February 2025

Self-healing Materials Market (By Product: Polymers, Ceramics, Cement, Asphalt, Metals, Fiber-reinforced composites, Coatings, Adhesives, Polymers, Concrete; By Technology: Skin Better Science, Encapsulated Ascorbic Acid Technology, ferment Filtrate Technology; By application: Microencapsulation, Shape Memory Polymers, Biological Systems, Nanotechnology, Capsule-Based Systems, Vascular Systems, and Others)- Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

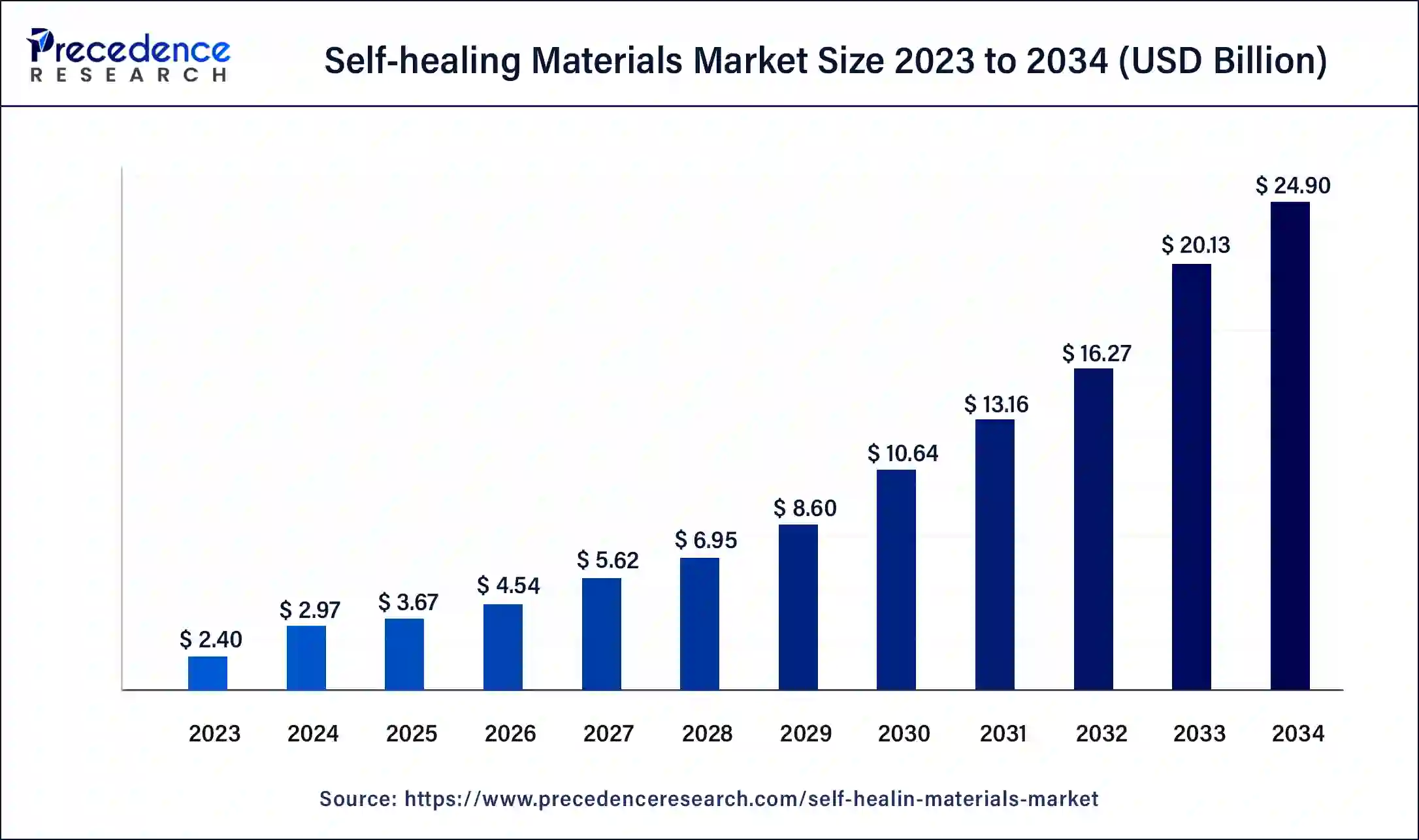

The global self-healing materials market size was USD 2.40 billion in 2023, calculated at USD 2.97 billion in 2024, and is expected to reach around USD 24.90 billion by 2034. The market is expanding at a solid CAGR of 23.7% over the forecast period 2024 to 2034.

