January 2025

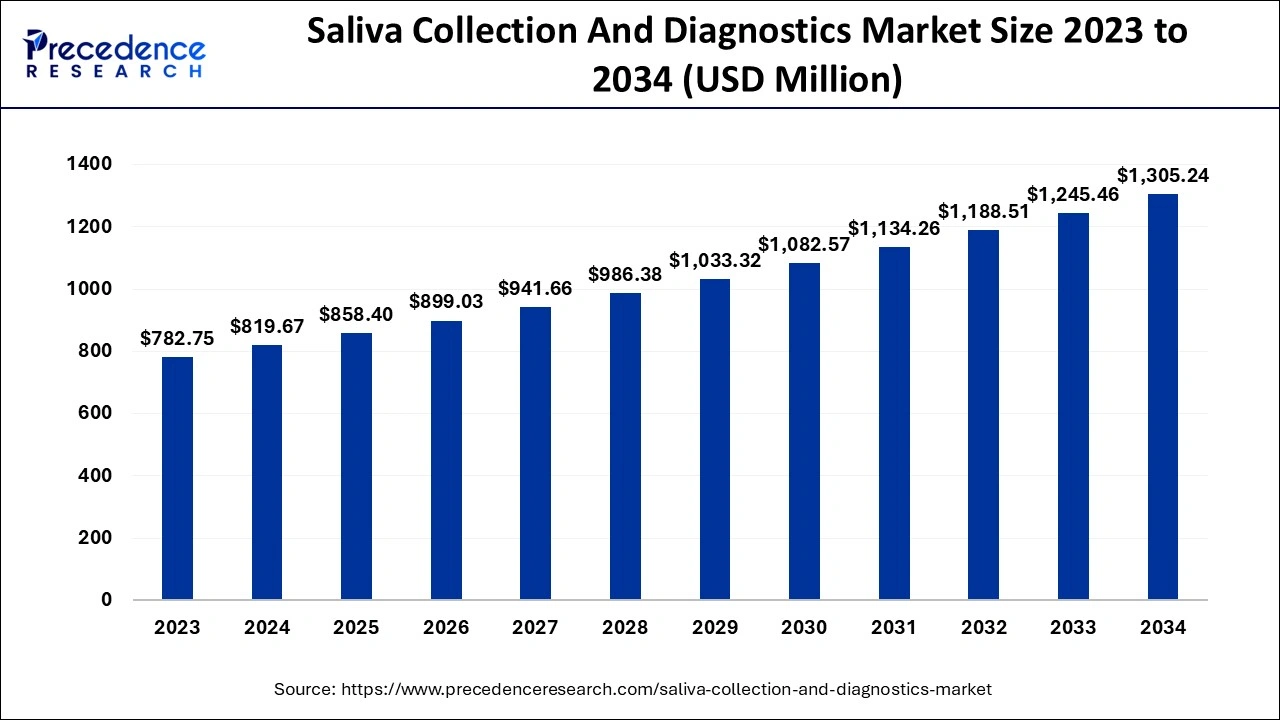

The global saliva collection and diagnostics market size accounted for USD 819.67 million in 2024, grew to USD 858.40 million in 2025 and is expected to be worth around USD 1,305.24 million by 2034, registering a CAGR of 4.76% between 2024 and 2034. The North America saliva collection and diagnostics market size is calculated at USD 360.66 million in 2024 and is expected to grow at a CAGR of 4.85% during the forecast year.

The global saliva collection and diagnostics market size is calculated at USD 819.67 million in 2024 and is predicted to reach around USD 1,305.24 million by 2034, expanding at a CAGR of 4.76% from 2024 to 2034. Increasing demand for quick diagnoses of diseases is the key factor driving the growth of the saliva collection and diagnostics market. Also, rising public awareness regarding safe diagnostic solutions coupled with the innovations in infant sample collection technology, can fuel market growth further.

