April 2025

Self-monitoring Blood Glucose Devices Market (By Product: Testing Strips, Self-Monitoring Blood Glucose (SMBG) Meters, Continuous Glucose Monitors, lancets; By Application: Type 2 Diabetes, Type 1 Diabetes, Gestational Diabetes) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

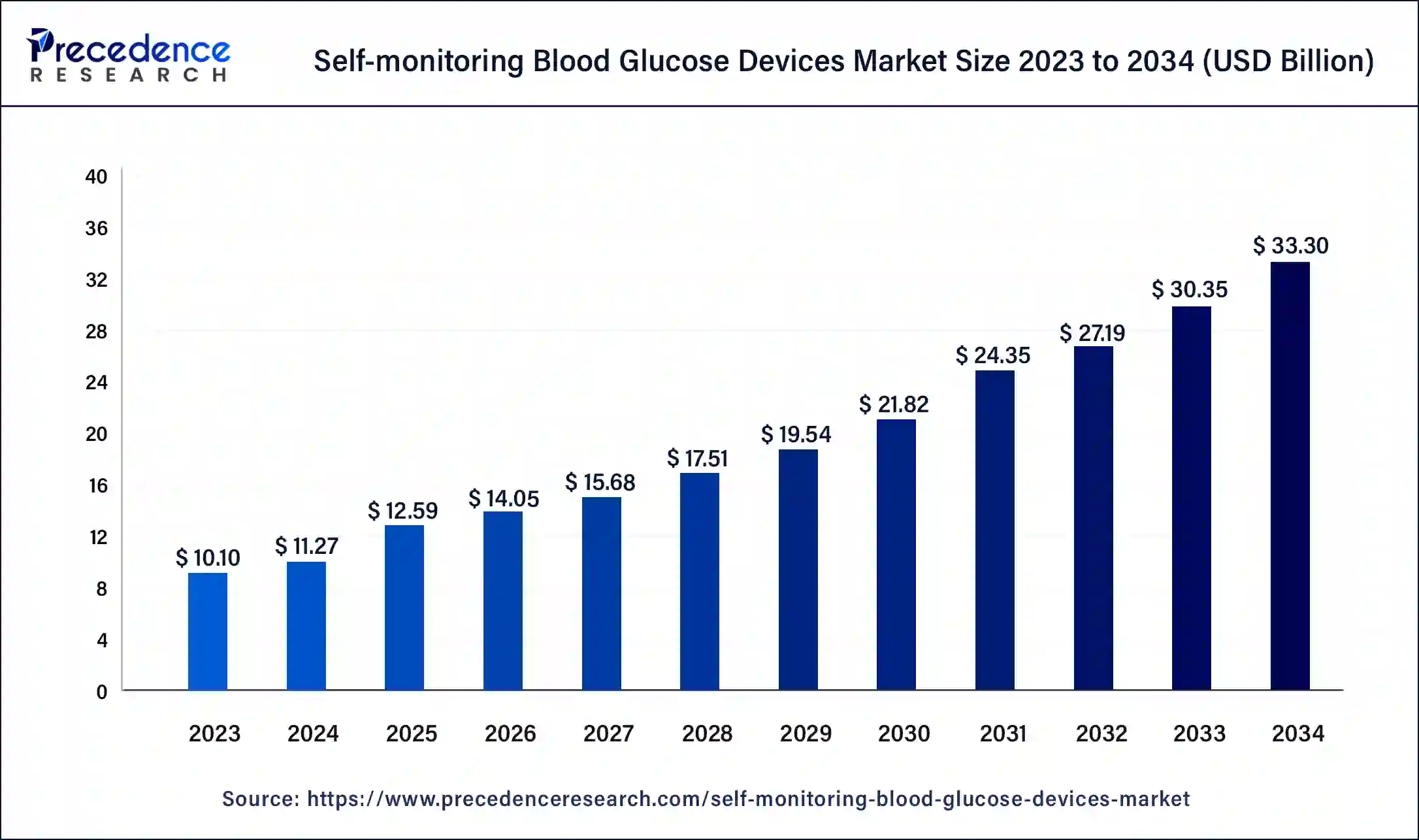

The global self-monitoring blood glucose devices market size was USD 10.10 billion in 2023, calculated at USD 11.27 billion in 2024 and is expected to reach around USD 33.30 billion by 2034. The market is expanding at a solid CAGR of 11.63% over the forecast period 2024 to 2034. The North America self-monitoring blood glucose devices market size reached USD 3.94 billion in 2023. The rising number of diabetes patients especially type 2 diabetes drives the growth of the self-monitoring blood glucose devices market.