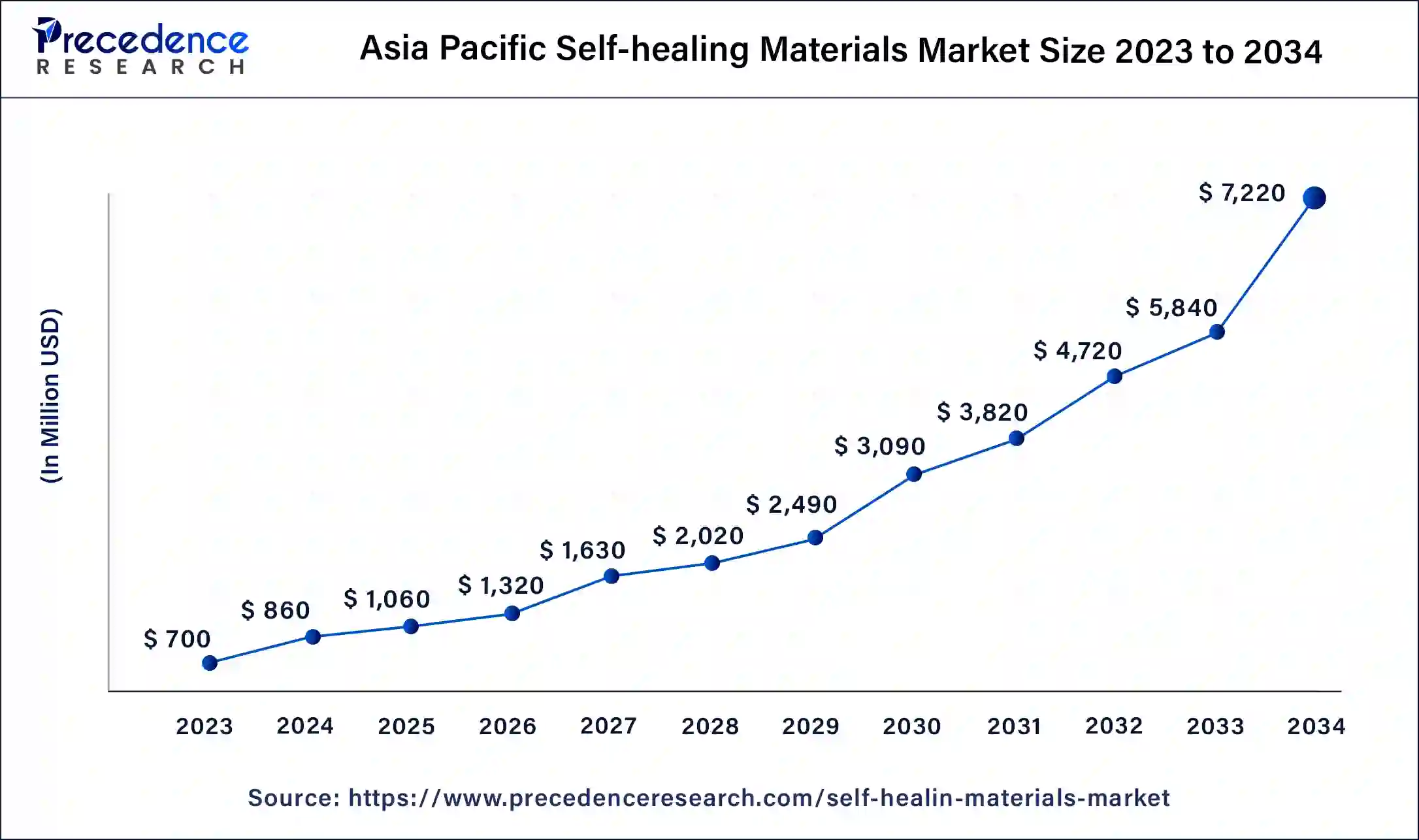

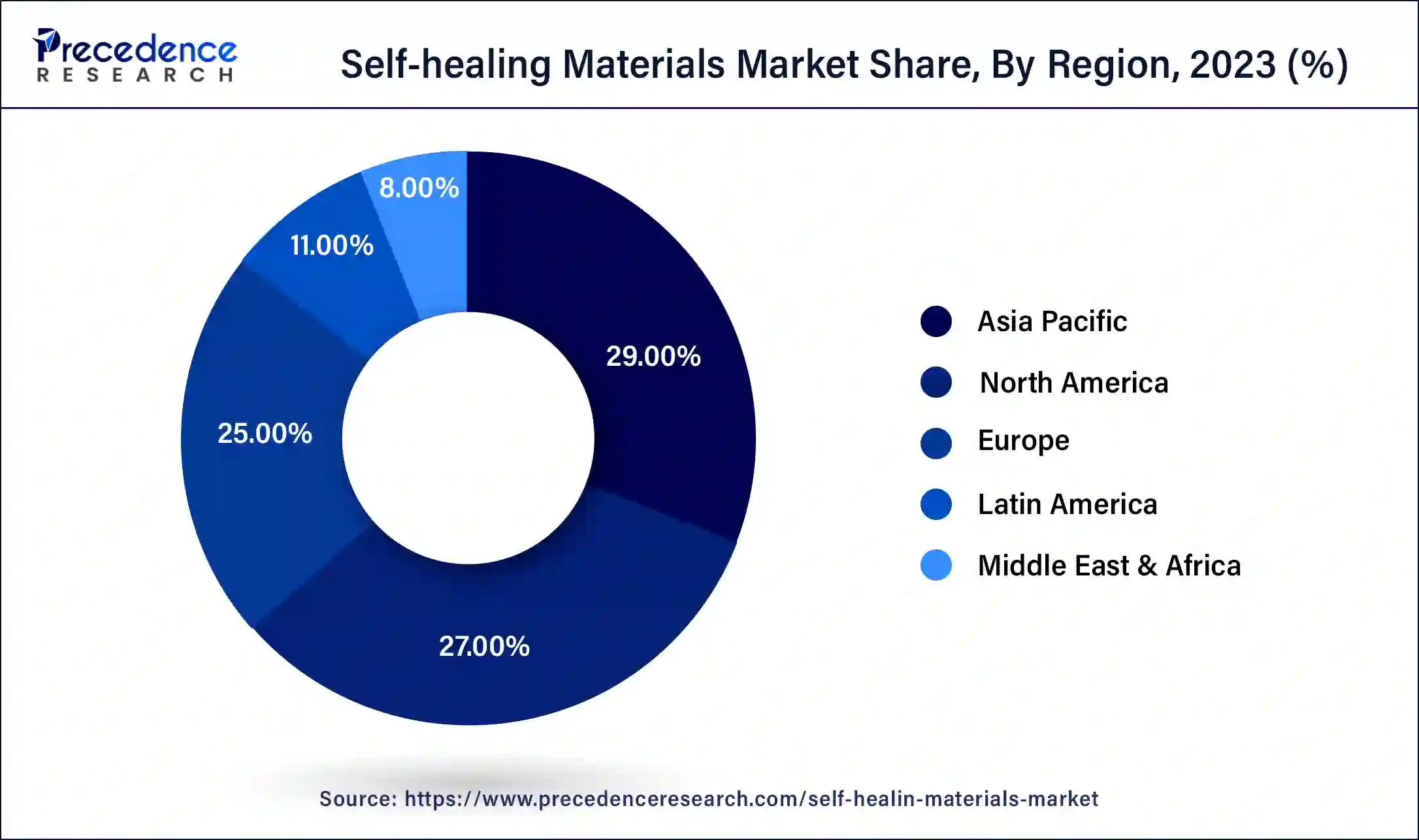

The Asia Pacific self-healing materials market size was estimated at USD 700.00 million in 2023 and is predicted to be worth around USD 7,220.00 million by 2034, at a CAGR of 23.9% from 2024 to 2034.

