February 2025

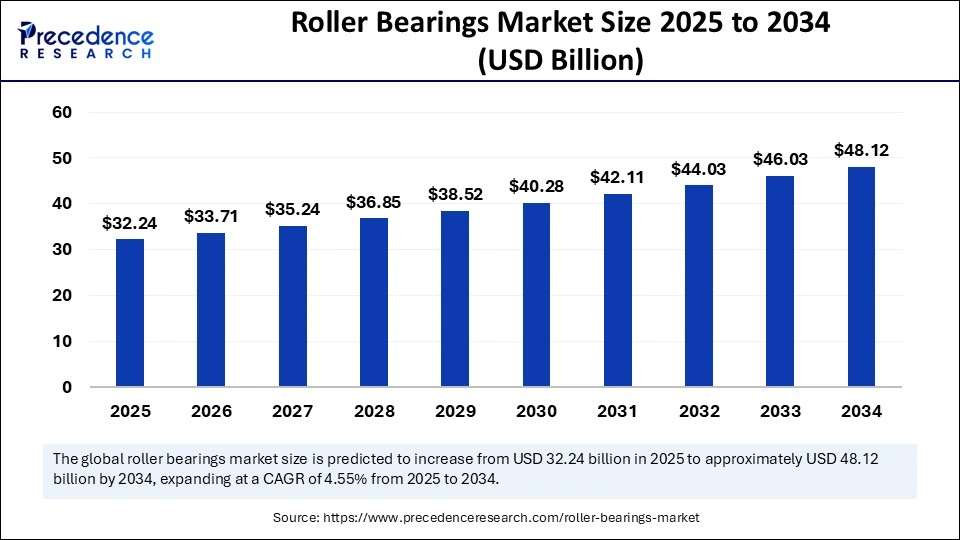

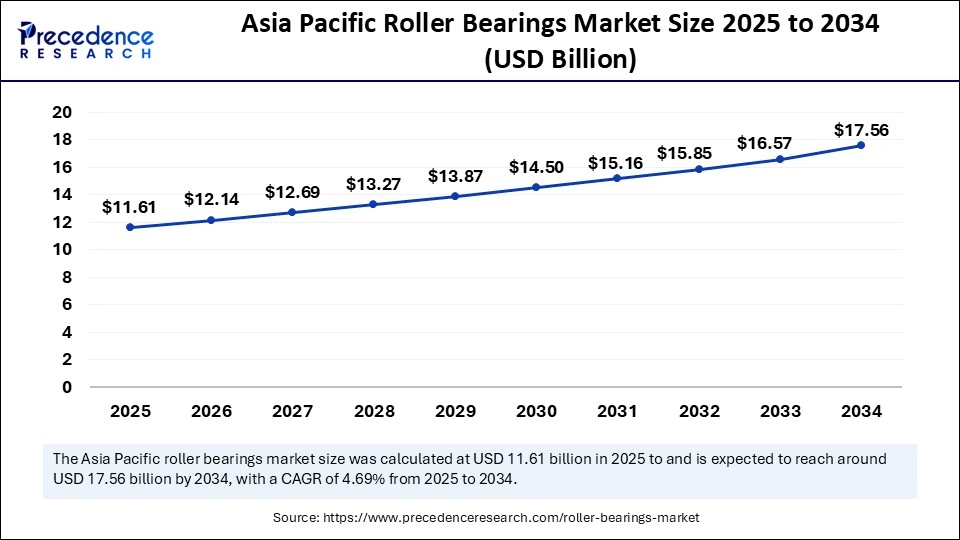

The global roller bearings market size is calculated at USD 32.24 billion in 2025 and is forecasted to reach around USD 48.12 billion by 2034, accelerating at a CAGR of 4.55% from 2025 to 2034. Asia Pacific market size surpassed USD 11.10 billion in 2024 and is expanding at a CAGR of 4.69% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global roller bearings market size accounted for USD 30.84 billion in 2024 and is predicted to increase from USD 32.24 billion in 2025 to approximately USD 48.12 billion by 2034, expanding at a CAGR of 4.55% from 2025 to 2034. The market is experiencing rapid growth due to the rising demand for roller bearings from the automotive, aerospace, and industrial machinery sectors.

Artificial Intelligence is transforming the market for roller bearings, facilitating enhanced performance monitoring, predictive maintenance, and optimized design. AI algorithms evaluate data gathered from sensors in the machinery to predict bearing failures before they occur and reduce downtime and maintenance costs. In manufacturing facilities, for example, condition monitoring systems utilize AI and machine learning to recognize wear patterns and vibration anomalies in real time to act on them. AI also aiding in smarter bearing materials and design by allowing R&D teams to simulate stress responses in materials under various conditions.

