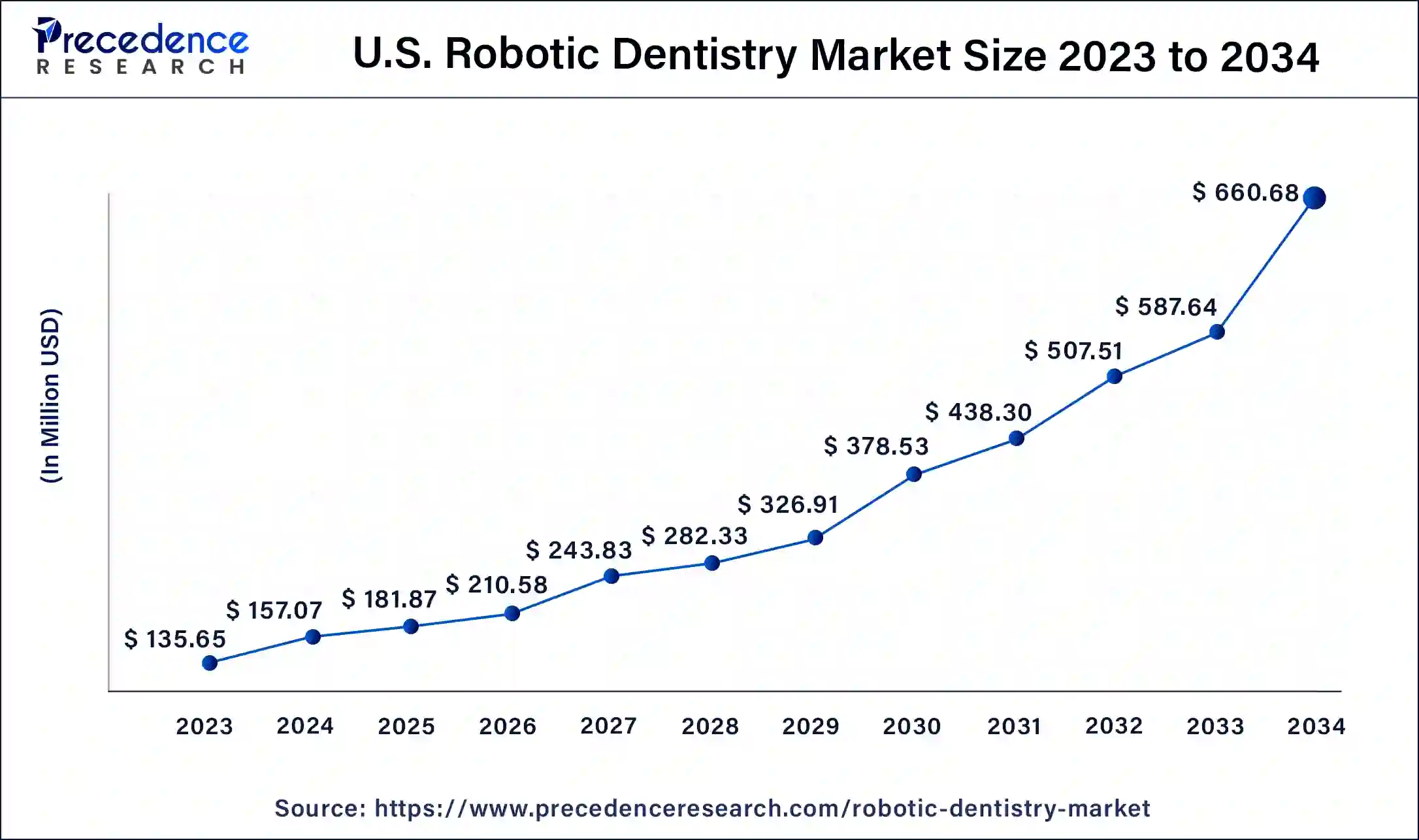

The U.S. robotic dentistry market size was valued at USD 135.65 million in 2023 and is expected to be worth around USD 660.68 million by 2034, at a CAGR of 15.45% from 2024 to 2034.