Asia Pacific currently leads the self-healing materials market, driven by rapid industrialization, infrastructure development, and a growing focus on sustainability. The region benefits from a large manufacturing base, increasing investments in research and development, and rising awareness about the benefits of self-healing materials in mitigating maintenance costs and improving product reliability. Additionally, government initiatives promoting technological innovation and sustainable development further propel the adoption of self-healing materials across diverse applications in the Asia Pacific.

Asia Pacific is poised to become a significant player in the global self-healing materials market as the region continues to witness economic growth and technological advancements, coupled with the increasing demand for durable and sustainable materials. Moreover, collaborations between regional and international players and supportive regulatory frameworks are expected to accelerate the penetration of self-healing technologies, contributing to the region's position as a key growth market in the coming years.

North America is emerging as a promising presence in the self-healing materials market, propelled by extensive research and development activities, robust technological infrastructure, and a high demand for advanced materials across various industries. The region boasts a strong presence of key market players, coupled with significant investments in innovation, fostering the development and commercialization of self-healing technologies. Industries such as automotive, aerospace, and electronics in North America prioritize the adoption of self-healing materials to enhance product lifespan, reduce maintenance costs, and improve safety.

The self-healing materials market offers a class of synthetic materials with the remarkable ability to repair damage autonomously, mimicking the healing process found in living organisms. Typically, these materials incorporate microcapsules containing healing agents, such as adhesives or polymers, dispersed throughout their structure. When damage occurs, these capsules rupture, releasing the healing agents to fill and seal the cracks or fractures, thus restoring the material’s integrity.

These materials find applications across various industries, including automotive, aerospace, electronics, and construction. In the automotive sector, self-healing polymers are utilized in coatings to prevent scratches and chips on vehicle surfaces, maintaining aesthetic appeal and reducing maintenance costs. Similarly, in aerospace, self-healing composites enhance the structural integrity of aircraft components, improving safety and longevity. In electronics, self-healing materials protect circuits from wear and tear, extending the lifespan of devices and reducing the need for repairs or replacements.

Self-healing materials hold promise in infrastructure development, where they can be integrated into building materials to enhance durability and resilience against environmental factors such as corrosion and fatigue. In the medical field, self-healing hydrogels show potential for tissue engineering and drug delivery systems, offering novel solutions for wound healing and controlled release of pharmaceuticals. Overall, self-healing materials represent a groundbreaking advancement with wide-ranging implications for enhancing the longevity, safety, and sustainability of various products and infrastructures.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.10 Billion |

| Market Size in 2023 | USD 8.10 Billion |

| Market Size in 2024 | USD 8.10 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.93% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Enhanced safety and reliability with self-healing materials

Self-healing materials offer a revolutionary solution to enhance the safety and reliability of critical components in industries such as aerospace, automotive, and medical fields. By autonomously repairing damage, these materials mitigate the risk of catastrophic failures that could have severe consequences. For instance, in aerospace applications, self-healing composites can prevent cracks from propagating, ensuring the structural integrity of aircraft components.

In the automotive sector, self-healing coatings protect vehicle surfaces from scratches and chips, maintaining both aesthetics and safety. In medical devices, self-healing materials enhance reliability by preventing leaks or fractures, crucial for ensuring patient safety and device functionality. Overall, the ability of self-healing materials to self-repair damage contributes significantly to the safety and reliability of critical components across various industries.

Environmental sustainability with self-healing materials

Self-healing materials play a pivotal role in promoting environmental sustainability by reducing material waste and energy consumption associated with traditional repair and replacement processes. By autonomously repairing damage, these materials extend the lifespan of products and infrastructure, minimizing the need for frequent replacements and reducing the overall demand for raw materials. This leads to a significant reduction in waste generation and resource depletion.

