April 2025

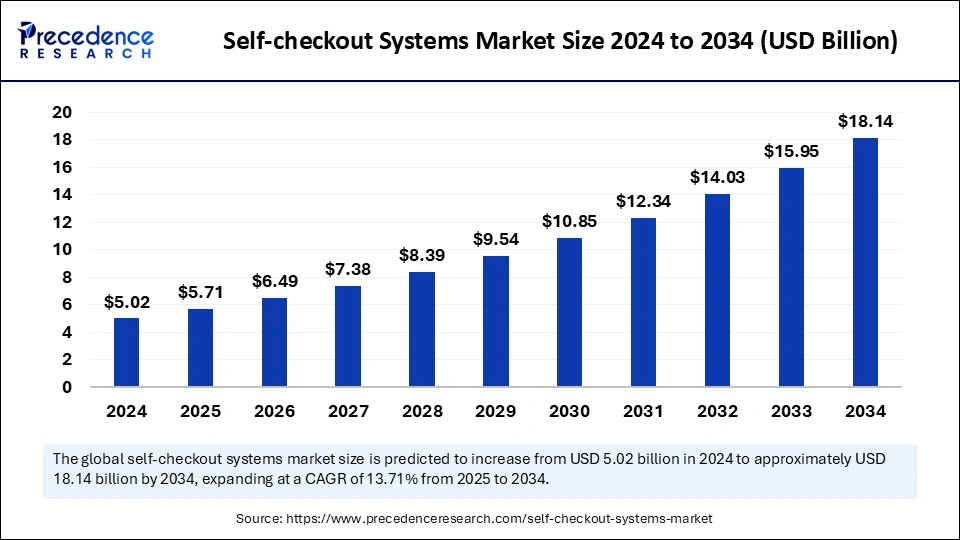

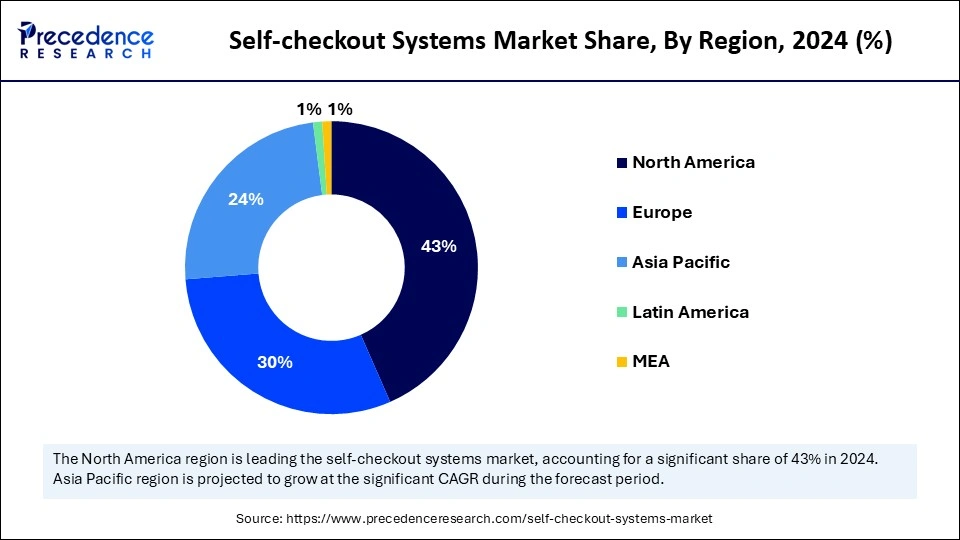

The global self-checkout systems market size is calculated at USD 5.71 billion in 2025 and is forecasted to reach around USD 18.14 billion by 2034, accelerating at a CAGR of 13.71% from 2025 to 2034. The North America market size surpassed USD 2.16 billion in 2024 and is expanding at a CAGR of 13.83% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global self-checkout systems market size was estimated at USD 5.02 billion in 2024 and is predicted to increase from USD 5.71 billion in 2025 to approximately USD 18.14 billion by 2034, expanding at a CAGR of 13.71% from 2025 to 2034. The self-checkout systems market is expanding rapidly due to the increasing need for quicker, more convenient shopping experiences, increasing contactless payment options, and the necessity for cost-effective measures to combat labor shortages and increase operational efficiency.

Artificial intelligence is revolutionizing self-checkout systems by enhancing efficiency, accuracy, and security. Computer vision technology powered by AI enables products to be scanned without barcodes, thereby simplifying the checkout process for customers. AI is also the key to detecting fraud by scanning transactions for abnormalities like unscanned items or barcode switching, minimizing shrinkage and operational losses. Furthermore, AI improves customer experience through personalized shopping suggestions based on buying habits and inventory management optimization through real-time sales data analysis.