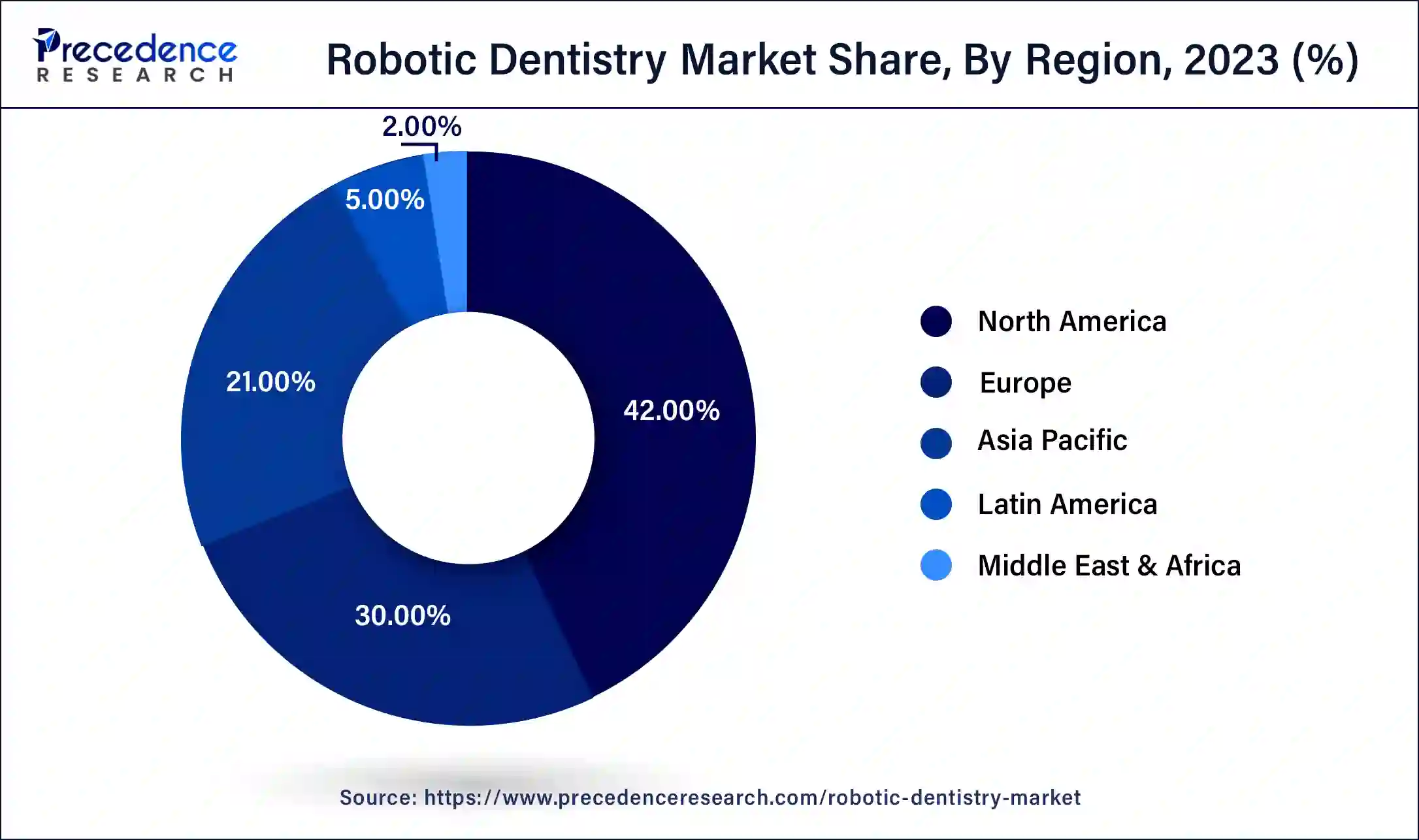

North America has held the largest revenue share of 42% in 2023 North America dominates the robotic dentistry market due to factors such as high healthcare expenditure, technological advancements, and a well-established healthcare infrastructure. The region's early adoption of innovative dental technologies, coupled with a growing awareness among both practitioners and patients, contributes to its major market share. Additionally, robust research and development activities, favorable reimbursement policies, and a concentration of key market players in North America further bolster the region's leadership in driving the adoption of robotic dentistry solutions.