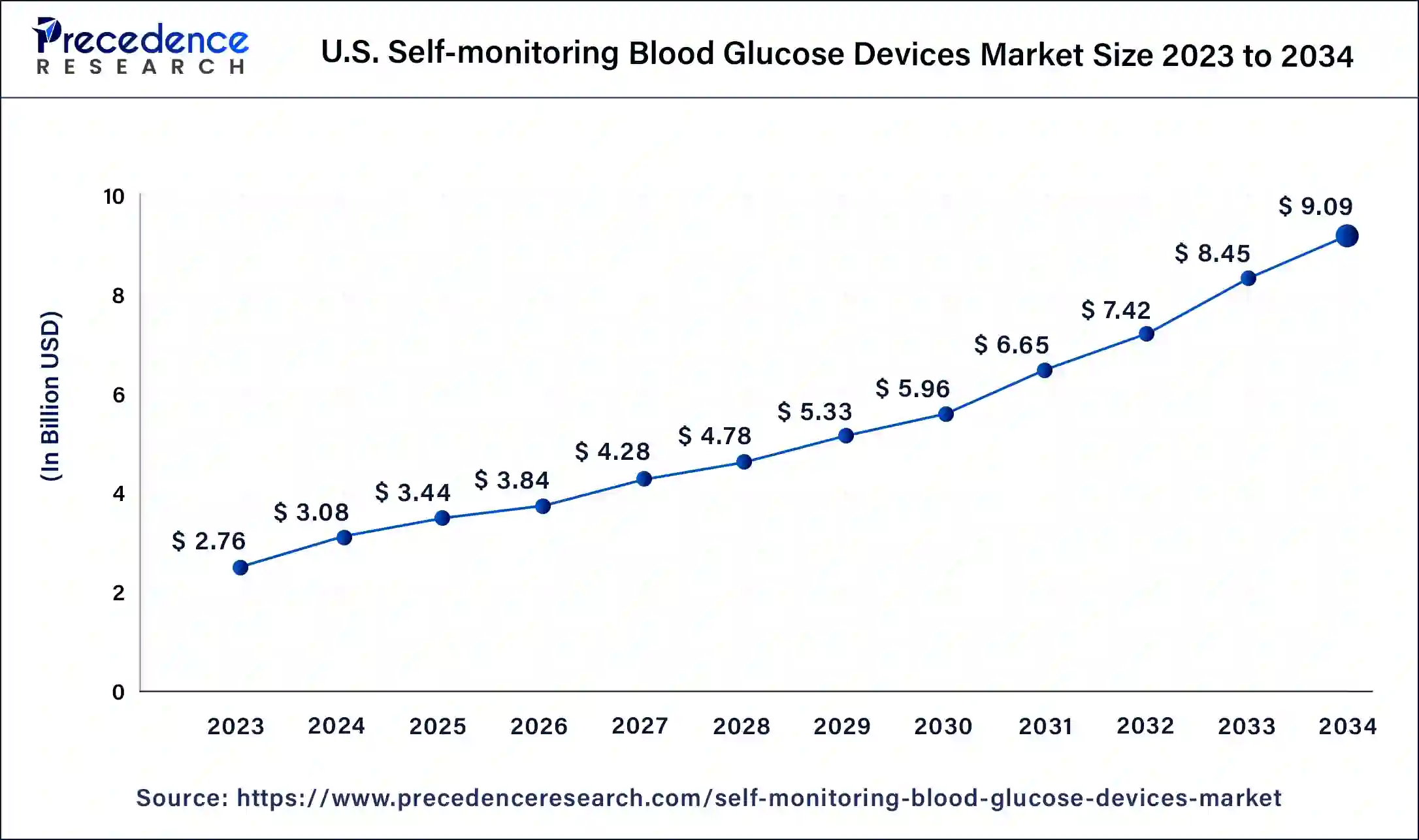

U.S. Self-monitoring Blood Glucose Devices Market Size and Growth 2024 to 2034

The U.S. self-monitoring blood glucose devices market size was exhibited at USD 2.76 billion in 2023 and is projected to be worth around USD 9.09 billion by 2034, poised to grow at a CAGR of 11.83% from 2024 to 2034.