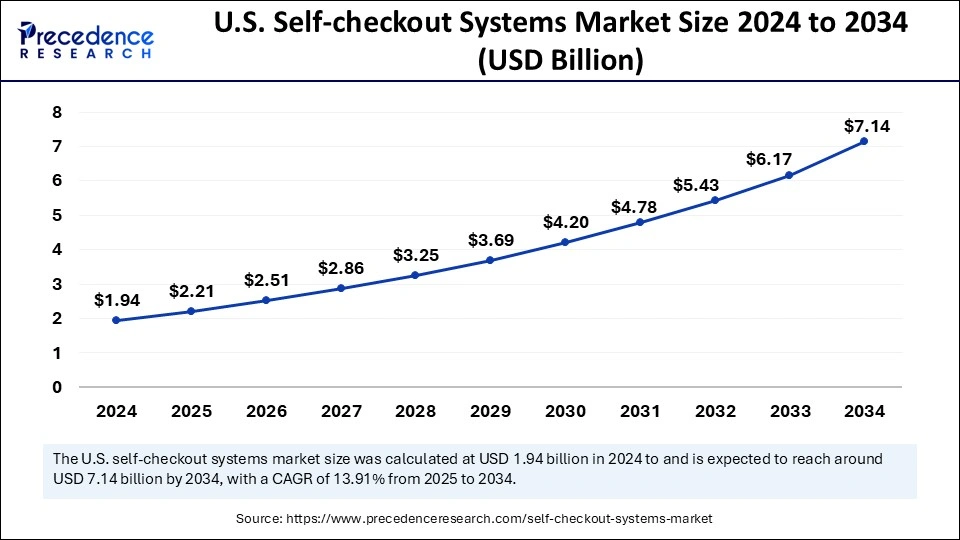

The U.S. self-checkout systems market size was exhibited at USD 1.94 billion in 2024 and is projected to be worth around USD 7.14 billion by 2034, growing at a CAGR of 13.91% from 2025 to 2034.

North America registered dominance in the self-checkout systems market by capturing the largest share in 2024. This is primarily due to retail digitalization, labor shortages, and growing consumer demand for quicker self-service channels. The region's sophisticated retail infrastructure and early adoption of self-checkout technologies further bolstered the market growth. Supermarkets, hypermarkets, and convenience stores are spending heavily on advanced self-checkout solutions, including AI-based product identification and mobile-connected systems for enhanced operational effectiveness and customer experience.

Market leaders like NCR Corporation, Diebold Nixdorf, and Toshiba Global Commerce Solutions have continued to spur innovation and adoption across this region. The introduction of advanced innovations, including AI-based product identification, mobile payment functionalities, and contactless payment options, has further boosted the use of self-checkout systems in the region.

The U.S. is a major contributor to the North American self-checkout systems market because of its large retail network, early implementation of self-checkout technology, and increasing consumer preference for contactless shopping experiences. Retailers are adopting innovative technologies such as AI-based product recognition, mobile payment integration, and biometric authentication to improve customer experience and operational efficiency.

Asia Pacific is expected to be the fastest-growing region in the market over the forecast period of 2025 to 2034. This is mainly due to the expansion of new retail formats, urbanization, and rising consumer demand for cashless and contactless payments. An expanding middle class and rising disposable income in the region have propelled the demand for convenience and speed in shopping. Technological innovations, including AI-based systems, mobile payment solutions, and retail automation, are driving growth.

China, Japan, India, and South Korea are at the forefront of this trend because of their robust retail sector and emphasis on digitalization. Government policies encouraging cashless economies also boost the use of self-checkout systems.

The self-checkout systems market in China is growing rapidly with investments in digital infrastructure by the government, growth of e-commerce, and cloud adoption. Mobile payments and stringent cybersecurity laws enable contactless and cashless adoption of self-checkout systems. Retailers are using these technologies to improve working efficiency and keep up with consumer expectations of streamlined shopping experiences. Freshippo stores of Alibaba increased AI-driven self-checkout systems in January 2025.

The self-checkout systems market in Japan is growing at a significant rate due to labor shortages and the adoption of sophisticated solutions. The cashless payment trend has accelerated the uptake of self-checkout systems. Small, intuitive, and efficient floor space optimization self-checkout systems are improving customer service and, in many cases, featuring emerging technologies such as RFID and mobile payment integration.