AI enables a more efficient design process that reduces prototyping costs. Companies are implementing AI into their supply chain and inventory management processes to aid in predicting demand more accurately. AI technology not only increases the reliability and performance of roller bearings but creates more efficient operations for companies involved in automotive, aerospace, and heavy machinery.

Asia Pacific roller bearings market size was exhibited at USD 11.10 billion in 2024 and is projected to be worth around USD 17.56 billion by 2034, growing at a CAGR of 4.69% from 2025 to 2034.

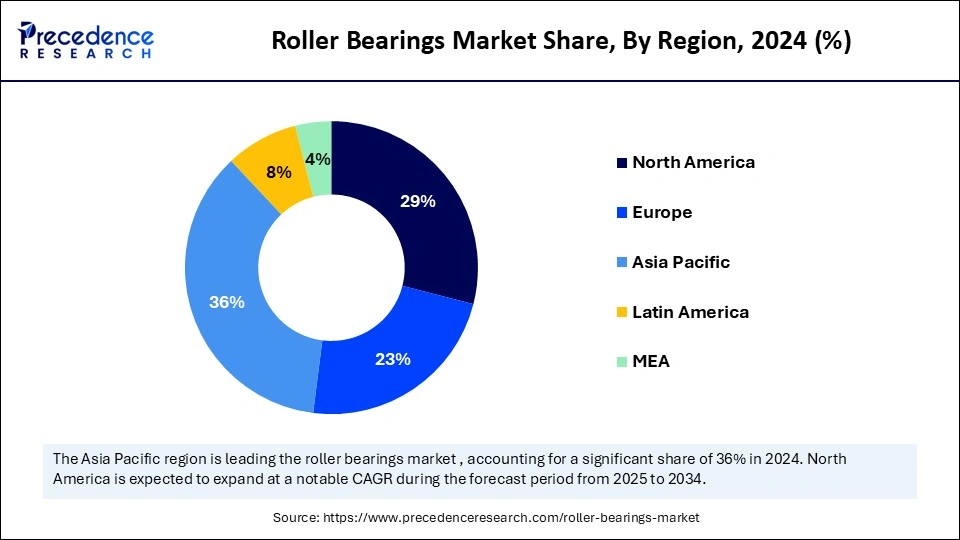

Asia Pacific dominated the roller bearings market with the largest share in 2024. This is mainly due to the increased industrialization and infrastructure development. The region is likely to sustain its position in the market in the coming years. Governments around the region are investing heavily in infrastructure projects, including transportation, construction, and energy & power. Many nations across the region are enhancing their manufacturing capacity by modernizing existing manufacturing facilities. This, in turn, boosts the demand for industrial machinery, and so does the need for roller bearings. The growing production of electric vehicles and renewable energy systems further supports market growth. Moreover, rising investments in high-speed rail projects boost demand for durable, high-performance bearings.

North America is projected to witness rapid growth in the upcoming period. This is mainly due to its robust industrial base. There is a heightened demand for specialized bearings from the automotive, aerospace, and energy sectors. Increasing government funding for infrastructure projects further bolsters the growth of the market in the region. As infrastructure development projects increase, so does the need for construction equipment, which directly translates to increased demand for roller bearings.

The U.S. is a major contributor to the North American roller bearings market. The rapid shift toward renewable energy sources, such as wind and solar, boosts the demand for roller bearings. With the rising vehicle ownership, there is a need for vehicle maintenance, requiring roller bearings replacement. The well-established automotive and transportation sectors further support market expansion.

Roller bearings are mechanical components designed to support rotating shafts and reduce friction between moving parts. Unlike ball bearings, roller bearings use cylindrical, tapered, or spherical rollers to spread loads over a larger surface, which makes them effective for heavy-duty applications. Roller bearings are widely used in industries like automotive, aerospace, construction, and industrial machinery, where reliability and load-bearing capacity are paramount.

The roller bearings market is driven by industrial automation, increased output of heavy equipment, and demand from the transportation sector. Enhanced materials and improved designs of bearing technologies continue to expand the performance and efficiency of roller bearings. The capability of roller bearings to provide higher reliability, overcome higher load capacities, and extend the life of widely used equipment is resonating with industrial users in applications throughout many sectors.

| Report Coverage | Details |

| Market Size by 2034 | USD 48.12 Billion |

| Market Size in 2025 | USD 32.24 Billion |

| Market Size in 2024 | USD 30.84 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.55% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End-User, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase in Heavy-Duty Vehicle Production

The rising production of heavy-duty vehicles (HDVs) is driving the growth of the roller bearings market. Manufacturing heavy-duty vehicles, like trucks, buses, and construction equipment, requires a large number of roller bearings for their axles and engines. Roller bearings ensure the smooth operation of these vehicles. HDVs often require specialized roller bearings that withstand high loads and extreme temperatures. In addition, government programs, like the Production Linked Incentive (PLI) scheme, are enhancing manufacturing capability and stimulating the production of HDVs, boosting the demand for roller bearings.