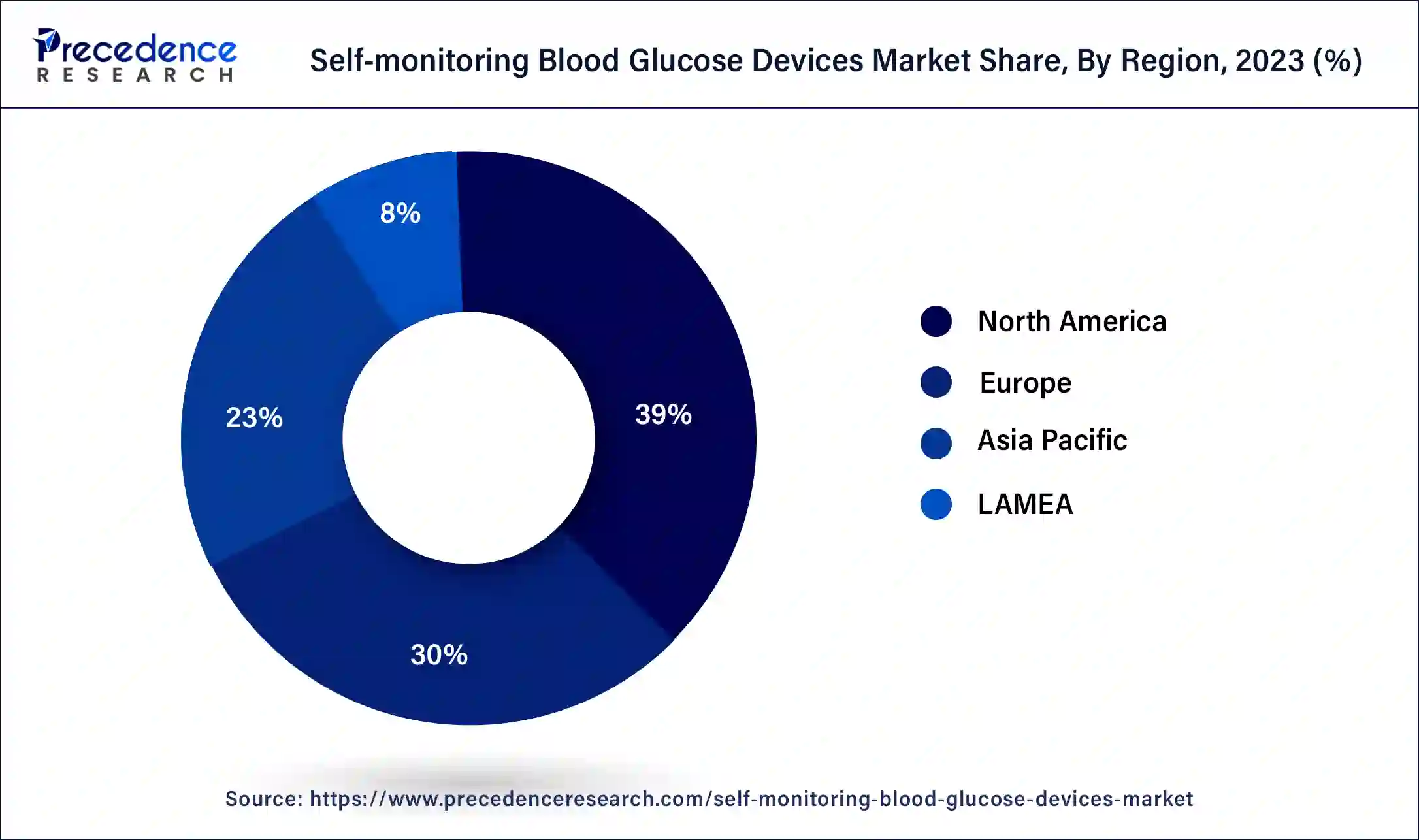

North America led the self-monitoring blood glucose devices market with the largest market share in 2023. While considering the overall pace of research and development along with product launch, the region is observed to sustain in the upcoming years. The growth of the market in the region is increasing due to the rising number of diabetes patients due to the sudden change in lifestyle, eating and sleeping habits, accepting sedentary lifestyle by the younger generation like smoking, drinking alcohol, and obesity are the major factors causing diabetes in the population. The rapid urbanization and changing environment and lifestyle in economically developed countries like the United States and Canada are causing a higher number of diabetes patients that anticipated the higher demand for self-monitoring blood glucose (SMBG) devices, and the technological advancements and the presence of the major market players in the healthcare devices that contributing in the expansion of the self-monitoring blood glucose devices market in the region.