Europe is observed to grow at a considerable growth rate in the upcoming period. This is due to the escalating labor expenses, technological advancements, and retail sector automation. Retailers are implementing self-checkout solutions to enhance operational effectiveness, minimize human cashier dependency, and address consumer expectations for quicker and more self-serviced shopping. Widespread usage of contactless payment technology and digital infrastructure aids this trend. Varied retail structures of Europe such as supermarkets, hypermarkets, convenience stores and department stores are adopting self-checkout systems to enhance customer satisfaction and efficiency. The market is also favored by regulatory environments and government policies encouraging cashless transactions and retail automation

Self-checkout systems are automated solutions where shoppers scan, pack, and pay for merchandise without the intervention of cashiers. They are deployed extensively in retail, supermarkets and fast-service restaurants for enhanced working efficiency, minimizing labor expenses, and increased customer convenience. Self-checkout systems leverage sophisticated technologies such as artificial intelligence, machine vision, contactless payment and biometric verification to solve theft prevention and quicker transactions.

They usually comprise hardware elements such as barcode scanners, touch screens, card readers, payment processing modules, and inventory management and transaction processing software. The self-checkout systems market is witnessing rapid growth due to the growing use of automation in retail and technology advancements in payments with the intent to maximize efficiency, minimize labor expenses, and respond to changing consumer demands for quicker and more convenient shopping.

| Report Coverage | Details |

| Market Size by 2034 | USD 18.14 Billion |

| Market Size in 2025 | USD 5.71 Billion |

| Market Size in 2024 | USD 5.02 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.71% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Type, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Need for Automation and Better Customer Experience

The rising need for automation in the retail industry is one of the major factors driving the growth of the self-checkout systems market. This wave is seeking to simplify operations, lower labor expenditure, and enhance customer experience. The market is also driven by staff shortages and the growing consumer desire for self-service and contactless choice, especially post-pandemic. This shift is revolutionizing retail businesses and driving the need for self-checkout systems.

Technical Glitches

One of the key factors restraining the self-checkout systems market is technical glitches in the system, which may cause operational interruptions, customer dissatisfaction, and even potential losses. Such problems usually result from system breakdown, connectivity issues, or software bugs, impacting the reliability and effectiveness of self-checkout systems.

Growing Embrace of Cashless and Digital Payments Technologies

The growing embrace of cashless and digital payment technologies is one of the prime opportunities in the self-checkout systems market. As consumers increasingly prefer contactless and mobile payment options, retailers can invest in self-checkout systems to make purchases more convenient, faster, and appealing to the digitally inclined populace. This demand is especially significant in markets with high digital wallet adoption as well as penetration of smartphones.

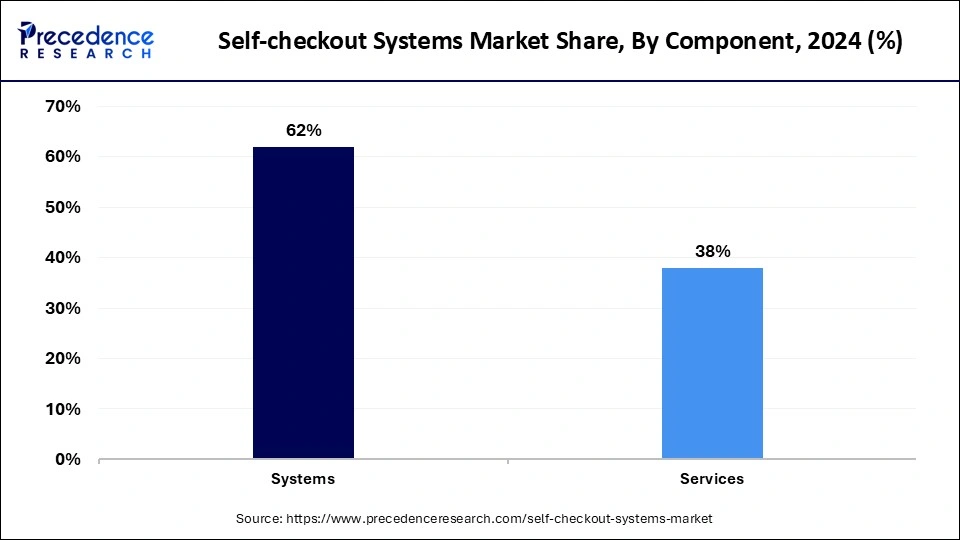

The systems segment dominated the self-checkout systems market with the largest share in 2024. This is mainly due to the increased investments by retailers on self-checkout kiosks, terminals, and related hardware to keep stores up to date along with boosting operational effectiveness and enhance customer convenience. The demand for self-checkout systems has been driven by the requirement for durable, easy-to-use systems that can process heavy volumes of transactions, be integrated into existing point-of-sale infrastructure, and accept multiple forms of payment.

The inclusion of the latest technologies, such as AI, computer vision, and RFID, in self-checkout has also enhanced the need for creative hardware solutions. The increased shift from manual cashier-based checkout to automated checkouts further bolstered the segmental growth.