Artificial intelligence (AI) can play a substantial role in the saliva collection and diagnostics market by enhancing the efficiency, precision, and duration of disease diagnosis and monitoring. It can use diagnostic images and clinical data to help diagnose oral conditions such as oral cancer, dental caries, and periodontal disease. Furthermore, AI can optimize the ability of salivary biomarkers to manage and diagnose maxillofacial diseases.

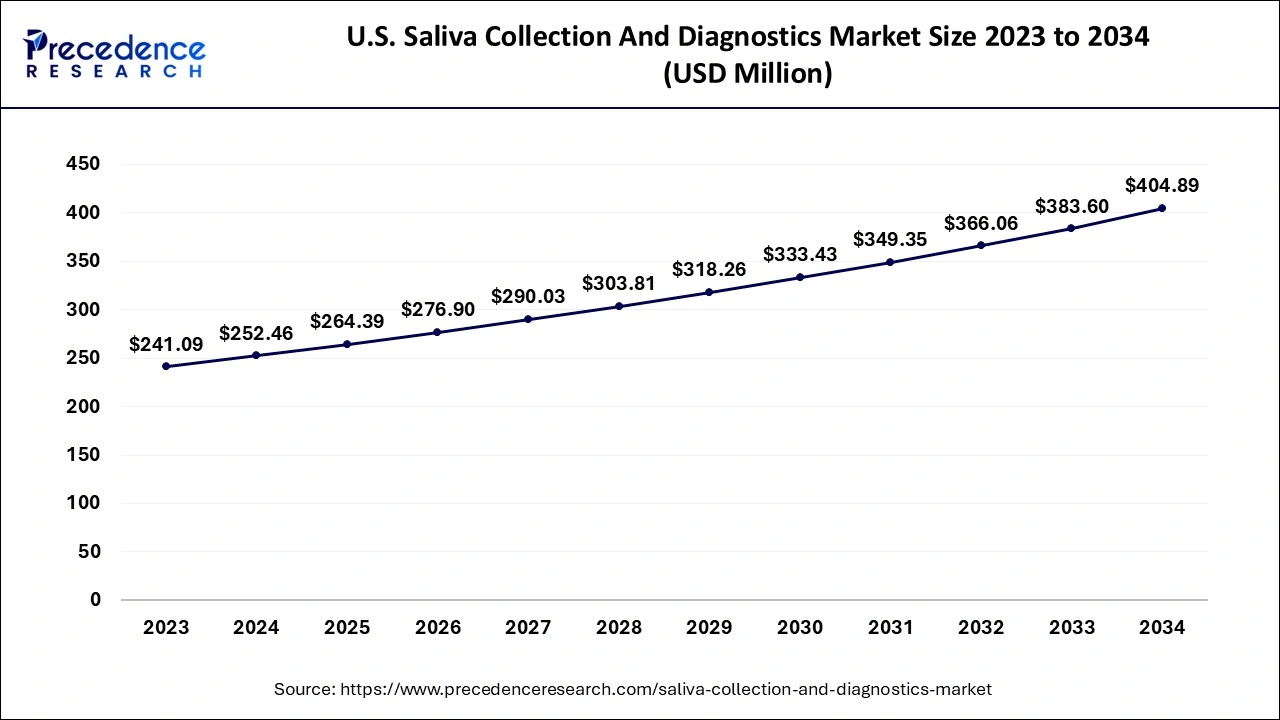

The U.S. saliva collection and diagnostics market size is evaluated at USD 252.46 million in 2024 and is projected to be worth around USD 404.89 million by 2034, growing at a CAGR of 4.92% from 2024 to 2034.