Asia Pacific is expected to witness the fastest growth in the market during the forecast period. The market development in the region is attributed to the rising population in countries like India and China and the rising number of diabetes cases in the middle and older age population, which drives the demand for the market. The rising awareness among people for regularity in health checkups for better health and the increasing healthcare infrastructure, such as the number of healthcare institutes and pharmaceutical industries, are contributing to the expansion of the region's self-monitoring blood glucose devices market.

The self-monitoring blood glucose (SMBG) device is one of the essential parts of diabetes management in individuals or patients. It is a modern therapy for diabetes mellitus. Physicians and patients approve the self-monitoring blood glucose (SMBG) device to achieve a certain level of glycemic control and prevent hypoglycemia. The primary role of the self-monitoring blood glucose (SMBG) device is to measure and inform about the exact blood glucose level in the patient's body, which helps maintain the constant glucose level with more valuable insights. The rising awareness about regular blood sugar monitoring and the increasing prevalence of diabetes patients are driving the expansion of the self-monitoring blood glucose devices market.

| Report Coverage | Details |

| Market Size by 2034 | USD 33.30 Billion |

| Market Size in 2023 | USD 10.10 Billion |

| Market Size in 2024 | USD 11.27 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.63% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising cases of diabetes patients

The rising prevalence of chronic illnesses such as diabetes in the population, especially in geriatric population due to fluctuating glucose levels and lower immune systems is observed to promote the market’s growth. The number of diabetes is growing globally due to changing lifestyle preferences and accepting a sedentary lifestyle, smoking, drinking, and unhealthy eating habits are causing diseases like diabetes. Rapid urbanization and awareness regarding health and self-monitoring in health drives the expansion of the market. The rising prevalence of type 1 and type 2 diseases in people drives the demand for self-monitoring devices for frequent monitoring in the personal environment which supports the market’s expansion. Additionally, the rising product innovation along with the research and development activities across the globe promotes the growth of the self-monitoring blood glucose devices market.

Higher cost and skepticism regarding the application

Self-monitoring devices for diabetes patients are comparatively newer to the market which offers patients the chance to test and monitor blood glucose levels at home care settings. The limited knowledge and lack of expertise while using can create significant skepticism among users by acting as a major restraint for the market. Along with this, the increased cost associated with the devices due to the technological advancements in the devices are limiting the use of the devices which restrains the growth of the self-monitoring blood glucose devices market.

Technological advancements

Technological advancements in self-monitoring blood glucose (SMBG) devices, such as wearable devices, are a revolutionary shift in the market for self-monitoring blood glucose devices. People are accepting digitally advanced diabetes monitoring systems and virtual care. The increasing demand for technologically advanced self-monitoring devices pushes manufacturers to launch meters in self-monitoring devices that are less painful and invasive at the time of testing. These types of meter devices provide more accurate and rapid results of the tests. Automated self-monitoring blood glucose (SMBG) devices are another type of advancement that is accepted at the level of personnel and physicians. Self-monitoring blood glucose (SMBG) device advancements have made devices more reliable, controlled, automated, connected, and innovative. Additionally, CGM technologies help reduce A1C and hypoglycemia.

The testing strips dominated the self-monitoring blood glucose devices market with the largest share in 2023. The segment is observed to sustain the position in the upcoming years. The growth of the segment is attributed to the higher use of texting strips in the self-monitoring blood glucose (SMBG) device for testing blood sugar. Testing strips are the most commonly used in the self-monitoring blood glucose (SMBG) device for the efficient monitoring of blood sugar with faster, simpler, and convenient analysis. The blood sugar testing strips are coated with biological enzymes for effective diabetes diagnosis and disposable. The growth of the segment is also driven by the easy availability of the product in the pharmacies and in the major e-commerce platform that drives the expansion of the segment. Additionally, the rising interest in the self-monitoring of blood sugar in the private environment and homely comfort drives the demand for the devices which results in the increasing demand for the testing strips segment.

On the other hand, the self-monitoring blood glucose (SMBG) meters segment is observed to grow at a notable rate in the self-monitoring blood glucose devices market during the forecast period. There is a growing trend towards self-care and personal health management. People are increasingly interested in monitoring their own health metrics, including blood glucose levels, to manage their conditions more effectively. Growing awareness about the importance of blood glucose monitoring in diabetes management is encouraging more individuals to regularly monitor their blood glucose levels.