Asia-Pacific is estimated to witness the highest growth. The region holds a significant share in the robotic dentistry market due to a burgeoning population, increasing disposable incomes, and growing awareness of advanced healthcare technologies. Rising dental tourism, particularly in countries like India and Thailand, further boosts the adoption of robotic dentistry. Additionally, governmental initiatives, improving healthcare infrastructure, and a surge in dental care expenditure contribute to the region's dominance. The market in Asia-Pacific is poised for continued growth, driven by a combination of economic factors, technological advancements, and a rising emphasis on oral healthcare.

Robotic dentistry involves incorporating advanced robotic technologies into dental procedures to elevate the precision and effectiveness of oral care practices. By utilizing robotic arms, dentists can enhance the accuracy of surgeries and implant placements, reducing the likelihood of errors and facilitating quicker patient recovery. Beyond that, robotic dentistry introduces autonomous tools that aid in teeth cleaning and diagnostics, promoting a proactive approach to dental health.

This innovative field also leverages artificial intelligence and machine learning algorithms to analyze patient data, assisting dentists in diagnosis and treatment planning. The ongoing development of robotic dentistry holds promise for transforming oral healthcare, offering more personalized, efficient, and minimally invasive solutions. This not only benefits dental practitioners by improving their capabilities but also ensures a superior and tailored experience for patients undergoing various dental procedures.

| Report Coverage | Details |

| Market Size by 2034 | USD 2228.10 Million |

| Market Size in 2023 | USD 461.38 Million |

| Market Size in 2024 | USD 533.82 Million |

| Growth Rate from 2024 to 2034 | CAGR of 15.36% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product & Services, Application, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Minimally invasive procedures and demand for dental implants

The surge in market demand for robotic dentistry is significantly influenced by the dual drivers of minimally invasive procedures and the escalating demand for dental implants. Robotic systems enable unprecedented precision in dental interventions, facilitating minimally invasive procedures that are less traumatic for patients. The appeal of reduced discomfort, quicker recovery times, and enhanced patient comfort associated with these procedures contributes to an increased preference among both practitioners and patients.

Moreover, the growing demand for dental implants, a prevalent solution for tooth loss, aligns with the capabilities of robotic dentistry. Robotic systems offer unparalleled precision in implant placement, ensuring optimal positioning for long-term success. As the global population seeks advanced and efficient dental solutions, the integration of robotic technology not only addresses these needs but also propels the market forward by providing a sophisticated approach to both minimally invasive treatments and the precise execution of dental implant procedures.

Lack of skilled workforce and concerns regarding reliability

The market demand for robotic dentistry faces significant constraints due to the lack of a skilled workforce and concerns regarding reliability. The successful integration and operation of robotic systems in dental practices require a specialized skill set, from system setup to maintenance. The scarcity of professionals proficient in handling these technologies creates a bottleneck, limiting the widespread adoption of robotic dentistry. Dental practitioners may be hesitant to invest in these systems without assurance of an adequately trained workforce, hindering the market's expansion.

Moreover, concerns regarding the reliability of robotic systems during critical dental procedures act as a substantial restraint. Dentists and patients alike may harbor reservations about relying on technology for tasks traditionally performed manually. The fear of technical malfunctions or errors in robotic systems could impede the trust and confidence necessary for broad market acceptance. Addressing these challenges by enhancing training programs and ensuring the robustness and dependability of robotic technologies is crucial for overcoming these restraints and fostering the broader adoption of robotic dentistry.

Expanded applications and rising dental tourism

Expanded applications and the rise of dental tourism present significant opportunities for the robotic dentistry market. With continuous advancements in technology, there is a potential to expand the applications of robotic systems beyond current uses. Innovations may lead to the development of new procedures and treatments that leverage the precision and efficiency of robotic dentistry, offering a broader range of solutions for dental interventions. This expansion in applications can attract interest from dental practitioners seeking advanced tools for a variety of treatments, thereby driving market growth. The increasing trend of dental tourism creates opportunities for global adoption of robotic dentistry.