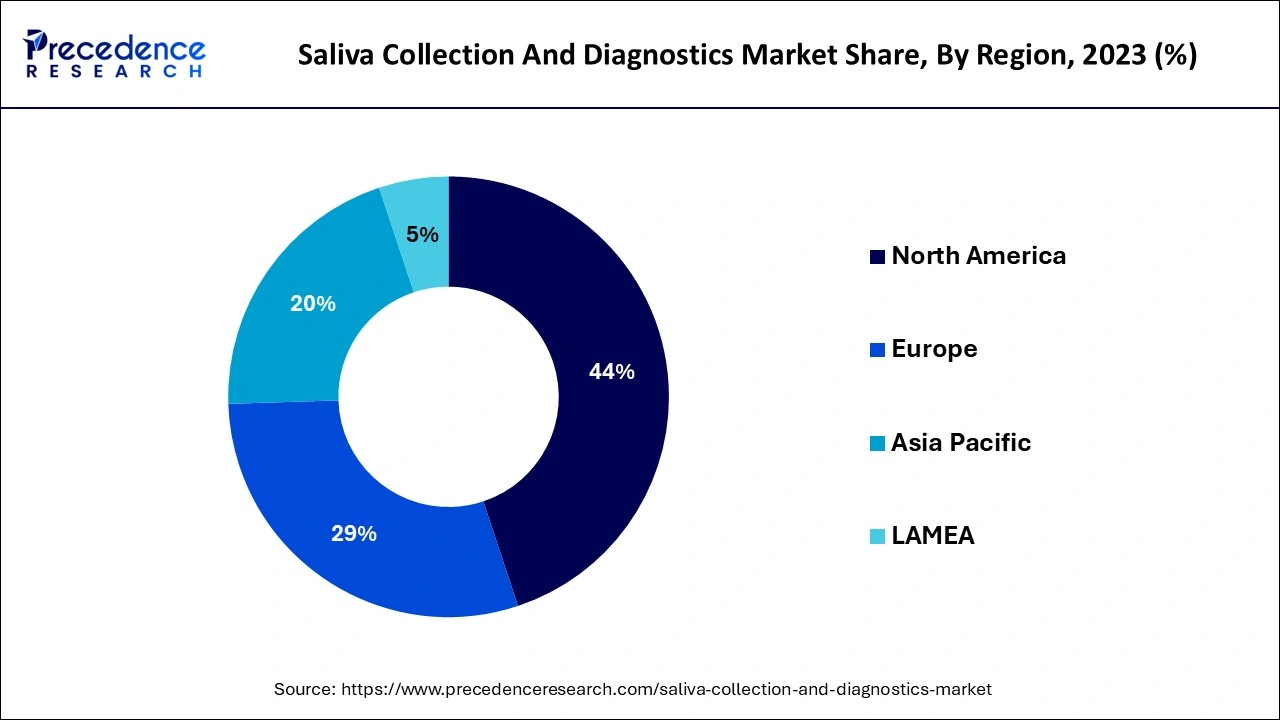

North America dominated the saliva collection and diagnostics market in 2023. The dominance of the region can be attributed to the increasing preference for saliva-based tests and the rise in cases of infectious diseases across the globe. Furthermore, in the region, the U.S. led the market owing to the growing demand for non-invasive testing methods offered by saliva sampling methods. Also, the strong presence of a healthcare infrastructure is supporting market expansion further.

Asia Pacific is anticipated to grow at the fastest rate in the saliva collection and diagnostics market during the forecast period. The growth of the segment can be linked to the rising incidence of infectious diseases where these tests are necessary. Moreover, saliva testing has gained huge acceptance because of its ease of collection and non-invasive nature. In the region, China is projected to show the fastest growth due to clear guidelines established by regulatory authorities.

The saliva collection and diagnostics market encompasses the collection, analysis, and interpretation of saliva samples for health care and research purposes. It also involves the use of saliva for biomedical research, diagnosing diseases, and non-invasive drug testing. Saliva is an important source of bodily information because it contains biomarkers like DNA and proteins that can help detect the presence of certain diseases like specific cancers and cardiovascular diseases. Also, saliva can show the body's physiological state, including endocrinal, nutritional, emotional, and metabolic variations.