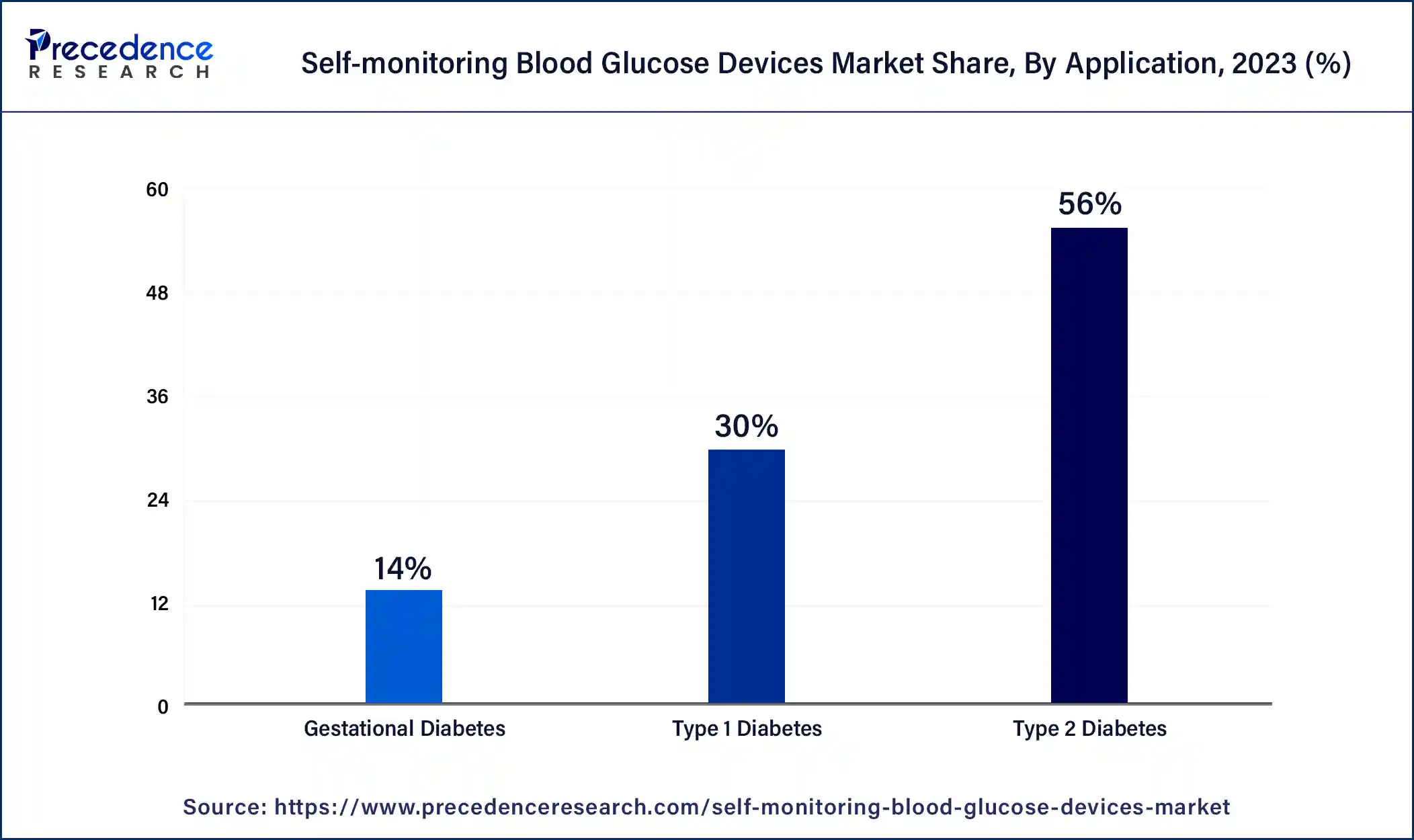

The type 2 diabetes segment held the largest share of the self-monitoring blood glucose devices market. Type 2 diabetes is a lifelong disease that needs to be regularly monitored for efficient treatment that drives the growth of the self-monitoring blood glucose devices market. The growing number of type 2 diabetes in the geriatric population as well as in kids and teens is due to the prevalence of sedentary lifestyle, obesity, smoking, and drinking habits. There are 90 to 95% of people globally affected by type 2 diabetes.

Four hundred sixty-two million people, or about 6.3% of the population, are affected by type 2 diabetes worldwide. It is one of the leading causes of death, and about 1 million deaths every year. The cases of economically developed and developing countries, the cases of type 2 diabetes are rapidly evolving, like in Europe and the United States. Type 2 diabetes is highly affecting the middle age and older generation, in which 4.4% are aged 15-49, 15% are 50-69, and 22% are between 70 and older. Thus, the rising cases of type 2 diabetes patients globally are anticipated to drive the growth of the self-monitoring blood glucose devices market.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

August 2024

March 2024