January 2025

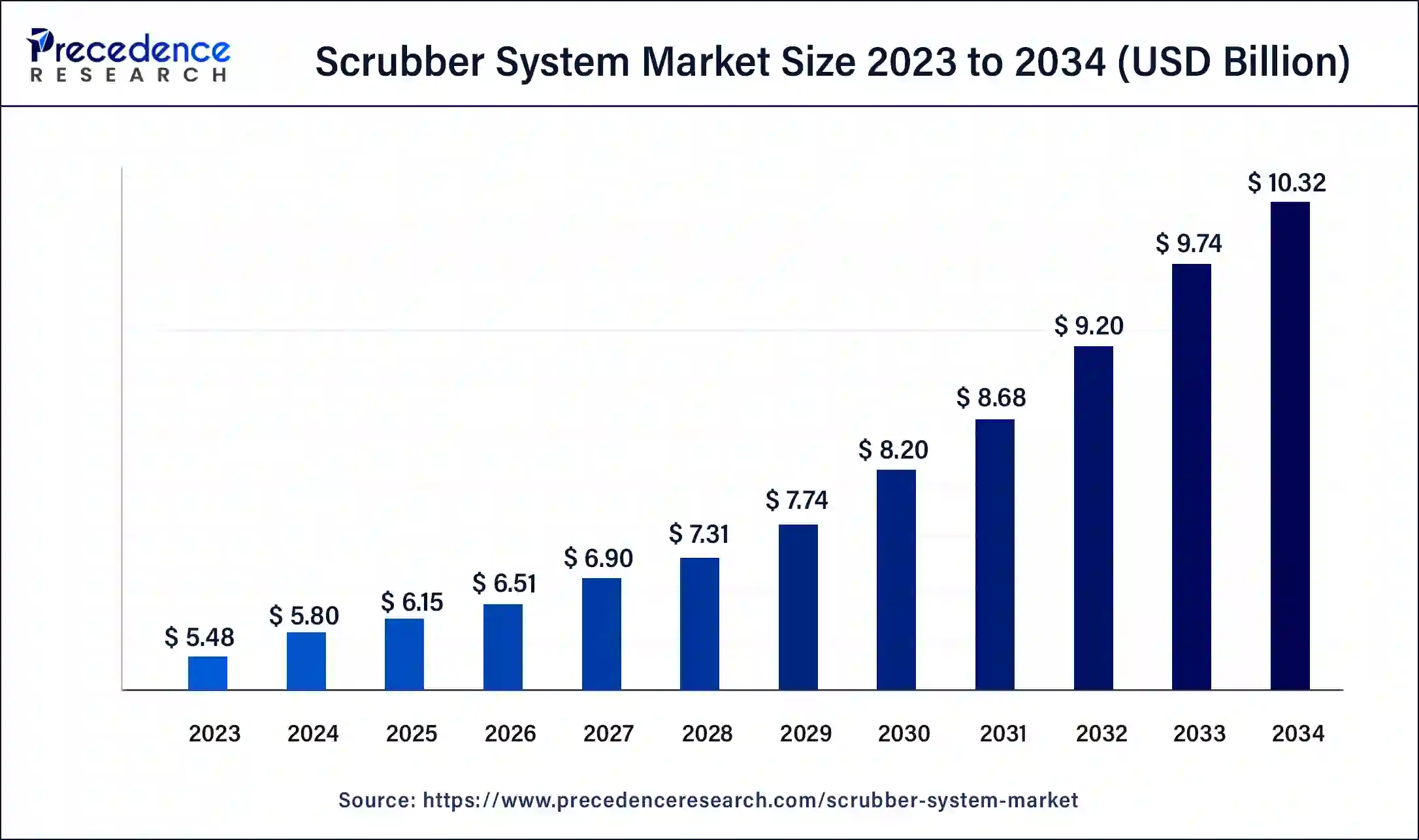

The global scrubber system market size was USD 5.48 billion in 2023, calculated at USD 5.8 billion in 2024 and is expected to be worth around USD 10.32 billion by 2034. The market is slated to expand at 5.92% CAGR from 2024 to 2034.