The services segment is expected to grow at a rapid pace over the forecast period due to higher demand for maintenance and software upgrades, along with system integration and training services. As more retailers use more advanced solutions, they need continuous technical support for peak performance, data protection, and system compatibility. The transition towards cloud-based and Software as a Service offering created new possibilities for managed services, remote monitoring and data analytics. This focus on extended service support guarantees ongoing performance enhancement, boosting the demand for reliable services.

The cash-based segment held the largest share of the self-checkout systems market in 2024. This is mainly due to the increased acceptance of cash-based self-checkout systems in the retail sector, especially in grocery stores, supermarkets, and convenience stores. These stores use cash-handling functionality to cater to a wide variety of customers including those who use or are confined to using cash. Most traditional retail chains first adopted cash-enabled self-checkout systems to be inclusive and offer flexibility in payment modes.

Hybrid systems that support both electronic and cash payments are still in favor, enabling retailers to support a wide array of customer options. Such flexibility has cemented the prevalence of cash-based self-checkout systems around the world. The continued application of cash across numerous markets and the preference for flexible payment systems have further solidified the visibility of cash-based self-checkout systems.

The cashless segment is projected to witness the fastest growth between 2025 and 2034 because of the mass popularity of digital payments and the adoption of contactless transactions. Customer behavior has shifted toward card-based solutions, mobile payments, and digital wallets, particularly post the COVID-19 pandemic. Cashless systems have been gaining recognition among retailers because of their operational advantages, such as quick transactions, low maintenance, and higher security. Government programs encouraging cashless economies and technology developments in payment are further propelling the segment. Cashless systems provide quicker transaction times as well as lower maintenance costs and better security.

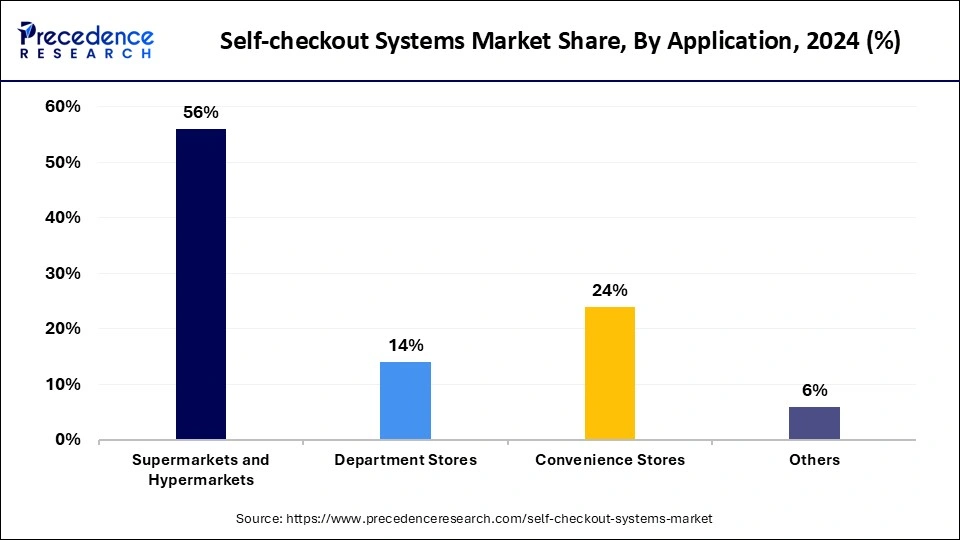

The supermarkets and hypermarkets segment dominated the self-checkout systems market with the largest share in 2024 because of their large-scale operations, high volume of transactions, and attention to enhancing customer throughput and operational efficiency. Such retail formats have massive footfalls, and therefore, self-checkout systems are an ideal way to minimize checkout queues and enhance customer satisfaction. They possess the capital and infrastructure to invest in new self-checkout technologies, including cash and cashless functionality, product recognition capabilities, and loyalty program integration. Their adoption of these solutions ahead of their competitors, motivated by reducing labor costs and enhancing store efficiency, has cemented their market leadership.

The capacity to process large transaction volumes economically and optimize operations makes self-checkout systems necessary for supermarkets.

The convenience stores segment is anticipated to grow at the fastest rate during the projection period because of changing preferences among consumers to shop faster and at greater convenience. Compact self-checkout systems are especially attractive because they take up minimal physical space, allowing for streamlined floor use and seamless customer flow. The growth of urban convenience store chains and the rise in demand for contactless payment and unmanned store models are also pushing the growth of self-checkout systems across this category. Urbanization and the growth of convenience store chains also boost the demand for seamless shopping experiences.

By Component

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

November 2024