Mouth and oral cancer rates in 2022

| Country | Number |

| India | 1,43,759 |

| China | 37,208 |

| United States of America | 27,750 |

| Bangladesh | 16,083 |

| Pakistan | 15,915 |

| World | 3,89,846 |

| Report Coverage | Details |

| Market Size by 2034 | USD 1,305.24 Million |

| Market Size in 2024 | USD 819.67 Million |

| Market Size in 2025 | USD 858.40 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.76% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Site of Collection, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Cost-effective collection and diagnostic offering

Collecting saliva DNA is not that expensive compared to other kinds of testing, such as blood and urine tests. Saliva samples do not need specific transportation and storage facilities from collection to processing. However, the blood samples need freezers, dry ice, and overnight shipping, while samples of saliva can easily be stored at the current temperature and transported via conventional methods, which makes the whole saliva collection process cheap.

Complex sample treatment

Saliva is a high blend of many substances such as proteins, enzymes, nucleic acids, and other hormones. The complexity of this mixture can make it difficult to characterize and isolate salivary EVs, which sometimes can show different detection results. Moreover, there are many hurdles in reliably supplying the required materials for saliva collection and diagnostics.

Advancements in saliva-based POCT devices

The requirement for the advancement of saliva-based POCT devices is because of the ability of saliva the rapidly detect systemic and oral diseases like cancers, fungal and bacterial infections, and genetic disorders. Furthermore, the growing R&D in disease prediction by testing providers offers numerous opportunities for key players to enter the global saliva collection and diagnostics market.

The submandibular/sublingual gland collection segment dominated the saliva collection and diagnostics market in 2023. The dominance of the segment can be attributed to the increasing cases of sialolithiasis across the globe due to poor dieting habits along with the side effects of certain medications. Additionally, this disease is most prevalent among middle-aged adults. Also, the family history of stone diseases can raise the potential risks of these diseases, contributing to segment growth further.

The parotid gland collection segment is anticipated to grow at the fastest rate in the saliva collection and diagnostics market over the forecast period. The growth of the segment can be linked to the growing incidence of rare salivary gland cancer, which often shows symptoms such as a noticeable lump or unease swallowing. Diagnosis of this disorder mostly relies on biopsies and imaging tests, including (PET) scans, CT scans, and MRIs.

The disease diagnostics segment dominated the saliva collection and diagnostics market. The dominance of the segment can be linked to the advancements in saliva diagnostic technology which makes it easier for the early detection of chronic diseases such as cancer and cardiovascular disease. Moreover, this method of testing is beneficial for diagnosing an extensive range of rare disease conditions like hormonal imbalances and certain infections.

The forensic segment is expected to show the fastest growth in the saliva collection and diagnostics market over the projected period. The growth of the segment can be driven by increasing innovations in DNA analysis coupled with the non-invasive nature of the sampling process. Saliva possesses proteins, DNA, and biomarkers that can give crucial data in forensic investigations like toxicology testing and individual identification. Furthermore, the raised demand for precise, rapid, and less invasive methods in forensic science has boosted the utilization of saliva-based diagnostics.

The diagnostic laboratories segment held the largest share of the saliva collection and diagnostics market in 2023. The dominance of the segment can be credited to the rising demand for diagnostic laboratories from customers across the globe. In addition, diagnostic laboratories use advanced analytical methods for the early detection of diseases and customized treatment for each patient. Diagnostic labs utilize automation and digitalization to test more samples in much less time.

The pharmaceutical & biotechnology companies segment is estimated to grow at the fastest rate in the saliva collection and diagnostics market over the projected period. The growth of the segment is due to the ongoing partnerships and number of product launches by key market players. Partnerships between commercial enterprises and research organizations also propel innovation, leading to further segment expansion. Also, the biotechnology segment is anticipated to grow because of surging biotech product pipelines.

By Site of Collection

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

February 2025

October 2024