The global scrubber system market size is worth around USD 5.80 billion in 2024 and is anticipated to reach around USD 10.32 billion by 2034, growing at a solid CAGR of 5.92% over the forecast period 2024 to 2034. The increasing demand for scrubber systems demonstrates a global commitment to minimizing environmental impact, safeguarding public health, and complying with strict regulatory standards for air quality.

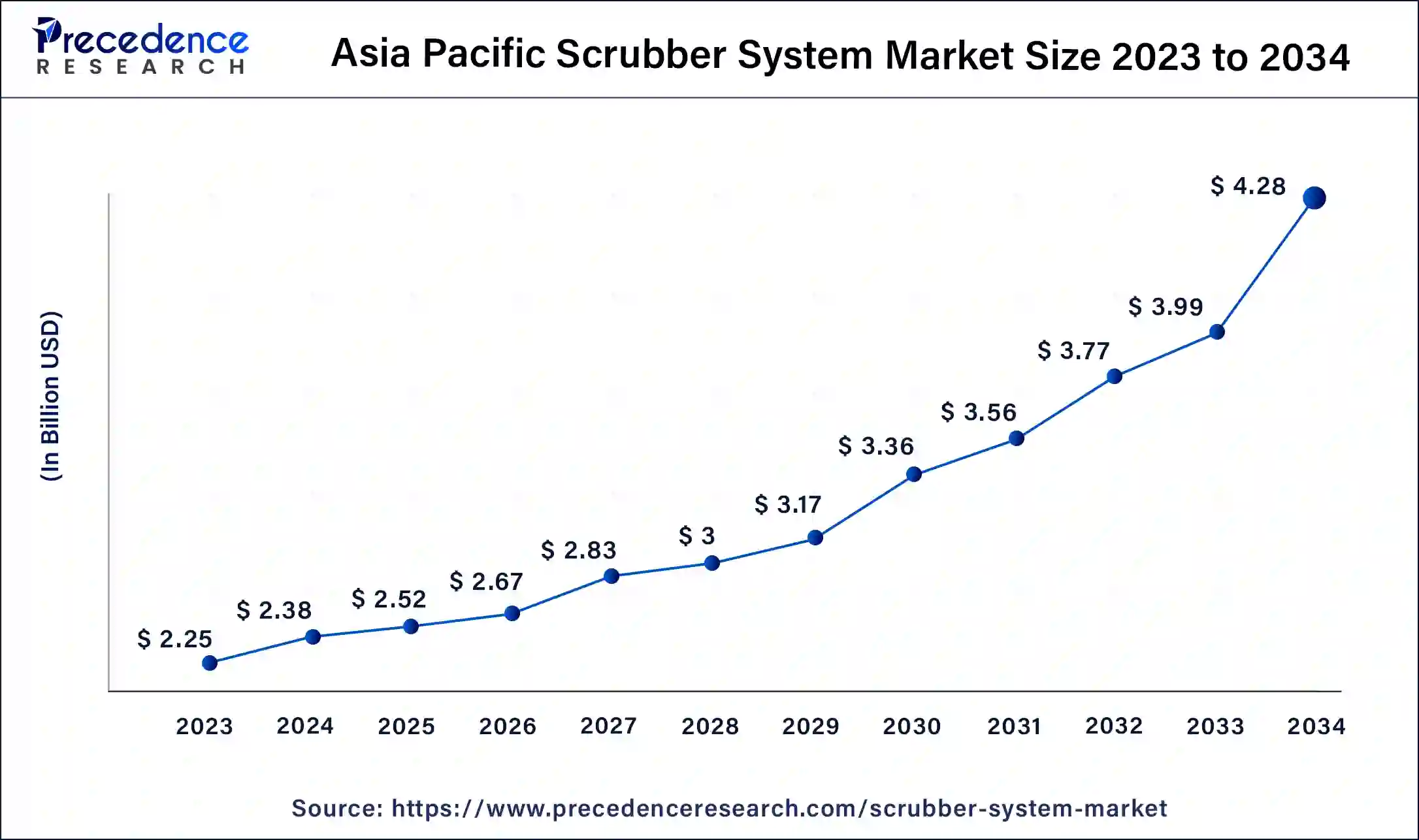

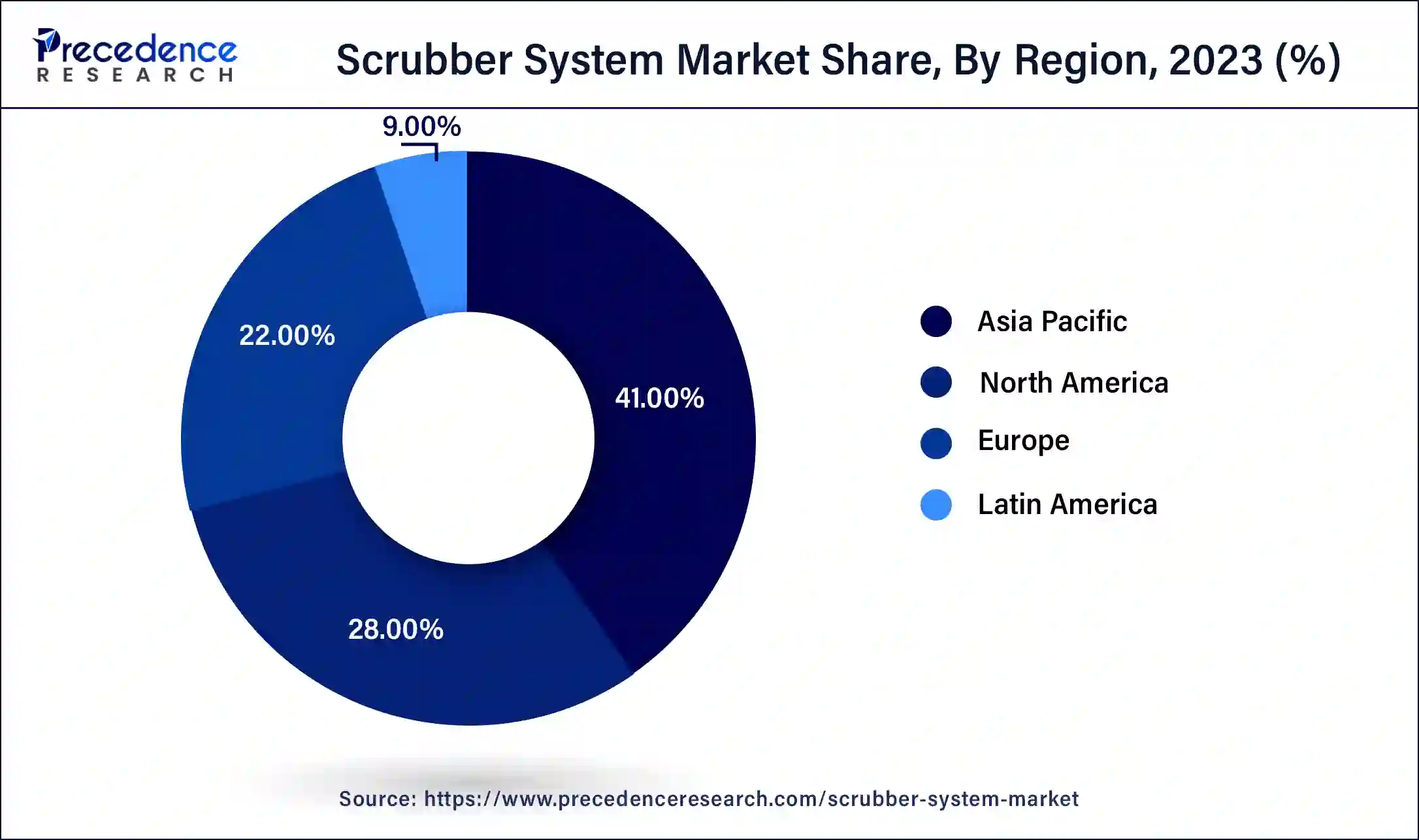

The Asia Pacific scrubber system market size was exhibited at USD 2.25 billion in 2023 and is predicted to reach around USD 4.28 billion by 2034, poised to grow at a CAGR of 6.01% from 2024 to 2034.