For instance, the Indian Ministry of Heavy Industries focuses on increasing the performance of the automotive industry by making funds available and increasing the production of HDVs. This translates into an increased demand for modern roller bearings to enhance HDV performance.

Fluctuating Raw Material Costs

The roller bearings market faces a significant obstacle when it comes to pricing fluctuations of raw materials, especially steel. Volatility in raw materials prices significantly increases manufacturing costs, compressing manufacturer margins and costing consumers more money. In July 2024, for example, the U.S. placed an additional 25% tariff on steel imported from Mexico, China, Russia, etc., creating a cost burden for bearing manufacturers. Economic policies, as well as geopolitical tension and global supply chain disruptions, lead to volatility in raw materials costs, making it difficult for manufacturers to maintain margins consistently. Such financial pressure limits market growth, particularly in regions that are sensitive to price increases. In addition, economic downturns encourage manufacturers to find alternative materials, limiting the growth of the market.

Surge in Electric Vehicle (EV) Production

The rising production and sales of electric vehicles (EVs) across the globe create immense opportunities in the roller bearings market. EVs require roller bearings to achieve high-performance levels and fuel efficiency. Using specialized bearings in critical components, such as e-axles and gearboxes, can enhance vehicle performance by reducing fuel consumption. The global EV sales in 2024 were 13.6 million units and is projected to reach over 20 million in 2025. This growth in EV sales is likely to drive demand for rolling bearings that are efficient and last longer. This overall rise dictated by EVs will require rolling bearing manufacturers to continue to innovate new bearing materials and coatings and provide intelligent sensors to the industry to meet specific EV needs. As production of EVs continues to ramp up globally, primarily in Asia and Europe, the market is likely to grow in the coming years.

The cylindrical segment held the largest share of the roller bearings market in 2024. This is mainly due to the increased adoption of cylindrical roller bearings in heavy machinery. These bearings are preferred for their higher load-carrying capability and the ability to efficiently perform in radial loading conditions. Cylindrical roller bearings find applications in electric motors, automotive gearboxes, and heavy industrial machinery. These bearings offer the highest compatibility in extremely high-speed applications. They are suitable for varying degrees of misalignment, which makes them the preferred choice for heavy-duty equipment.

The tapered segment is anticipated to grow at a remarkable CAGR during the projection period. The growth of the segment can be attributed to the rising adoption of tapered roller bearings in a variety of applications within the automotive and aerospace sectors. Tapered roller bearings are an effective solution for axial and radial loading scenarios and are found mostly in heavy-duty vehicles. They are also used in vehicle gearboxes. The rising production of vehicles significantly contributes to segmental growth.

The OEM segment dominated the roller bearings market with the largest share in 2024. The OEM distribution channel is most popular in supplying automotive parts and accessories. Vehicle manufacturers often favor automotive parts that have been specifically designed for their models in order to ensure warranties and acceptable quality standards. Customers usually prefer OEM parts since they provide better reliability and compatibility for new vehicle purchases or repairs. OEMs often establish long-term partnerships with suppliers, ensuring a consistent supply of roller bearings.

The aftermarket segment is expected to expand at a notable CAGR over the projected period. The increasing vehicle ownership and the rising demand for customization drive segmental growth. This distribution channel offers cost-effective alternatives to original equipment parts. The rising focus on maintenance of existing vehicle fleets is boosting the need for bearings replacement. Online platforms and e-commerce have greatly improved access to aftermarket parts, supporting segmental growth.

The automotive segment held the largest share of the roller bearings market in 2024. This is mainly due to the increased production of passenger, commercial, electrical, and heavy-duty vehicles. Roller bearings are used in wheels, engines, transmissions, and steering systems. Roller bearings significantly impact the performance and fuel efficiency of vehicles. The increased repair of aging vehicle fleets further bolstered the segment’s growth. The rise in the demand for specialized bearings that are being built for quieter and more energy-efficient systems also contributed to segmental growth.

The energy & power segment is projected to expand at a significant rate during the projection period. This is mainly due to the rising investment in renewable energy sources and the modernization of grid infrastructure. Specialized roller bearings that can withstand extreme loads are typically utilized in wind turbine generators. Roller bearings reduce energy losses and improve energy efficiency in power generation and transmission systems.

By Product

By End-User

By Distribution Channel

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

September 2024