Dental practices in popular medical tourism destinations can leverage advanced robotic technologies to attract international patients seeking high-quality dental care. The appeal lies in offering cutting-edge, precise treatments with robotic assistance, enhancing the overall patient experience. By aligning with the demand in dental tourism markets, the robotic dentistry sector can capitalize on these opportunities to expand its reach and influence in the global healthcare landscape.

The robot assisted systems segment held the highest market share of 45% on the basis of the produc and services in 2023. The robot assisted systems segment in the robotic dentistry market comprises advanced robotic technologies designed to assist dental practitioners in various procedures. These systems include robotic arms and devices that offer precision and automation in tasks such as surgeries and implant placements. A notable trend in this segment is the continuous refinement of robotic technologies to provide increased accuracy, improved control, and enhanced patient outcomes. The demand for robot-assisted systems in dentistry is driven by a growing emphasis on minimally invasive procedures and the pursuit of innovative solutions to optimize dental interventions.

The standalone robots segment is anticipated to witness the highest growth at a significant CAGR of 16.4% during the projected period. In the realm of robotic dentistry, the standalone robots segment refers to independent robotic systems designed specifically for dental applications. These robots operate autonomously or semi-autonomously, assisting dentists in various procedures, from surgeries to diagnostics.

A notable trend in this segment involves the integration of artificial intelligence and machine learning algorithms, enhancing the robots' capabilities in diagnostics, treatment planning, and overall procedural precision. Standalone robots in robotic dentistry are evolving to become increasingly intelligent and adaptable, offering innovative solutions to dental practitioners for improved patient care and treatment outcomes.

According to the application, the implantology segment has held 44% of the market share in 2023. In the field of robotic dentistry, implantology refers to the application of robotic systems in dental implant procedures. This segment focuses on enhancing precision and accuracy during implant placement surgeries. A notable trend in robotic implantology involves the integration of artificial intelligence for real-time diagnostics, allowing for optimal implant positioning. The use of robotics in implantology not only streamlines the procedure but also contributes to improved long-term success rates, fostering a growing interest among dental practitioners seeking advanced solutions for dental implant surgeries.

The endodontics segment is anticipated to witness the highest growth over the projected period. In the field of robotic dentistry, the endodontics segment focuses on the use of robotic technologies in root canal procedures and treatments. Robotic systems offer precise instrumentation and control during endodontic interventions, enhancing the accuracy and efficiency of root canal therapies. A notable trend in this segment is the integration of artificial intelligence and machine learning algorithms, providing real-time analysis of canal anatomy and aiding practitioners in decision-making. This trend contributes to improved outcomes, reduced procedural times, and an overall advancement in endodontic care through the application of robotic technologies.

According to the end-use, the dental hospitals & clinics segment has held 54% market share in 2023. The dental hospitals and clinics segment in the robotic dentistry market refers to the adoption of robotic technologies in traditional dental healthcare settings. Trends in this segment include an increasing preference for robotic-assisted surgeries, such as implant placements, due to enhanced precision. Dental hospitals and clinics are incorporating robotic systems to streamline workflows, improve patient outcomes, and offer cutting-edge treatments. The integration of robotics in these settings reflects a commitment to technological advancements in oral healthcare, providing patients with state-of-the-art dental services.

The dental academics segment is anticipated to witness highest growth over the projected period. The dental academics segment in the robotic dentistry market pertains to educational institutions and research centers focused on dentistry. Trends in this segment involve the integration of robotic technologies into dental education programs, providing students with hands-on experience in utilizing advanced tools. As robotic dentistry gains prominence, academic institutions are incorporating these technologies into their curriculum to prepare future dental professionals for the evolving landscape, fostering a skilled workforce capable of leveraging robotic systems for precision and efficiency in dental practice.

By Product & Services

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

February 2025

March 2025