Asia Pacific held the leading share of the scrubber system market in 2023 and is observed to witness productive growth during the forecast period. Rapid economic growth and industrialization in Asia Pacific have led to increased demand for raw materials and goods, which are primarily transported via maritime routes. This growth fuels the need for efficient and environmentally friendly shipping solutions, including scrubber systems. There is growing awareness and concern about environmental sustainability in Asia Pacific. These factors collectively contribute to the region’s leading position in adopting and advancing the scrubber system market.

North America is observed to expand at a rapid pace in the scrubber system market during the forecast period. Significant growth in the scrubber system market is driven by stringent environmental regulations from agencies like the Environment Protection Agency (EPA), industrial activities, and commitments to improving air quality. In the United States, electricity generation and industrial activities contribute to half of greenhouse gas emissions, primarily CO2 from fossil fuels. These sectors also produce various chemical and acidic waste products. Scrubber systems are well suited for these industries due to their ability to treat contaminants and high levels of air pollutants.

Scrubber systems are widely employed in industries for treating exhaust, and vent gases and are an effective method in the inhibition of air pollution. These gases can sometimes contain harmful particles that impact the environment and human health. The scrubber system market solutions are increasingly preferred over traditional methods due to their cost effectiveness and effectiveness in eliminating particulate matter and gases.

Application of scrubbing systems encompasses the removal of particulates, dust, and odors from industrial exhaust and venting systems or residues in continuous or emergency operations of chemical, fertilizer, petrochemical, refinery, pharmaceutical, mining, and other industries. Scrubber systems, including chemical and gas scrubbers, constitute a varied array of devices for controlling air pollution by removing gases and particulates from industrial exhaust streams.

Impact of AI on the Scrubber System Market

The scrubber system integrates advanced AI-enabled control and monitoring, optimizing EGCS performance with constant refinement. The scrubber system market minimizes losses from fines. Downtime and fuel switching costs through advanced analytics and enhanced monitoring, reducing compliance-related operating expenses.

The IoT is revolutionizing scrubber system maintenance with remote sensors and real-time data transmission, enabling proactive upkeep and minimizing downtime. From advanced designs to AI and IoT integration, the industry adapts to environmental challenges. As industries prioritize emission reduction, scrubber systems play a crucial role in creating a sustainable future. Key benefits include reduced maintenance hours, extended system life, and optimized power consumption through AI analytics. Having an automated system helps you to reduce manpower, accident risks, and equipment hazards.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.32 Billion |

| Market Size in 2023 | USD 5.48 Billion |

| Market Size in 2024 | USD 5.80 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.92% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, Orientation, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Stringent government regulation to battle air pollution

Regulation imposed by global entities such as the International Maritime Organization (IMO), the European Union (EU), the U.S. Environmental Protection Agency (EPA), and others aims to reduce environmental impact on both global and local air quality. A primary focus is on lowering sulfur oxide (SOx) emissions, largely from traditional marine fuels with high sulfur content. These rules compel ship designers, owners, and operators to adopt effective measures for SOx compliance. The stringent requirements outlined in regulations like the Clean Air Act (CAA) are driving the demand for the scrubber system market in the maritime sector.

Focus on waste management

Scrubbers are vital in waste management, serving to regulate emissions from a variety of sources such as municipal and medical waste incinerators, as well as industrial operations like cement and lime kilns, metal smelters, petroleum refineries, glass furnaces, sulfuric acid plants. They are critical devices that employ gas absorption techniques to extract harmful gases from waste gas streams. Scrubbers are effectively removing acid gases (e.g., HCl, HF, and H2SO4) in industrial waste streams. These capabilities make scrubbers essential solutions driving growth in the scrubber system market for emission control technologies.

High installation and operating cost

The scrubber system market faces high costs associated with various factors such as installation, maintenance, operation, and waste disposal. Protection against freezing temperatures poses a significant challenge, leading to increased capital and operational expenses during winter months in the scrubber system market. Waste disposal can also become costlier due to specific handling requirements. Packed bed scrubbers, in particular, face high installation, operational, and wastewater disposal costs compared to other scrubbers. Moreover, ongoing maintenance of packaging material adds to operational costs along with expenses related to pump and fan power and solvent replenishment, influencing investment decisions and operational strategies.