Additionally, the self-repair process requires minimal external energy input, further reducing the carbon footprint associated with maintenance activities. Industries adopting self-healing materials, such as construction, transportation, and electronics, can significantly lower their environmental impact while improving the longevity and performance of their products. Overall, self-healing materials represent a promising avenue for achieving sustainability goals and fostering a more environmentally friendly approach to manufacturing and maintenance practices.

Navigating regulatory hurdles on challenges in adopting self-healing materials in regulated industries

The incorporation of self-healing materials in regulated sectors like aerospace and healthcare faces obstacles due to rigorous regulatory standards and a shortage of standardized testing protocols. Complying with safety and performance criteria is paramount for widespread commercial acceptance. However, the absence of universally accepted testing methodologies complicates the validation process. Overcoming these challenges necessitates concerted efforts to establish clear regulatory pathways and develop standardized testing frameworks tailored to the unique characteristics of self-healing materials, facilitating their integration into highly regulated industries.

Extended product lifespan

Self-healing materials revolutionize product longevity by autonomously repairing damage, thereby mitigating the need for frequent replacements. This not only reduces the environmental impact associated with manufacturing and disposal but also translates into substantial cost savings for consumers and industries alike. By enhancing durability and resilience, self-healing materials ensure that products maintain their functionality and structural integrity over an extended period, delivering value and sustainability in various applications from electronics to infrastructure.

Technological breakthroughs on self-healing materials pioneering innovation

The emergence of self-healing materials as a cutting-edge technology drives innovation across material science, chemistry, and engineering disciplines. By pushing the boundaries of traditional material design, researchers develop novel solutions that offer unprecedented functionalities and performance. These advancements open up a multitude of applications across diverse industries, from aerospace to consumer electronics, unlocking new possibilities and benefits. The ongoing pursuit of self-healing materials fosters collaboration and cross-disciplinary research, fueling technological advancements that have the potential to revolutionize various sectors and shape the future of materials science and engineering.

Polymers have a significant presence in the self-healing materials market due to their versatility, ease of processing, and widespread applicability. Self-healing polymers are used in various industries, including automotive, aerospace, electronics, and construction, where they provide enhanced durability and damage resilience.

The concrete segment shows notable growth during the forecast period. Self-healing concrete has gained traction recently, particularly in the construction industry. With the ability to autonomously repair cracks and mitigate structural deterioration, self-healing concrete offers significant advantages in terms of durability, maintenance cost reduction, and sustainability, making it a prominent segment in the self-healing materials market.

The encapsulated ascorbic acid segment dominated the self-healing materials market in 2023. Massive application of encapsulated ascorbic acid in several industries, especially pharmaceuticals and beauty and cosmetics, supports the dominance. Several Cosmetics companies use encapsulation technologies as a form of sustainable and quick-release packaging. Particularly in skincare products, encapsulated ascorbic acid technology ensures stability and potency, allowing vitamin C to effectively brighten the skin tone and reduce hyperpigmentation, delivering noticeable results with consistent use.

The skin better science segment is expected to sustain growth notably during the forecast period. Renowned for its efficacy, it harnesses plant-based adaptogens to enhance skin health and quality within a short timeframe visibly. It targets skin concerns such as redness, discoloration, fine lines, and enlarged pores, promising significant improvements over time.

The microencapsulation segment dominated the market in 2023. Microencapsulation involves embedding tiny capsules filled with healing agents within the material matrix. When damage occurs, these capsules rupture, releasing the healing agents to repair the cracks or fractures. This approach offers versatility and scalability, enabling self-healing properties in a wide range of materials, from polymers to composites.

The shape memory polymers segment is expected to witness significant growth in the self-healing materials market during the forecast period of 2024-2034. Shape memory polymers possess the ability to revert to their original shape after deformation, making them particularly effective in self-repair applications. When subjected to external stimuli such as heat or light, shape memory polymers can undergo reversible changes in shape and properties, facilitating autonomous repair of damage. These two dominant segments showcase diverse strategies for achieving self-healing capabilities, catering to different material requirements and applications across industries like automotive, aerospace, and electronics.

Segment Covered in the Report

By Product

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

April 2025

January 2025