Advancement in scrubber system

Manufacturers of scrubbers are actively developing new and enhanced scrubbing technologies. Another major driver of the global scrubber system market is the requirement to meet stringent carbon emissions norms by the oil and gas industries. Additionally, the necessity to reduce operational expenditures is boosting oil and gas companies to set up advanced scrubbing technology. This is foremost due to a surging number of rigs being deployed around the world. Advancements aim to minimize water, electricity, and chemical usage in scrubbing processes while boosting efficiency and cutting costs. Innovations include automated battery maintenance, customizable features, and size reduction. These changes are being made to address environmental concerns, which are increasing globally.

The wet scrubber system segment accounted for the dominating share of the scrubber system market in 2023. Wet scrubbing systems utilize a scrubbing liquid to clean exhaust gases by removing pollutants and dust particles. Wet scrubber systems find extensive use across diverse industrial sectors such as industrial boilers, incinerators, metals processing, chemical production, asphalt production, and fertilizer manufacturing. Wet scrubbers effectively remove pollutants from exhaust gases, achieving a high level of pollutant removal through contact with scrubbing solutions like water or specific reagents. They are effective in removing acids and contaminants from exhaust gases. The purpose of wet scrubbers is to purify vapors and gases to acceptable levels before releasing them into the environment or using them for other purposes.

ERGIL wet scrubbers are particularly effective in treating chemicals such as ammonia from process exhaust air streams.

The dry scrubber system segment is expected to witness significant growth in the scrubber system market during the forecast period. Dry scrubbers offer cost advantages over wet scrubbers due to their simpler design, reduced water consumption, and lower waste processing requirements. Dry scrubbers primarily target acid gases from combustion sources. Generally, this is done by introducing a series of dry reactants to exhaust gas at high speeds. This neutralizes the pollutants in the gas. This versatility and effectiveness in diverse industrial settings underscore why the dry scrubber system is experiencing rapid growth in the scrubber system market.

The particulate cleaning segment held the largest share of the scrubber system market in 2023. Particulate matter (PM) refers to a mixture of solid and liquid droplets suspended in the air. Wet scrubbers are air pollution control devices utilized to eliminate particulate matter and acid gases from waste gas streams at stationary sources. These pollutants are primarily captured through mechanisms such as impaction, diffusion, and interception onto liquid droplets. The scrubber system is widely used to remove particular matters, demonstrating their critical role in environmental stewardship and regulatory compliance.

The gaseous/chemical cleaning segment is expected to grow at the fastest rate in the scrubber system market during the forecast period. Scrubbers have traditionally focused on removing sulfur oxides from stack gases. However, as advancements in control systems continue to evolve, there is a growing trend towards designing scrubbers that can simultaneously remove gases and particulate matter in combustion processes. In a gas treatment system, the principle involves washing waste gases using Rasching rings. This method effectively captures both gas phase pollutants and solid particulates, ensuring cleaner emissions from industrial processes.

The marine segment accounted for the largest market share of the scrubber system market in 2023. Scrubber technology is a key element in the global maritime industry to reduce sulfur oxide (SOx) emissions from ships. This system can be used to replace conventional fuel oil and help ships comply with international environmental regulations. The marine industry is grappling with the adoption of new technologies and operational standards to meet stringent international, regional, national, and local regulations aimed at reducing exhaust emissions from ships.

The International Maritime Organization (IMO) adopted guidelines on the approval, installation, and use of exhaust gas scrubbers on board ships to ensure compliance with the sulfur regulation. The United Nations Convention on the Law of the Sea also bestows port states with a right to regulate and even ban the use of open-loop scrubber systems within ports and internal waters. Marine air pollution regulations typically require the use of low sulfur fuel to reduce SOx gaseous emissions and the sulfate portion of the particulate matter (PM) emissions.

The oil and gas segment is observed to be the fastest-growing in the scrubber system market during the forecast period. In the oil and gas industry, scrubbers play a crucial role in eliminating impurities like hydrogen sulfide (H2S) and carbon dioxide (CO2) from the gas streams generated during drilling, refining, and processing operations. These impurities pose risks to both workers and the environment, and scrubbers help to reduce the impact of these pollutants.

Segments Covered in the Report

By Product Type

By Application

By Orientation

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

November 2024